SafetyWing: The only insurance that covers motorbike accidents for digital nomads

Motorbikes are a common way for digital nomads to get around, especially in Southeast Asia. Many travel insurance plans do not cover motorbike accidents, leaving nomads with high medical costs if something goes wrong. SafetyWing Nomad Insurance includes motorbike accident coverage, helping with medical bills, hospital stays, and emergencies. It’s a smart choice for nomads who rely on motorbikes while travelling.

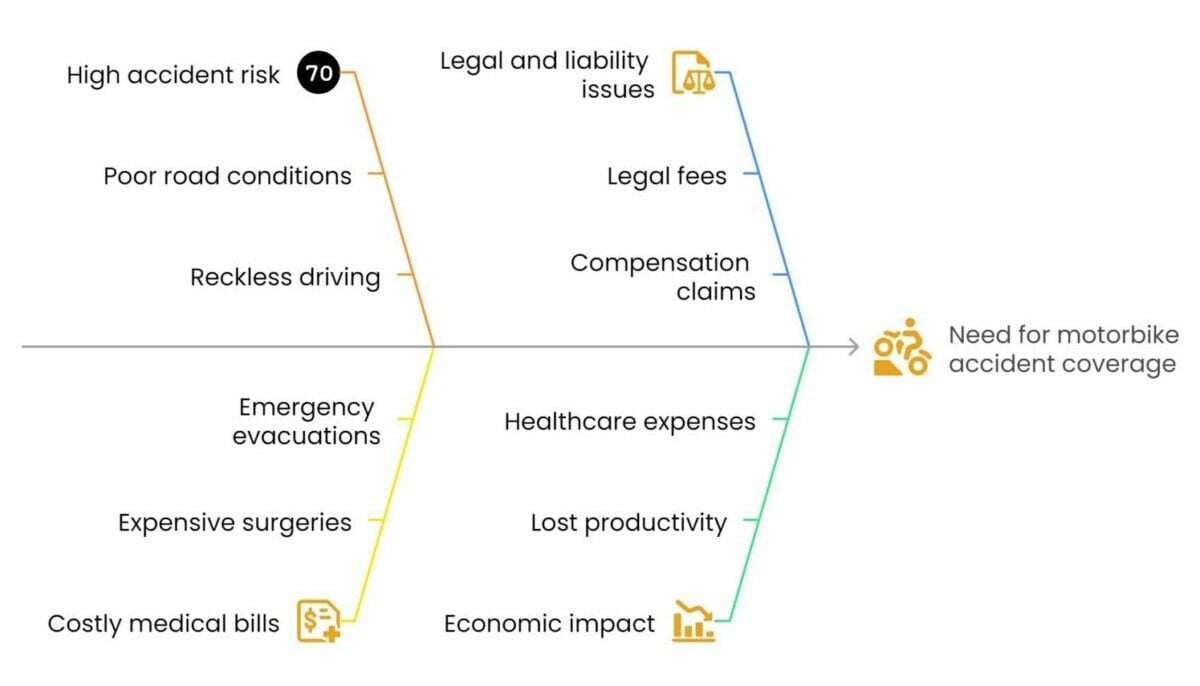

Why digital nomads need motorbike accident coverage in Thailand

Many digital nomads use motorbikes to get around in Thailand, especially in places like Chiang Mai, Phuket, and Koh Samui. While motorbikes are convenient, they come with serious risks. Having motorbike accident coverage is important for staying safe.

- High accident risk: Motorbikes are involved in 74–85% of road deaths in Thailand. In 2020, there were over 22,000 motorbike accidents, causing more than 19,000 injuries and 6,000 deaths. Poor road conditions, reckless driving, and lack of experience make accidents common. Many tourists and nomads are unfamiliar with local traffic laws, increasing their risk.

- Costly medical bills: Motorbike accidents can cause minor injuries or serious trauma that requires surgery or long hospital stays. Without insurance, medical costs can be thousands of dollars, and emergency evacuations to better hospitals can cost over US$50,000 (approximately 1.7 million Thai baht).

- Legal and liability issues: If a rider injures someone or damages property, they may face legal fees or compensation claims. Insurance with personal liability coverage can prevent large financial losses. To be covered, riders must wear helmets and have a valid motorcycle license or International Driving Permit.

- Economic impact: Road accidents cost Thailand up to 22% of its potential GDP growth each year due to lost productivity and healthcare expenses.

How insurance helps

A travel insurance plan with motorbike coverage provides:

- Medical expenses: Covers hospital bills, surgery, and medication.

- Emergency evacuation: Pays for transport to a better-equipped hospital if needed.

- Personal liability: Covers legal claims for injuries or damages.

- Accidental death & disability: Provides financial support for severe injuries or death.

Riding a motorbike in Thailand is risky, but comprehensive insurance like SafetyWing helps digital nomads stay protected. With the right coverage, they can travel safely without worrying about medical costs or legal problems.

How SafetyWing covers motorbike accidents

SafetyWing Nomad Insurance gives digital nomads comprehensive protection for motorbike accidents, covering medical care, evacuation, and liability. Here’s what the plan includes:

- Emergency medical care: Covers up to US$250,000 for hospital stays, surgeries, and treatments after a motorbike accident. Also includes urgent care, such as X-rays, MRIs, and diagnostic tests.

- Evacuation support: If local hospitals cannot provide proper treatment, SafetyWing covers emergency medical evacuation up to US$100,000. This includes transport by air or land to the nearest suitable hospital.

- Liability protection: Covers up to US$25,000 for legal costs or compensation if the rider injures someone or damages property in an accident.

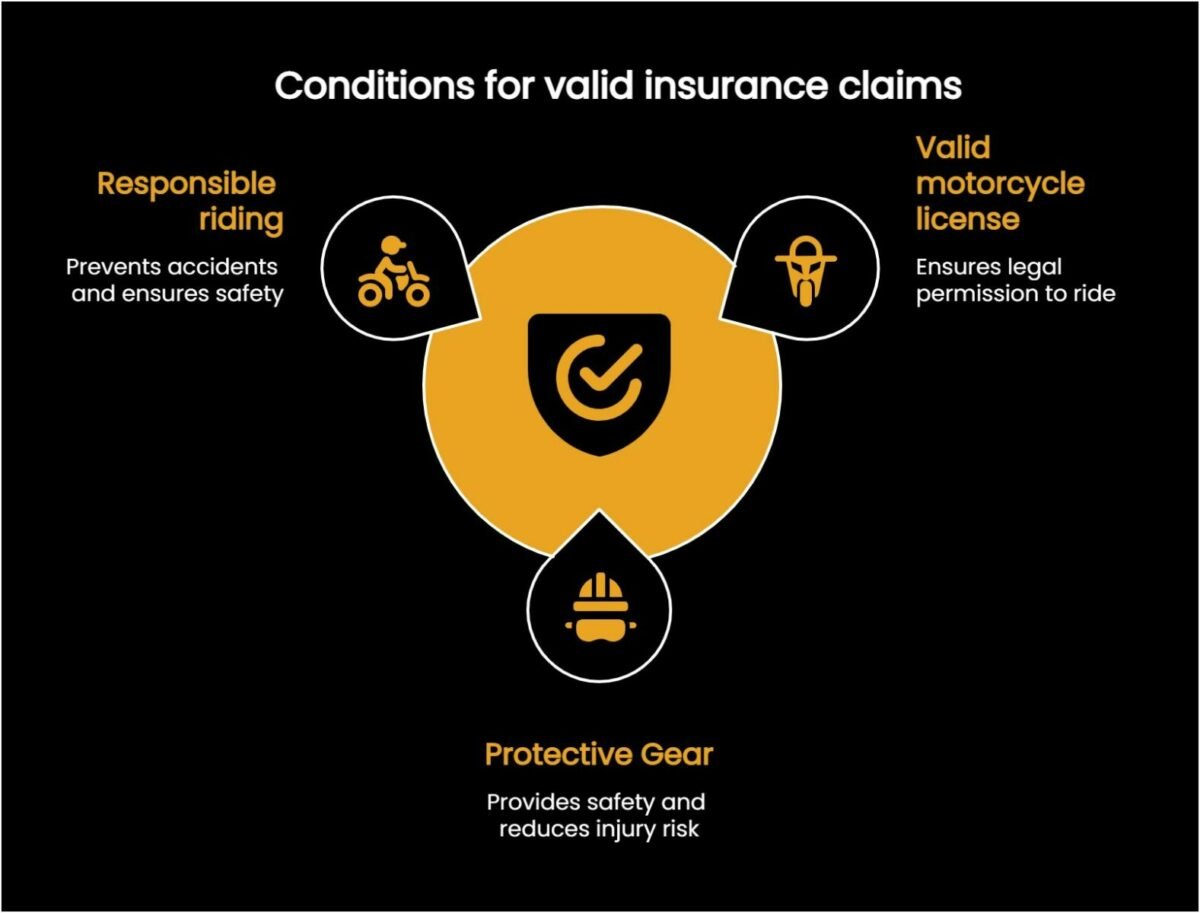

Conditions for coverage

To ensure claims are valid, riders must follow these rules:

- Have a valid motorcycle license: Foreign riders should carry an International Driving Permit (IDP) along with their home country’s license.

- Wear a helmet and safety gear: Not using protective gear may result in denied claims.

- Ride responsibly: Accidents caused by drugs or alcohol are not covered.

Why choose SafetyWing?

SafetyWing provides affordable and flexible insurance for digital nomads who rely on motorbikes. It covers medical emergencies, evacuations, and personal liability, ensuring riders are financially protected. Policies renew automatically every 28 days, and coverage can be purchased while abroad, giving nomads peace of mind while exploring new places.

How SafetyWing compares to other travel insurance plans

Most travel insurance plans do not cover motorcycle accidents or offer limited coverage with extra costs. SafetyWing Nomad Insurance includes motorbike accident protection as part of its standard plan, making it a better choice for digital nomads.

Comprehensive coverage for motorbike accidents

- SafetyWing Nomad Insurance covers motorbike accidents as part of its standard health and travel plan, with no need for extra upgrades.

- Covers medical expenses up to US$250,000, including hospital stays, surgeries, X-rays, and MRIs for injuries from motorbike accidents.

- Provides emergency evacuation up to US$100,000 if local hospitals cannot offer proper treatment.

- Includes personal liability coverage up to US$25,000 for legal claims or damages if the rider injures someone or causes property damage in an accident.

Calculate your cost here!

Flexibility and accessibility

- Travellers can buy coverage anytime, even after starting their trip, making it ideal for digital nomads.

- Policies renew automatically every 28 days, ensuring continuous protection with no coverage gaps.

- Offers worldwide coverage in over 180 countries, with an option to add U.S. coverage for an extra fee.

No hidden restrictions

- Coverage applies if riders follow local laws, including wearing helmets and having a valid motorcycle license.

- No engine size limits or restrictions on riding conditions, as long as the rider follows traffic laws and rides responsibly.

SafetyWing stands out by combining health and travel insurance into one plan, making it ideal for digital nomads who rely on motorbikes. Unlike many other insurance providers, it offers comprehensive protection, covering medical emergencies, evacuations, and personal liability in case of an accident. This ensures that digital nomads can ride safely and confidently while exploring new destinations, knowing they are financially protected from unexpected medical costs or legal issues.

How to get covered with SafetyWing nomad insurance

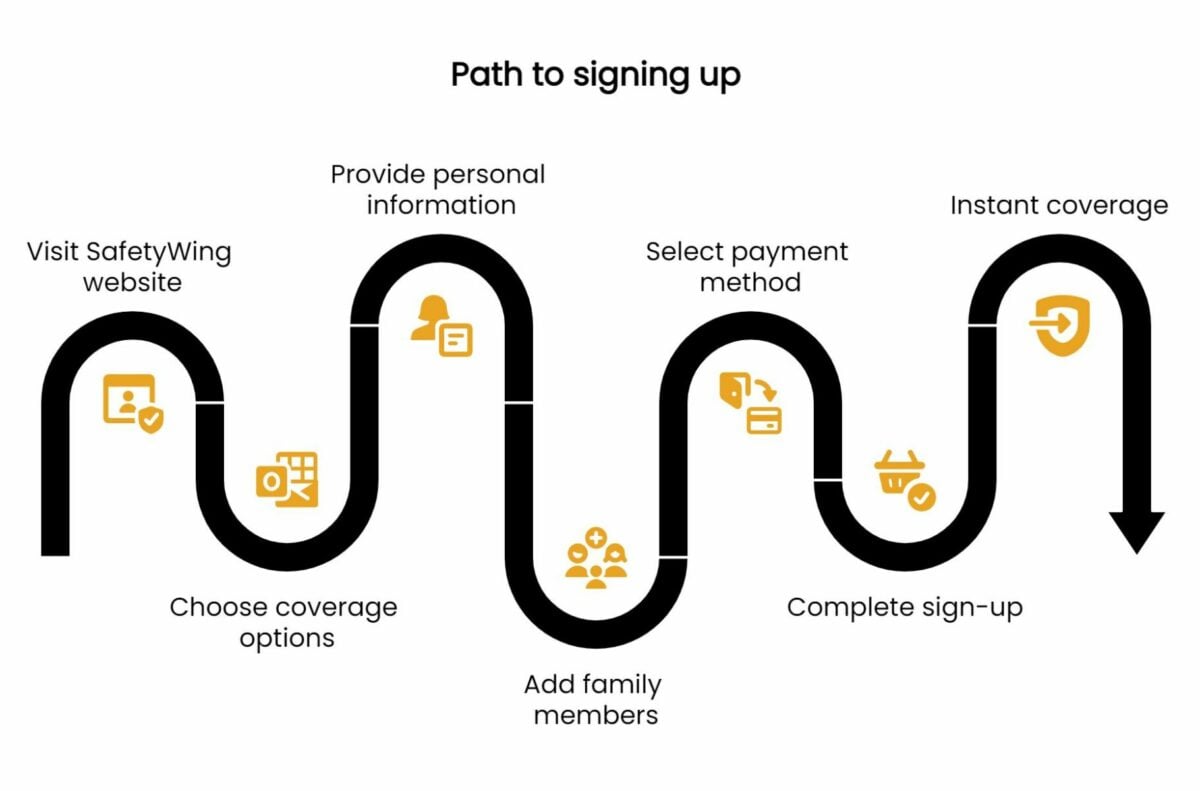

Signing up for SafetyWing Nomad Insurance is simple and designed for digital nomads, remote workers, and long-term travellers.

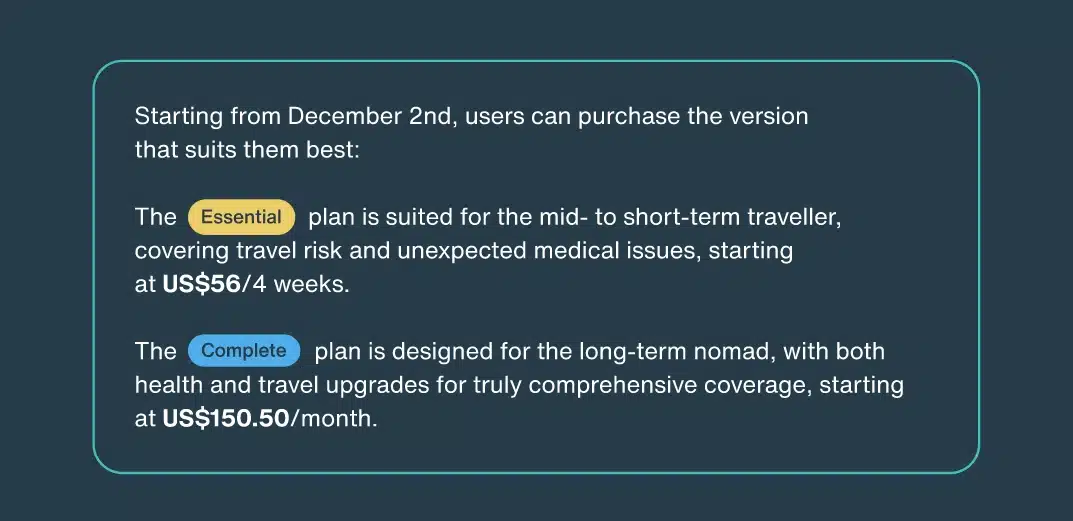

- Sign up online: Visit the SafetyWing website, choose between Nomad Essential (basic medical and travel coverage) or Nomad Complete (full medical and travel protection), and click “Sign Up” to start.

- Enter personal details: Provide your name, date of birth, nationality, and travel destinations. Select optional add-ons like U.S. coverage or adventure sports protection if needed.

- Customise your plan: Choose your start date, add family members or dependents, and select trip duration or automatic 28-day renewals.

- Make a payment: Pay with a credit or debit card. Pricing varies by age, with rates increasing for older travellers.

- Get instant coverage: Once payment is confirmed, coverage starts immediately on your chosen date. You’ll receive a confirmation email and access to your dashboard.

- Manage your policy easily: Use the SafetyWing dashboard to view policy details, add extra coverage (like dental or maternity), and update beneficiaries. Policies renew every 28 days unless cancelled.

Why SafetyWing stands out

- Flexible sign-up: Buy coverage anytime, even after your trip has started.

- Worldwide protection: Covers over 175 countries, with home country benefits for up to 30 days every 90 days (15 days in the U.S.).

- Easy process: No medical exams are required—everything is handled online in a simple and user-friendly interface.

With SafetyWing Nomad Insurance, digital nomads get reliable, flexible, and hassle-free protection, ensuring they travel with peace of mind.

SafetyWing Nomad Insurance gives digital nomads motorbike accident coverage, which most travel insurance plans do not offer. Since motorbikes are a popular but risky way to travel, especially in Thailand, having proper coverage is important. SafetyWing covers up to US$250,000 for medical expenses, US$100,000 for emergency evacuation, and US$25,000 for liability claims without extra fees.

Riders must follow local laws, such as wearing helmets and having a valid motorcycle license, to stay covered. With automatic renewals every 28 days, worldwide protection, and a simple sign-up process, SafetyWing makes it easy for nomads to stay safe while travelling.

Sponsored

Latest Thailand News

Follow The Thaiger on Google News: