How to pay your road tax in Thailand and how much it costs?

Understanding Thailand’s road tax fees, documents, and payment options

The Thaiger key takeaways

- Road tax is mandatory for all vehicles in Thailand and must be renewed yearly.

- Expats need a blue book, Por Ror Bor, and inspection documents before paying.

- Costs vary by engine size, and EVs enjoy a five-year road tax exemption.

Paying your road tax in Thailand is a crucial part of owning a car or motorbike in the country. Whether you’re a newly settled expat or a long-time resident upgrading to your second-hand pickup, understanding how to keep your vehicle legal can save you time, stress, and potential fines. Here’s what you need to know about paying your road tax in Thailand.

On this page

| Click to jump to section | Short Summary |

|---|---|

| What is road tax in Thailand? | Road tax is a yearly fee required to keep any vehicle legally on Thai roads. Missing it can lead to fines or invalid insurance. |

| Who needs to pay road tax? | If your vehicle is registered in Thailand, you must renew the tax, whether you’re a Thai national or a foreign resident. |

| Where to pay your road tax in Thailand | From DLT offices to drive-thru services and even Big C counters, several options exist depending on convenience. |

| How much is road tax in Thailand? | Costs vary by engine size, vehicle type, and age, with EVs enjoying tax exemptions during their first five years. |

What is road tax in Thailand?

Road tax in Thailand is a mandatory annual fee imposed on all registered vehicles to keep them legally on the road. This includes private cars, motorbikes, and even EVs (Electric Vehicles). The revenue supports infrastructure, road maintenance, and traffic systems.

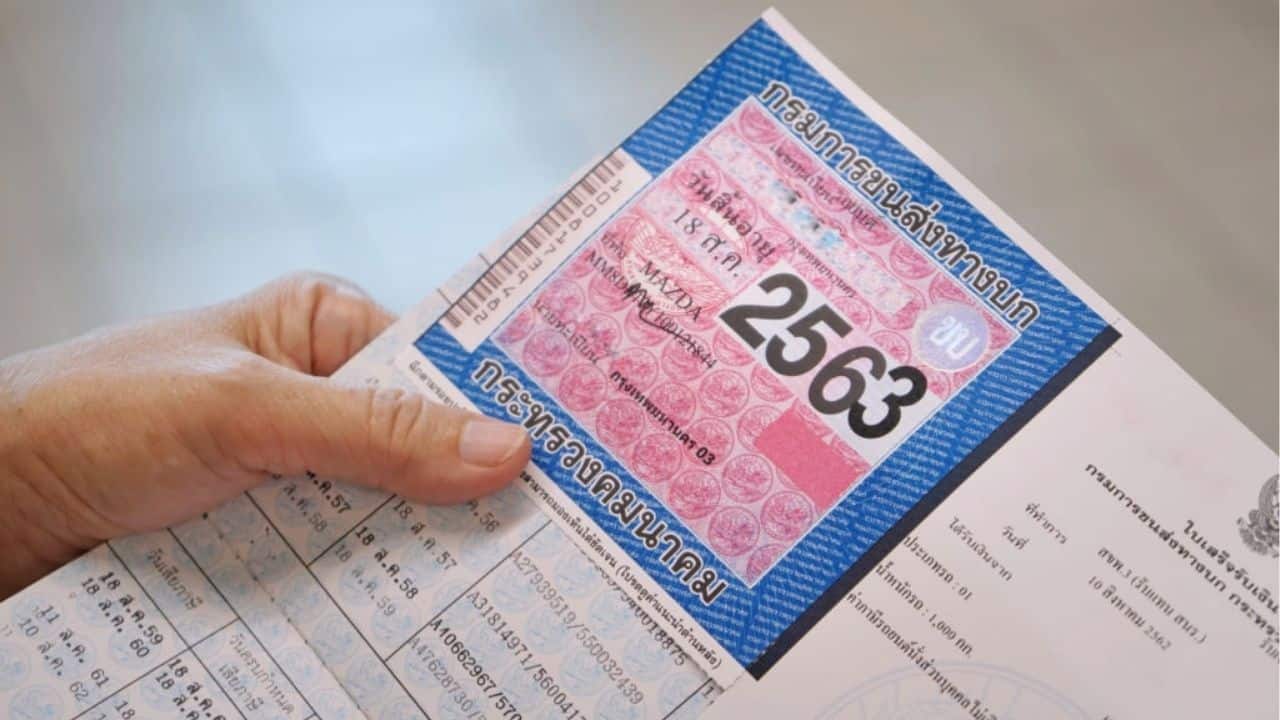

Without a valid road tax sticker, you’re at risk of fines or even having your insurance invalidated. You’ll need to display a valid tax sticker (a coloured square) on your front windshield or on your motorbike.

Who needs to pay road tax?

If you own a motor vehicle registered in Thailand, you must pay road tax annually. This applies to:

- Thai citizens and foreign residents who own a vehicle in Thailand

- Vehicles of all types: cars, motorbikes, trucks, EVs

- Both new and second-hand vehicles

Even if your vehicle is not used regularly or sits in your driveway, as long as it’s registered, you’re expected to pay.

What you need before paying your road tax

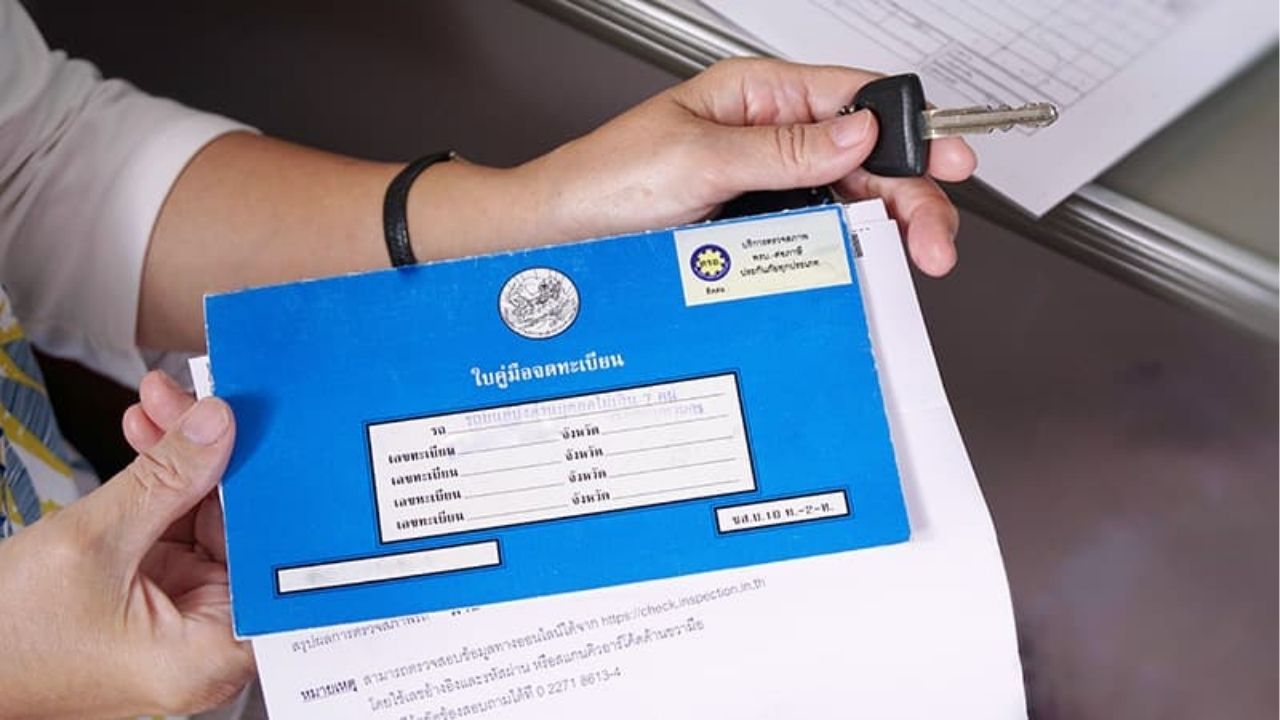

To pay your road tax in Thailand, you need a few key documents and checks:

- Blue Book (Vehicle Registration Document)

- Compulsory Motor Insurance (Por Ror Bor)

- Tor Ror Or (Vehicle Inspection Certificate) – required for:

- Cars over 7 years old

- Motorcycles over 5 years old

These inspections check your vehicle’s emissions, brakes, and lights. They’re quick and available at authorised garages and DLT offices. You’ll get a small paper confirming that the inspection was passed.

Where to pay your road tax in Thailand

You have a few options depending on your location and whether you’re eligible to pay online:

1. Department of Land Transport (DLT)

The most common place to pay road tax is your local DLT office. You bring all required documents, and the staff will process everything on-site.

2. Online (DLT e-Service)

Some Thai citizens can use https://eservice.dlt.go.th to pay online. Unfortunately, expats with foreign ID numbers are often unable to access this system unless they have a Thai ID or an e-wallet linked to the DLT database.

3. Drive Thru for Tax (Bangkok only)

In Bangkok, the DLT offers drive-thru road tax services at select locations. You stay in your car, hand over your documents, and receive your sticker, all without leaving your vehicle.

4. Big C and Tesco Lotus

Some shopping centres offer temporary road tax counters, especially during renewal season. These are often cash-only and require you to bring your documents.

How much is road tax in Thailand?

Road tax fees vary based on your vehicle’s engine size, type, and age. Below is a basic overview:

Passenger cars (under 7 years old)

| Engine Size | Annual Road Tax (approx.) |

|---|---|

| Under 600cc | 400 Thai baht |

| 601cc to 1,800cc | 600 to 2,000 Thai baht |

| Over 1,800cc | 2,000 to 5,000+ Thai baht |

Motorbikes

| Engine Size | Annual Road Tax (approx.) |

| 50cc to 125cc | 100 to 200 Thai baht |

| 126cc to 250cc | 200 to 400 Thai baht |

| Over 250cc | 400 to 1,000+ Thai baht |

Electric Vehicles (EVs)

EVs enjoy a 5-year tax exemption if newly purchased. After that period:

- Smaller EVs pay rates comparable to 1,000cc petrol engines

- Tax increases gradually after the fifth year

What happens if you forget to pay?

If you miss your road tax payment deadline:

- You’ll be charged a fine of 1% per month of the tax amount

- Your Por Ror Bor insurance may become invalid

- You’ll fail inspection or registration renewals

If you delay too long (over 3 years), your vehicle registration may be cancelled, requiring a more complicated process to re-register.

Tips for paying road tax in Thailand

- Keep a photo of your road tax sticker and documents in your phone

- Set a calendar reminder for one month before expiry

- Check your inspection expiry date, especially for older vehicles

- If you just bought a used car, double-check the tax status with the DLT before driving

Paying your road tax in Thailand is relatively simple once you understand the process. While expats may face occasional hiccups, especially with online systems, you can complete your renewal with a little preparation and the right documents.

Whether you’re driving a humble scooter or a shiny electric SUV, make sure that you stay up to date with the road tax in Thailand; otherwise, you will encounter a police officer who may not appreciate your lack of sticker.

ดูโพสต์นี้บน Instagram

Latest Thailand News

Follow The Thaiger on Google News: