What happens if you get hospitalised in Thailand without insurance?

This is one way you can helps cover medical bills, emergency care, and hospital stays

If you get hospitalised in Thailand without insurance, it can be stressful and expensive. Thailand’s public healthcare does not cover foreigners, and private hospitals often ask for payment before giving treatment. Even public hospitals may delay care if you can’t pay right away. In this article, we’ll explain what to expect if you don’t have insurance, how much it can cost, and why having a plan like SafetyWing Nomad Insurance can help you avoid big medical bills and get the care you need.

On this page

| Topic (Jump to section) | Description |

|---|---|

| Hospital admission without insurance in Thailand | Without insurance, hospitals in Thailand may require large upfront payments and could delay treatment until you pay. |

| Cost of hospital care in Thailand | Medical care in Thailand is affordable compared to Western countries, but private hospitals can be significantly more expensive than public ones. |

| Risks of having no insurance in Thailand | Without insurance, you risk high medical bills, delayed care, and administrative burdens, which can cause financial and emotional stress. |

| How SafetyWing helps if you’re hospitalised in Thailand | SafetyWing provides coverage for emergency medical care, evacuation, and hospital stays, ensuring you don’t have to deal with upfront payments. |

| Stay protected while living or travelling in Thailand | For just US$2 per day, SafetyWing offers simple, flexible health insurance for digital nomads and travellers, ensuring coverage in over 180 countries. |

Hospital admission without insurance in Thailand

If you don’t have insurance in Thailand, getting into a hospital, especially a private one, can be challenging and expensive. Here’s what you need to know.

Upfront payment rules

Private hospitals often ask for a deposit right away, usually between 50,000 and 200,000 Thai baht (US$1,500–US$6,000+), before they treat you in an emergency. Public hospitals might ask for a smaller deposit, but they give priority to Thai citizens who are covered by the country’s health system. If your condition is not urgent, public hospitals may delay treatment until you can pay.

Showing you can pay

If you don’t have insurance, you’ll need to:

- Show your passport for ID.

- Prove you can pay using credit cards, bank statements, or cash.

- Talk to hospital staff about a payment plan for small treatments. You may need to pay a large amount upfront for surgeries or longer stays.

Limited care and hospital transfers

Hospitals may:

- Limit access to specialists, tests, or scans until you pay.

- Move you from a private hospital to a public one if you run out of money.

- Delay elective treatments and give priority to insured patients.

Emergency care

If you have a life-threatening condition, hospitals will stabilise you first. But after that, they’ll still ask for payment before doing surgery, admitting you to the ICU, or continuing treatment. Public emergency rooms are cheaper than private ones, but they can be crowded and may not have English-speaking staff.

Extra paperwork

Without insurance, you’ll need to:

- Work with hospital staff directly to understand bills and get cleared for discharge.

- Handle all your own paperwork, especially if you need documents for visa extensions or travel.

- Deal with possible language issues, especially in smaller towns.

Common medical costs

- Doctor visit (private): US$30 to US$80

- Doctor visit (public): US$10 to US$20

- Specialist: US$45 to US$120 (not including scans or tests)

- Surgery (e.g., appendectomy): Often over US$2,000 in private hospitals

After leaving the hospital

- You usually must pay in full before discharge.

- Some hospitals may hold your passport or personal items until you pay.

- Follow-up care is not arranged unless you pay and schedule it yourself.

- Thai hospital bills are rarely negotiable, and it’s hard to dispute charges.

Tips for uninsured travellers

- Always carry at least US$3,000 in emergency funds.

- Ask to speak with a hospital social worker for help with payments.

- Contact your embassy in case you need financial help or a repatriation loan.

If you want to avoid high costs, delays, and paperwork stress, having insurance like SafetyWing Nomad Insurance makes a big difference. It covers you even in the case you get hospitalised in Thailand and over 180 other countries, so you can focus on getting better, not on how to pay.

Cost of hospital care in Thailand

Thailand has two types of hospitals, which are public (government) and private. Both offer good medical care, but the costs, service, and experience are very different.

Public hospitals

Public hospitals are much cheaper than private ones. They are run by the government and mainly serve Thai citizens under a national healthcare system. Foreigners can still get treatment, but they must pay out of pocket.

Public hospitals are a good choice if you’re looking for affordable care. However, they are often busy, especially in cities, so you may have to wait a long time, especially for non-emergency treatment. Most of the staff speak Thai, so communication can be a challenge if you don’t know the language. Even with these downsides, public hospitals offer many services, including surgery, at much lower prices than private hospitals.

Private hospitals

Private hospitals in Thailand are known for their modern equipment, fast service, and comfortable rooms. Many are internationally accredited and cater to foreigners and medical tourists, especially in Bangkok. They have English-speaking staff and doctors trained abroad.

But these hospitals are more expensive. You’ll pay much more for doctor visits, tests, and treatment compared to public hospitals.

Things to keep in mind

- Medical care in Thailand costs 50% to 75% less than in Western countries.

- Foreigners usually pay more than Thai citizens.

- Private hospitals give faster service and speak English but cost more.

- Public hospitals are more affordable, but you may face long waits and language barriers.

Thailand offers quality healthcare at a much lower cost than many other countries, but the gap between public and private hospital fees is large. If you don’t have insurance, especially as a foreigner, be prepared to pay out of pocket, especially if you go to a private hospital or need urgent care.

Risks of having no insurance in Thailand

If you don’t have health insurance in Thailand, getting sick or injured or anything to get you hospitalised can lead to big problems. Here are the main risks you should know about:

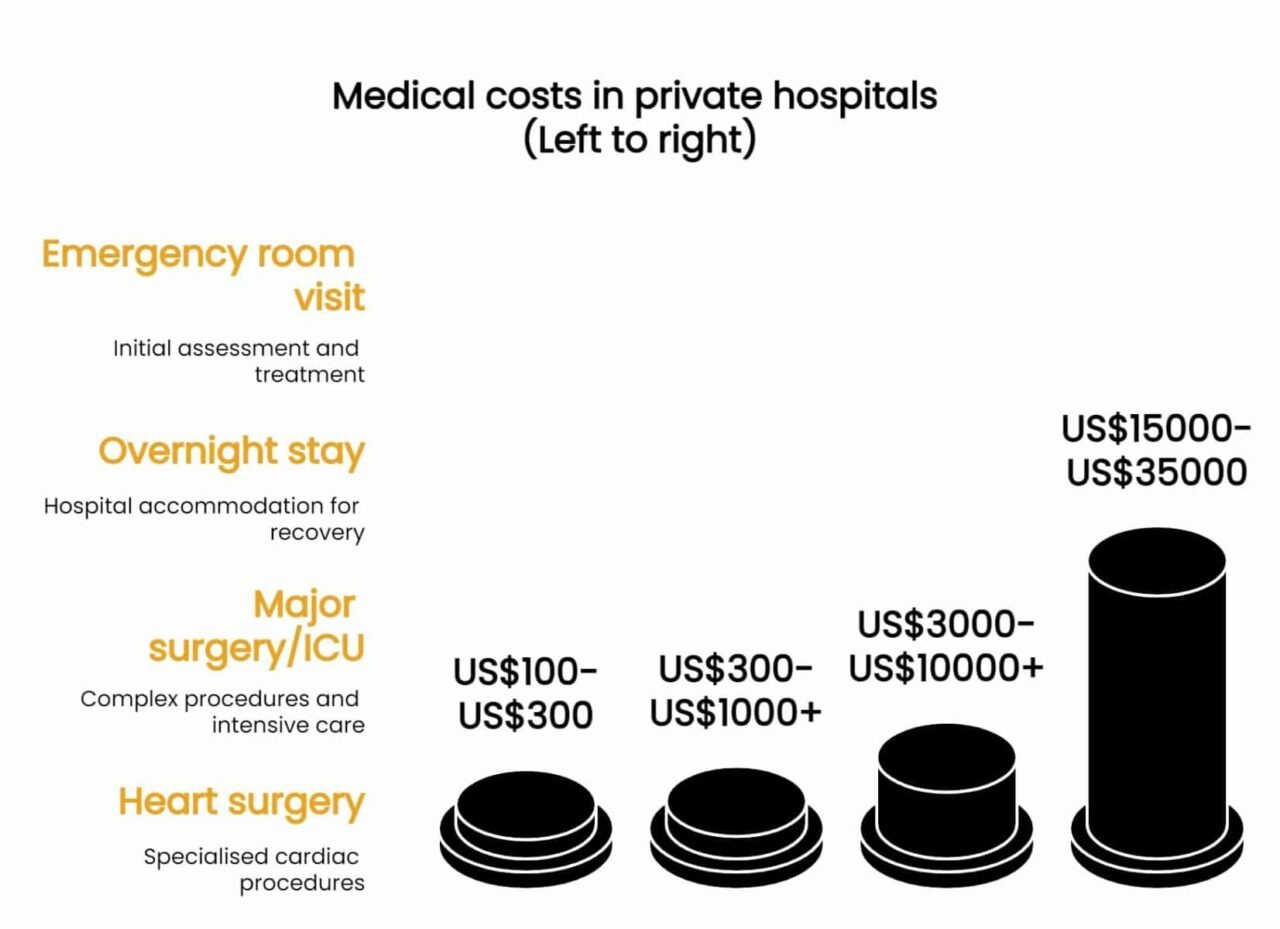

Big medical bills

Even basic care can be expensive, especially in private hospitals where many tourists and expats go for faster service and English-speaking staff.

- Emergency room visit: US$100 to US$300

- Overnight stay: US$300 to US$1,000+

- Major surgery or ICU care: US$3,000 to US$10,000 or more

Some surgeries, like heart operations, can cost US$15,000 to US$35,000. Most hospitals ask for payment up front or before you leave. If you can’t pay, you may not get the care you need.

Delayed or denied treatment

Hospitals—especially private ones—usually ask for a deposit before they treat non-emergency issues. If you don’t have money ready, your care might be delayed or denied. In emergencies, they will stabilise you, but ongoing care often depends on your ability to pay. Public hospitals may offer more help, but there can be long waits and language problems.

No help with admin or emergencies

Without insurance, you’ll have to do everything yourself—from filling out hospital forms to paying bills and booking follow-up appointments. Insured patients often get help with these tasks, including translation support. In public hospitals, staff may not speak English, making things even harder to manage on your own.

Long-term problems

Not having insurance can leave you in debt. Some people even need to ask their family or the embassy for help. In some cases, hospitals may delay your discharge or hold on to your passport until you pay. There’s also no coverage for medical evacuation or flying back home for treatment—something that can cost tens of thousands of dollars.

No insurance in Thailand means high medical costs, possible delays in care, and handling everything by yourself. If you’re staying in Thailand—whether short- or long-term—having private insurance can protect your health and your wallet.

How SafetyWing helps if you’re hospitalised in Thailand

SafetyWing Nomad Insurance helps travellers and digital nomads deal with medical emergencies abroad, including being hospitalised in Thailand. It covers many of the costs and helps make the process easier during stressful times.

Emergency medical coverage

If you’re hospitalised because of an accident or sudden illness, SafetyWing pays for the care you need. This includes:

- ER visits

- Surgery

- ICU care

- Tests like X-rays or MRIs

The Essential Plan covers up to US$250,000 per policy period, and the Complete Plan offers even more. If you catch Covid-19 while insured, hospital treatment is also covered.

Paying at the hospital

In some hospitals, especially big or international ones, SafetyWing may work directly with the hospital, so you don’t need to pay upfront. If that’s not possible, you’ll pay first and send the receipts online to claim your money back. Claims are usually processed within a few weeks.

Emergency evacuation and flying home

If your condition needs treatment, such as one that will get you hospitalised in Thailand, that local hospitals can’t provide, SafetyWing will arrange and pay for an emergency evacuation to the nearest good hospital up to US$100,000 (or US$25,000 if it’s a pre-existing condition). If needed, they’ll also pay to send you back to your home country. This only happens if a doctor says your life or a body part is at serious risk, and SafetyWing must approve it in advance.

Extra support you get

- Hospital benefit: You get US$100 per night in the hospital to help with extra costs.

- Family visit: If you’re in the ICU or need emergency transport, a family member can visit you. SafetyWing pays for travel and hotels up to US$6,000.

- Follow-up care: If you need physical therapy or nursing after you leave the hospital, it’s covered if related to your illness or injury.

- 24/7 support: You get help with paperwork, translation, and claims anytime—very useful in Thailand, where not all staff speak English.

What’s not covered

- Pre-existing conditions (unless clearly included in your plan)

- Elective or non-emergency care, cosmetic surgery, and risky sports injuries

- Evacuations and flights home must be approved by SafetyWing before they happen.

Calculate your costs below!

Stay protected while living or travelling in Thailand

For about US$2 a day, SafetyWing gives you simple and flexible health insurance that works in Thailand. It’s a good choice for travellers, digital nomads, and expats.

You can sign up or extend your plan online anytime, even if you’re already in Thailand. The coverage includes emergency treatment, hospital stays, medical evacuation, and even motorbike accidents (as long as you wear a helmet and have the right licence).

SafetyWing uses a pay-as-you-go subscription, so there’s no long contract. The claims process is easy, and you get 24/7 support if you need help. Whether you’re working, living, or just exploring in Thailand, SafetyWing helps you stay safe and stress-free.

If you get hospitalised in Thailand without insurance, it can cost a lot and cause a lot of stress. Private hospitals often ask for a big deposit before they treat you, and even public hospitals may delay care if you can’t pay. Medical bills for things like surgery or an ICU stay can be very high, and without insurance, you have to handle everything on your own—paperwork, payments, and language barriers.

SafetyWing Nomad Insurance helps take away that worry. For about US$2 a day, it covers hospital care, emergency evacuation, and more. You can sign up online, even if you’re already in Thailand, and get 24/7 support when you need it. It’s a simple way to stay safe while living or travelling in Thailand. If you want to know more about staying prepared, take a look at the 5 most common travel emergencies in Thailand and how to be prepared.

Latest Thailand News

Follow The Thaiger on Google News: