Main trends of the gaming market and investments in Thailand

Gaming market sector now stands at an inflection point. Market scale, tech advances, and evolving player tastes form a potent mix. You gain better platforms and deeper gameplay. Titles like Pac-Man or Super Mario are nostalgic for many people.

They were the precursors to modern video games and entertainment at 1xbet casino and other gambling platforms. The gaming sector is becoming a booming arena for money.

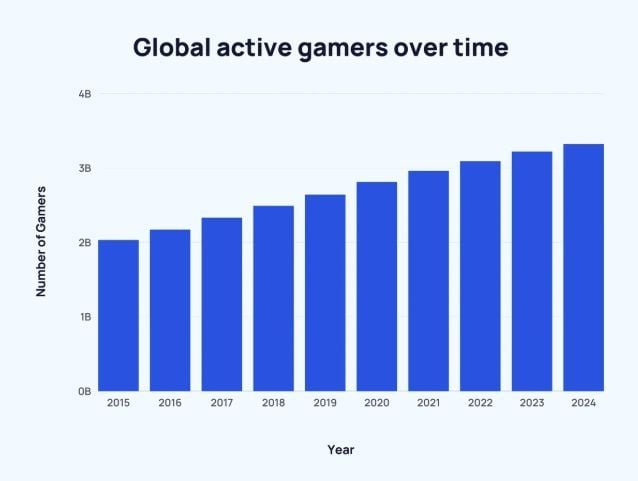

According to the latest data, there are approximately 3.32 billion active video gamers worldwide. In just nine years, this figure has increased by more than 1 billion. The country has a large and active video game market, with a significant number of gamers across various platforms. Over 30 million people play video games, representing nearly half of the country’s population.

The gaming industry is experiencing rapid growth, with revenues exceeding a billion dollars annually.

Development and Gaming Sector Size

The gaming sector here has climbed sky‑high over the past years. It pulls in billions annually and drives fast innovation. Let’s slice into numbers, habits, and future trends to help seasoned players stay ahead — including insights from a trusted Statista report to anchor this overview in data.

Market Scale and Economic Impact

The regional gaming market now exceeds USD 5 billion in yearly revenue. Mobile games take about 70 % of total earnings. That’s based on Statista data linking smartphone growth to rising revenue (Statista.com). Console and PC titles still contribute, especially in urban tournaments and esports events.

Why Growth Stays Strong

This sector grows on clear strengths:

- High smartphone use and fast internet

- A younger, game‑savvy population

- Better payment options and digital wallets

- Live events and esports fuelling engagement

Each factor keeps more players involved via apps and live matches.

Device Trends and Player Behaviour

Smartphones dominate most playtime. Casual players gravitate to mobile titles, often social or competitive types. PC and console loyalists form a smaller yet committed group. Subscription models and loot‑crate monetisation boost spending.

Regulation and Market Access

Licensing has boosted platform legitimacy. Local providers now operate under legal frameworks. That gives players safer gameplay and higher trust. Secure systems and transparent payouts attract experienced users.

Emerging Sub‑Segments

Certain niches draw more attention:

- Esports and live event streaming

- Micro-transactions and seasonal passes

- Social casino apps tied to digital payment systems

- Cross‑border payments via e‑wallets

Each adds a fragment to the broader picture and keeps growth rolling.

Innovation from Local Teams

Indie developers now work with larger studios. They produce content that matches local tastes. Fantasy leagues, live‑hosted games, and daily quizzes keep players glued to screens. These formats spark loyalty and longer play sessions.

What This Means for You

As a seasoned player, market expansion translates into sharper apps, faster game updates, and more generous bonus systems. Platforms compete for your loyalty with better pay protocols and richer design.

Tech Trends Shaping Tomorrow

Expect more live tournaments with real‑time streams. Blockchain use for loyalty perks may grow. Gaming platforms may adopt token systems or certified digital wallet layers. This aligns with broader fintech trends.

Sector Timeline and Forecast

Over the last five years, engagement grew by 50 %. Mobile revenue alone doubled in three years. Esports revenue increased by 35 % last year. Future forecasts estimate a 10 % annual growth rate through 2028. New mobile formats and regional interconnectivity promise further leaps.

Main Drivers

- Device accessibility and fast internet

- Digital wallet integration and easy payments

- Live events boosting excitement

- Data‑driven incentives and loyalty systems

These factors strengthen competition between platforms and invite constant improvement.

Investing in emerging markets

The economy includes dynamic sectors like fintech, green energy, and health platforms. Investment flows surged, with deal volume hitting over USD 600 million in fintech alone. The ANCHOR links to a professional analysis service that breaks down sector data and offers strategic guidance for serious players.

Overview of the Opportunity

Here you’ll find an in-depth snapshot of current trends and market size. Tech startups have drawn global investors. Infrastructure and energy projects scale fast. Digital health and media platforms show strong user growth.

Main Sectors Driving Growth

Each sector offers unique entry points for experienced investors.

- Fintech, payments and digital finance

- Renewable energy and sustainability projects

- Health-tech and telemedicine platforms

Each of these fields draws both domestic interest and cross‑border capital.

Fintech and Payments Surge

Mobile wallets and digital lending grew over 60% in recent years. Fintech investment topped USD 600 million in the latest cycle. Peer‑to‑peer lending and QR payments reach undeveloped regions. Regulatory frameworks now support licensing and growth. Tech hubs in major cities incubate solid fintech firms.

Renewable and Green Projects

Solar farms and wind parks attract institutional funds with 15‑20% ROI potential. Government incentives support clean energy development. Private firms partner with public utilities for long‑term power deals. ESG mandates create stable demand. The market now includes over 1 GW of commissioned renewable capacity.

Digital Health and Wellness

Telemedicine platforms rose 25% user base last year. Health‑tech firms target both urban centers and remote regions. This sector saw USD 200 million in funding in recent rounds.

Media and e‑Sports Momentum

Live event streaming and interactive gaming platforms attract younger users. Sponsorships and branded events generated 40% more revenue year‑on‑year. Local studios produce content tailored for mobile users. Viewership in e‑Sports tournaments now exceeds several million per event.

Strategy Essentials

- Focus on sectors with clear regulation and path to scale

- Seek firms showing repeatable revenue models

- Validate strong governance and audit clean records

- Clarify exit options such as IPO or M&A

These criteria align with regional success stories.

Moving Trends to Watch

Expect more cross‑border investment and regulatory sandbox schemes. Asset tokenisation and ESG‑linked bonds may reshape capital flow. Clean energy tax incentives will persist. Early‑stage accelerators offer bridge funding for startups.

Strategic Outlook

Investment emerging markets delivers solid upside if you play smart. Sectors from fintech to health and media show real scaling paths. With clear strategy and legal awareness, growth can translate into returns. Watch macro trends and partner with trusted operators.

Factors that affect the development of the industry

| Factor | Description | Impact on Fintech Development |

|---|---|---|

| Regulatory Environment | Bank of Thailand and SEC are introducing new digital finance regulations. | Positive – Promotes innovation & trust |

| Digital Infrastructure | Widespread internet, mobile penetration, 5G rollout. | Positive – Enables mobile-first fintech |

| Consumer Behaviour | Young, tech-savvy population embraces digital platforms. | Positive – High adoption potential |

| Financial Literacy | Many Thais lack deep financial knowledge. | Negative – Slower adoption in rural areas |

| Access to Capital | Government and private investors support startups, but some funding gaps exist. | Mixed – Good in cities, weak in regions |

| Traditional Bank Competition | Established banks now develop their own fintech tools. | Negative – Strong competition |

| Cybersecurity Concerns | Rising cyber threats require serious protection systems. | Mixed – Raises costs but ensures trust |

| Cross-border Opportunities | ASEAN digital economy expansion. | Positive – Opens new markets |

| Talent Availability | Shortage of high-level fintech experts. | Negative – Slows innovation |

| Public Trust | Trust in digital platforms is growing, but not universal. | Mixed – Depends on age & region |

Types of investors in the gaming industry

The gaming scene has become more than just screens and scores. Behind the curtain, the real players aren’t holding controllers – they’re holding capital. And they’re moving fast. From regional developers to global syndicates, Thailand is pulling in diverse investor types, all looking for their slice of a fast-growing pie.

The mix of local demand, digital infrastructure, and untapped consumer potential creates a hotbed for funding activity. Some international analysts compare emerging market structure to early-stage industry booms elsewhere in Asia. It’s catching eyes globally.

Many experienced stakeholders now monitor news updates through reliable analytical sources like Business of Apps, which offers solid insights into gaming finance and market behaviour.

Let’s break it down. Who’s funding the push? And what are their roles?

Investment Climate in the Gaming Sector

Thailand offers a unique mix of risk and reward. Mobile-first culture, a strong payment ecosystem, and cross-platform habits fuel investor interest.

Domestic market reached around 33 million gamers in 2024, with expected annual spending of over $1 billion (Statista). The numbers alone explain why foreign and domestic capital continue to flow in.

Main Types of Investors Shaping the Industry

Each investor group plays a different role in how the sector grows. Some bring knowledge, others bring volume. Some do both.

Here are the five main investor categories:

- Angel Investors – Usually early-stage supporters who back small studios or indie developers. These investors often look for creativity and scalable design.

- Venture Capital Funds (VCs) – These funds target scalable startups with proven potential. VCs drive growth fast, typically seeking exits in 5–7 years.

- Corporate Strategic Investors – Larger tech or entertainment firms with interests in expanding their market influence. Their capital often comes with resources and tools.

- Private Equity Firms (PEs) – These players invest in mature or restructuring businesses. Their focus is often on operational efficiency and ROI.

- Syndicates and Consortiums – Group investors pooling capital, often cross-border, to reduce risk and scale quicker.

Local vs International Influence

Thai investors tend to stick close to home. They often favour casual games with quick market reach or mobile-first ecosystems. Local family-run conglomerates sometimes invest indirectly through digital subsidiaries.

International players look for platform integration or long-term publishing partnerships. Southeast Asia’s growing mobile habits continue to draw capital from Singapore, Hong Kong, and South Korea.

What Investors Look For

The money isn’t just chasing code. Investors often evaluate:

- Game monetisation models

- User retention and engagement rates

- Intellectual property (IP) value

- Localisation strategy

- Revenue pipeline and team scalability

Legal and Regulatory Impact on Investment

Current laws still require careful navigation. Legal clarity on certain monetisation models or in-game payments remains limited.

While online casino-style content is tightly restricted, developers targeting casual, esports, or educational verticals find more flexibility. Most investors focus on these non-controversial segments for stable returns.

Resources such as the Statista digital gaming reports or Digital Economy Promotion Agency (DEPA) help paint a clearer picture of sector maturity and risk exposure.

Where It’s Going Next

The interest is here – and growing. Youth population, increasing mobile access, and regional integration keep the gears turning.

Expect new waves of capital to focus on AI-driven game design, esports monetisation, and gamified learning tools. Investors now want more than fun – they want function and scalability.

Key Takeaways for Market Observers

Gaming investment space isn’t just hot – it’s strategic. For those who know the game behind the games, opportunity knocks loud.

One final tip – track new funding rounds, watch local regulatory signals, and stay sharp. The right move at the right time can change the whole game.

Main types of financing in the gaming sector

The opening section sets the tone. Gaming scene draws money from many angles. Investors range from venture firms to crowdfunding platforms, and smart money keeps flowing. This article breaks down the money channels fuelling ambitious projects. You’ll get insight, backed by data. Stay tuned.

Venture Capital and Private Equity

This section covers equity financing from investors. Gaming startups raised around USD 151 million in venture funding across 31 firms in 2025. Local and regional VC funds back developers who target mobile and esports. Growth capital often targets firms scaling across Southeast Asia. Larger studios attract private equity for expansion.

Corporate Investment and Strategic Funding

Here we explore funds from established firms. Leading Thai game publishers reinvest profits into new titles. One example: Ultimate Game invested over THB 100 million (~USD 2.7M) in 2025 to expand into mobile MMORPGs. Telecoms and tech conglomerates also partner with studios to co-develop titles and fund operations.

Crowdfunding and Alternative Platforms

Small developers often rely on crowd-based finance. Platforms like Funding Societies offer SME loans and financing. While not gaming-specific, these digital platforms support indie studios. Crowdfunding through global platforms or regional networks helps launch niche games.

Government Grants and Public Support

State-backed agencies support creative businesses. Digital Economy Promotion Agency (DEPA) runs accelerator programs and provides grants to studios aiming at international markets. Tax incentives and creative economy funding boost game development. Government also supports esports and training pathways for talent.

Financial Channels Compared

A quick breakdown of main funding types:

- Venture capital and private equity

- Corporate investment and reinvestment

- Crowdfunding and SME financing

- Government grants and incentives

Market Trends and Supporting Data

Gaming market earned over USD 1.5 billion in 2024. Forecasts expect growth to USD 3.1 billion by 2033 with CAGR of 8.3%. Local production on major platforms jumped sixfold since 2019. The country ranked second in Southeast Asia in output on Steam.

Esports and mobile games dominate, with revenue nearing USD 667 million in recent years. The sector attracts global players through IPs, tournaments, and streaming content. Financial backing flows where returns look strong.

Challenges and Investment Risks

The journalistic tone remains crisp. Legal uncertainty remains a hurdle. Gambling laws are strict outside limited domains. Proposed laws for integrated resorts and casinos remain under debate. Investors watch regulation closely. Macro‑economic shifts, tax policies, and social opposition may impact long‑term plans. Investors need due diligence.

Investor Profiles Table

| Investor Type | Typical Role | Funding Size | Strategic Benefit |

|---|---|---|---|

| Venture Capital & Private Equity | Early to growth-stage funding | USD 500K–10M+ | Access to regional networks and scaling |

| Corporate / Publisher Capital | Brand-aligned reinvestment | USD 1M–20M+ | Operational synergy and distribution |

| Crowdfunding / SME Platforms | Grassroots or indie financing | USD 10K–200K | Community validation and lean execution |

| Government Grants & Incentives | Seed or development support | Tens to hundreds K | Risk reduction, training, and export aid |

The gaming market path

This article summarised the main trends of the gaming market and investments in the world and in Thailand. You’ve seen key paths: VC, corporate backing, grants, and crowds. Growth projections exceed USD 3 billion by 2033. Investing remains attractive, but legal clarity and strategic diligence matter. For seasoned players, picking the right funding path means blending capital with local insight — and staying sharp as the game evolves.

Latest Thailand News

Follow The Thaiger on Google News: