What’s not covered by health insurance in Thailand?

Health insurance in Thailand has important limits that everyone should know. Many policies do not cover pre-existing conditions, motorcycle accidents, extreme sports, or specific treatments. These gaps can lead to unexpected costs during emergencies. Coverage for outpatient care and hospital stays also varies between plans. In this article, we’ll explore what is typically not covered by health insurance in Thailand and why it’s important to understand these exclusions.

Factors not covered by health insurance in Thailand?

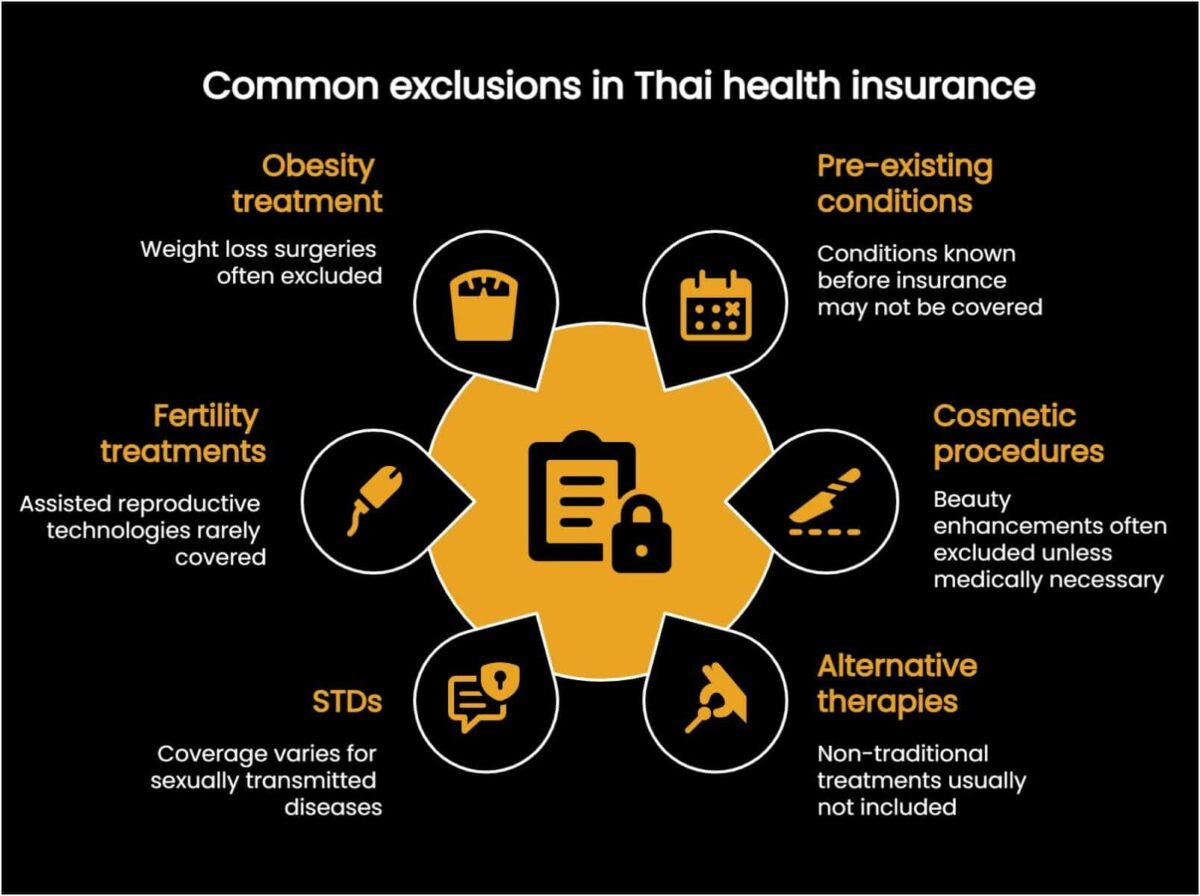

Common exclusions

Health insurance in Thailand often comes with exclusions that policyholders should understand to avoid unexpected costs. Knowing these exclusions helps in making better decisions about coverage. Some of the most common exclusions include:

- Pre-existing conditions: Most plans do not cover pre-existing conditions or require a waiting period. This means treatment for any condition you had before getting insurance may not be reimbursed.

- Cosmetic procedures: Plastic surgery and other cosmetic treatments are usually not covered unless medically necessary. This applies to procedures aimed at improving appearance.

- Alternative therapies: Treatments like acupuncture or homoeopathy are not included in many standard plans, limiting options for those seeking alternative care.

- Sexually transmitted diseases (STDs): Coverage for conditions like HIV/AIDS or other STDs varies. Many insurers impose limitations or exclude these altogether.

- Fertility treatments: Procedures like IVF or other assisted reproductive technologies are rarely included, leaving individuals to bear these costs themselves.

- Obesity treatment: Treatments for obesity, including surgeries, are often excluded unless specific medical criteria are met.

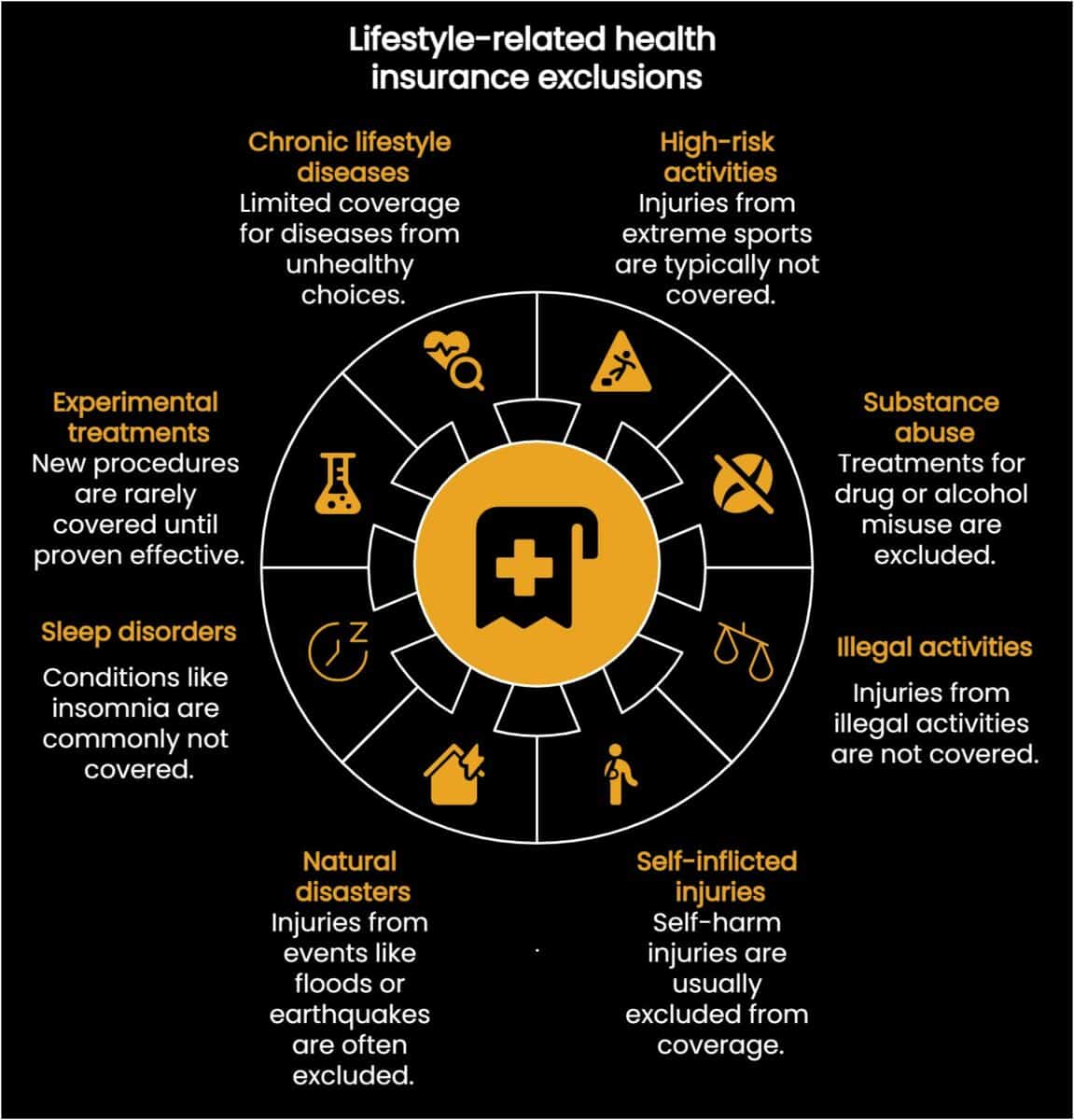

Lifestyle-related exclusions

Many health insurance plans in Thailand come with lifestyle-related exclusions that can affect coverage and lead to unexpected costs. Knowing these exclusions helps individuals make better decisions about their insurance. Here are some common examples:

- Injuries from high-risk activities: Injuries from extreme sports like skydiving, rock climbing, or motocross are usually not covered unless extra coverage is purchased.

- Substance abuse: Treatments for drug or alcohol misuse, including rehabilitation, are excluded. Injuries while under the influence are also not covered.

- Illegal activities: Most policies do not cover injuries or illnesses caused by illegal activities, such as breaking the law or drug use.

- Self-inflicted injuries: Most policies exclude coverage for injuries caused by self-harm or suicide attempts, leaving individuals to cover these costs themselves.

- Natural disasters and terrorism: Injuries from events like floods, earthquakes, or acts of terrorism are often not covered by health insurance.

- Sleep disorders: Conditions such as insomnia or sleep apnoea are usually excluded, making it difficult to access necessary treatment.

- Experimental treatments: New or experimental procedures are rarely covered until they are proven effective through clinical trials.

- Chronic lifestyle diseases: Some plans limit coverage for diseases like diabetes or hypertension, especially if linked to unhealthy lifestyle choices.

Specific limitations

Many health insurance plans come with specific limitations that can impact individuals’ coverage for important health services. The following are common examples:

-

- Dental and vision care: Basic plans often exclude routine dental care, braces, and corrective eyewear, leaving individuals to pay out-of-pocket or buy extra coverage.

- Maternity care: Most policies don’t include pregnancy-related costs like prenatal care, childbirth, or postnatal care unless specifically stated in the plan.

- Mental health services: Many plans offer limited or no coverage for counselling or psychiatric treatments, which may not meet the needs of some individuals.

- Preventive services: Vaccinations and screenings may not always be fully covered, and some plans require co-pays or have restrictions.

- Outpatient services: Coverage for outpatient treatments can vary, with some plans limiting visits or excluding specific services altogether.

- Emergency services: Some policies require pre-authorisation for emergency treatments or set limits on coverage amounts, which can create issues in urgent situations.

International coverage

When choosing health insurance in Thailand, it’s important to know that many plans don’t cover medical care received abroad. Most policies are designed for use within Thailand, which can leave travellers facing high medical expenses if they need treatment while overseas.

To avoid this, it’s worth considering a plan that includes international coverage. These plans allow access to healthcare providers in other countries and often include emergency services for urgent situations.

However, even with international coverage, there may be exclusions. For example, treatments related to pre-existing conditions or injuries from high-risk activities might not be covered. These plans typically have higher premiums, but the added options they provide can make a big difference.

It’s also helpful to understand the claims process for receiving treatment outside Thailand. This ensures a smoother experience if medical care is needed during travel. For frequent travellers or those living abroad, a policy with international coverage offers valuable peace of mind.

Optional add-ons

In Thailand, many health insurance policies offer optional add-ons that allow individuals to tailor their coverage based on personal needs. These add-ons cover services often excluded from basic plans, such as maternity care, dental treatments, and protection for high-risk activities.

For example, maternity add-ons provide coverage for prenatal visits, childbirth, and postnatal care, which are typically not included in standard policies. Dental add-ons cover routine care like check-ups and cleanings, as well as major procedures such as surgeries, although waiting periods may apply. For those participating in extreme sports or high-risk activities, specific add-ons ensure protection against unexpected medical expenses.

Cigna offers a range of flexible add-ons to enhance its health insurance plans. Customers can choose options that suit their lifestyle and health needs.

Additionally, Cigna provides a 10% discount on expat health plans, helping customers save while enjoying extensive coverage. Requesting a free quote can help you explore these add-ons and design a plan that fits your specific requirements.

How to verify coverage

Verifying your health insurance in Thailand is important to avoid unexpected costs and ensure you receive the care you need. Start by carefully reading your policy document to understand what is covered and any exclusions. This helps you avoid surprises when seeking treatment.

Before visiting a hospital or clinic, contact them to confirm if they accept your insurance. You should also ask about required documents, such as your insurance card or ID, to make the process smoother.

It’s also a good idea to call your insurance provider and ask specific questions about your coverage, including exclusions or limits. Taking these steps ensures you have a clear understanding of your benefits and helps you avoid unexpected expenses during medical care.

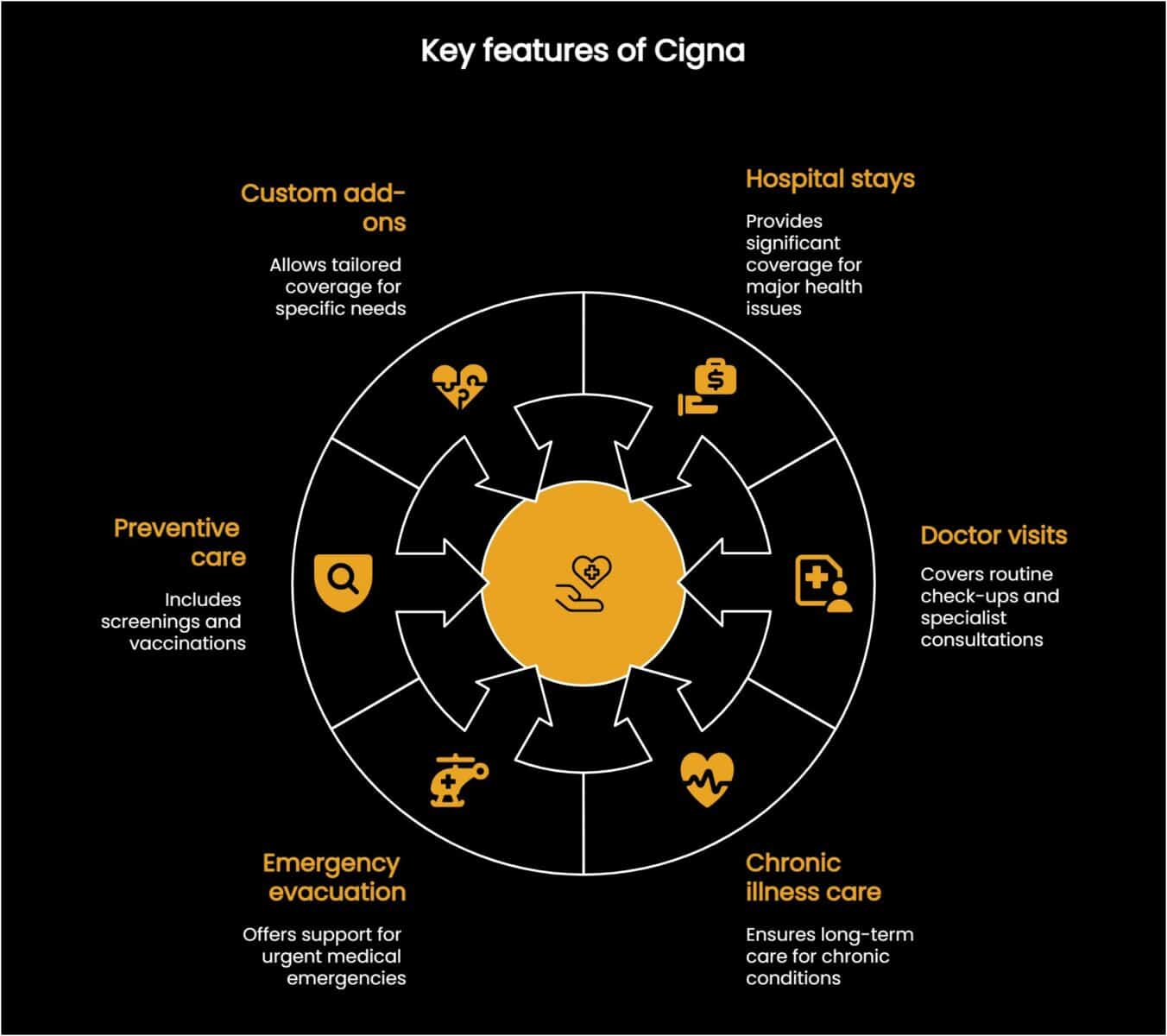

Key features of Cigna health insurance for expats in Thailand

When choosing health insurance in Thailand, it’s important to understand features that can improve your healthcare experience as an expat.

- Hospital stays: Covers up to US$1,000,000 annually for severe health conditions, reducing the financial burden of major treatments.

- Doctor visits: Provides up to US$25,000 per year for routine check-ups and specialist consultations, minimising out-of-pocket expenses.

- Chronic illness care: Offers full coverage for long-term treatments, ensuring ongoing care for chronic conditions without financial strain.

- Emergency evacuation: Includes worldwide coverage for urgent medical situations, offering support in critical emergencies.

- Preventive care: Covers screenings, vaccinations, and routine check-ups to help detect and manage health problems early.

- Custom add-ons: Allows additional coverage for dental, vision, or maternity care, tailored to individual health needs.

Securing health insurance now ensures you are protected from rising costs and have access to quality care tailored to expats in Thailand.

Health insurance in Thailand often comes with exclusions like pre-existing conditions, high-risk activities, and cosmetic procedures, which can leave gaps in coverage. Optional add-ons for services such as maternity care, dental treatments, and extreme sports allow individuals to tailor their plans for more complete protection.

Verifying coverage details and understanding exclusions is essential to avoid surprises during treatment, while international coverage is a valuable option for frequent travellers or expats.

For a deeper look into the costs of health insurance in Thailand, the article about how much Thai health insurance can be offers helpful insights.

Sponsored

FAQ for What’s not covered by health insurance in Thailand?

What is health insurance in Thailand?

Health insurance in Thailand helps cover medical expenses but often has exclusions and limits. Understanding these is important to avoid unexpected costs.

What are common exclusions in Thai health insurance?

Exclusions include pre-existing conditions, cosmetic treatments, alternative therapies, fertility procedures, and injuries from high-risk activities. Substance abuse and self-inflicted injuries are also not covered.

How can someone verify their health insurance coverage?

Read the policy document carefully to check coverage and exclusions. Contact the hospital or clinic to confirm they accept the insurance. Reach out to the insurance provider to clarify details and required documents.

Are optional add-ons available for health insurance in Thailand?

Yes, optional add-ons like maternity care, dental treatments, and coverage for high-risk activities can help customise plans to match specific needs.

Is international coverage included in Thai health insurance?

Most Thai health insurance plans don’t cover medical care abroad. Some plans offer international coverage, useful for frequent travellers or expats.

Latest Thailand News

Follow The Thaiger on Google News: