Phuket property market in 2025: Evolving with demand and diversification

Change marked by growing inventory, shifting buyer preferences, and intensifying competition

Phuket’s real estate market is undergoing a significant transformation in 2025, marked by growing inventory, shifting buyer preferences, and intensifying competition. The latest Phuket Property Market Update by C9 Hotelworks reveals a dynamic landscape shaped by lifestyle migration, maturing development ecosystems, and rising price premiums, particularly in branded and well-located properties.

Performance in early 2024 and emerging trends

The first four months of 2024 saw strong transactional activity, underpinned by pent-up international demand and a resurgent tourism sector. Both primary and secondary markets experienced momentum, especially in high-demand areas such as Bangtao/Cherngtalay, Rawai, and Kamala.

Notably, branded condominiums and villas outperformed the broader market in terms of pricing and absorption, reaffirming the premium buyers place on quality, location, and lifestyle integration.

However, signs of market softening began to emerge in Q2 as the sheer volume of new inventory entered the pipeline. Developers pushed to launch projects to capture early-year demand, creating a robust supply base that is expected to weigh on pricing power in the coming months.

Current market landscape

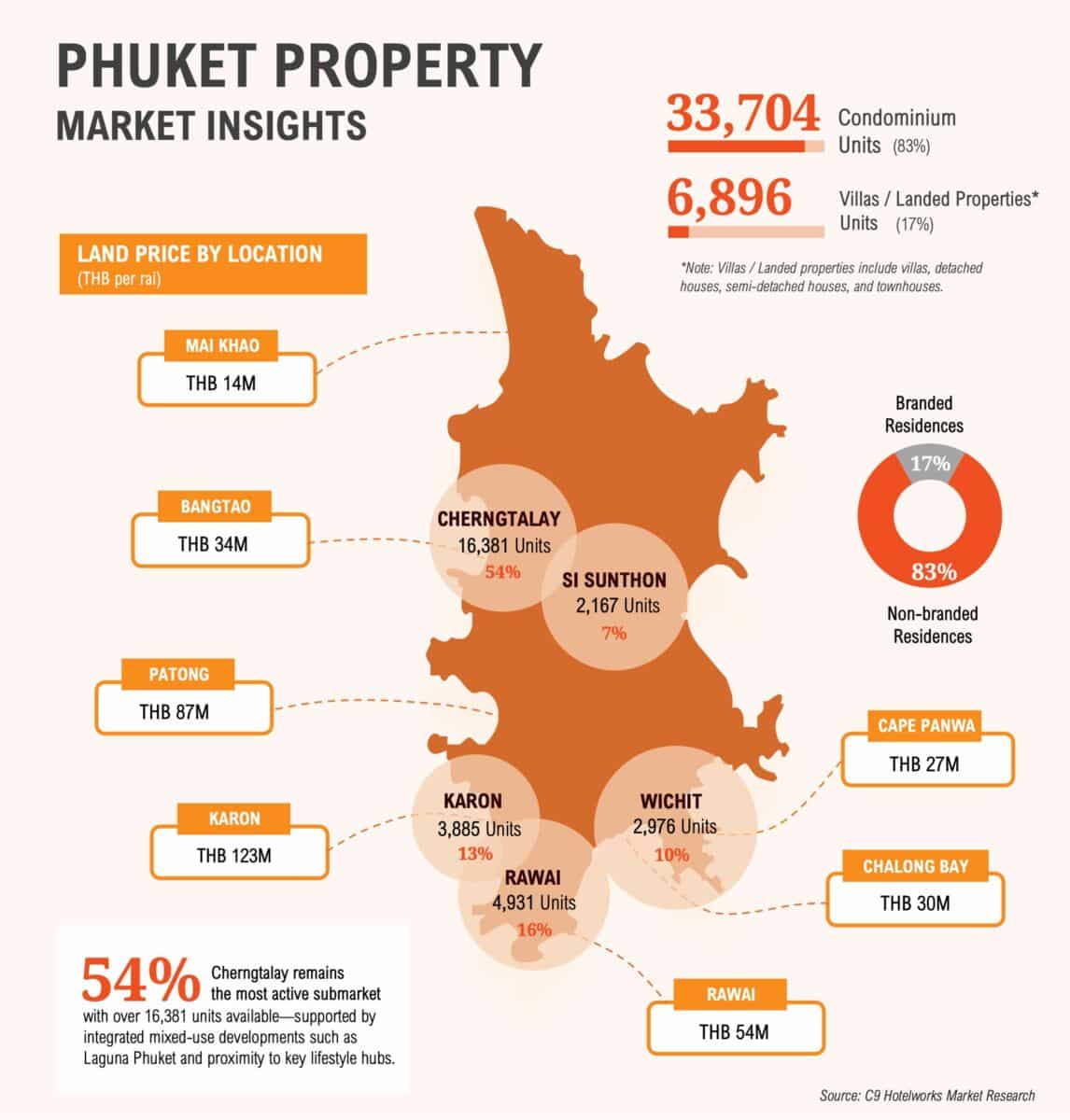

As of Q1 2025, Phuket boasts 40,600 residential units for sale across 343 active developments. Condominiums dominate this supply, accounting for nearly 83% with 33,704 units in 124 projects. The remaining 6,896 units are in the landed property category, including villas and townhouses.

The island’s residential market is being redefined not just by volume, but by its diversity and targeting of specific buyer profiles, from end-users and investors to digital nomads and retirees.

The Cherngtalay submarket continues to lead with 54% of all active listings, thanks to its proximity to lifestyle amenities and the presence of major mixed-use developments like Laguna Phuket. Developers from Bangkok, such as Sansiri, Ananda, and Origin, are increasingly expanding into Phuket, contributing to the upscale transformation of the island’s real estate offerings.

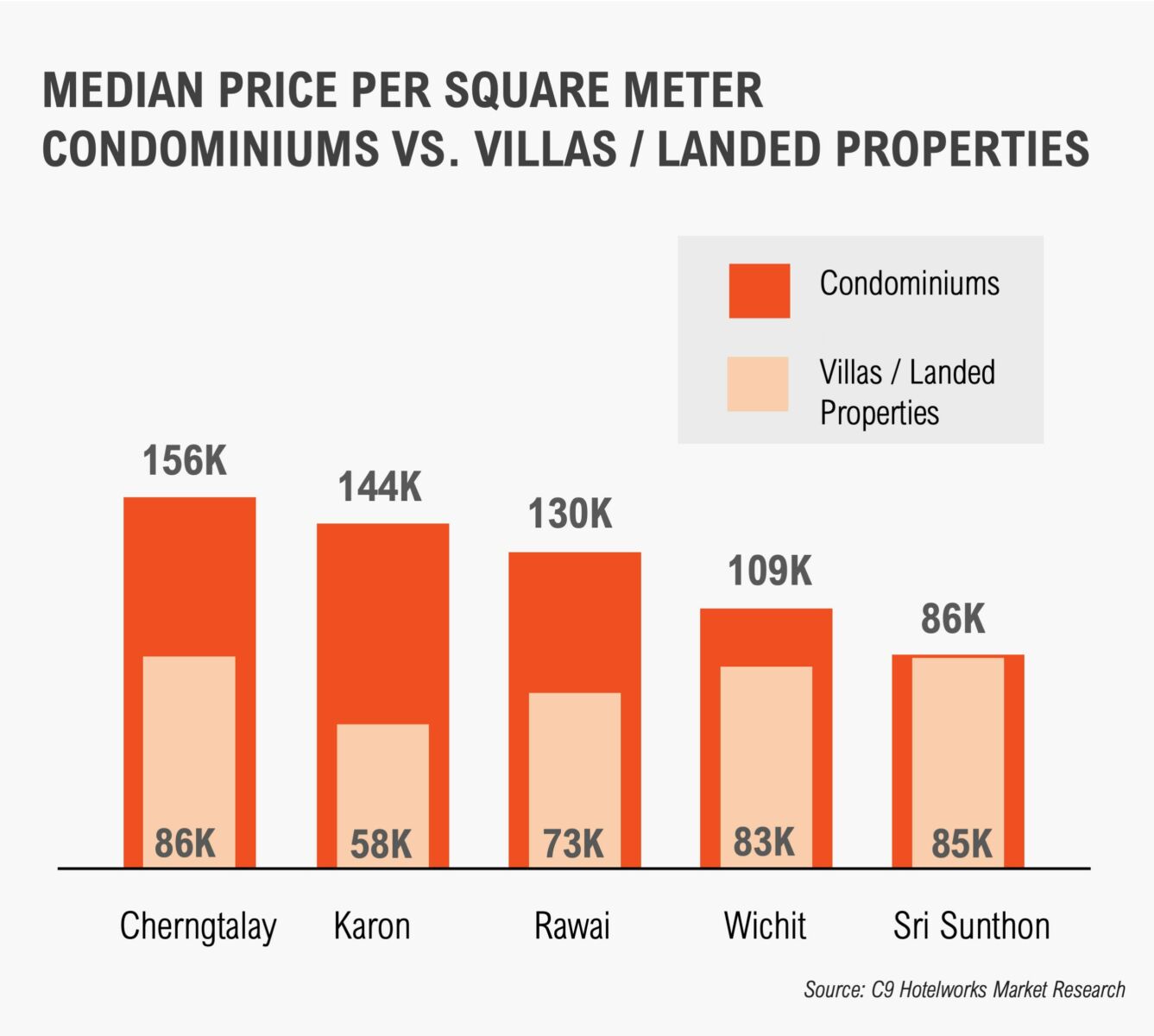

Price trends reflect the value being placed on brand affiliation, design, and location. The median price for condominiums stands at 144,000 baht per square metre, while villas/landed homes average 70,000 baht per square metre.

Branded condominiums fetch up to 28% more than their non-branded counterparts (181,000 baht vs. 141,000 baht per sqm), and branded villas command double the price of non-branded options (162,000 baht vs. 73,000 baht per sqm).

Cherngtalay again tops the pricing spectrum with one-bedroom condos reaching up to 19.4 million baht and luxury villas climbing as high as 137.9 million baht.

Rental and resale dynamics

With over 32,000 condo units in circulation, the resale market is beginning to heat up. Older projects, benefiting from legacy land costs and more modest original construction expenses, are now competing with new builds.

However, new developments continue to attract premium pricing due to modern layouts and enhanced facilities. Primary market non-branded condos, for example, average 139,000 baht per sqm compared to 100,000 baht in the secondary market, according to leading Thailand property portal FazWaz.

The rental sector mirrors these broader trends, with demand especially strong in Cherngtalay, Rawai, and Patong. One-bedroom units remain the most popular for both short- and long-term rentals. Short-term rental rates for condos average 26,616 baht per month, while premium villas, often used for holiday stays, average nearly 180,000 baht per month.

However, legal enforcement against illegal daily rentals in condominiums has intensified, which may temper future investment enthusiasm in this segment.

Commercial growth and market differentiation

Commercial development is also keeping pace. Seven new retail and lifestyle projects, including expansions of Central Phuket and the arrival of Siam Premium Outlet, aim to meet the demands of both residents and the growing influx of tourists and long-term visitors. These mixed-use hubs are transforming formerly isolated areas into vibrant, walkable communities.

The Phuket property market is thriving but becoming more selective. Developers are shifting focus from mass appeal to finely tuned products aligned with targeted buyer groups. Branded properties are setting the pricing benchmark, and flexible, design-savvy units are gaining favour due to shifting lifestyle patterns and regulatory changes. As resale competition intensifies, differentiation through post-sales services and mixed-use integration is becoming essential.

Outlook for 2025: Cautious optimism amid challenges

Looking ahead, the remainder of 2025 presents a more challenging landscape. A robust pipeline of new developments is expected to create competitive pressure on both pricing and absorption rates.

At the same time, global geopolitical uncertainty and fluctuating exchange rates may impact international buyer sentiment and capital flows into resort real estate.

While the market outlook is undeniably challenging, Phuket remains well-positioned due to its strong set of demand generators, including tourism, lifestyle migration, and digital nomadism. As the island continues to evolve into a truly international community, it offers a resilient and adaptable real estate market that, while maturing, still holds long-term potential for investors and end-users alike.

Latest Thailand News

Follow The Thaiger on Google News: