Why health insurance for digital nomads is more important than ever in 2025

Digital nomads are people who work remotely while travelling the world. This lifestyle has grown quickly, with more people choosing to work from places like Portugal, Mexico, and Thailand because of low living costs and good digital infrastructure. However, living and working in different countries also brings challenges like changing travel rules, health risks, and expensive medical bills.

This year, having health insurance is more important than ever for digital nomads. It helps them stay safe, follow visa rules, and get medical care when needed. This article explains why health insurance is essential for digital nomads in 2025.

The rise of digital nomads in 2025

The digital nomad lifestyle is growing fast, with 45 million people working remotely in 2024 and expected to reach 60 million by 2030. Places like Thailand are popular because of their low living costs, lively culture, and good digital infrastructure. Cities such as Bangkok and Chiang Mai attract digital nomads with coworking spaces and community events. Advances in technology and changing work cultures allow more people to work from anywhere and enjoy a flexible lifestyle.

Long-term travel and health risks

Digital nomads often travel long-term and live in different countries, which increases health risks. They face challenges like unfamiliar healthcare systems, different health standards, and unexpected medical emergencies. Medical expenses can be high, making health insurance essential. Flexible plans like the ones that SafetyWing offers adapt to travel schedules and provide coverage in multiple countries. Health insurance helps digital nomads protect their finances and get the care they need while living and working abroad.

Why health insurance is essential for digital nomads in Thailand

Thailand is a popular choice for digital nomads because of its low cost of living, vibrant culture, and strong expat communities in cities like Bangkok and Chiang Mai. However, living in a foreign country comes with health risks and financial challenges, making health insurance essential.

Unpredictable health issues

Digital nomads in Thailand face health risks due to changes in climate, food, and exposure to new germs. Common problems include stomach infections, heat-related illnesses, and mosquito-borne diseases like dengue fever. Without health insurance, getting quality medical care can be expensive and difficult.

High medical costs

Medical expenses in Thailand can be high, especially for serious illnesses or hospital stays. Public hospitals are affordable but may have long wait times and language barriers. Most foreigners prefer private hospitals for better service and English-speaking staff, but these can be costly. Health insurance helps cover these expenses, protecting digital nomads from financial strain.

Visa and travel requirements

Thailand offers several visa options for digital nomads, like the “Smart Visa” for remote workers. Although health insurance is not always required for these visas, having it is recommended for financial security and to prepare for any future visa rules.

Health insurance is crucial for digital nomads in Thailand. It protects against unexpected health issues, covers high medical costs, and helps with visa requirements, giving peace of mind while living and working in Thailand.

Key features to look for in health insurance for digital nomads

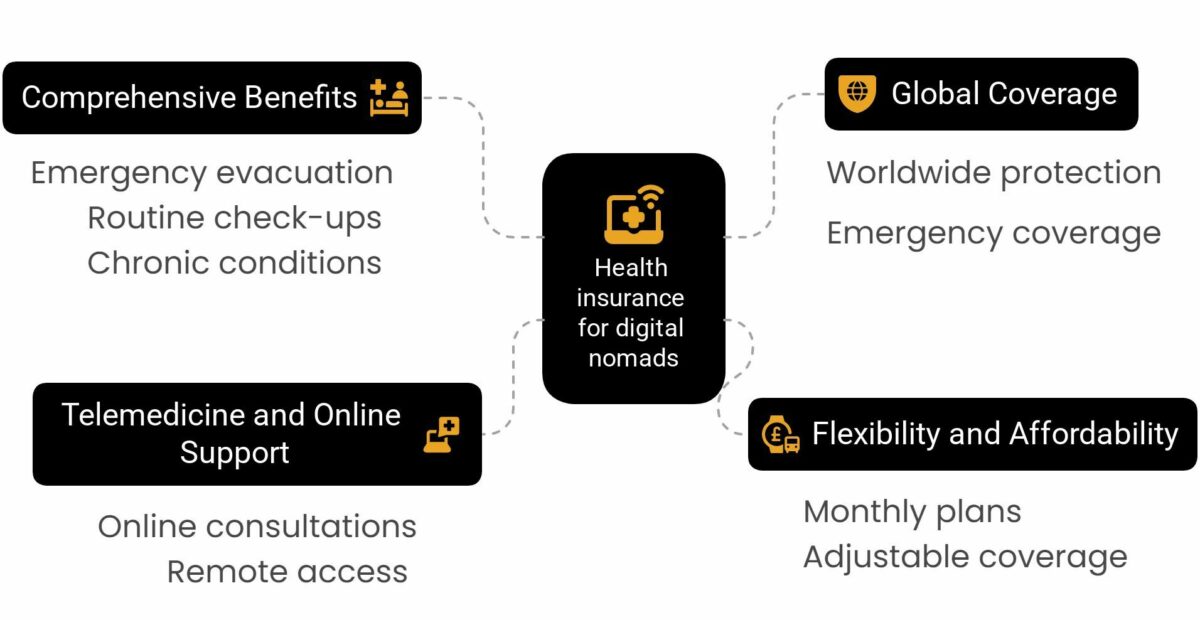

Global coverage

Digital nomads often travel to different countries, so having health insurance with global coverage is important. This ensures you are protected against medical emergencies not only in Thailand but also in other countries you visit. Insurance providers like SafetyWing offer worldwide coverage, making them a good choice for frequent travellers.

Flexibility and affordability

Digital nomads have changing travel schedules, so flexible and affordable insurance plans are helpful. Look for monthly plans that you can adjust as needed. This allows you to pay only for the coverage you need, helping you manage costs better. SafetyWing offers flexible plans that are budget-friendly for digital nomads.

Comprehensive benefits

A good health insurance plan should include:

- Emergency evacuation: In case of serious illness or injury, it covers transportation to a better hospital.

- Routine check-ups: Regular health check-ups to maintain overall well-being.

- Chronic conditions: Coverage for ongoing medical conditions to ensure continuous care without high costs.

Telemedicine and online support

Access to telemedicine is useful for digital nomads. It allows you to consult with doctors online, which is helpful if you are in a remote area or unsure about local healthcare. This feature makes it easier to get medical advice without visiting a clinic.

In Thailand, health insurance is not always required for digital nomad visas, but it is strongly recommended. Having good coverage ensures you can get quality healthcare and protects you from unexpected medical costs.

Why SafetyWing is a great choice for digital nomads in Thailand

SafetyWing is a popular health insurance option for digital nomads in Thailand because it is flexible, affordable, and designed for remote workers. Here’s why it’s a great choice:

Global coverage

SafetyWing covers you in over 180 countries, so you are protected no matter where you travel. This is useful for digital nomads who move between countries often.

Flexible plans

You can buy a SafetyWing plan at any time, even if you are already travelling. It’s easy to renew, and you don’t need to return home to keep your coverage active.

Affordable pricing

SafetyWing offers budget-friendly options:

- Essential plan: Starts at $56 USD (about 1,885 THB) for four weeks. It covers emergency medical expenses, hospital visits, accidents, medical evacuation, and lost luggage.

- Complete plan: Costs $150.50 USD (about 5,067 THB) per month. It includes everything in the Essential Plan, plus routine healthcare, mental health support, maternity care, cancer screening, and outpatient services.

Easy to use

You can manage your SafetyWing plan online. This includes buying, renewing, or adjusting your coverage. Customer support is also available if you need help.

SafetyWing is a great choice for digital nomads in Thailand because of its global coverage, flexible plans, and affordable pricing. It provides peace of mind, ensuring digital nomads are protected wherever they go.

Digital nomads are choosing Thailand for its low cost of living, dynamic culture, and strong digital infrastructure. However, this lifestyle also brings health risks, like new germs, heat-related illnesses, and high medical costs. Health insurance is important for digital nomads to protect against unexpected medical expenses, follow visa rules, and get quality healthcare.

Good insurance should offer global coverage, flexibility, and benefits like emergency evacuation and telemedicine. All in all, SafetyWing is a top option in 2025 because it provides affordable, flexible plans designed for digital nomads.

Sponsored

Latest Thailand News

Follow The Thaiger on Google News: