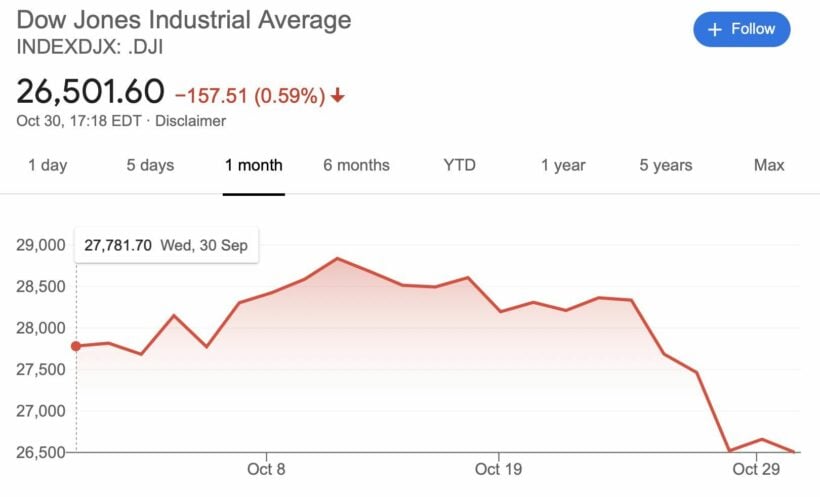

Dow and S&P 500 take a breath after an ugly week, tech stocks lead the way down

US stocks closed lower yesterday to end an ugly week downbeat with ‘uncertainty’ remaining the overwhelming sentiment. Tech stocks led the march downwards. The Dow Jones Industrial Average dropped in its biggest monthly collapse since March with investors reacting to rising Covid-19 cases in the US and Europe, peppered by nervousness ahead of next Tuesday’s US presidential election. The increased volatility forced all three major indexes seeing their biggest weekly declines since the worst of the coronavirus-inspired selloff 8 months ago.

The Dow fell around 157 points, to end near 26,502, according to preliminary figures, while the S&P 500 lost around 40 points, or 1.2%, to finish near 3,270. The Nasdaq Composite gave up around 274 points, or 2.4%, closing near 10,912. The Dow had a 6.5% weekly fall and a 4.6% monthly drop. Friday’s decline saw the Nasdaq negative for the month of October, falling 2.3%. The Nasdaq was down 5.5% for the week.

The Dow dropped more than 500 points at its session low with tech stocks – primarily Apple, Amazon, Alphabet and Facebook – leading the market decline.

A number of stocks were on the move, down, following a slew of earnings, including from the tech giants. Twitter sank more than 20% on slowing growth, while Exxon reported its 3rd straight quarter of losses.

Key moments yesterday…

- Dow closed down 0.59% for its 5th negative day out of 6

- S&P 500 closed down 1.21% for its 4th negative day in 5

- Dow closed down 6.47% this week for its worst week since March 20

- S&P closed down 5.64% this week for its worst week since March 20 when the S&P lost 14.98%

- S&P closed down 2.77% this month for its second-straight negative month

- Nasdaq closed down 5.51% this week for its worst week since March 20 when the Nasdaq lost 12.64%

Latest Thailand News

Follow The Thaiger on Google News: