How TrustFinance is leading financial transparency in 2025

The world of digital finance is full of malicious people who seek to use the anonymity and obscure nature of the internet to scam and take advantage of other people’s money. Almost everyone has lost their money or at least had a friend or family member scammed by what they thought was a trusted person telling them to trade, invest, or give their information away. With not too many resources available to help you out online, TrustFinance aims to help solve that problem.

TrustFinance’s vision for a transparent financial world

TrustFinance is leading the way in digital finance by focusing on transparency and trust, crucial components for a reliable financial ecosystem. Their goal is to provide a neutral platform where both businesses and consumers can interact confidently, knowing that they are dealing with verified data and trustworthy information. Through its services, TrustFinance empowers businesses to build strong reputations while offering consumers peace of mind when making financial decisions.

The company’s mission goes beyond providing services. It seeks to establish a global standard for transparency in the financial sector. By improving data accessibility and helping businesses maintain trust, TrustFinance is helping to shape a more transparent, sustainable financial system. This initiative has far-reaching implications for how consumers and financial institutions engage with each other moving forward.

The importance of trust

Trust is fundamental to the success of any financial system, and in today’s digital world, it’s more important than ever. With the rise of embedded finance services like True Wallet or the GrabPay Wallet, the relationship between businesses and consumers is evolving. But with the benefits come challenges—particularly around trust and the security of transactions. TrustFinance addresses these concerns by offering a platform for verified reviews, much like how TripAdvisor helps travellers choose reliable destinations.

By ensuring that businesses have substantial and verified reviews, TrustFinance builds trust from the ground up. This is vital in an era where consumers face an overwhelming amount of information and often struggle to know what’s real. TrustFinance’s model allows businesses to showcase their credibility, reassuring customers and encouraging more informed decision-making.

Innovation at TrustFinance

At the heart of TrustFinance’s work is innovation. The company focuses on advanced technologies like Smart Machine Systems and Business KYC (Know Your Customer) to verify and authenticate financial data. These technologies play a crucial role in establishing trust within the digital finance world by ensuring that the information businesses provide is accurate and trustworthy.

A key element of TrustFinance’s approach is to fight against fake reviews, which undermine trust in the digital space. CEO of TrustFinance, Peter Bu, mentioned that for a business to truly be trustworthy, it needs 200 to 300 reviews, which ensures a much more reliable reputation than just a handful. Through TrustFinance, businesses can manage their digital reputation and consumers can confidently engage with those that meet the necessary trust standards.

Although one could be concerned that TrustFinance would be swayed by collaboration and companies who want to pay them, Bu stated that TrustFinance will not have review spam, planted reviews, or will not even take money from companies to give them more favour on the website.

Event Overview: TrustFinance Vision Bangkok 2025

The TrustFinance Vision Bangkok 2025 event on January 17 was a landmark occasion aimed at driving the future of financial transparency. The event was more than just a conference; it was an opportunity to present the innovative ideas and goals that TrustFinance has been developing to make the financial world more open and reliable. It gathered experts and thought leaders from the financial and tech industries to discuss how to make digital finance safer, more transparent, and accessible to everyone.

There was the main speech by Bu to introduce TrustFinance’s mission and goals followed by a speech by the Sales Director, Nasri Mohammed Aymen, who introduced the key features that will be offered by TrustFinance. Following this, some panels discussed various concepts about the Internet and digital finance.

The discussions revolved around the key issues facing the financial world today, from the impact of emerging technologies like blockchain to the importance of maintaining transparency and trust. The event highlighted TrustFinance’s efforts to establish a trustworthy framework that consumers and businesses alike can rely on to ensure fairness and accountability in the financial sector.

You can find more information about them on the TrustFinance Facebook page.

Panel Discussions: Expert Insights on Financial Trust

Leading experts from various sectors shared their insights during the event’s panel discussions, diving into the future of financial transparency, cross-border services, and digital identity.

Panel 1: The evolution of trust in digital finance

Kenneth James Bery, CEO of ConnectWeb3, discussed the rapidly evolving role of trust in the digital financial landscape. He explored how new technologies, such as blockchain and cryptocurrencies, are transforming traditional financial models by offering enhanced security and transparency. Kenneth emphasised that these innovations were necessary to meet the growing demand for trustworthy, digital financial services.

This panel focused on the shift from traditional financial systems to more decentralised, transparent models where trust is embedded within the technology itself. The panellists also explored the role that smart contracts and digital identity verification will play in fostering trust and security, ensuring that the financial ecosystem remains reliable as it continues to grow.

Panel 2: Streamlining cross-border financial services

Chanon Charatsatikul, Co-Founder and CEO of FWX, and J.D. Salbego, Co-Founder of Etheros Labs, led a discussion on the challenges and opportunities of cross-border financial services. They highlighted the need for seamless, secure international transactions, and the role of blockchain and AI in facilitating these services.

The panellists examined the hurdles that exist in today’s cross-border financial landscape, such as regulatory challenges and the lack of efficient systems for global transactions. By addressing these issues, they explored how emerging technologies can bridge the gaps and create a more streamlined, secure system for cross-border financial services, making global transactions more accessible and efficient.

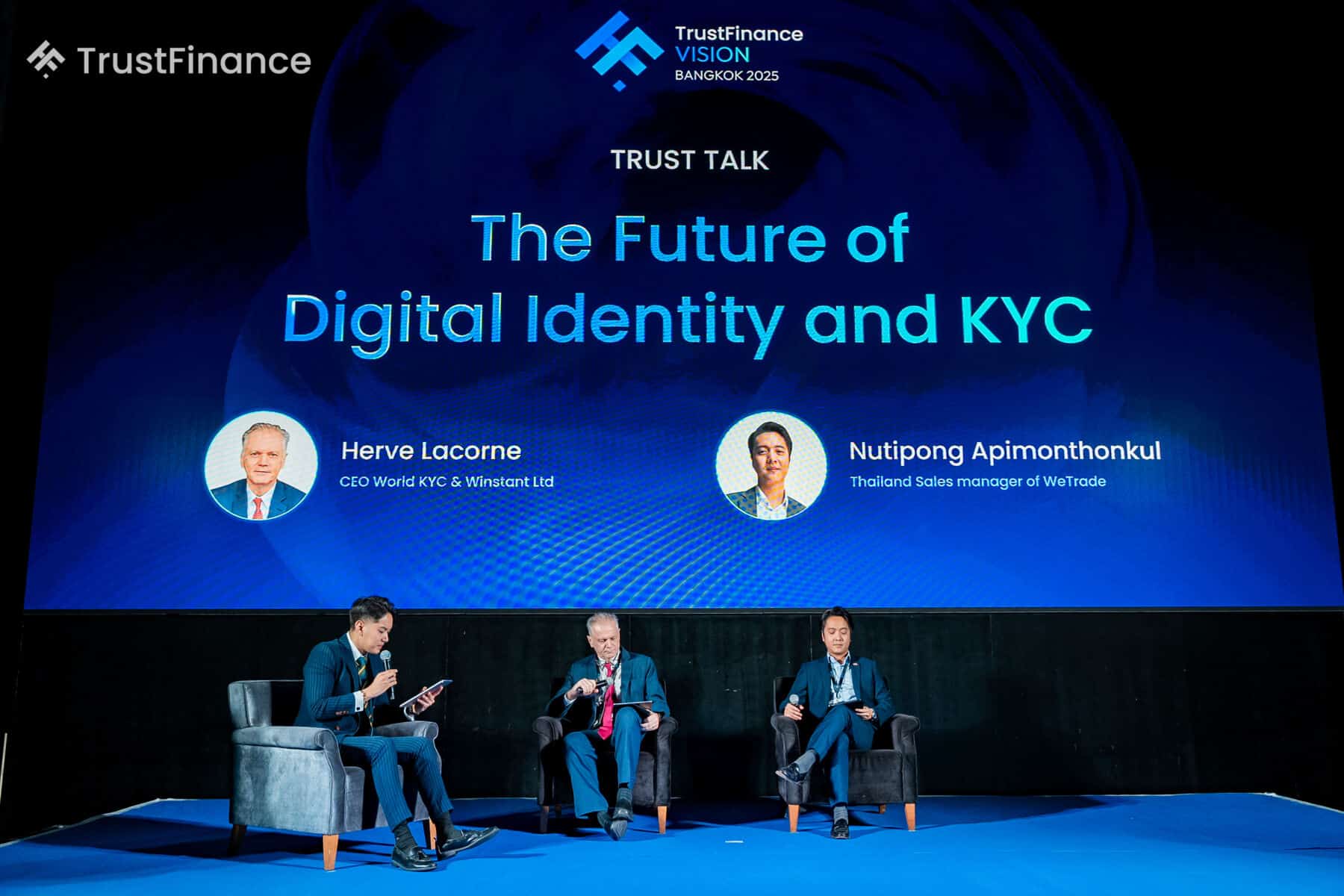

Panel 3: The future of digital identity and KYC

The third panel featured Harve Lacome, CEO of World KYC, and Nutipong Apimontohnkul, Thailand Sales Manager at WeTrade. This discussion focused on the evolving role of digital identity systems and KYC (Know Your Customer) processes in financial institutions.

The panellists discussed how technologies like biometrics and blockchain are improving the security, transparency, and convenience of KYC processes. They also examined how digital identity verification can help tackle regulatory challenges in different regions, ensuring a seamless, secure experience for both businesses and customers. This panel shed light on the growing importance of secure digital identity systems in fostering trust in the global financial market.

Looking into the future of Digital Finance and trust

The future of digital finance is closely tied to continued innovation and a focus on building trust. As the market evolves, there will be increased competition, and more companies like TrustFinance are expected to emerge. However, with the rise of misinformation, businesses will need to find ways to stand out as trustworthy, especially as online platforms become more susceptible to fraudulent activity.

Bu noted that, while social media currently drives awareness, there may be a shift away from the internet in the next five years. He emphasised the need for innovative solutions that not only promote transparency but also protect consumers from the growing risks of misinformation. The next few years will require a collective effort to ensure that trust and transparency are at the forefront of digital finance.

With TrustFinance’s vision, the future of digital finance looks promising. By prioritising trust, transparency, and innovation, the company is helping to shape a new standard for the financial industry, one that will serve as the foundation for a more reliable financial future.

Press Release

Latest Thailand News

Follow The Thaiger on Google News: