What you actually get for US$2 a day with SafetyWing insurance

How affordable coverage can help you in your life

SafetyWing is a popular travel and health insurance provider that offers affordable coverage for digital nomads, remote workers, and long-term travellers. For just US$2 a day, their Nomad Insurance plan gives you essential protection, including emergency medical care, medical evacuation, trip interruption support, and coverage for lost luggage or travel delays.

With automatic monthly renewals, 24/7 support, and a simple claims process, SafetyWing keeps you covered while you travel. This article will explain what you get for US$2 a day with SafetyWing insurance, showing how it’s a great option for budget-friendly travellers.

on this page

| Jump to section | Description |

|---|---|

| Coverage overview | SafetyWing offers essential protection for digital nomads, including emergency medical care and travel insurance. |

| What’s included for US$2 a day? | For US$2/day, get coverage for health emergencies, medical evacuation, trip interruption, and more. |

| Limitations and exclusions | Some exclusions include pre-existing conditions, elective procedures, and chronic care management. |

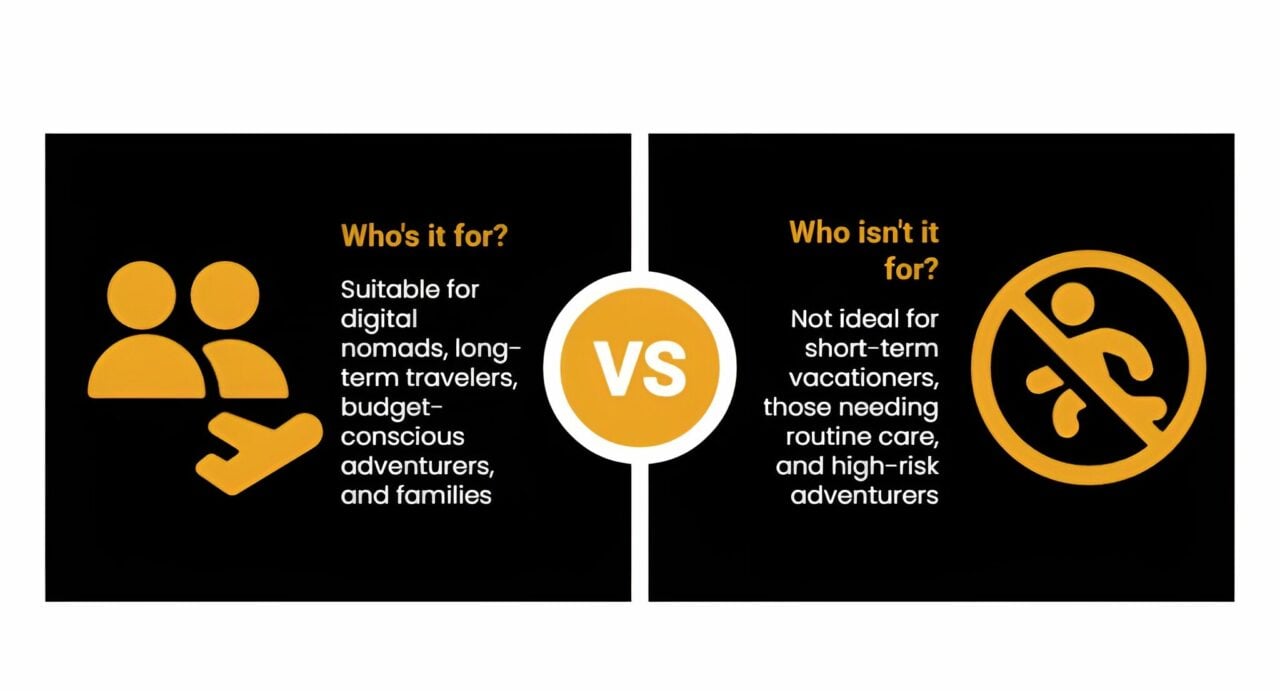

| Who it’s best for? | Ideal for digital nomads, remote workers, long-term travellers, and budget-conscious adventurers. |

| Who it’s not for? | Not suitable for short-term vacationers or those needing routine care or high-risk activities. |

| How SafetyWing simplifies global insurance for nomads | Easy sign-up, no long-term commitments, and flexible monthly plans that cover you wherever you go. |

Coverage overview

Basic coverage: key features

SafetyWing’s Nomad Insurance gives travellers, digital nomads, and remote workers a solid protection plan. The main benefits include:

- Medical coverage: Emergency medical treatment, hospitalisation, surgery, tests (like X-rays and MRIs), and prescribed medications are covered. Emergency dental care is included up to US$1,000, and emergency medical evacuation is covered up to US$100,000 for your lifetime.

- Travel coverage: This includes protection for trip interruptions (up to US$5,000), lost luggage (up to US$3,000 per policy period, US$500 per item), stolen passports or visas, and travel delay benefits. It also covers political evacuation and personal liability.

- Additional benefits: SafetyWing also covers emergency eye exams, prosthetics, physical therapy, and a daily hospital payment if you’re hospitalised. Adventure sports coverage can be added, and the Complete plan gives extra benefits like routine care, wellness treatments, and maternity coverage.

Global reach

SafetyWing is designed for people who travel or live anywhere in the world. The insurance covers nearly every country (with a few exceptions), so you don’t need to update your policy when you move from place to place. This makes it perfect for digital nomads, remote workers, and long-term travellers.

Duration and flexibility

SafetyWing works on a monthly subscription. You can start, pause, or cancel coverage whenever you want, with no long-term contract. Your insurance renews automatically every four weeks unless you decide to stop it. This setup is great for unpredictable travel and gives you continuous coverage without the hassle of long-term commitments.

SafetyWing offers affordable, flexible, and worldwide coverage that fits the needs of modern travellers and remote workers.

What’s included for US$2 a day?

SafetyWing’s Nomad Insurance Essential plan costs about US$2 a day and provides basic coverage for travellers and digital nomads. Here’s what’s included:

Health insurance

- Medical emergencies: Covers unexpected illnesses or injuries, including hospital stays, surgeries, tests (like X-rays or MRIs), and prescribed medications.

- Doctor visits: Includes care for both outpatient and inpatient treatments.

- Emergency dental: Covers up to US$1,000 for pain relief or dental injuries from accidents.

- Physical therapy: Covers up to US$50 per day for therapy sessions after a referral.

Emergency medical evacuation

- Evacuation to better facilities: Covers transportation to a more equipped hospital if needed, with a lifetime limit of US$100,000.

- Repatriation: Covers a one-way economy flight (up to US$5,000) to your home country if follow-up care is needed.

Travel insurance

- Trip interruption: Reimburses up to US$5,000 for unexpected changes to your travel plans.

- Lost luggage: Covers up to US$3,000 per policy period (US$500 per item).

- Travel delays: Gives US$150 per day (for up to three days) if your travel is delayed for over three hours.

- Political evacuation: Covers up to US$10,000 for evacuation due to sudden political unrest.

Covid-19 coverage

- Treatment included: Covid-19 is treated like any other illness, covering hospitalisation and testing if needed.

Additional features

- Adventure sports add-ons: You can add coverage for activities like scuba diving or skiing.

- Flexibility: It works on a monthly subscription, with no long-term commitment and automatic renewals every four weeks.

- Home country coverage: Provides up to 30 days of medical coverage in your home country for every 90 days spent abroad.

The Essential plan is a great option for travellers who need affordable emergency coverage. If you want more benefits, like wellness visits or maternity care, the Complete plan (US$161.5 per month) offers these extras.

Limitations and exclusions

What’s not covered

The Nomad Insurance Essential plan from SafetyWing has some key exclusions:

- Pre-existing conditions: Conditions like diabetes, cancer, or previous injuries aren’t covered, except in sudden, life-threatening emergencies. For example, if someone with high blood pressure has a heart attack, it may be covered.

- Elective procedures: Cosmetic surgeries, weight-loss treatments, and non-emergency dental care (like cleanings or braces) are not covered.

- Routine care: Wellness visits, mental health therapy, and maternity services aren’t included unless there’s a complication like an ectopic pregnancy or pre-eclampsia within the first 26 weeks.

- Chronic or incurable conditions: Long-term treatments for illnesses like Parkinson’s or chemotherapy are excluded.

- Non-medical costs: Things like administrative fees, over-the-counter medications, and foot care (e.g., bunions) aren’t covered.

Coverage limits and deductibles

- Deductibles

- US$250 per claim for most medical expenses (e.g., hospitalisation, prescriptions).

- US$0 deductible for lost luggage, travel delays, or accidental limb/eye loss.

- Lifetime/period limits

- US$250,000 for medical expenses per policy.

- US$100,000 lifetime limit for medical evacuation.

- US$3,000 for lost luggage per policy period (US$500 per item).

- Special conditions

- Pre-existing coverage: After 1 year of continuous coverage, pre-existing conditions may be covered if no treatment was sought during that year.

- Home country coverage: Limited to 30 days per 90-day period (15 days for U.S. residents).

Critical exceptions

- Covid: Covered just like any other illness, including testing if medically necessary.

- Adventure sports: Covered only if you add extra coverage for activities like scuba diving or skydiving.

- Political evacuation: Covers up to US$10,000 for evacuations due to political unrest.

Calculate your costs here!

Who it’s best for?

SafetyWing’s Nomad Insurance is designed for people who live a flexible, location-independent lifestyle. It’s a great option for:

Digital nomads & remote workers

SafetyWing is ideal for digital nomads and remote workers, offering global coverage in over 175 countries. This makes it perfect for those who move frequently or have flexible travel plans. The plan automatically renews every month, ensuring continuous coverage as you travel without the need for long-term commitments. Additionally, you don’t need a return ticket, making it easy for nomads with open-ended travel plans to stay protected wherever they go.

Long-term travellers

For long-term travellers, SafetyWing offers annual policy renewals, covering up to 364 days at a time. This flexibility ensures you’re protected throughout your journey. The plan also includes 30 days of medical coverage in your home country for every 90 days spent abroad (15 days for U.S. residents).

Budget-conscious adventurers

The Essential plan provides solid medical protection, including coverage for hospital stays, medical evacuation (up to US$100k lifetime), and emergency dental care (up to US$1,000). The plan also covers a wide range of adventure activities, such as scuba diving, motorbiking, and skiing (off-piste excluded). It also includes Covid coverage, treating it like any other illness, ensuring you’re protected during your travels.

Families

SafetyWing is family-friendly, offering free coverage for up to two children under 10 years old per adult policyholder. The claims process is simple, with an easy online submission and 24/7 support, making it hassle-free for families to get the help they need.

Who it’s not for?

SafetyWing may not be the best fit for:

- Short-term vacationers: While it provides coverage for travellers, SafetyWing offers limited benefits for trip cancellation and delays compared to traditional travel insurance plans.

- Those needing routine care: It does not cover wellness visits, mental health therapy, or long-term management of chronic conditions.

- High-risk adventurers: SafetyWing excludes extreme sports, such as mountaineering above 4,500 metres, and professional athletic activities.

How SafetyWing simplifies global insurance for nomads

For digital nomads and remote workers, getting reliable health and travel insurance can be tricky with complex terms and rigid plans. SafetyWing changes that with a simple subscription model that’s as flexible as your travels. Here’s how to get covered in minutes and why it’s perfect for a location-independent lifestyle.

The sign-up process: quick, digital, and hassle-free

- Visit the website:

- Start by going to SafetyWing’s Nomad Insurance page. The website is easy to use and designed for quick sign-ups.

- Input basic details:

- Your age (prices start around US$56.28/month for those under 40).

- Travel dates (coverage can start within 24–72 hours, even if you’re already abroad).

- Home country (this helps set your home-country coverage limits: 30 days per 90-day period for most, 15 days for U.S. residents).

- Review coverage:

- SafetyWing offers two plans:

- Essential plan: Covers emergency medical care, hospital stays, surgeries, and diagnostics (up to US$250,000).

- Complete plan: Includes everything in the Essential plan plus routine care.

- Medical evacuation up to US$100,000 and coverage for travel issues like lost luggage and trip interruptions are also included.

-

Payment and activation:

- Pay easily via credit/debit card (Visa, Mastercard, Amex).

- The subscription renews every 28 days automatically, but you can pause or cancel anytime.

- Once you’ve paid, you’ll get a digital insurance card by email, so there’s no physical paperwork.

Why digital nomads love it

- No long-term commitments: Unlike yearly plans, SafetyWing’s monthly model works with unpredictable travel schedules.

- Family-friendly: You can add up to two children under 10 for free per adult policyholder, which is rare in travel insurance.

- Home country coverage: Many insurers don’t cover your home country, but SafetyWing provides limited coverage for short visits.

Managing your policy

- Pause or cancel: You can adjust your coverage dates through your account dashboard. If you cancel mid-term, you’ll get a prorated refund.

- Claims process: Simply submit your medical bills or police reports through the portal, and reimbursements usually take 7–30 days.

SafetyWing offers a simple, flexible, and affordable way for digital nomads and remote workers to stay covered, with easy sign-up, no long-term contracts, and support for families.

SafetyWing’s Nomad Insurance offers affordable, flexible coverage for digital nomads, remote workers, and long-term travellers. For just US$2 a day, it provides essential protection, including emergency medical care, medical evacuation, trip interruption support, and coverage for lost luggage and travel delays. With automatic monthly renewals and no long-term commitment, SafetyWing makes it easy to stay covered wherever you go. The plan also offers free coverage for children under 10 and includes coverage for short visits to your home country.

If you need more comprehensive benefits, the Complete plan includes routine care and wellness treatments. SafetyWing is a great choice for location-independent lifestyles, offering reliable insurance without rigid contracts. Learn more about how one insurance plan can cover you while working from anywhere in our related article: Can one insurance plan cover you while working from anywhere?

Latest Thailand News

Follow The Thaiger on Google News: