Power semiconductor demand for EVs: manufacturing opportunities

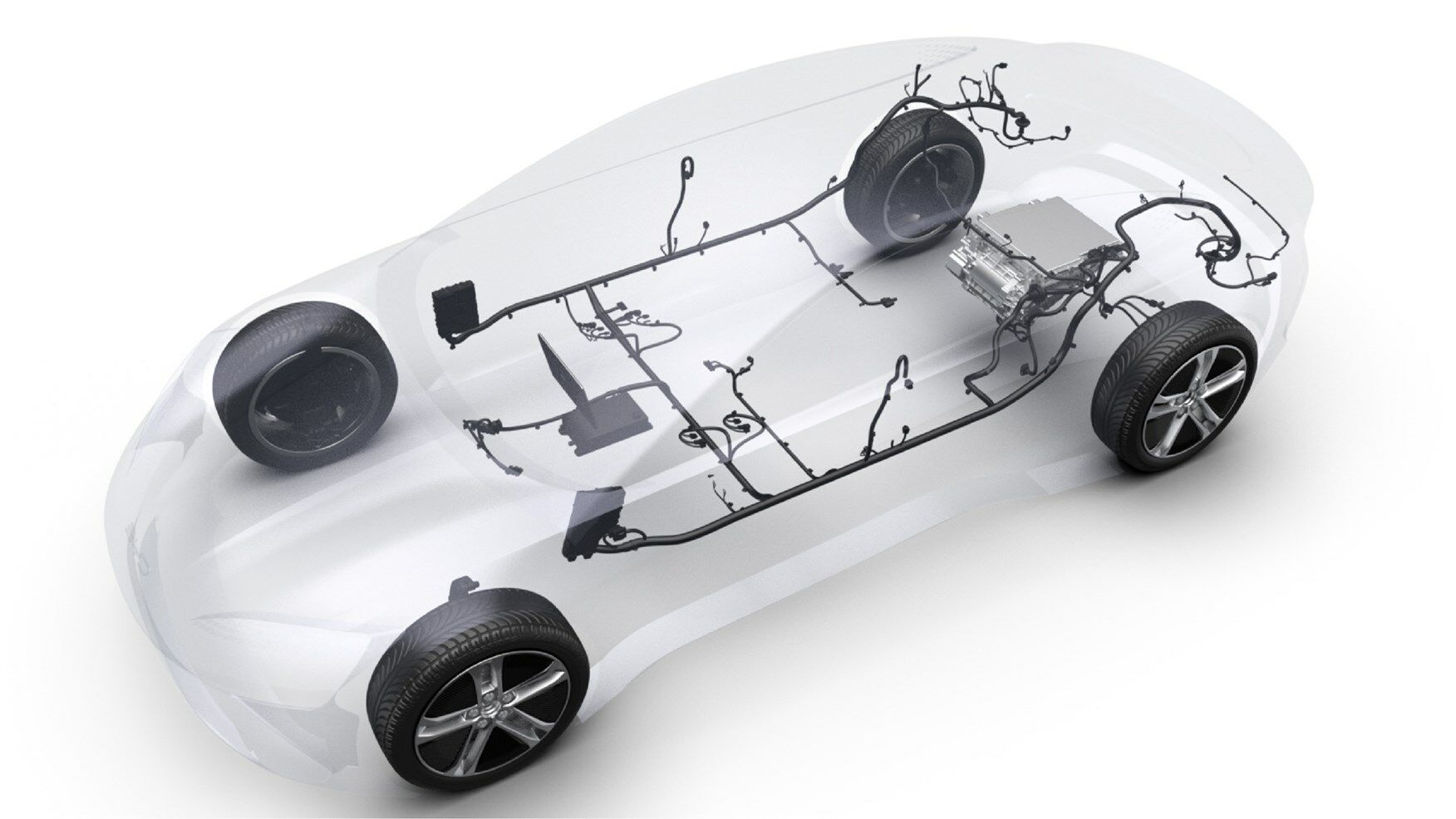

The electric vehicle revolution depends fundamentally on power semiconductor technology that enables efficient energy conversion and management. Silicon carbide and gallium nitride semiconductors have emerged as critical components in EV powertrains, as they offer superior performance compared to traditional silicon-based devices.

These materials allow electric vehicles to achieve longer range, faster charging times, and improved efficiency through reduced energy losses.

The Growing Market for EV Power Semiconductors

![]()

Global demand for power semiconductors in electric vehicles is experiencing exponential growth as automakers accelerate their electrification strategies. Industry analysts project the EV power semiconductor market will exceed 20 billion dollars by 2030, driven by increasing EV production volumes and higher semiconductor content per vehicle.

Manufacturing for these critical components is evolving as companies expand capacity and new players enter the market. Investment flows have intensified, with investors closely monitoring currency markets as exchange rate fluctuations impact costs. Market analysts and investors using the services of brokers like WongaaFX track how currency movements affect the manufacturing economics, particularly when investments in fabrication facilities involve equipment priced in USD, EUR, and JPY.

These investments are driven by two advanced materials that have proven superior to traditional silicon for EV applications. Understanding the technical advantages of these next-generation semiconductors explains why manufacturers are committing billions to production capacity expansion, despite the risks involved.

Silicon Carbide

Superior Performance Characteristics

Silicon carbide power semiconductors offer substantial advantages due to their ability to operate at higher temperatures, voltages, and switching frequencies. These properties translate directly into smaller, lighter, and more efficient power electronics systems for electric vehicles.

SiC devices can reduce energy losses in inverters by approximately 50 percent compared to silicon IGBTs, which directly improves vehicle range and reduces battery size requirements. The higher operating temperature capability of SiC also allows for simplified cooling systems, which reduces vehicle weight and complexity.

Cost Reduction Trajectory

The automotive industry projects that SiC device costs will decline by 30 to 40 percent over the next five years as wafer sizes increase from 150mm to 200mm and manufacturing yields improve. This cost reduction trend is making SiC technology economically viable for mass-market electric vehicles, rather than limiting it to premium models.

Gallium Nitride

Gallium nitride power semiconductors are gaining traction due to their exceptional switching speed and power density. GaN devices enable more compact and efficient charging solutions and support the faster charging times that consumers demand.

Automotive suppliers are adopting GaN technology for DC-DC converters and auxiliary power systems within vehicles. The material’s ability to handle high frequencies makes it ideal for reducing the size and weight of power conversion equipment while maintaining or improving efficiency levels.

Manufacturing Opportunities in Thailand

Backend Semiconductor Operations

Thailand possesses established capabilities in semiconductor assembly, testing, and packaging that can be leveraged for power semiconductor manufacturing. The country hosts major backend facilities operated by international companies and provides existing infrastructure and a skilled workforce.

Expanding these operations to include power semiconductors for EV applications represents a natural progression that capitalises on existing strengths. The proximity to major automotive manufacturing hubs in Thailand and throughout Southeast Asia creates logistical advantages for supplying power semiconductors to EV production lines.

Supply Chain Integration

Thai manufacturers can establish partnerships with SiC and GaN substrate suppliers while building expertise in device fabrication and packaging.

Government incentives through the Board of Investment provide attractive conditions for semiconductor manufacturing investments, including tax holidays and infrastructure support. The Eastern Economic Corridor offers dedicated industrial zones with a reliable power supply and transportation links essential for semiconductor operations.

Market Positioning Strategies

Thai manufacturers can pursue several strategic approaches to enter the EV power semiconductor market effectively. Focusing on specific device types or applications allows companies to build specialised expertise rather than competing across the entire product range. Establishing joint ventures with well-known semiconductor companies provides access to technology and manufacturing know-how while sharing investment risks.

Targeting regional automotive customers creates opportunities to develop long-term supply relationships as the Southeast Asian EV market expands. Companies should also consider certification processes early, as automotive qualification cycles typically require two to three years before devices enter production vehicles.

The transition to electric vehicles creates unprecedented opportunities for semiconductor manufacturers willing to invest in power device capabilities. As the automotive industry continues its electrification trajectory, demand for silicon carbide and gallium nitride power semiconductors will grow substantially, which creates market opportunities for manufacturers who establish competitive positions.

Latest Thailand News

Follow The Thaiger on Google News: