The hidden costs of ignoring pre-existing conditions in Thailand

Avoid claim rejections and visa issues by declaring your health history

The Thaiger key takeaways

- Not declaring pre-existing conditions can result in denied claims, high costs, or visa problems.

- Cigna provides coverage for common chronic conditions like diabetes and arthritis with high limits and direct billing.

- Honest disclosure ensures proper coverage, financial protection, and peace of mind for expats in Thailand.

If you’re planning to live in Thailand for a long time, it’s important to understand how pre-existing conditions affect health insurance. A pre-existing condition is any illness or health problem you had before you bought a new insurance policy. If you don’t declare these conditions, you might face unexpected bills or find your coverage limited later. Healthcare in Thailand can range from affordable check-ups to very costly hospital treatments, so it’s best to be prepared. Cigna offers health insurance plans that consider pre-existing conditions carefully, giving expats and long-term residents the right balance of cover and peace of mind.

On this page

| SECTION (CLICK TO JUMP) | SUMMARY |

|---|---|

| What are pre-existing conditions? | Health issues diagnosed or showing symptoms before buying insurance, such as diabetes or hypertension. Disclosing them ensures proper coverage and avoids claim rejections. |

| Hidden costs of ignoring pre-existing conditions in Thailand | Not declaring pre-existing conditions can lead to denied claims, large medical bills, and even visa problems. Honest disclosure protects your health and finances. |

| How Cigna addresses pre-existing conditions | Cigna covers common chronic conditions like diabetes and arthritis, offering high annual limits, direct billing, and easy claims for expats in Thailand. |

| Benefits of choosing insurance covering pre-existing conditions | Provides financial protection, access to quality care, visa compliance, and peace of mind for expats managing long-term health conditions in Thailand. |

What are pre-existing conditions?

Pre-existing conditions are health problems, illnesses, or injuries that a person already has before buying a new health insurance plan. These may have been diagnosed, treated, or shown symptoms in the past, often within the last five years. Even if the condition is under control or has not caused issues recently, it can still count as a pre-existing condition.

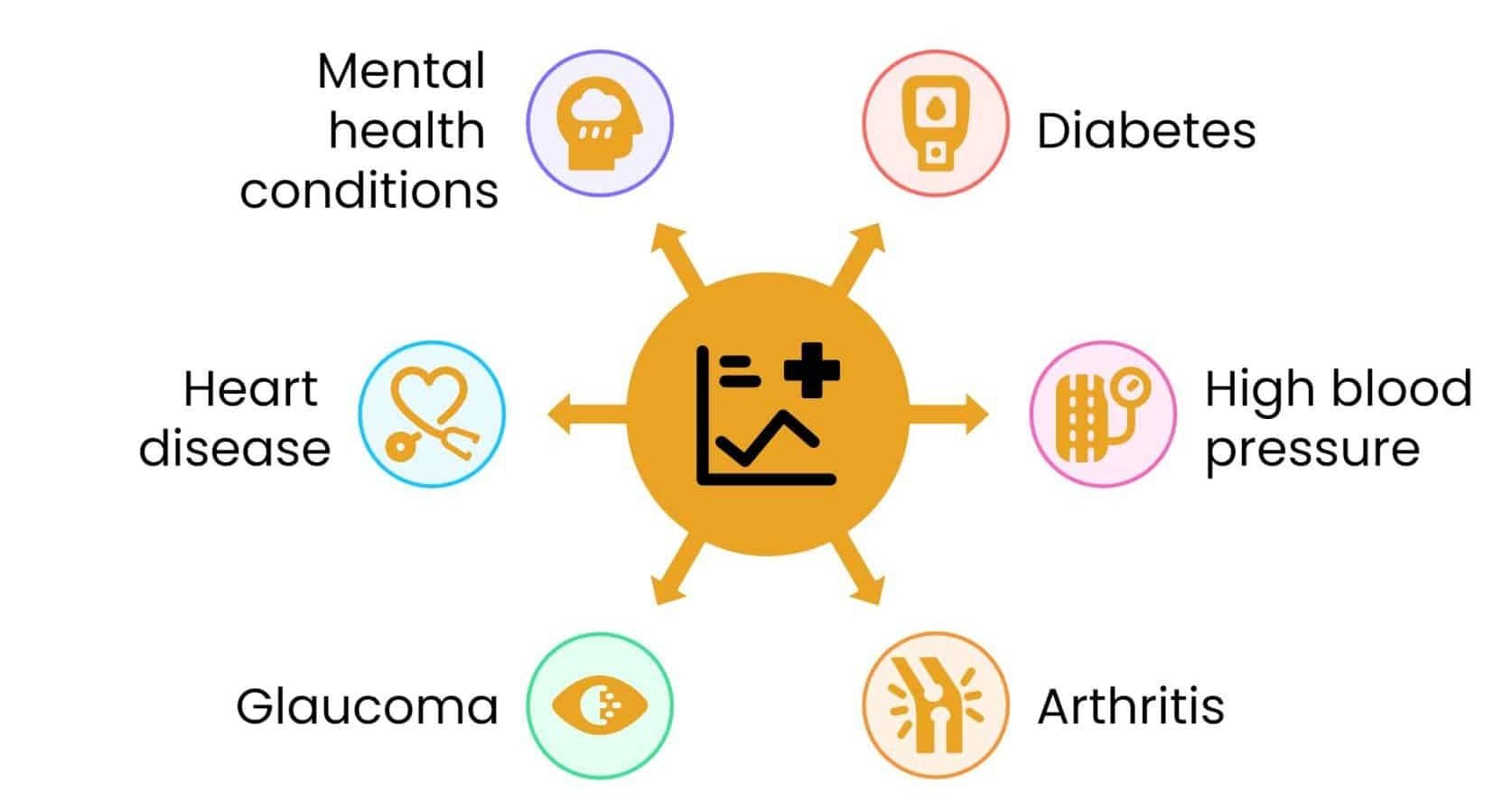

Some common examples include:

- Diabetes

- High blood pressure

- Arthritis

- Glaucoma

- Heart disease

- Mental health conditions such as anxiety or depression

When applying for health insurance, it is important to fully disclose these conditions. If not, you may face denied claims or limited coverage later.

Why disclosure matters:

- Insurers use this information to assess health risks and decide coverage.

- Some policies may exclude or limit treatment for these conditions.

- In some countries, regulations stop insurers from refusing cover or charging more, but this may not apply everywhere.

In Thailand, health insurance terms and healthcare costs can differ a lot between providers. Being open about your medical history helps insurers create a suitable plan for you. This way, you get proper coverage and avoid unexpected expenses when you need medical care.

Hidden costs of ignoring pre-existing conditions in Thailand

Ignoring pre-existing conditions when living in Thailand can lead to big problems and hidden costs. The main risk is that medical treatments may not be covered by your insurance, leaving you to pay large bills yourself. Healthcare in Thailand can be expensive, and without proper coverage, this can quickly damage your finances.

Many insurers in Thailand may:

- Exclude coverage for pre-existing conditions

- Add waiting periods before coverage begins

- Charge higher premiums to include these conditions

If you don’t disclose your conditions honestly, insurers can reject your claims. This means you might have to pay out-of-pocket for treatments, which is especially costly for chronic illnesses that need regular care and medication.

The risks go beyond money. Long-term visa holders in Thailand must maintain valid health insurance. If your insurance does not meet the requirements, because it excludes your condition or you gave incomplete information, you could face visa problems, fines, or even deportation.

Other risks include:

- Stress and worry from not having the right cover

- Delays in getting treatment when you need it

- Poorer health outcomes due to a lack of proper care

Being open about your medical history and choosing a plan that covers pre-existing conditions helps protect both your health and your legal status in Thailand. It also gives you peace of mind, knowing you are prepared for the unexpected.

How Cigna addresses pre-existing conditions

Cigna offers a supportive and clear approach to pre-existing conditions in Thailand, which is very helpful for expats. While many insurers either exclude or limit coverage, Cigna includes several common chronic conditions, such as:

- High blood pressure (hypertension)

- Type 2 diabetes

- Glaucoma

- Arthritis

- Osteoporosis

This means expats can get cover for specialist visits, prescribed medicines, tests, and hospital stays linked to these conditions. Cigna’s plans also provide high annual coverage limits and access to leading private hospitals, helping policyholders manage their health without paying huge bills out-of-pocket.

To get the most from Cigna, it’s important to:

- Be open about your medical history when applying

- Disclose all pre-existing conditions clearly

- Understand the terms of your plan to avoid denied claims

Cigna also makes healthcare easier with:

- Direct billing at many hospitals in Thailand

- A simple claims process

- Quick access to treatment without extra paperwork

For expats, this brings peace of mind. Cigna’s plans are designed to support long-term health needs while living in Thailand, making it easier to stay covered and confident about healthcare.

Benefits of choosing insurance covering pre-existing conditions

Choosing health insurance that covers pre-existing conditions gives strong financial protection, especially for people with chronic illnesses like diabetes or high blood pressure. Without this cover, expensive treatments can quickly drain savings and cause ongoing money problems. Insurance that includes pre-existing conditions helps reduce these risks by paying for:

- Specialist visits

- Diagnostic tests

- Treatments and procedures

- Regular medication

This means fewer unexpected bills and more peace of mind when living in Thailand.

Other key benefits include:

- Access to quality care at top Thai hospitals

- Timely treatment to manage long-term health issues

- Meeting Thailand’s health insurance rules for long-term visas

- Avoiding fines or visa problems due to a lack of proper coverage

With the right insurance, expats and long-term residents can focus on living well instead of worrying about healthcare costs. It also gives the freedom to travel and enjoy life in Thailand with less stress and more security.

Pre-existing conditions are an important part of health insurance in Thailand. If you don’t declare them, you could face denied claims, high medical bills, or even visa problems. Being honest about your health helps you get the right cover and avoid stress. Cigna is one insurer that includes common chronic conditions, with benefits like high coverage limits, access to private hospitals, and easy claims. Choosing insurance that covers pre-existing conditions protects your money, ensures timely treatment, and keeps your visa secure. To learn more, check out our guide on what’s not covered by health insurance in Thailand.

Latest Thailand News

Follow The Thaiger on Google News: