How one hospital visit in Thailand could cost more than your whole trip

You might save money day to day, but one accident or illness could leave you with a big bill and a lot of stress

Thailand is a favourite spot for travellers who want to enjoy more while spending less. From cheap street food to low-cost hotels and fun attractions, it’s easy to stretch your budget here. But there’s one thing many people don’t think about—a sudden hospital visit. It can cost more than your whole trip. You might save money day to day, but one accident or illness could leave you with a big bill and a lot of stress but good health insurance such as SafetyWing can help you with these issues.

On this page

| Jump to Section | Description |

|---|---|

| Real cost of healthcare in Thailand for tourists | The cost of healthcare in Thailand can be high for tourists, especially at private hospitals. Treatments can range from US$50 to US$20,000, depending on the severity. |

| Why travel insurance matters | Travel insurance is crucial for covering emergency medical expenses, avoiding large bills, and preventing delays in treatment in Thailand’s healthcare system. |

| SafetyWing as a smart choice for travellers | SafetyWing offers flexible, low-cost travel medical insurance for digital nomads and travellers, covering medical visits, emergencies, and more for around US$2/day. |

| Long-term travellers are at higher risk | Long-term travellers face higher health risks like dengue fever, motorbike accidents, and tropical diseases, making comprehensive insurance essential for extended stays. |

| How SafetyWing fits into your travel budget | SafetyWing is affordable, costing around US$56 per month, and can save you from high medical bills in private hospitals, making it a smart investment for long-term travel. |

Real cost of healthcare in Thailand for tourists

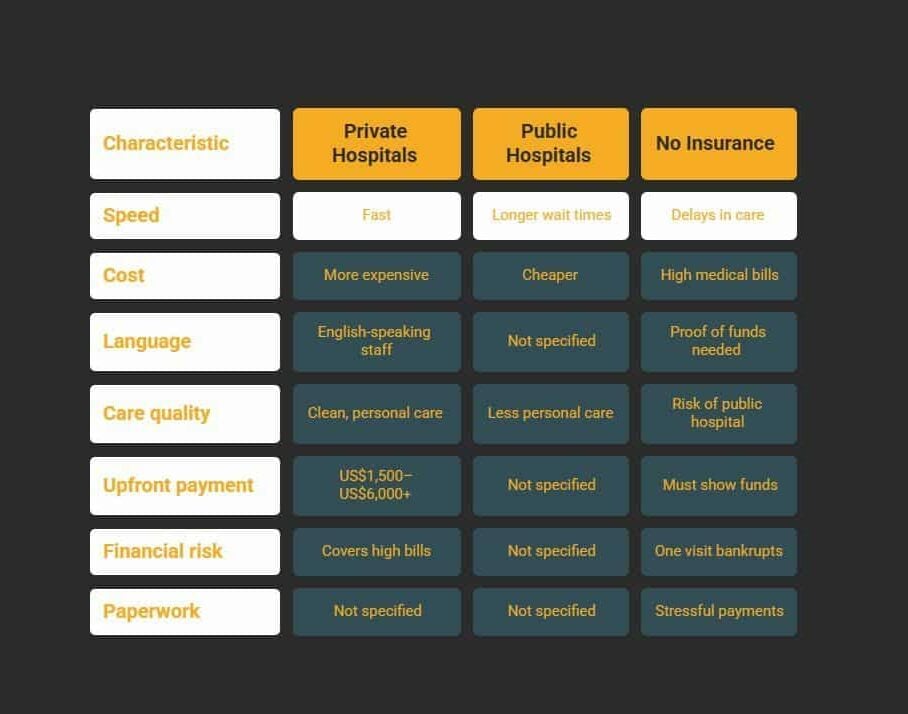

The cost of healthcare in Thailand depends on where you go. Tourists usually choose private hospitals because they are cleaner and faster and have English-speaking staff. But they also cost more. Public hospitals are cheaper, but you might have to wait longer and get less personal care.

Many tourists end up in hospital for things like food poisoning, motorbike accidents, or heatstroke. A short visit to the emergency room in a private hospital can start at US$50 to US$100. But if you need to stay overnight or have surgery, the price can rise quickly—into the hundreds or even thousands of US dollars. Major operations, like heart or joint surgery, can cost between US$10,000 and US$20,000 or more.

On top of that, there are extra costs most people don’t expect. Ambulance rides, tests, specialist doctors, and medicine can all add to the bill. These hidden charges often surprise tourists and can turn one hospital visit into the most expensive part of the trip.

That’s why having good travel health insurance is so important. It helps you avoid big bills and gives you peace of mind while you enjoy your time in Thailand.

Why travel insurance matters

Many tourists think that because Thailand is cheap, healthcare must be cheap too. But that’s not always true. If you go to a private hospital, you may be asked to pay a large amount before getting treatment. This can be between 50,000 and 200,000 Thai baht (about US$1,500 to US$6,000 or more), even in emergencies.

Without travel insurance, a small accident can lead to a big bill. For example, treating a broken leg at a private hospital can cost over US$5,000. These costs add up fast, and many people are not ready for them.

Travel insurance is important because it helps cover these high medical bills. It also means you won’t have to wait or deal with paperwork while you’re in pain. If you don’t have insurance, hospitals might delay treatment unless you show a credit card or cash. You could even be moved to a crowded public hospital or have care delayed.

Good travel insurance takes away that worry. It lets you focus on getting better, not stressing about money, during your trip to Thailand.

SafetyWing as a smart choice for travellers

SafetyWing is a simple and low-cost travel medical insurance made for digital nomads, backpackers, and families. It gives you flexible, worldwide cover that’s easy to manage. With the Nomad Insurance plan, you get important protection for about US$2 a day. This includes hospital visits, emergency care, surgeries, prescription medicine, and even emergency dental work up to US$1,000. It also covers Covid-19 like any other illness, which is helpful for today’s travel needs.

One of the best things about SafetyWing is how flexible it is. The insurance works on a monthly plan that you can start, pause, or cancel whenever you want. It renews every four weeks and works in almost every country, so you don’t need to keep buying new insurance when you move around. It also covers emergency evacuation up to US$100,000, return travel costs, trip cancellations, lost luggage, and delays.

Families save money too. Each adult plan includes free cover for up to two children under 10. The claims process is easy, and you get 24/7 help from real people. SafetyWing gives strong medical cover at a fair price, with the freedom travellers need when exploring the world.

Calculate your costs below!

Long-term travellers are at higher risk

Long-term travellers in Thailand face higher health risks simply because extended stays increase exposure to local illnesses and accidents. Common concerns include mosquito-borne diseases like dengue fever and chikungunya, which are prevalent in many regions, especially during rainy seasons.

Routine check-ups become important as travellers may encounter foodborne illnesses such as travellers’ diarrhoea, hepatitis A, and typhoid fever due to contaminated food or water. Additionally, heat-related conditions like heat exhaustion and heatstroke are common in Thailand’s tropical climate.

Motorbike accidents also pose a significant risk, as scooters are a popular but sometimes dangerous mode of transport for tourists and expats alike. The combination of unfamiliar roads, heavy traffic, and varying safety standards contributes to frequent injuries requiring medical attention.

Given these risks, maintaining comprehensive health coverage throughout a long-term stay is essential. Staying insured not only ensures access to quality medical care but also provides peace of mind, allowing travellers to focus on enjoying their time in Thailand without worrying about unexpected medical expenses or complications.

How SafetyWing fits into your travel budget

Just one night in a private hospital in Bangkok can cost US$3,000 to US$5,000. That’s the same as paying for six months or more of SafetyWing’s travel insurance. The Nomad Insurance Essential plan costs about US$56 per month (around US$2 per day) and gives you up to US$250,000 in emergency medical cover. This big difference shows how a small monthly payment can protect you from large, unexpected medical bills.

SafetyWing is easy to use. There are no long-term contracts. You can start, pause, or stop your plan whenever you want. It renews every four weeks, and you can sign up online in just a few minutes. This makes it great for people with changing travel plans.

For digital nomads or anyone travelling for a long time, SafetyWing is a smart choice. It helps turn big hospital bills into small monthly costs, giving you peace of mind and more control over your travel budget.

Thailand is a great place for budget travel, but one hospital visit can cost more than your whole trip. Many tourists choose private hospitals for faster care and English-speaking staff, but the prices can be high—sometimes between US$3,000 and US$20,000, especially if you need surgery or stay overnight. If you don’t have travel insurance, even a small accident can lead to big bills and delays in treatment. That’s why having a flexible plan like SafetyWing helps. It covers your medical costs and gives you peace of mind, especially if you’re staying in Thailand for a long time. To learn more about why the right insurance matters, see The cost of not having the right insurance.

Sponsored

Latest Thailand News

Follow The Thaiger on Google News: