How Phuket’s once tourism-reliant Greater Bangtao is tranforming into an international ‘Gold-Coast’ community

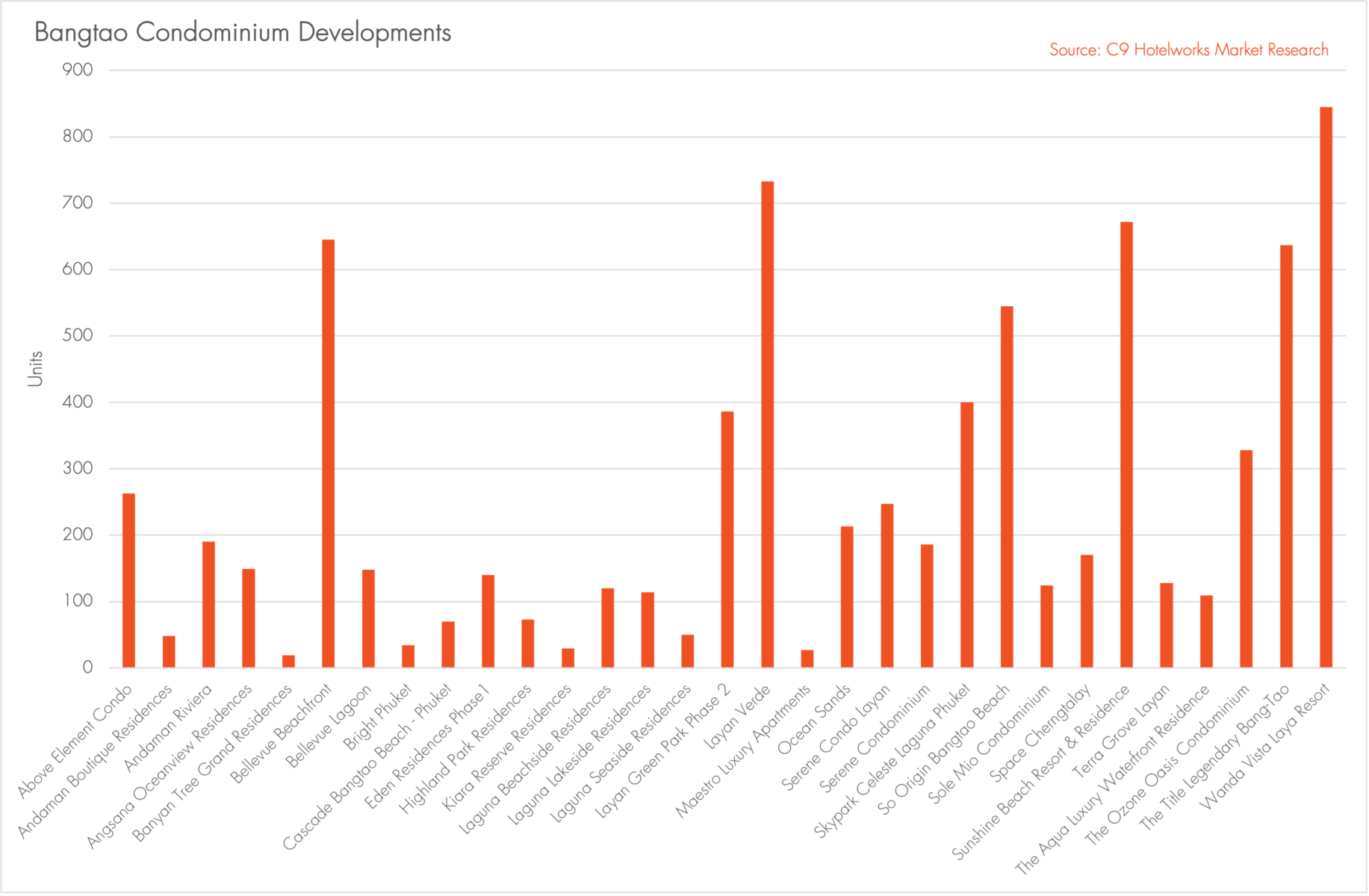

Phuket’s once-quiet beachside west coast community of Bangtao is experiencing an unparalleled surge in real estate development. According to new research from C9 Hotelworks, there are currently 7,842 condominium units (click to see upcoming project map). Added to the supply influx are just over 2,400 upscale and luxury homes, which equate to a pipeline of more than 10,000 residential units in the market.

In what is a fragmented neighbourhood of Bangtao, Laguna, Cherngtalay, and Layan, these areas traditionally formed what is a tourism-oriented district. All of this is now changing, and the influx of real estate projects looks to recast the area as Phuket’s ‘Gold Coast’ in what is an emerging metropolitan area.

Despite a methodical pace of property growth over the past two decades, the post-pandemic inward migration onslaught of expatriates has been nothing short of phenomenal. Inland land prices in the area have more than tripled over the past 24 months, where land that had been THB8-10 million a rai is now THB25-30 million.

One of the key triggers of the property boom has been the Russian-Ukraine conflict, which has supercharged what was already a growing geographic source of business for tourists and real estate. Russian buyers now account for the lion’s share of properties, though there continues to be diversity in broader terms. Coupled with the incoming Eastern European growth is a steady stream of lifestyle buyers who are jumping onto the urban flight trend to work from home and focus on quality of life away from highly populated cities.

There is a rapid rise in new residents from the US, Singapore, Hong Kong, China, and Europe. Key to the migration storyline has been the widely popular Thailand Elite long-term visa program as well as the government-initiated retirement visa. A secondary demand generator has been the strong growth of international schools, which are now in double digits in size and expanding. These offer access to dependent and/or guardian visas.

Moving back to the makeover of Bangtao from a tourist area into an international community, there is an escalation of residential properties in size versus hotels. C9’s research shows there are 2,837 rooms/key of international standard properties in the expansive area. These are now being dwarfed by property development, which creates challenges and a potential problem of unlicensed tourism accommodation.

Thailand’s Hotel Act, as it stands now, makes it difficult and in many cases impossible for residential condominiums or villa estates to obtain hotel licenses. For condominiums, the conversion from residential use to commercial use that is required for a hotel license has been stymied at local approval levels and remains a contentious issue.

What is apparent with over 10,000 new properties coming up is that not all buyers will be end-users or owners of holiday/second homes. In many cases, residential buyers have expectations of high rental yields from a flourishing Phuket tourism market, yet they might face problems in the future as projects lack hotel licenses. For the traditional hotel sector, there is concern over unfair competition from the informal rental market.

Realistically, the lack of a licensing mechanism for residential properties is putting the government at a substantial tax disadvantage, and funds that could be earmarked for badly needed infrastructure are an opportunity missed. Safety in non-licensed accommodation should also be a critical area of concern.

As to who is developing the upcoming projects, these are comprised of three main groups. Laguna Phuket remains the largest land bank in the Greater Bangtao area, and it has shifted focus from tourism to real estate as an economic necessity. With more projects within the main destination resort area, the company will also push into a new mixed-use community north of Laguna Village.

On the Thai development front, post-COVID19 has seen Bangkok developers active, such as CPN (Central Pattana), One Origin, AssetWise, and Sansiri. Local groups include Boat Pattana, Botanica, and Anchan. Given the escalation of land prices, the current state of play favours mid-rise condominiums as the only way developers can make an economic case with underlying land costs.

For the third group, Eastern European, or mainly Russian developers have flocked to the Bangtao area as market sentiment is at its highest level. These projects account for at least half of the total condominium units coming to market, due to the greater density of development. At the end of the day, rising land acquisition costs are spurring this trend.

Another change for Phuket property is the escalation of commissions which remain unstandardized. In many of the new Bangtao properties that lack brand or strong customer bases, commissions have risen to 7-10 percent. In certain cases, even a cash bonus of up to THB100,000 has been added to the incentive.

Whereas more traditional projects would have seen lower commissions and higher marketing costs, developers are now becoming massively reliant on a growing brokerage base. A growth spurt of Russian and Eastern European agents now sees projects chasing them for prospective buyers. Certainly, brokerage has taken centre stage for the moment, though there remain questions as to the depth of their customer base longer term. One good example of underlying growth in brokerage is the leading portal FazWaz, which has established a strong base for online buyer generation.

Lastly, larger property groups are closely watching the formation of new Phuket development regulations. This is regulated by the Phuket Department of Public Works and Town and Country Planning together with the Bangkok-based Ministry of Natural Resources and Environment which oversees Environmental Regulations.

In C9’s discussions with experts on the draft plan which is expected to formalize in 2024, there will be a greater alignment to Bangkok-type rules that focus on FAR (floor area ratio) and higher minimum-road width for mid-rise development. It’s likely that given Phuket’s growth, certain areas will be zoned for high-rise development.

These changes, while needed, will come too late to address growing traffic concerns. The addition of over 10,000 new residential properties to the Bangtao area will see an uptick of large construction vehicles, a large-scale growth in private vehicles, and it is a serious situation that has to become a government priority. Sadly, there is no blueprint structure for an expanding Bangtao metropolitan district that crosses many local jurisdictions. The most glaring immediate need is a traffic study and action plan by the municipality and highway department.

As a final point, one missing link in the growth of residential units is the lack of diversification of larger demand generators such as a full-service hospital, central parking structures, commercial buildings, international convention centres, public parks, and pedestrian-friendly access. This, of course, is at odds with sky-high property prices that dictate highly dense projects to make economic sense. What is desperately needed is a Phuket Master Plan and acceleration of transportation infrastructure.

Bangtao’s journey into a metropolitan, ‘Gold Coast’ community is well underway, and we do expect cyclical growth to continue into the high season, but there is also a tendency to wonder: when does the market peak, and what comes next?

Press Release

Latest Thailand News

Follow The Thaiger on Google News: