Thailand economy: Fiscal position to suffer due to government policies like digital wallet scheme

Thailand’s fiscal position is predicted to face a downturn in the medium term, according to analysts, as the government advances populist policies such as the digital wallet scheme. BMI, a division of Fitch Solutions, forecasts that the nation’s budget deficit will escalate from 2.9% in the current fiscal year to 3.6% in the following fiscal year.

This is due to the government’s announcement of various policies aimed at stimulating GDP growth, coupled with a fiscal budget of 3.48 trillion baht for next year, said BMI, the London-based research firm.

“The fiscal position of Thailand is anticipated to be strained in the medium term, as the Pheu Thai government is likely to execute expansionary populist spending to achieve its growth target of 5.0%.”

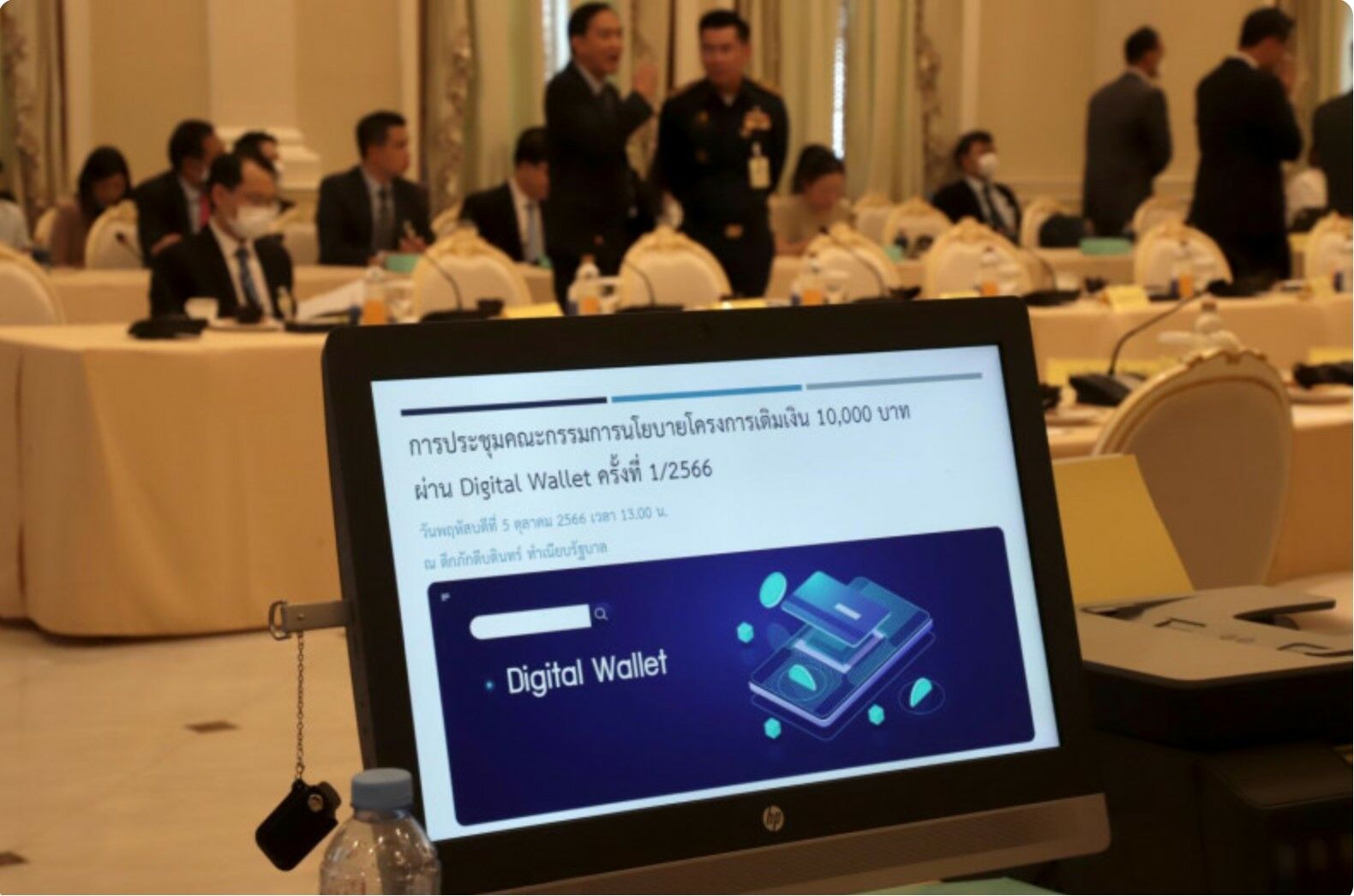

Several measures that could potentially harm Thailand’s fiscal position have already been unveiled by policymakers. The most significant of these is the 10,000 baht digital handout, which, according to initial estimates, would entail a cost of about 560 billion baht, or 2.8% of GDP.

Adjustments have been made to the scheme to exclude the wealthy, although the specific definition of this group remains unclear. The BMI believe it will still demand a considerable amount from the government if it encompasses everyone from the lower-middle-income bracket.

BMI also predicts that Thailand’s debt levels will remain high at approximately 60% of GDP over the medium term. This is because the government is increasing fiscal spending to finance new initiatives, which could have a negative impact on fiscal stability.

“In the aftermath of the pandemic, the country’s fiscal deficit expanded to record levels and debt levels have surged.”

Digital wallet scheme

Maybank Securities suggested that the revised digital wallet scheme and its delayed implementation would lessen the immediate pressure on Thailand’s fiscal balances.

“This comes at a time when credit rating agencies are expressing concerns about the country’s public debt levels.”

Advisors to Prime Minister Srettha Thavisin have confirmed that the digital wallet scheme’s coverage will be reduced to 40 million recipients from the initial 56 million, and its implementation will be postponed from February to September next year.

This development is expected to decrease the necessity for the central bank to elevate the policy rate to counter inflationary pressures from an excessively expansionary fiscal policy stance.

The Bank of Thailand has voiced support for fiscal consolidation, in line with recommendations from the International Monetary Fund, to strengthen economic resilience amid concerns about currency weakness among Asian central banks.

Follow more of The Thaiger’s latest stories on our new Facebook page HERE.

Latest Thailand News

Follow The Thaiger on Google News: