Travel insurance vs digital nomad insurance: What’s the difference?

Travel insurance and digital nomad insurance protect travellers but cater to different needs. Travel insurance is for short trips, like vacations or business trips. It covers things like medical emergencies, trip cancellations, and lost bags.

It works best for people who return home after a set time. Digital nomad insurance is for people who travel long-term and work remotely. It gives full medical coverage, including regular check-ups so that they can get healthcare anywhere. Knowing the difference helps travellers pick the right insurance for their lifestyle.

Understanding travel insurance

Travel insurance helps travellers protect their money and health during short trips. It covers unexpected events like trip cancellations, medical emergencies, and lost or delayed bags. If you get sick or injured while travelling, travel insurance can pay for medical care, but it usually doesn’t cover pre-existing conditions or ongoing treatments. It also covers emergency medical evacuation if you need to be taken to a nearby hospital for urgent care.

Travel insurance can also pay for prepaid travel costs if you need to cut your trip short. Some plans cover flight delays due to weather or mechanical problems. Many travel insurance plans offer a 24-hour helpline to assist with finding doctors, replacing lost passports, or rebooking cancelled flights. This makes it a useful safety net for short-term travellers.

What is digital nomad insurance?

Digital nomad insurance is made for people who travel and work remotely for long periods. Unlike travel insurance, which is for short trips, digital nomad insurance gives more complete coverage for those who live and work in different countries.

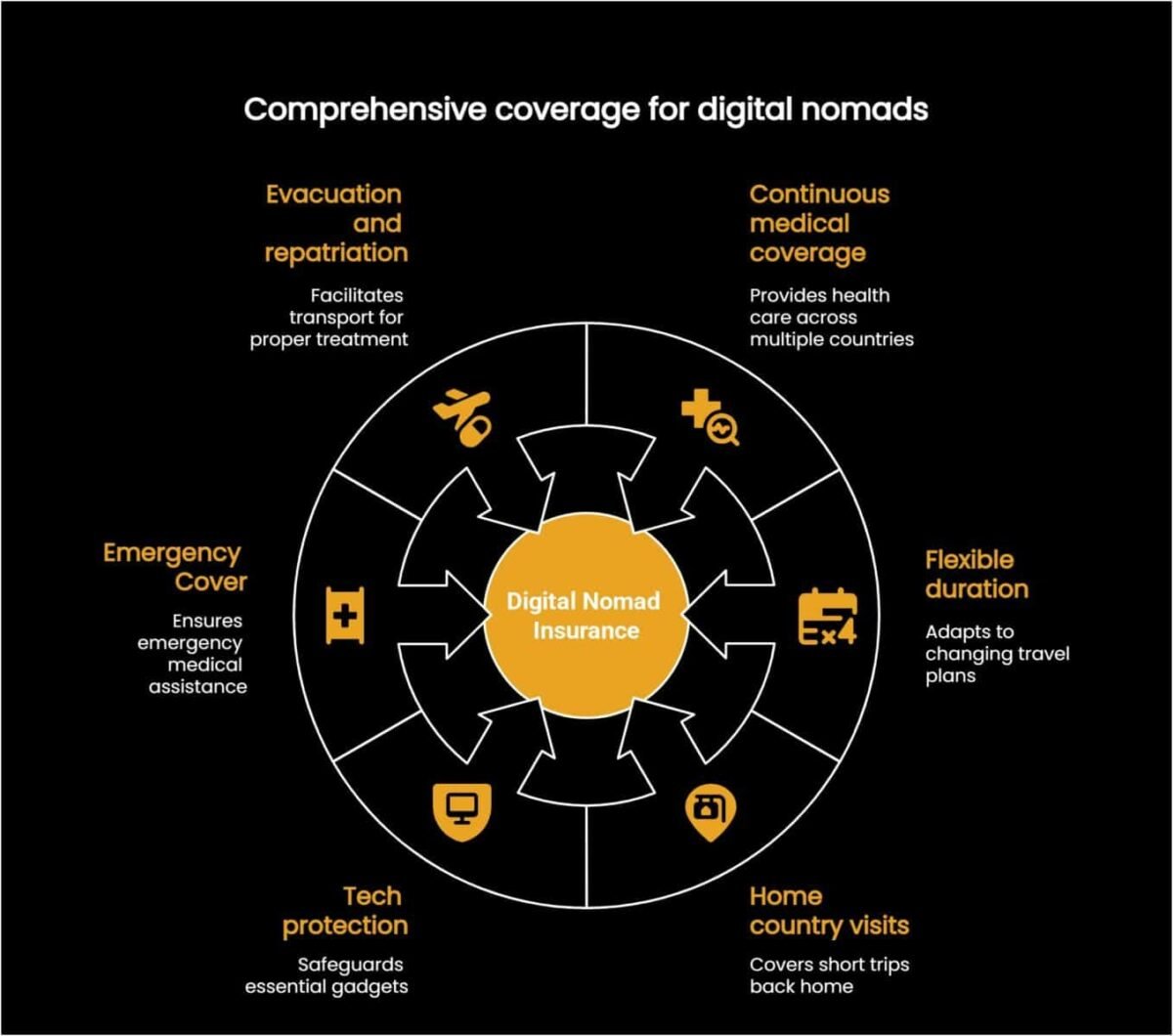

Key features include:

- Continuous medical coverage: It covers medical emergencies, routine check-ups, preventive care, and ongoing health issues in multiple countries.

- Flexible duration: It doesn’t have a fixed end date, which is perfect for digital nomads whose travel plans often change.

- Home country visits: Some plans cover short visits to your home country, giving peace of mind during quick trips back.

- Tech and equipment protection: It can protect important gadgets like laptops and cameras against theft, damage, or loss, which is useful for remote workers.

- Emergency cover: It includes emergency medical care, like hospital stays and ambulance rides.

- Evacuation and repatriation: If local medical care isn’t enough, the plan covers transportation to a place where you can get proper treatment.

Digital nomad insurance combines travel and health insurance, giving long-term travellers and remote workers the protection they need. It covers medical emergencies, trip disruptions, and sometimes personal belongings. It’s a flexible and reliable choice for people who live and work in different countries around the world.

SafetyWing is a popular choice for digital nomads because it offers flexible, affordable plans that cover multiple countries, including short visits to your home country. It’s designed to support the lifestyle of remote workers who need reliable coverage no matter where they go.

Key differences between travel insurance and digital nomad insurance

Travel insurance and digital nomad insurance have different purposes and are meant for different types of travellers. Knowing the differences helps you choose the right one for your needs.

- Duration: Travel insurance is for short trips with a set return date. It’s great for vacations or business trips. Digital nomad insurance is for long-term or indefinite travel. It covers travellers who move from place to place without a fixed return date.

- Medical Coverage: Travel insurance mainly covers medical emergencies that happen during the trip. It does not include routine check-ups or ongoing health issues. Digital nomad insurance gives full medical coverage, including regular doctor visits, chronic condition management, and healthcare in multiple countries.

- Flexibility: Digital nomad insurance is more flexible. It allows monthly payments and can be bought or extended even while you are already travelling. Travel insurance is usually less flexible. You need to buy it before your trip, and you may not be able to extend it once your trip has started.

In short, travel insurance is good for short-term trips that need emergency coverage. Digital nomad insurance is better for long-term travellers who work remotely and need continuous and flexible coverage.

SafetyWing: The best choice for digital nomad insurance

SafetyWing is a popular choice for digital nomad insurance because it is made for people who work remotely and travel long-term. It offers flexible, affordable, and worldwide coverage in over 180 countries. This makes it perfect for digital nomads who need reliable protection no matter where they go.

SafetyWing plans:

- The Essential Plan: This plan covers emergency medical expenses, such as unexpected illnesses, injuries, and hospital stays. It also includes medical evacuation, repatriation, and trip protection for delays, interruptions, and lost luggage. It’s great for short- to mid-term trips and uses a subscription model that you can start even while travelling.

- The Complete Plan: This is a full health and travel insurance plan. It covers routine healthcare, mental health support, and maternity care. It also includes trip cancellations, burglary, and delayed luggage. If you develop a new health condition while covered, it will stay covered when you renew. This plan is ideal for long-term travellers who want complete health and travel protection.

Why choose SafetyWing?

- Worldwide coverage: Protects you in over 180 countries.

- Flexible plans: You can buy, renew, or adjust your plan online, even if you’re already travelling.

- Affordable pricing: The Essential Plan starts at around US$56 for four weeks, while the Complete Plan costs about US$150.50 per month.

- Easy to use: You can manage everything online.

- 24/7 customer support: Help is always available when you need it.

SafetyWing is a great choice for digital nomads because it offers strong protection, flexibility, and good prices, letting you travel and work without worry.

Calculate your cost below!

Travel insurance and digital nomad insurance both protect travellers but are meant for different needs. Travel insurance is for short trips and covers emergencies like medical issues, trip cancellations, and lost luggage. Digital nomad insurance is for people who travel long-term and work remotely. It offers full medical coverage, routine check-ups, and flexible plans to fit their changing lifestyle. SafetyWing is a popular choice because it provides worldwide coverage, affordable prices, and flexible options for remote workers.

If you’re thinking about living and working in Thailand as a digital nomad, you might also want to learn about the 5-year visa option. This visa allows long-term stays and the freedom to work remotely. Read more about it in this guide to the 5-year visa for digital nomads in Thailand.

Latest Thailand News

Follow The Thaiger on Google News: