What is SafetyWing? The insurance every digital nomad needs in 2025

Companies like SafetyWing offer plans that cover medical emergencies lost belongings, and even adventure sports for digital nomads. Having reliable insurance helps travel with confidence as this lifestyle has grown, especially after the pandemic when more people came to Thailand and chose to live and work here.

Digital nomads work remotely using technology, allowing them to live and travel anywhere. They rely on the internet to do jobs like writing, design, and marketing from cafés, coworking spaces, or even the beach.

Understanding SafetyWing for the digital nomad

SafetyWing is a travel medical insurance provider designed for digital nomads and remote workers. It offers flexible, affordable coverage for people who travel often or live abroad for long periods. With coverage in over 180 countries and 24/7 support, SafetyWing helps travellers stay protected wherever they go.

Unlike regular travel insurance, SafetyWing removes common restrictions like trip length limits. It works like a subscription, so you can sign up anytime, even if you’re already abroad!

SafetyWing insurance plans

SafetyWing offers two plans under its Nomad Insurance:

- The Essential Plan: Covers emergency medical expenses for short-term travellers and nomads. It includes hospital visits, accidents, and unexpected medical issues but does not cover routine checkups or preventative care.

- The Complete Plan: Provides full health and travel insurance, including doctor’s visits, prescriptions, preventative care, and protection against travel delays or lost luggage.

The SafetyWing Essential Plan

The Essential Plan is a flexible travel medical insurance designed for digital nomads and travellers. It mainly covers emergency medical needs and travel-related incidents.

What it Covers

- Emergency medical coverage: Covers unexpected illnesses, injuries, and hospital stays.

- Medical evacuation & repatriation: Up to a set limit for emergency transport.

- Trip protection: Covers delays, interruptions, and lost luggage.

- Add-ons: Options for adventure sports, electronics theft, and U.S. coverage.

What it doesn’t cover

The plan does not include routine checkups, vision, dental, maternity care, or extended home country coverage. Pre-existing conditions are also not covered by the plan.

Pricing & who it’s for

- Starts at US$56 (about 1,885 baht) for four weeks (28 days) and can be extended up to 364 days.

- Ideal for short-term travellers and digital nomads looking for emergency medical coverage.

- Covers travellers as long as they are outside their home country.

- Works on a subscription model, allowing sign-up even while abroad.

The Essential Plan is perfect for those who want medical and travel protection for short- to mid-term trips without the restrictions of traditional insurance.

Calculate your cost below!

The SafetyWing Complete Plan

The Complete Plan offers full health and travel insurance for long-term digital nomads. It includes everything in the Essential Plan and adds routine healthcare, mental health support, and maternity care.

This plan also covers trip cancellations, burglary, and delayed luggage. Unlike the Essential Plan, if a new health condition starts while you’re covered, it will stay covered as long as you renew the plan.

What it covers

- Includes all essential plan benefits: covers emergency medical care, hospitalisation, medical evacuation, lost luggage, and leisure sports.

- Routine healthcare: Covers wellness checkups and preventive care.

- Mental health support: Access to therapy and counselling.

- Maternity care: Covers pregnancy and childbirth expenses.

- Cancer screening and treatment: Provides coverage for necessary screenings and medical care.

- Outpatient services: Covers doctor visits and medical treatments outside the hospital.

- Complementary therapies: Includes chiropractic care and other alternative treatments.

- Trip or accommodation cancellation: Reimbursement for non-refundable expenses.

- Burglary protection: Covers theft of personal belongings.

- Delayed luggage: Compensation for essential items while waiting for lost luggage.

- Full coverage in your home country: Access to healthcare when visiting your country of residency.

What it doesn’t cover

- Pre-existing conditions: Conditions that existed before the plan started are not covered. However, any new conditions that develop while you’re insured will stay covered if you renew.

Pricing & who it’s for

- Costs US$150.50 (about 5,067 baht) per month.

- It requires a 12-month minimum contract, paid monthly or yearly, and renewable indefinitely.

- Ideal for long-term travellers or digital nomads who want full health and travel protection.

- It works for year-long travel or settling in one place, and it even offers home-country coverage.

This plan is perfect for those who need comprehensive, long-term coverage, ensuring they have access to healthcare and travel protection wherever they go.

Why SafetyWing is great for digital nomads

SafetyWing is a top choice for digital nomads because it offers flexible, affordable, and global insurance that fits a remote lifestyle. Unlike traditional insurance, it’s designed specifically for people who travel and work from anywhere.

- Worldwide coverage: SafetyWing protects you in over 180 countries, so you’re covered no matter where you go.

- Flexible plans: You can buy a plan anytime, even if you’ve already started travelling. Renewing is easy, and you don’t need to return home to keep your coverage.

- Affordable pricing: SafetyWing offers lower costs compared to many traditional insurance providers, making it a budget-friendly option for nomads.

- Easy to use: Managing your plan is simple. You can buy, renew, and adjust coverage online. Customer support is always available if you need help.

Things to keep in mind

While SafetyWing is a great option, here are a few things to consider:

- Pre-existing conditions: These are not covered, but if you develop a new condition while insured under the Complete Plan, it will stay covered as long as you renew.

- Age-based pricing: The cost of insurance may vary depending on age. It’s good to check the rates before choosing your plan.

- Home country visits: Coverage during visits to your home country may have limits. Reviewing the plan details will help you understand how long you’re covered.

SafetyWing offers a great balance of protection, flexibility, and affordability, making it an excellent choice for digital nomads who want to travel worry-free. Sign up by clicking the button below!

How digital nomads can sign up for SafetyWing

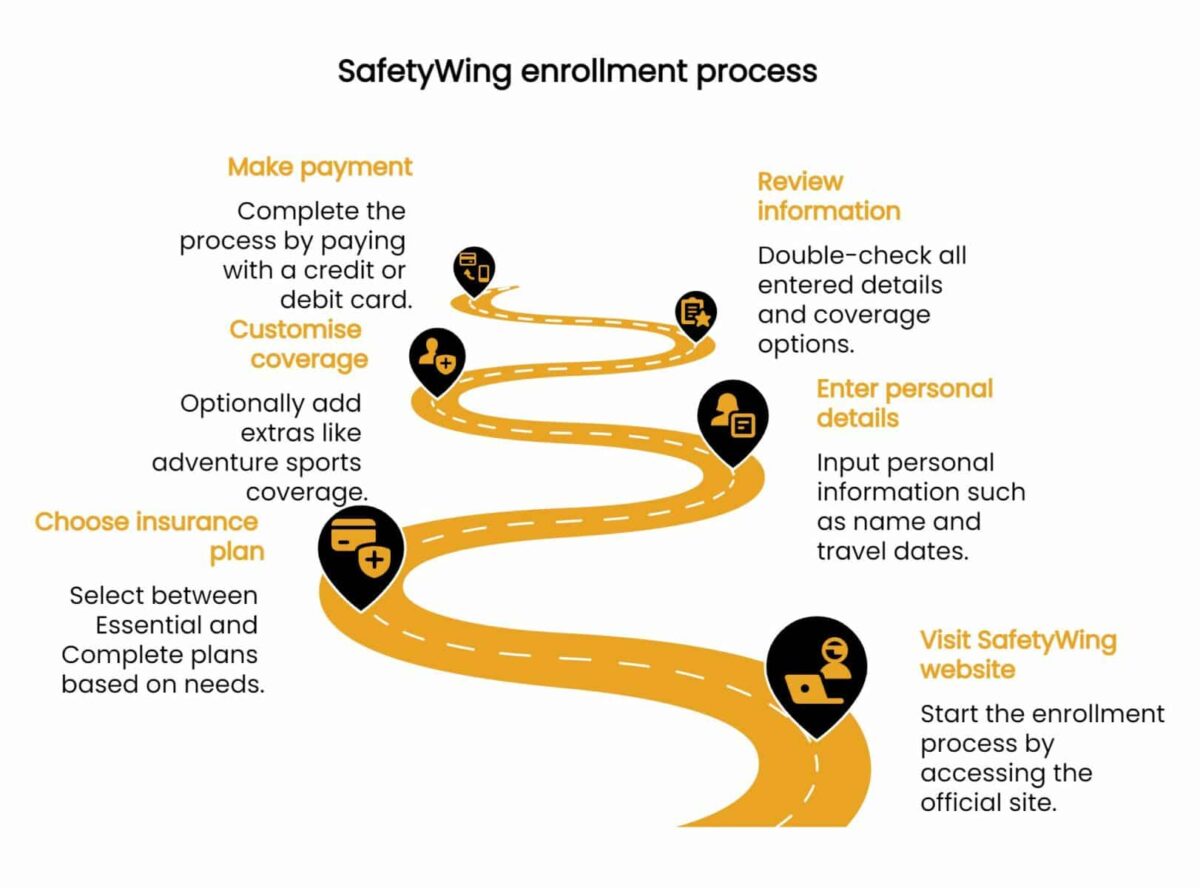

Getting insured with SafetyWing is quick and easy. You can sign up online in just a few steps.

Steps to enrol

- Go to the SafetyWing website: Visit the official website to start your enrollment.

- Pick your plan: Choose between the Essential and Complete plans based on your travel needs and budget.

- Enter your details: Fill in your name, date of birth, travel dates, and current location (even if you’re already abroad).

- Customise your coverage (optional): If needed, add extras like adventure sports coverage for extra protection.

- Review & confirm: Double-check your details, coverage, and payment info before proceeding.

- Make payment: Pay using a credit or debit card.

- Get your confirmation: Once your payment is processed, you’ll receive a confirmation email with your policy details. You can also access them in your SafetyWing account.

Payment & Renewal

- The Essential Plan: Billed every 4 weeks on a subscription basis.

- The Complete Plan: Choose between monthly or yearly payments, with automatic renewal.

You can cancel anytime if you no longer need coverage. Just make sure to review your billing cycle so you know when payments are due.

Signing up is simple, and once you’re covered, you can travel worry-free, knowing you have protection wherever you go!

Having the right insurance, such as SafetyWing, is essential for digital nomads to ensure they stay protected from unexpected medical issues and travel mishaps while exploring the world. SafetyWing offers flexible, affordable, and global coverage tailored to the unique needs of remote workers and travellers. Whether you need emergency medical protection or comprehensive health coverage, their plans will provide peace of mind wherever you go.

Sponsored

Latest Thailand News

Follow The Thaiger on Google News: