Trumped up trouble puts brakes on Thailand’s car industry

Exports stall, loans slump, and a bumpy ride looms for local auto trade

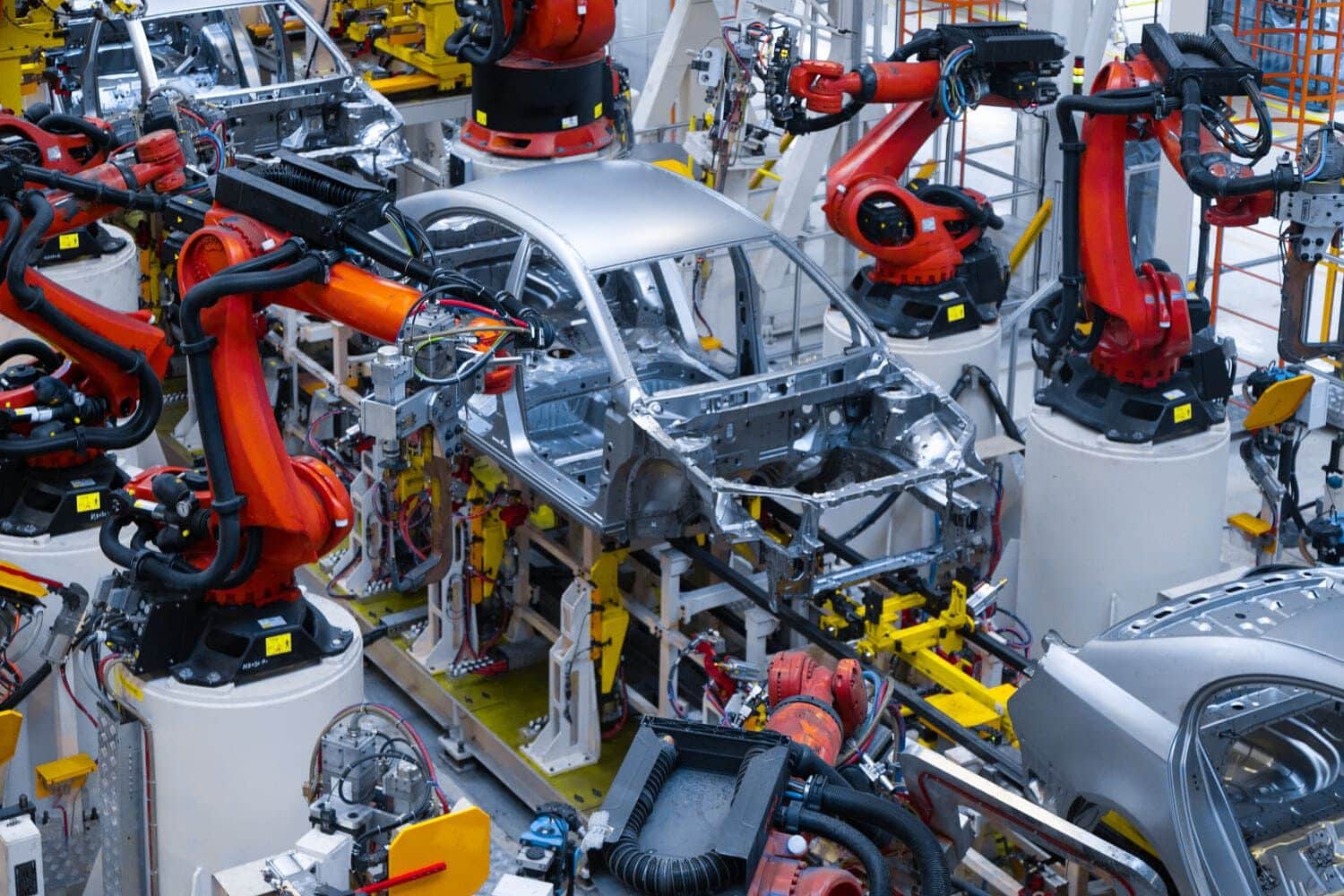

Thailand’s car industry is veering off course, with annual production now expected to skid below target thanks to Washington’s punishing tariffs and a domestic market bogged down by debt and rejected loans.

Thailand’s automotive engine is spluttering, with the Federation of Thai Industries (FTI) warning that this year’s car production is set to fall short of its 1.5 million-unit goal, for the second year in a row, as US trade tensions throw a spanner in the export works.

Surapong Paisitpatanapong, FTO Vice Chairman and spokesperson for its Automotive Industry Club, said the target is being revised down to below 1.4 million units. In 2024, the country produced 1.46 million vehicles, already missing the mark.

“We’ll review the target mid-year, once we’ve seen the full fallout from the US tariffs.”

On April 2, US President Donald Trump’s 25% tariff on foreign-made cars took effect, with duties on auto parts expected to kick in by May 3. The so-called reciprocal tariff, originally slated for April 9, was delayed by 90 days for non-retaliatory nations, allowing time for further negotiations but not before sending shockwaves through Thai export circles.

March saw car production in Thailand slump 6% year-on-year to 129,909 units, driven by a sharp 9.3% dip in export-focused output as manufacturers juggled new model changes. The only glimmer of hope? A modest 0.36% uptick in domestic manufacturing, fuelled by a rise in electric vehicle production.

The broader picture is gloomier still: total car output from January to March stood at 352,499 units, a hefty 14.8% drop year-on-year.

The domestic market didn’t fare much better. Car sales dipped by 0.54% in March to 55,798 units, as surging household debt and stricter auto loan approvals kept buyers at bay. Q1 sales totalled 153,193 vehicles, a 6.45% year-on-year decline, Bangkok Post reported.

Exports were hit even harder. March saw shipments slump 14.9% to 80,914 units, with a staggering 18.6% drop over the first quarter to just 220,139 vehicles.

With export clouds gathering and home-grown demand floundering, Thailand’s once-revving car industry may have to settle for cruising in the slow lane, at least for now.

Latest Thailand News

Follow The Thaiger on Google News: