Travel vs international health insurance: Which coverage do you need overseas?

Expat or traveller? Here’s which insurance you should get before going abroad

The Thaiger key takeaways

- Travel insurance is ideal for short-term trips, covering emergencies, cancellations, and lost luggage, but not routine care.

- International health insurance suits expats and long-term residents, offering full medical coverage, including checkups, maternity, and chronic care.

- Choosing the right plan helps you meet visa rules, avoid high bills, and access reliable healthcare abroad — with trusted providers like Cigna Global

When you travel or live abroad, the right insurance protects both your health and your money. Travel insurance and international health insurance may sound similar, but they serve different purposes. Travel insurance is best for short trips and covers things like medical emergencies, lost luggage, or trip cancellations.

On the other hand, international health insurance caters to extended stays and provides comprehensive medical coverage, encompassing routine checkups and ongoing care. Understanding how these two types of coverage differ helps you choose the one that fits your travel plans and lifestyle.

On this page

| Section (Click to jump to section) | Short Summary |

|---|---|

| Understanding the key differences | Learn how travel insurance covers short-term trips, while international health insurance protects expats and long-term residents abroad. |

| When to choose travel insurance | Ideal for short trips and tourists, travel insurance covers medical emergencies, cancellations, and lost luggage for peace of mind. |

| When to choose international health insurance | Best for expats and long-term travellers, this option includes regular care, chronic conditions, and global hospital access through Cigna. |

| Coverage comparison table | See how travel insurance and international health insurance differ in duration, coverage, and cost with this easy comparison chart. |

| Why choosing the right coverage matters | Picking the right plan helps you avoid medical debt, meet visa rules, and stay protected wherever you are in the world. |

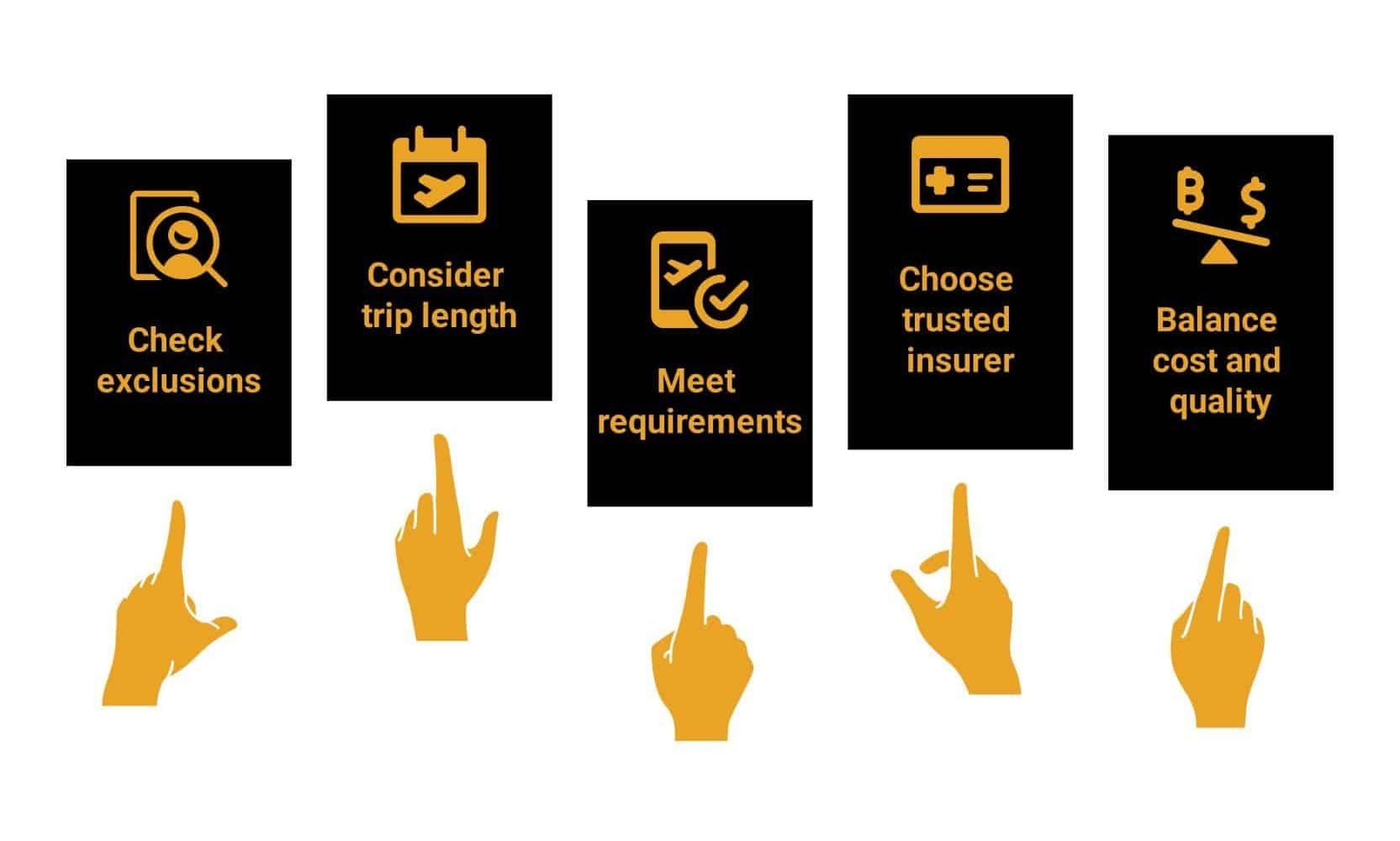

| Practical tips before buying | Check exclusions, trip length, and visa needs before buying. Choose a trusted insurer like Cigna for reliable worldwide support. |

Understanding the key differences

Travel insurance

Travel insurance is made for short trips, usually lasting from a few days up to 12 months. Its main purpose is to protect you from unexpected problems that could affect your trip or cost you money. It helps cover medical emergencies, trip cancellations, and lost or stolen items. However, it doesn’t cover regular doctor visits, ongoing treatments, or planned procedures.

Key points:

- Short-term coverage (usually up to 12 months)

- Covers emergencies, trip cancellations, lost luggage, and delays

- Best for tourists, business travellers, and students on short programmes

- Excludes ongoing medical conditions and routine healthcare

International health insurance

International health insurance is designed for people who live abroad for a long time — such as expats, digital nomads, retirees, or families moving overseas. It offers full medical coverage, including checkups, preventive care, maternity, and treatment for chronic illnesses. Unlike travel insurance, it does not include benefits for travel delays or cancellations.

Key points:

- Long-term protection for expats, digital nomads, retirees, and families abroad

- Covers routine checkups, chronic diseases, maternity care, and preventive health

- Provides global access to hospitals and healthcare networks

- Does not cover travel disruptions

Cigna Global Health Insurance offers strong and reliable coverage for people living abroad long-term. Its plans include both inpatient and outpatient care, emergency medical evacuation, prescription drugs, and maternity benefits. Policyholders can access a large network of trusted hospitals and clinics around the world, ensuring they get quality care wherever they are.

Cigna also provides 24/7 multilingual customer support to help with medical or claim-related questions, making the process simple and stress-free. With this level of protection, Cigna Global is a great choice for anyone who wants dependable healthcare while living overseas.

When to choose travel insurance

Travel insurance is perfect when you’re abroad for a short time—usually less than 12 months. It protects you during your trip from sudden issues and financial surprises.

It’s best for:

- Vacations or business trips abroad

- Students studying abroad for under a year

- Travellers who only need emergency medical coverage

- Anyone seeking compensation for cancelled trips or lost luggage

This type of insurance is affordable and flexible compared to long-term plans. However, it does not cover ongoing healthcare, regular check-ups, or long-term treatments.

When to choose international health insurance

International health insurance is best for people who plan to live abroad for a long time—such as expats, professionals moving for work, retirees, or families relocating overseas. It provides stable and reliable healthcare access without needing to return home for treatment. Unlike travel insurance, it covers a full range of medical needs, offering long-term support and peace of mind.

Best for:

- Long-term residents, expats, or those relocating for work or retirement

- People who want regular healthcare access while living abroad

- Those needing coverage for chronic conditions, preventive care, or maternity

- Individuals applying for visas or long-term residency who require health coverage

Cigna’s international health plans are designed for long-term residents and expats. They include flexible benefits, direct hospital billing to reduce upfront payments, and access to a wide network of hospitals worldwide. With 24/7 multilingual customer support, Cigna makes healthcare abroad simple and stress-free.

Coverage comparison table

| Feature | Travel insurance | International health insurance |

| Duration | Up to 1 year | 1 year or longer |

| Medical coverage | Emergency only | Comprehensive (routine, chronic, maternity) |

| Trip cancellation | Covered | Not covered |

| Lost luggage | Covered | Not covered |

| Pre-existing conditions | Limited | Often covered with selected plans |

| Routine checkups | Not covered | Covered |

| Prescription drugs | Emergency only | Covered for chronic care |

| Cost | Lower (short-term) | Higher (comprehensive) |

Latest Thailand News

Follow The Thaiger on Google News: