The cost of not having the right insurance

Having the right insurance, especially in a country like Thailand, is important in today’s unpredictable world. Medical emergencies, trip cancellations, and lost belongings can happen anytime, leading to unexpected expenses. Without proper coverage, these costs can put a heavy strain on finances and even affect long-term stability. Insurance acts as a safety net, helping people avoid major financial setbacks.

With the right plan, individuals can handle unexpected situations without worrying about money. This article explains why having the right insurance matters and how it can help reduce the financial impact of life’s surprises.

Financial risks of having no insurance in Thailand

Living or travelling in Thailand without insurance can lead to serious financial problems. Medical emergencies, emergency evacuations, and lost belongings can be costly, especially for foreigners. Here’s how these risks can impact finances and how SafetyWing Nomad Insurance can help.

High medical bills

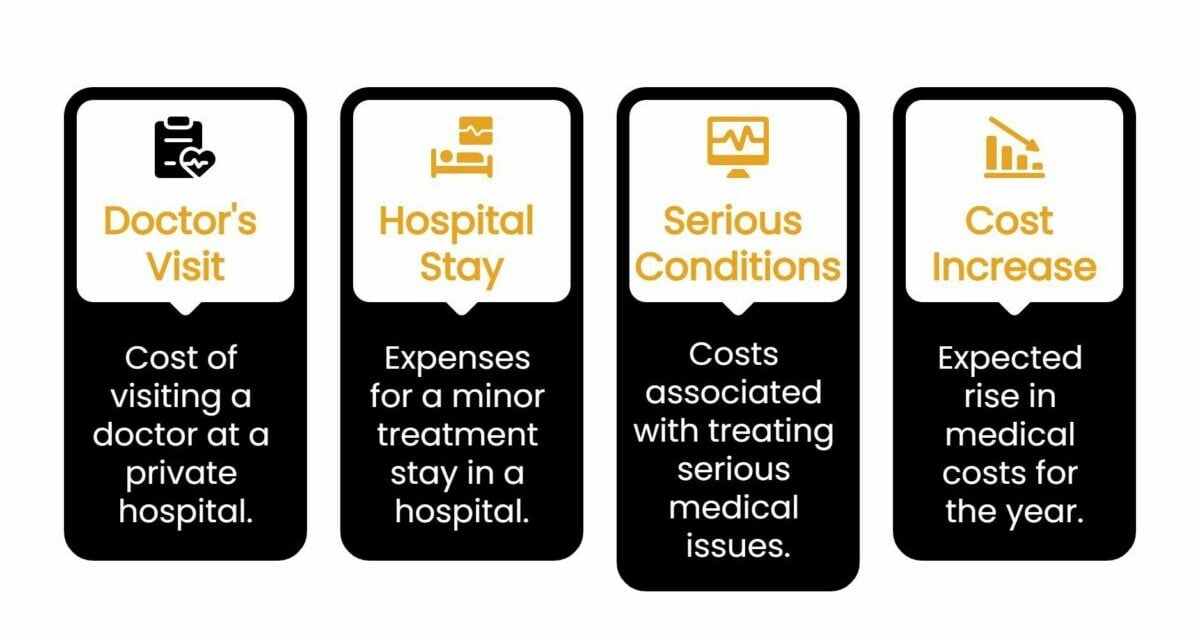

Healthcare costs in Thailand vary, but private hospitals—where most foreigners seek treatment—can be expensive.

- A doctor’s visit at a private hospital costs between 1,000 and 3,000 Thai baht.

- A hospital stay for minor treatment can range from 30,000 to 100,000 Thai baht.

- Serious medical conditions, such as a heart attack, may require treatment costing up to 1,000,000 Thai baht or more.

- Medical costs in Thailand are expected to rise by 14.2% this year, making healthcare even more expensive.

SafetyWing Nomad Insurance provides:

- Essential Plan: Covers up to US$250,000 for medical treatment, including hospitalisation and emergency dental care.

- Complete Plan: Covers up to US$1,500,000, offering more protection for major medical issues.

Emergency evacuations

If someone needs an ambulance within Thailand, costs can be unexpectedly high:

- A ground ambulance for non-critical transport can cost between 3,000 and 20,000 Thai baht, depending on distance and hospital fees.

- An air ambulance within Thailand, such as an emergency helicopter or fixed-wing aircraft, can cost 150,000 to 800,000 Thai baht, depending on the medical care required and the distance travelled.

SafetyWing Nomad Insurance helps cover these high costs:

- The Complete Plan includes US$100,000 lifetime coverage for emergency medical evacuations, ensuring transport to the nearest hospital with proper facilities.

Lost or stolen items protection from having insurance in Thailand

Thailand is a popular tourist destination, but theft and lost belongings are common risks, especially in crowded areas.

- A stolen laptop or camera can cost between 30,000 and 100,000 Thai baht to replace.

- Lost luggage on international flights can mean replacing items worth 10,000 to 50,000 Thai baht.

SafetyWing Nomad Insurance offers protection:

- Luggage coverage: Up to US$3,000 per year, with a lifetime limit of US$6,000.

- Electronics theft add-on: Covers up to US$3,000 per item, with a US$6,000 lifetime limit.

Travel disruptions and unexpected expenses in Thailand

Travelling in Thailand is exciting, but unexpected problems like flight cancellations, accommodation issues, and legal costs can lead to extra expenses. Here’s how these risks can affect travellers and how insurance can help.

Flight cancellations and delays

Flight disruptions can be expensive, forcing travellers to pay for rebooking, hotels, and food.

- A flight delay of more than 6 hours can lead to additional expenses for meals and transportation, costing 1,000 to 5,000 Thai baht.

- Last-minute hotel stays due to cancellations can cost 3,000 to 10,000 Thai baht per night, depending on the location.

- Budget airlines in Thailand often do not cover extra costs, making travel insurance important for compensation.

Accommodation issues

Many hotels and resorts in Thailand have strict cancellation policies. If plans change, travellers can lose the full booking amount for non-refundable reservations.

- A 3-night stay at a mid-range hotel can cost 15,000 Thai baht, which may not be refunded if cancelled.

- Resorts and luxury hotels charge up to 50% of the booking cost if cancelled within a few days of arrival.

- Peak season (December to February) has even stricter policies, with no refunds in most cases.

Legal and liability costs

Accidents or legal issues in Thailand can result in high costs, especially if a lawyer is needed.

- A minor traffic accident involving a rented motorbike or car can result in fines and legal fees of 20,000 to 100,000 Thai baht.

- If a traveller accidentally damages property, compensation claims can reach hundreds of thousands of Thai baht.

- Hiring a lawyer for legal disputes can cost 5,000 to 50,000 Thai baht, depending on the case.

Why travel insurance in Thailand is important

Travel disruptions in Thailand can lead to high costs, but the right insurance helps travellers manage unexpected expenses. By covering flight delays, hotel cancellations, and legal issues, insurance provides financial protection and peace of mind.

SafetyWing Nomad Insurance helps travellers manage unexpected travel costs in Thailand. It provides coverage for lost luggage, trip interruptions, and travel delays, reducing financial stress when plans change.

- Trip interruption and travel delay coverage: The Complete Plan reimburses unexpected costs if a trip is cut short or delayed due to covered reasons, such as flight cancellations or severe weather.

Having SafetyWing Nomad Insurance ensures that travellers don’t have to bear the full cost of these disruptions, making trips smoother and more financially secure.

Long-term consequences of having no insurance in Thailand

Living or travelling in Thailand without insurance can lead to serious financial problems, difficulty accessing healthcare, and loss of work income. Here’s how these risks can affect individuals in the long run.

Debt and financial instability

Thailand already has a high household debt rate, with the debt-to-GDP ratio at 104% in 2024. A single emergency can push people into deep financial trouble.

- Private hospitals charge tens of thousands of Thai baht for treatment, and without insurance, foreigners must pay upfront.

- A hospital stay for a serious condition can cost over 1,000,000 Thai baht, forcing some to borrow money at high interest rates or even face bankruptcy.

- Some uninsured people turn to loan sharks, leading to long-term financial struggles.

Insurance helps cover unexpected costs, preventing massive debt from medical bills and keeping finances stable.

Limited access to healthcare

Thailand offers universal healthcare for citizens, but foreigners must pay out of pocket at private hospitals. Many hospitals require upfront payment before starting treatment.

- Without insurance, some people delay seeking medical help, leading to worse health conditions.

- Transportation to major hospitals can be costly for those in rural areas, adding to the difficulty of getting care.

With insurance, individuals get access to treatment without worrying about upfront costs, ensuring they receive proper medical care on time.

Loss of work and productivity

Being uninsured can hurt income and job security for digital nomads and remote workers.

- A serious illness or injury could mean weeks or months without work, leading to missed deadlines and lost clients.

- Even short work breaks can affect career growth and financial stability in Thailand’s competitive job market.

Insurance allows individuals to recover without financial stress, helping them return to work faster.

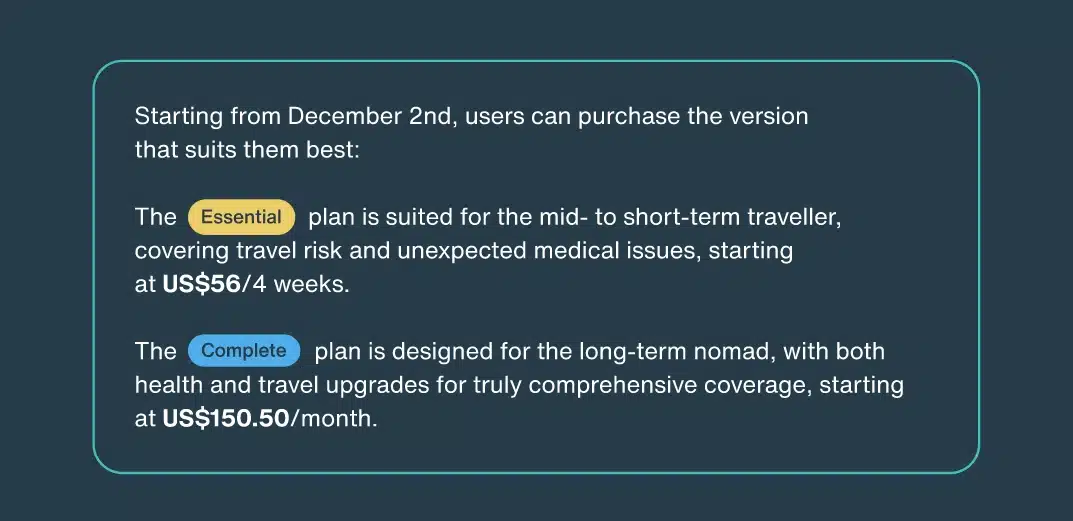

SafetyWing Nomad Insurance in Thailand

SafetyWing Nomad Insurance provides coverage tailored to people who live or work abroad.

- It covers routine checkups and preventive care with the Complete Plan, making it easier for travellers to manage long-term health.

- It offers flexible worldwide coverage, allowing travellers to stay protected no matter where they go.

- The subscription-based model lets users pause or stop coverage anytime, making it more affordable than traditional insurance.

With SafetyWing Nomad Insurance, remote workers and travellers can stay financially secure, access healthcare without upfront payments, and avoid long-term financial struggles while living in Thailand.

Calculate your costs below!

Not having insurance in Thailand can lead to high medical bills, costly travel disruptions, and financial stress. Private hospitals require upfront payments, and emergency services like ambulances can be expensive. Flight cancellations, hotel issues, and legal problems can also add unexpected costs. Without coverage, people may struggle to get medical care, fall into debt, or lose income if they cannot work. SafetyWing Nomad Insurance helps by covering these risks, making travel and living abroad more secure.

Latest Thailand News

Follow The Thaiger on Google News: