Key strategies for successful gold trading in 2025

Gold trading for 2025 holds both opportunities and challenges for market participants. As one of the most actively traded commodities globally, the popularity of gold transcends its traditional role as a store of value. It has also been a highly reactive asset, responding to changes in the global economy, the actions of the central banks, geopolitical happenings, and sentiment among investors.

The interactions among these factors this year are multifaceted than ever before, so traders need to get to the market with a mix of insight, discipline, and flexibility.

Understanding the Market Context

It is necessary to comprehend the underlying reasons for the prices of gold for the year to be able to execute on any strategy. The global economy, for the year 2025, sits on the razor’s edge between stifled growth and persistent inflationary attitudes.

Central banks, headed by the US Federal Reserve and the European Central Bank, have been on high alert with policies, keeping the market on the edge of the precipice. Geopolitics continues to intensify in some corners of the globe, continuing to fuel the demand for the gold haven.

In this respect, the volatility of the gold will continue to remain high, offering the possibility of gain to those skilful enough to sense its movement.

Integrating Fundamental and Technical Analysis

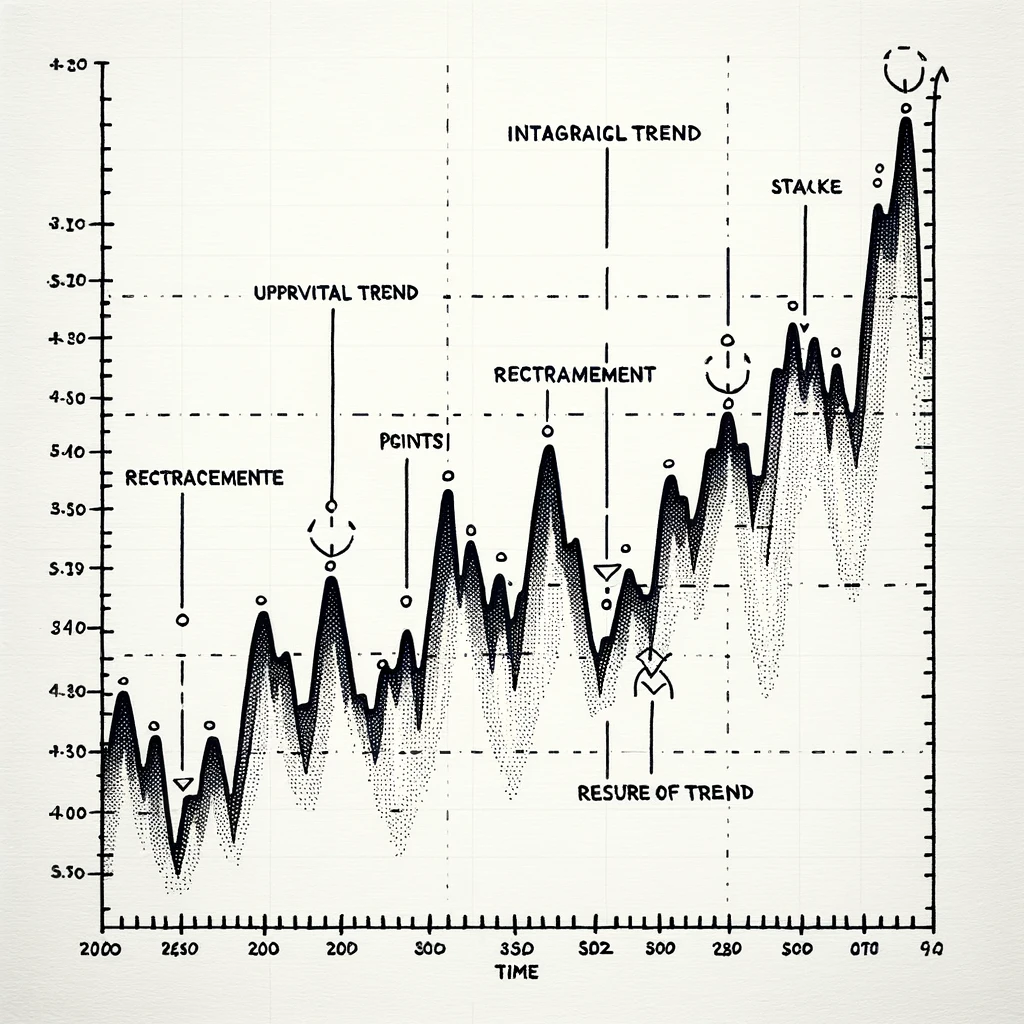

Profitable trading of gold in 2025 will require the blending of both the fundamental and technical viewpoints.

Fundamental analysis gives you insight into the underlying reasons for the moves, the changes in interest rates, inflation figures, and the global performance of the economy.

Technical analysis, by contrast, gives you buying and selling signals from the action of the price, chart formations, and major support and resistance points.

Traders who will be able to combine the two—knowing why the gold is going somewhere and knowing when to do it—will gain a significant advantage.

Adapting to Rapid Market Reactions

Typical of gold trading today is the reactivity of the market to information. Enhanced automated trading technology means significant shifts in the price can occur within seconds of breaking news releases.

Traders must be equipped with pre-set tactics to capitalise on this action by executing them immediately. Alerts of significant levels of the price, stop-losses, as well as take-profits, for example, must be pre-set to keep capital intact during rapid market action.

Managing Risk with Precision

No matter how bullish the times, gold will often suddenly reverse, springing surprises on traders caught off guard.

Risk management is thus not a choice—it is the key to long-term success. In 2025, prudence dictates curtailing exposure on individual trades, diversifying positions where it is necessary, and continually reassessing risk against evolving market conditions.

The goal is to endure losing runs and conserve capital to take advantage of opportunities when they come along.

Leveraging the Role of Gold in Currency Markets

Gold’s dominance extends beyond the spot price to the forex market, especially the XAU/USD pairs.

The negative correlation between the US dollar and gold tends to offer good trading indications. For instance, a declining dollar tends to favor higher prices of gold, but dollar strength tends to pressure the metal. Traders can detect high-probability setups by keeping track of currency movements, together with gold charts.

Conclusion

Gold trading during the year 2025 will be profitable for the informed, prepared, and disciplined individual. The market this year is characterised by the intersection of economic turmoil, regional conflict, and explosive changes in technology within the world of trading.

Those who grasp the larger perspective, synthesise different types of analysis, respond to changes quickly, and approach risk with sophistication will reap success. In a world where opportunities emerge and disappear within minutes, being prepared is the line between seeing profits disappear on the screen or achieving steady returns.

For investors willing to dedicate themselves to a thoughtful, nimble approach, the gold of 2025 continues to be among the most exciting venues for potential.

Latest Thailand News

Follow The Thaiger on Google News: