Thai government pushes capital shake-up to win back investors

Tax breaks, IPO incentives and tech reforms among key proposals

Thailand’s new government has unveiled plans to overhaul capital market regulations in a bid to restore investor confidence and boost economic growth.

The newly installed administration has pledged to roll out urgent capital market reforms ahead of the next election in a bid to boost investor sentiment and economic momentum.

At the centre of the plan is a sweeping regulatory overhaul designed to eliminate outdated rules and cut corporate costs by an estimated 134 billion baht annually. According to the government, this could lift GDP growth by as much as 0.89% each year.

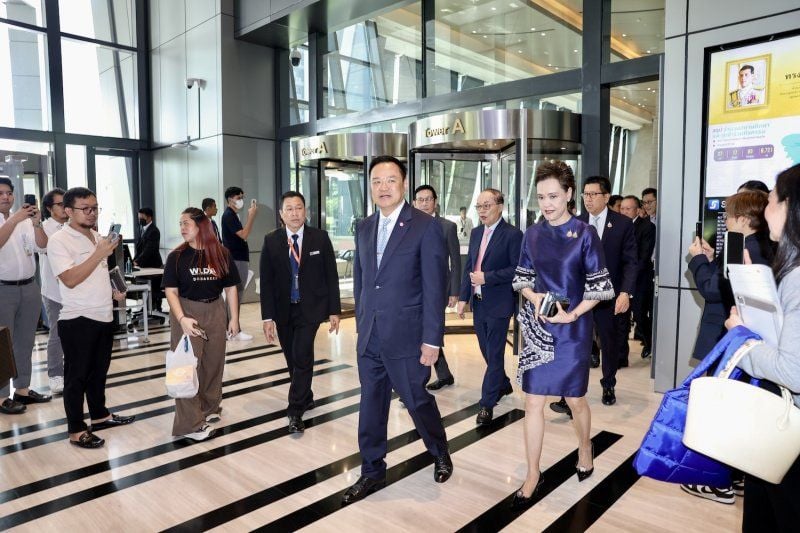

Prime Minister Anutin Charnvirakul met with his economic team yesterday, September 25, to finalise the immediate measures. The talks included senior representatives from the Stock Exchange of Thailand (SET) and the Federation of Thai Capital Market Organisations (FETCO).

Anutin said the initiative will prioritise reforms that can be made through ministerial action without the need for new legislation.

“We believe the regulatory guillotine proposed by the SET can be completed successfully. I have given full authority to each minister to coordinate with their respective agencies to deliver results quickly and build a long-term foundation for Thailand’s capital market.”

The government is also eyeing a dividend tax exemption on long-term stock investments as part of the stimulus package, along with a return of the popular half-half co-payment scheme.

Anutin projected that investor confidence could rebound within four months if the measures are swiftly implemented.

He also ordered an investigation into suspicious capital inflows that have recently strengthened the baht. Finance Minister Ekniti Nitithanprapas, the Anti-Money Laundering Office, and the Securities and Exchange Commission have been tasked with identifying any illicit activity.

“If grey or illegal money is identified, it will be seized.”

FETCO chairman Dr Kobsak Pootrakool voiced support for the government’s direction, calling for IPO promotion and regulatory updates to attract both domestic and foreign companies, especially those linked to BOI incentives and the Eastern Economic Corridor, reported Bangkok Post.

He added that swift action on revising investment regulations for foundations and insurance associations could release tens of billions of baht in market liquidity.

SET chairman Kitipong Urapeepatanapong also expressed optimism, urging that reform be treated as a national agenda to reduce business costs and drive growth.

Latest Thailand News

Follow The Thaiger on Google News: