Ombudsman: No jurisdiction over digital wallet scheme complaints

Keirov Kritteeranon, the secretary-general of the Office of the Ombudsman, revealed that they lack the power to escalate complaints about the contentious digital wallet scheme to the Constitutional Court or any other legal forum.

At the heart of the furore are the government’s ambitious plans to distribute 10,000-baht payments to a staggering 50 million adult citizens through digital wallets, alongside a proposed eye-watering 500-billion-baht loan to bankroll the endeavour.

Allegations have been rife that these moves flagrantly violate not only the Constitution but also the Currency Act and the Financial Discipline Act. However, the Ombudsman’s verdict lands a devastating blow to those seeking legal recourse.

Explaining the rationale behind the decision, the Ombudsman stressed that while it oversees governmental governance actions, the Cabinet’s formulation of policies like the digital wallet scheme falls under the realm of administrative authority, hence beyond its jurisdiction.

Dismissing calls for the matter to be escalated to the Constitutional Court, the Ombudsman highlighted a crucial detail missing from the prime minister’s April 10 statement, crucial to the complainants’ argument regarding the purported 500-billion-baht loan decree, reported The Nation.

A complaint challenging Prime Minister’s Office Minister Pichit Chuenban’s eligibility, owing to a past prison stint, was also left hanging.

ORIGINAL STORY: Thai govt’s digital wallet project: A cash splash on the horizon

The Government of Thailand is still finalising its digital wallet project, a financial aid initiative which promises a 10,000 baht disbursement to eligible citizens. The specific criteria for eligibility include an age threshold, and a deposit cap to ensure the aid reaches those intended.

Citizens who are 16 years old as of September 30 of this year, or born before October 1 2008, will qualify for the scheme.

Moreover, the project stipulates that individuals’ savings in commercial and state-owned banks, including savings accounts, fixed deposits, and other deposit products must not exceed 500,000 baht as of March 31.

This figure does not include government savings bonds, emphasising that only baht-denominated deposits will be considered.

The income cap for eligibility has been set at 840,000 baht per annum, as verified against the Revenue Department’s tax records for the year 2023.

This includes all taxable income streams, such as salaries, wages, freelance payments, contractor fees, rent, interest, dividends, and royalties.

As for the project’s operational details, the registration process is slated to start in the third quarter of this year, with funds becoming available for spending in the fourth quarter.

The criteria for spending these funds remain as initially outlined, focusing on specific product categories and excluding services, prohibited items, oil products, and certain online purchases. Items on the negative list, which are excluded from the program will not be considered until further review in an upcoming meeting.

The project aims to stimulate local economies by directing funds to smaller vendors. Small businesses, both corporate and individually operated, are encouraged to participate, wiexceptupermarkets and hypermarkets.

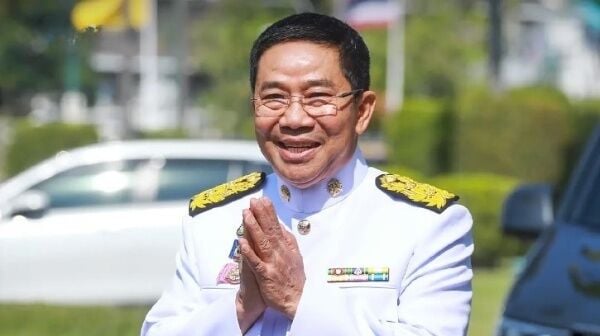

During a recent meeting, Deputy Finance Minister Phaiboon Rojanasakul highlighted the intensive discussions surrounding the project’s systems and conditions, ensuring its smooth progression.

Phaiboon stated there was particular emphasis on identity verification and the linking of data from various government entities, such as the Revenue Department and the Department of Provincial Administration, to facilitate the program’s operations, reported Khaosod.

“The applications to be used in this project are continuously being developed. Agreements with multiple agencies are necessary, such as how to link and verify deposit account data. Initial plans are to use a state-developed application for data integration.”

The digital wallet aid initiative represents a significant effort by the Thai government to support its citizens, particularly the younger generation and those with limited financial resources.

By setting clear guidelines and leveraging technology, the Digital Wallet project aims to deliver financial aid effectively and efficiently. With the project’s launch on the horizon, eligible individuals are advised to prepare their documents and comply with the criteria to benefit from this financial assistance.

Latest Thailand News

Follow The Thaiger on Google News: