Does your health insurance still cover Covid-19? What expats in Thailand need to check

Infection cases are rising again and heres how you can ensure coverage

Covid-19 cases are rising again in Thailand, with the Ministry of Public Health reporting that five provinces with the highest Covid-19 infections, with a national total of 324,692 cases and 69 fatalities. The spike comes as the rainy season begins and schools reopen, and the virus is expected to keep spreading, especially in places like Chiang Mai, where many expats live. Most cases are mild, but the risk is still there. That’s why now is a good time for expats to check their health insurance.

Not all plans are still over Covid, and rules can change. Making sure your insurance includes the right coverage can help you stay safe and avoid high medical costs.

On this page

| Jump to Section | Description |

|---|---|

| Health insurance rules for expats in Thailand | Learn about the specific insurance requirements for various types of long-term visas, including those for retirees and residents. |

| Common insurance gaps to watch for in Thailand | Understand where typical health insurance plans fall short, especially during the rainy season and in dealing with local health risks like dengue fever. |

| How to check your health insurance coverage for Covid in Thailand | Guidelines to ensure your insurance policy covers Covid-related medical expenses and emergency treatment in Thailand. |

| Why full health insurance is important for expats in Thailand | Explore the importance of comprehensive health insurance for expats, covering both routine and emergency healthcare needs in Thailand. |

| What to do if your health insurance is outdated | Steps to take if your health insurance doesn’t cover necessary treatments or is outdated, with a focus on finding reliable options like Cigna. |

Health insurance rules for expats in Thailand

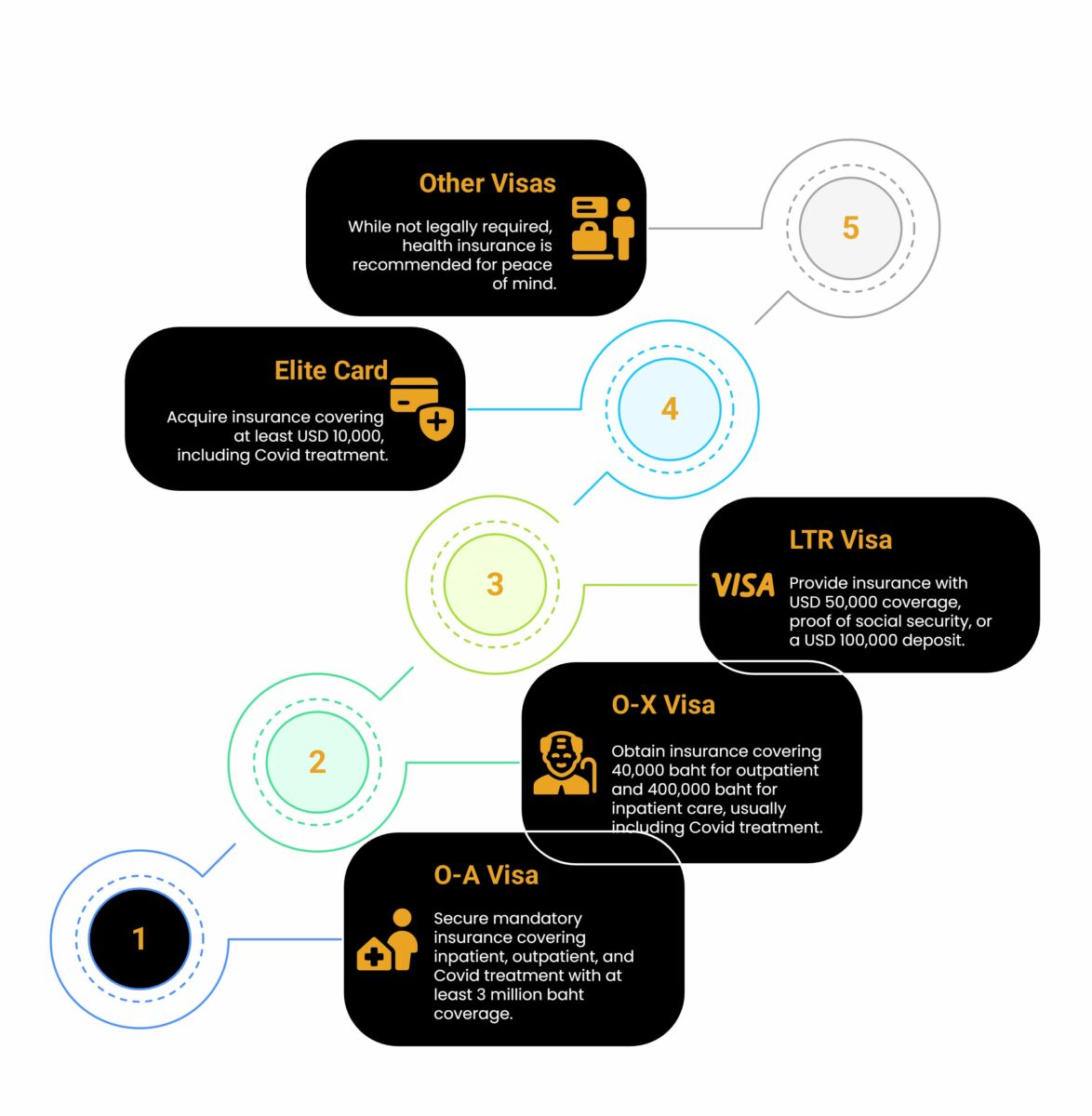

If you’re living in Thailand long-term, your visa may require health insurance, especially for retirement or extended stays. Here’s what you need to know:

1. Non-immigrant O-A visa (retirement visa)

- Insurance is mandatory for new applications and renewals.

- Must cover:

- Inpatient and outpatient treatment

- At least 3 million baht in coverage

- Covid coverage is required.

- Insurance must be from a Thai-approved provider (international policies may be accepted for renewals).

2. Non-immigrant O-X visa (long-stay for 50+)

- Must have insurance covering:

- 40,000 baht for outpatient care

- 400,000 baht for inpatient care

- Covid treatment is usually included.

3. Long-term resident (LTR) visa

- Need one of the following:

- Insurance with US$50,000 coverage per year

- Proof of social security covering treatment in Thailand

- A deposit of US$100,000

- Covid coverage may still be required.

4. Thailand elite card

- Insurance is required.

- Must cover at least US$10,000, including Covid treatment

5. Other visas (tourist, work, student, diplomatic)

- Health insurance is not required by law.

- Still recommended to have coverage for peace of mind.

If you’re staying in Thailand long-term, make sure your insurance covers Covid and meets the minimum amounts set by the Thai government. These rules can change, so it’s best to keep up to date and check your policy before renewing your visa.

Common insurance gaps to watch for in Thailand

Many expats in Thailand find that their health insurance doesn’t cover everything they expect—especially when it comes to Covid and other serious health needs. If you live in Thailand, it’s important to understand what your plan does and doesn’t cover.

Pandemic and Covid exclusions

Some insurance plans do not cover pandemics or only pay for emergency Covid care. This means you might have to pay for things like COVID tests, outpatient visits, or quarantine costs yourself. Since Covid is still spreading in Thailand, make sure your plan clearly includes full Covid coverage, not just hospital stays.

Limits on coverage and claim caps

Many plans have yearly or per-visit limits. If you need serious treatment or stay in hospital for a long time, these limits can run out fast. Some plans also have high deductibles or don’t fully cover outpatient care, which means more costs for you.

Hospital access and cashless billing

Not every insurance company has agreements with private hospitals in Thailand. This means you might have to pay first and get reimbursed later. That can be stressful and expensive. Try to get a plan that offers cashless treatment at your preferred hospital.

Pre-existing conditions and age limits

If you already have a health problem, some plans won’t cover it or will ask you to wait before they do. Also, many insurers don’t accept new customers over a certain age, usually between 60 and 70. This can make it harder for older expats to find good coverage.

Travel insurance is not enough

Travel insurance is made for short visits. It only covers emergencies and doesn’t help with long-term or regular care. If you live in Thailand full-time, you need proper health insurance and not just a travel plan.

Choosing a trusted insurer like Cigna with clear terms and wide coverage can save you stress and money later on. Make sure your policy protects you fully while living in Thailand.

How to check your health insurance coverage for Covid in Thailand

If you’re living in Thailand, it’s important to make sure your health insurance still covers Covid. Here’s a simple guide to help you check your policy and avoid any problems later.

Key questions to ask your insurer or broker

- Does my plan cover Covid testing, hospital stays, medication, and quarantine?

- Are both outpatient (clinic) and inpatient (hospital) treatments included?

- Can I use private hospitals, and is there a cashless option?

- What are the limits and deductibles for Covid care?

- Is my policy accepted by Thai immigration for visa or visa extension?

- Does it meet the government’s requirement of at least US$100,000 coverage?

- Will it cover home or community isolation if advised by a doctor?

Tips to check your coverage

- Ask for a full benefits summary or insurance certificate. This will list what’s covered and which hospitals are included.

- Make sure your policy is valid for the full length of your stay and meets visa rules.

- Check if your insurer works directly with your preferred hospital, so you won’t have to pay upfront.

- If your insurance is from another country, confirm that it’s accepted by Thai immigration and hospitals.

- Look for any exclusions or waiting periods for Covid or other illnesses.

Things to keep in mind

- Some insurers in Thailand, like Cigna, clearly include Covid and even home isolation in their plans.

- Long-stay visa holders must have insurance with at least US$100,000 coverage for Covid-related treatment.

- You can also buy special Covid insurance that includes treatment, quarantine, and even repatriation, which is helpful when entering or staying in Thailand.

By checking these details early, you can avoid stress and make sure you’re fully protected if you get sick with Covid in Thailand.

Why full health insurance is important for expats in Thailand

Thailand is known for good healthcare at lower prices than many Western countries. But private hospital costs can still be high, so having full health insurance is important for expats.

More than just Covid

Health insurance isn’t only for Covid. Expats can face other health risks like motorbike accidents, dengue fever, malaria, or long-term illnesses such as diabetes and heart problems. These issues often need regular doctor visits, tests, or even surgery, which can be expensive without good coverage.

Private hospital costs

Private hospitals in Thailand offer great care with modern equipment and English-speaking staff. But they’re not cheap:

- A single or deluxe hospital room can cost US$199 to over US$280 per night (not including meals or nursing care)

- Major surgeries like a heart bypass or joint replacement can cost US$10,000 to US$20,000

- A visit to a specialist may cost between US$30 and US$120, and tests or medicine will add more

If you don’t have insurance

Without insurance, you’ll need to pay upfront—often a deposit between US$1,500 and US$6,000 before private hospitals will treat you. This can delay care and cause stress. Public hospitals are cheaper but often have long waits, and communication can be difficult. In emergencies, bills can run into thousands of dollars, and you won’t be covered for things like emergency flights home.

Protect your health and your money

Having full health insurance gives you peace of mind. It helps you avoid big bills, gets you faster care, and often includes extra help like direct billing and paperwork support. It also meets Thai visa rules, which often require proof of proper insurance. With the right plan, you can focus on enjoying your life in Thailand, knowing you’re protected if something goes wrong.

What to do if your health insurance is outdated

If you’re an expat in Thailand and your health insurance is out of date or doesn’t cover enough, it’s time to take action. Visa rules can change, and health needs can grow, so having the right coverage is important.

Choose an international plan made for expats

International health insurance is a good option for expats. These plans usually offer:

- Full coverage for hospital stays and clinic visits

- Support for chronic illnesses and long-term care

- Covid treatment

- Emergency medical evacuation

- Access to private hospitals in Thailand and overseas

Compare benefits and hospital access

Before choosing a new plan, check:

- Coverage limits and deductibles

- If Covid and pandemics are included

- Access to top hospitals like Bumrungrad, Bangkok Hospital, or Samitivej

- Coverage for specialists, outpatient care, and chronic conditions

- If the insurer offers direct billing to avoid paying upfront

Check for 24/7 support

Good insurance also gives you round-the-clock help, fast claims service, and support in your language—especially helpful in emergencies.

Cigna for expats in Thailand

Cigna offers international health insurance designed for expats. Their plans are flexible and cover a wide range of needs, including Covid treatment. You can get care at leading hospitals and choose benefits that suit your lifestyle. Cigna’s coverage goes up to 35 million Thai baht (about US$1 million), giving you strong protection wherever you are.

Expats living in Thailand need to make sure their health insurance is up to date and fully covers Covid, especially with recent case spikes and changing visa rules. Many long-stay visas require specific coverage amounts, and not all plans include pandemic-related treatment, outpatient care, or access to private hospitals.

Gaps like claim limits, pre-existing condition exclusions, or lack of cashless billing can lead to high costs and delayed care. If your current plan is outdated, switching to an international health policy, such as one from Cigna, can offer broader benefits, including emergency support and visa compliance. For those planning to retire in Thailand, it’s also helpful to check out this health checklist before the move to stay fully prepared.

Latest Thailand News

Follow The Thaiger on Google News: