A crash course on Thailand market entry in 2026

Your ThAI-powered playbook for launching and scaling in the Land of Smiles!

Thailand’s market entry landscape in 2026 demands understanding beyond digital metrics. As AI integration becomes standard operational practice and e-commerce matures into habitual consumer behaviour, success depends on cultural fluency, regulatory compliance, and local partnerships.

In this guide, AJ Marketing examines the playbook for 2026, analysing the tools, platforms, and trends shaping Thailand’s commercial landscape.

On this page

| Section | Short summary |

|---|---|

| Understanding Thailand’s digital & economic landscape | Thailand’s 2026 market is defined by habitual e-commerce use, price sensitivity, and data-driven consumer behaviour rather than novelty-driven digital growth. |

| Legal & regulatory strategies to keep in mind | Successful market entry depends on compliant structuring, data protection readiness, and alignment with evolving AI and digital governance standards. |

| InThai-lligent networking with influencers & celebrities | Influencers and celebrities function as trust infrastructure, accelerating legitimacy, partnerships, and consumer acceptance for foreign brands. |

| ThAI-First marketing & growth strategy through localisation | AI enables scale, but cultural localisation determines impact, with Thai audiences responding to relevance, familiarity, and human-led creative nuance. |

| Success blueprints: Case studies & future-ready wins | Winning brands prioritise long-term cultural embedding, influencer-led participation, and local storytelling over short-term promotional tactics. |

1. Understanding Thailand’s digital & economic landscape

Thailand’s 2026 consumer market demonstrates exceptional e-commerce maturity. Weekly online shopping behaviour now defines consumer life, with 68.6% of internet users aged 16 to 64 purchasing products or services online every week, a rate surpassing regional averages and indicating that online buying has become routine rather than occasional.

The depth of digital commerce is especially evident in essential categories. Some 43.3% of users order groceries online each week, highlighting consumer trust in logistics, payment systems, and last-mile delivery.

This shift signals a consumer base comfortable with outsourcing even daily necessities to digital platforms, creating opportunities for brands that can integrate into routine purchasing behaviour.

Value-driven and comparison-led shopping is rising simultaneously. Some 28% of users regularly use online price comparison services, whilst 25.7% rely on Buy Now, Pay Later (BNPL) options, underscoring heightened price sensitivity alongside growing acceptance of alternative payment models.

These behaviours indicate that transparency, flexibility, and perceived value strongly influence conversion.

Secondary and recommerce markets are also gaining traction, with 16.4% of users buying second-hand items online each week, a signal of increasing sustainability awareness and comfort with peer-to-peer and resale platforms.

Consumer behaviour & digital adoption

Thailand’s digital commerce landscape in 2026 is structured, data-driven, and highly competitive. Weekly engagement across multiple e-commerce behaviours shows that consumers expect frictionless experiences, personalised recommendations, and payment flexibility by default.

Mobile-first access remains the norm, but success increasingly depends on understanding shopping frequency, category penetration, and financial behaviour, not just traffic volume.

For foreign brands entering Thailand, digital presence is foundational. Differentiation is built on precision and trust, and growth comes from aligning with how Thai consumers actually shop week to week, not just where they browse.

2. Legal & regulatory strategies to keep in mind

Entering the Thai market requires an understanding of regulatory frameworks, particularly the Foreign Business Act (FBA), which determines sectors in which foreign investors may operate and under what conditions.

The FBA categorises business activities into three lists:

- Prohibited activities (reserved exclusively for Thai nationals)

- Activities requiring special approval

- Activities requiring majority Thai ownership unless specific exemptions apply.

Whilst the legal foundation remains consistent, regulatory processes in 2026 are increasingly shaped by digital systems and data-driven oversight.

Key developments include stronger emphasis on data protection, compliance requirements for digital operations, and growing attention to AI governance, particularly around data usage, transparency, and consumer protection.

Foreign brands should anticipate:

- Entity structuring decisions based on business activity classification under FBA

- Work permit and visa requirements for foreign personnel

- Tax registration and compliance, including VAT, corporate income tax, and withholding tax obligations

- Data protection compliance for customer data collection and processing

- Intellectual property registration to protect brand assets in-market

Even though AI tools can streamline documentation, internal compliance tracking, and regulatory monitoring, working closely with local legal partners and technology consultants remains essential to reduce risk and ensure proper market entry structures.

3. InThai-lligent networking with influencers & celebrities

In Thailand, influence functions as a credibility infrastructure. Influencers and celebrities serve as cultural gatekeepers, shaping which brands gain attention, legitimacy, and consumer acceptance.

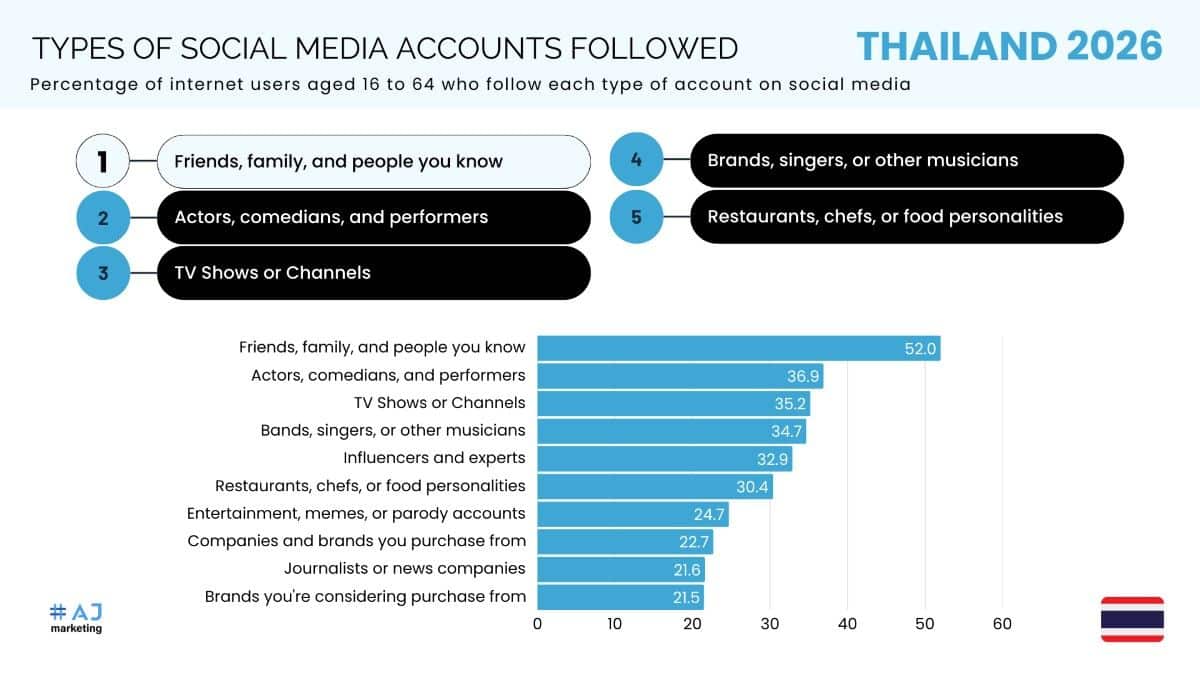

Thai consumers place substantial trust in public figures they admire, particularly influencers and K-pop celebrities whose lifestyles, values, and aesthetics align with aspirations. Some 36.9% of internet users in Thailand aged 16 to 64 follow actors and performers, whilst 32.9% follow influencers and experts on social media, rates that exceed typical brand following by substantial margins.

When these figures engage with a brand, the endorsement extends beyond awareness. It signals legitimacy. For foreign brands entering Thailand, this trust transfer is often the difference between getting noticed and being ignored.

This dynamic extends beyond consumer marketing into partnerships, distribution, and brand positioning. Campaigns fronted by culturally relevant celebrities or creators open conversations with retailers, media, and local collaborators significantly faster than traditional networking approaches.

In Thailand’s relationship-first business environment, who represents your brand carries weight comparable to what you offer.

At AJ Marketing, influencer strategy centres on precision: selecting culturally relevant figures whose audiences, image, and social standing align with a brand’s long-term market positioning goals. This approach treats influence as curated, purpose-driven brand infrastructure rather than transactional promotion.

4. ThAI-First marketing & growth strategy through localisation

In Thailand’s digital ecosystem, technology alone does not drive growth; cultural relevance does. AI has become a standard marketing tool, but its real value emerges only when paired with deep localisation and creative interpretation.

AI supports scale, speed, and precision. Localisation determines whether a campaign actually resonates. Thai consumers expect brands to understand their lifestyles, aspirations, and social nuances, not merely their data points. This means content, visuals, language, and offers must feel native, not imported.

Consider a skincare product positioned around confidence. The product attributes remain identical across markets, but framing that product in culturally meaningful ways, through local aesthetics, familiar use cases, and trusted voices, is what creates resonance in Thailand.

AI helps identify patterns and segments, but localisation translates those insights into stories that feel relevant and human.

Localisation forms the foundation of every strategy at AJ Marketing. Data and AI help identify audience segments, content opportunities, and performance signals, but impact comes from human-led creative interpretation. Insights are translated into market-specific narratives, localised short-form video, and influencer-led content that aligns with Thai consumer identity.

In 2026, successful brands in Thailand do not ask, “How do we scale faster?” They ask, “How do we fit in better?”

AJ Marketing helps global brands answer that question by combining cultural intelligence, localised creativity, and influence-led execution, turning visibility into trust, and trust into sustained growth.

5. Success blueprints: Case studies & future-ready wins

Brands that succeed in Thailand are not those that simply digitise faster; they are those that localise better. In today’s market, winning strategies combine cultural understanding, creative execution, and influence-led distribution to build relevance from day one.

Rather than relying on direct translation or global playbooks, Thailand must be treated as a distinct cultural market. Invest in local faces, local storytelling formats, and experiences designed specifically for Thai social behaviour and consumption patterns.

These campaigns offer a clear blueprint for what works.

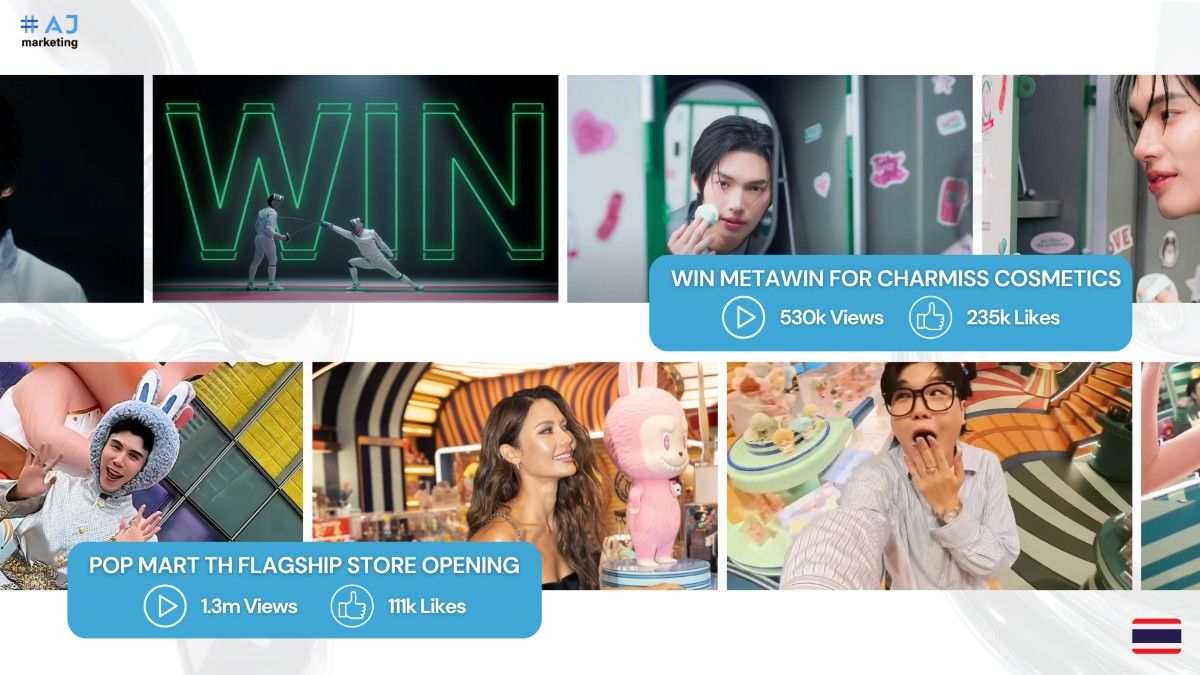

Win Metawin × Charmiss Cosmetics

Category: Beauty & Personal Care

Challenge:

Stand out in Thailand’s highly competitive beauty landscape where emotional connection and celebrity credibility matter as much as product efficacy.

Approach:

Charmiss partnered with Thai actor Win Metawin as a long-term brand ambassador. Instead of a one-off endorsement, the campaign was built around localised storytelling, fan-driven content, exclusive events, and limited-edition merchandise, all deeply intertwined with Thai fandom culture.

Rather than a one-off endorsement, the strategy recognised a key local insight: Thai beauty consumers value aspirational connection, celebrity credibility and authenticity. By integrating Win Metawin into the brand’s narrative through sustained engagement, Charmiss positioned itself as culturally embedded rather than externally marketed.

Outcome:

The campaign generated sustained engagement and brand affinity by turning promotion into participation, a model that resonates strongly with Thailand’s youth and pop-culture-driven audiences.

Pop Mart Thailand Flagship Store Opening at ICONSIAM

Category: Retail / Collectables

Challenge:

Launch Pop Mart’s Thailand flagship store in a way that creates cultural resonance beyond a standard retail opening.

Approach:

For the ICONSIAM launch, the brand activated a localised influencer-first experiential campaign. Thai creators were invited to attend the opening, explore the immersive retail environment, and produce short-form content that felt native to Thai social feeds rather than corporate announcements.

The campaign reframed a retail milestone as a cultural and lifestyle moment: playful, visual, and highly shareable. Influencers acted as cultural translators, helping local audiences emotionally connect with the brand’s collectable universe through creator storytelling.

The Outcome:

The store opening became a social event rather than a static announcement, driving awareness, foot traffic, and sustained online buzz through organic creator storytelling rooted in Thai consumer behaviour.

What these campaigns demonstrate

Both case studies illustrate core principles for Thailand market success:

- Long-term thinking over transactional campaigns: Sustained engagement builds deeper brand equity than one-off activations

- Cultural gatekeepers matter: The right influencers and celebrities accelerate credibility and market access

- Localisation extends beyond language: Visual aesthetics, social mechanics, and experiential design must align with Thai consumer expectations

- Participation over broadcast: Thai consumers respond to campaigns that invite engagement rather than passive consumption

A closing note

Thailand in 2026 is a market brands must earn. While digital maturity and technology continue to shape how brands scale, success is ultimately driven by cultural fluency, creative relevance, and trust. Brands must embed themselves into Thai culture through the right voices, narratives, and experiences.

AJ Marketing supports global brands in navigating this landscape, translating market ambition into culturally intelligent strategies powered by premium influencer partnerships, localised creativity, and deep market insight.

For brands willing to invest in authenticity and long-term relationships, Thailand remains one of Southeast Asia’s most dynamic and opportunity-rich growth markets.

Sponsored

Latest Thailand News

Follow The Thaiger on Google News: