How much is Thai health insurance?

Health insurance in Thailand is essential for expats and locals, providing financial protection and access to quality care. Costs depend on age, health, and coverage level, with basic plans being cheaper but limited and comprehensive plans offering more benefits at a higher price. Regardless, getting Thai health insurance has its costs and it’s good to be aware of how much you are giving and what you gain from it.

Factors affecting health insurance costs

Health insurance costs in Thailand depend on several factors that affect both locals and expats. Understanding these factors is important for choosing the right plan that fits individual needs and budgets.

Age and health condition

Age is a major factor in health insurance costs. Older individuals pay higher premiums due to increased health risks and the likelihood of needing more medical care.

Pre-existing conditions can also raise costs, as insurers may charge more for people who require frequent or intensive treatment. Insurers often use medical underwriting to evaluate health before setting premiums.

Type of coverage (Basic vs. comprehensive)

The type of plan people choose greatly affects the cost. Basic plans are cheaper and cover only essential services, but they may exclude major treatments.

Comprehensive plans offer broader coverage, including hospitalisation and outpatient care, but come with higher premiums. Balancing your healthcare needs with your budget is key when deciding.

Local vs. international insurance providers

Local insurers usually have lower premiums, focusing on domestic coverage tailored for Thai residents. International providers, while more expensive, offer wider coverage, including access to global hospitals and clinics. Many expats prefer international plans for their flexibility and extensive benefits.

Additional services

Adding services like dental, vision, or maternity care increases premiums. These options are often add-ons but can be essential for specific needs. Choosing additional coverage depends on individual priorities and how much extra protection is required.

Average costs of Thai health insurance

Understanding the average Thai health insurance cost is important for both locals and expats. Cigna offers plans tailored to different needs and budgets, with options for comprehensive coverage. Below is a breakdown of typical health insurance costs in Thailand and insights into what Cigna provides.

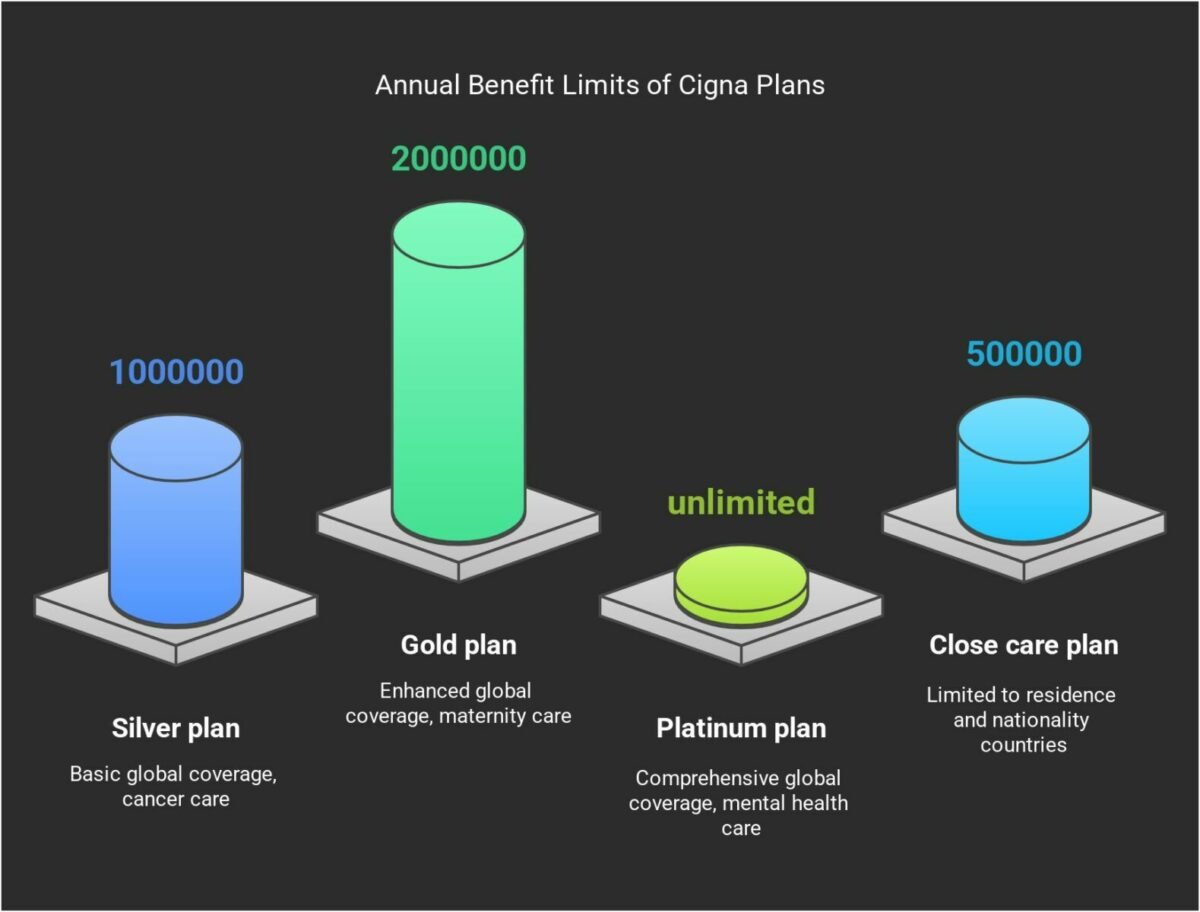

Cigna global health options plans

Cigna offers health insurance plans designed for expats in Thailand. These plans provide flexible options to meet different needs and budgets. Here are the key features and average costs of Cigna’s plans.

| Plan type | Coverage area | Annual benefit limit (US$) | Core benefits |

| Silver plan | Worldwide or worldwide excluding USA | 1,000,000 | – Inpatient and daypatient treatment – Private room accommodation – Full cancer care – Newborn care cover |

| Gold plan | Worldwide or worldwide excluding USA | 2,000,000 | – Inpatient and daypatient treatment – Private room accommodation – Full cancer care – Inpatient maternity care |

| Platinum plan | Worldwide or worldwide excluding USA | Paid in full (unlimited) | – Inpatient and daypatient treatment – Private room accommodation – Full cancer care – Inpatient maternity care – Mental and behavioural health care paid in full |

| Close care plan | Country of residence + Country of nationality | 500,000 | – Inpatient and daypatient treatment (semi-private room) – Full cancer care |

Key benefits of Cigna plans

Cigna’s health insurance plans offer key benefits that provide strong coverage and flexibility for expats in Thailand.

| Benefit | Details |

| Inpatient care | Up to US$1,000,000 per year for hospital stays |

| Outpatient visits | Up to US$25,000 annually for doctor consultations |

| Chronic condition support | Full coverage for ongoing treatment of chronic illnesses |

| Emergency evacuation | Covered 100% worldwide for life-threatening situations |

| Preventive care | Includes check-ups, screenings, and vaccinations |

| Customisable add-ons | Options for dental, vision, and maternity care can be added |

Considering health insurance? Premiums often increase at the start of the year when policies are updated. Securing your plan now can save you money in 2025. Prioritise your health and act today. Click to get your quote today!

Benefits of investing in health insurance

Investing in health insurance offers several key benefits for expats and families living in Thailand. Health insurance helps cover unexpected emergencies like accidents or sudden illnesses, reducing financial stress from high medical bills.

It also supports the management of chronic conditions like diabetes or asthma by covering doctor visits, diagnostic tests, prescriptions, and hospitalisations. This ensures patients receive proper care and helps prevent complications from untreated conditions.

Access to private hospitals and international-standard care

Health insurance provides access to private hospitals known for high-quality services, shorter wait times, and advanced medical facilities. Many expats prefer these hospitals for their reliable care, especially during emergencies. Insurance plans often include a network of trusted hospitals, ensuring quick and efficient treatment when needed.

Overall, having health insurance gives expats and families peace of mind, knowing medical costs are covered in times of need. This reduces stress during emergencies and allows focus on recovery. For families, it’s especially valuable for children or older people members who may need frequent care. Many policies also include additional benefits like mental health support and wellness programs, promoting overall well-being.

Choosing the right health insurance plan in Thailand

You must understand your healthcare needs before choosing a plan and think about how often you visit doctors, if you have chronic conditions, or if you prefer specific providers. This helps you pick coverage that works best for you and your family.

With that, it is better to check the insurance plans to find the right balance of coverage and cost and see what each plan covers, like hospital stays, outpatient care, and preventive services. Furthermore, review the premiums and benefit limits to ensure you get good value.

Understanding exclusions and coverage limits

Carefully check what the plan does not cover, like pre-existing conditions or specific treatments. Be aware of coverage limits to avoid surprises later. Knowing these details helps you choose a plan that fits your needs.

Latest Thailand News

Follow The Thaiger on Google News: