Motorbike accidents in Thailand: Why most insurance won’t cover you

And some steps to ensure that you will be covered

Motorbike accidents in Thailand are a major problem, with the country being one of the most dangerous places for riders. Motorbikes are the most common way to get around for both locals and tourists, but they also make up over 70% of traffic deaths.

Having insurance is important, but many travellers and expats don’t know that most regular insurance policies don’t cover motorbike accidents.

On this page

| Topic (Jump to section) | Description |

|---|---|

| The popularity of motorbikes in Thailand: A nation on two wheels | Motorbikes are a primary mode of transport in Thailand, with 43% of Thais using them daily. |

| Common causes of motorbike accidents in Thailand | Accidents stem from reckless driving, bad roads, intoxication, and tourists’ inexperience. |

| Why do most standard insurance policies exclude motorbike accident coverage in Thailand? | High-risk activity classification, legal requirements, and behavioural exclusions make coverage rare. |

| Why specialised travel insurance is important for motorbike riders in Thailand | Specialised insurance covers medical costs, liability, and other motorbike-related risks not included in regular policies. |

| What does SafetyWing offer for motorbike accidents? | SafetyWing provides emergency medical coverage, liability protection, and more for riders in Thailand. |

The popularity of motorbikes in Thailand: A nation on two wheels

Motorbikes are everywhere in Thailand, a key part of daily life across the country. From the busy streets of Bangkok to the mountain roads of Chiang Mai, motorbikes are the main way people get around. Around 43% of Thais use motorbikes as their primary mode of transport, and over 87% of households own at least one. Motorbikes are affordable, help avoid traffic jams, and can carry everything from groceries to families.

For tourists, renting a motorbike is easy and cheap. With just a passport and a small deposit, visitors can rent a bike for 200 to 500 Thai baht per day (about US$5 to US$15). This makes motorbikes a popular choice for exploring Thailand’s beaches, temples, and countryside. But the ease of renting a bike can lead to risks: many tourists don’t have a licence, wear helmets, or know the rules for driving on the left side of the road. Locals also rely on motorbikes, with motorcycle taxis (win motos) navigating busy streets to offer quick, affordable rides.

However, this widespread use of motorbikes comes with a serious downside. Thailand has some of the most dangerous roads in the world, and motorbikes are involved in over 70% of traffic deaths. Easy rental rules, uneven law enforcement, and crowded streets create a dangerous mix. For tourists, the excitement of riding through beautiful landscapes can quickly turn risky without proper preparation or insurance that covers motorbike use. Understanding how essential motorbikes are in Thailand can help you navigate the roads more safely.

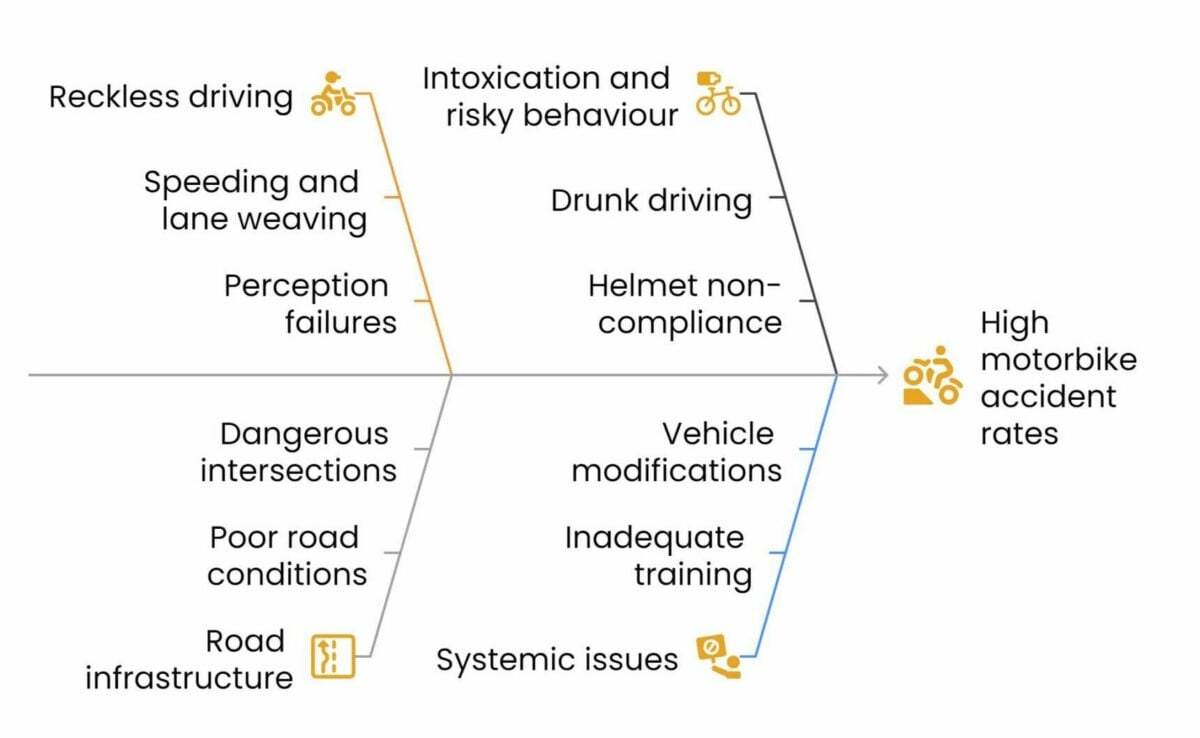

Common causes of motorbike accidents in Thailand

Motorbike accidents in Thailand happen for several reasons, involving human behaviour, poor road conditions, and other factors. Here are the main causes:

Reckless driving and human error

- Speeding and lane weaving: Many riders drive too fast or switch lanes suddenly, increasing the chance of crashes.

- Perception and decision failures: A study of 1,000 accidents showed that 60% of crashes were caused by riders misjudging distances or reacting too slowly to danger.

- Lane changes without signals: Riders often change lanes abruptly, especially in rural areas, leading to accidents.

Road infrastructure and design

- Poor road conditions: Potholes, uneven surfaces, and bad lighting, especially in rural areas, make accidents more likely.

- Dangerous intersections: Mixing motorbikes with cars at U-turns and junctions causes many crashes, calling for road redesigns to separate the traffic.

- Lack of enforcement: Speed limits and helmet laws are not always enforced, and fines rarely stop people from breaking the rules.

Intoxication and risky behaviour

- Drunk driving: Alcohol affects judgment and reaction times. A study found that 35% of solo crashes were linked to riders being under the influence.

- Helmet non-compliance: Over 62% of fatal head injuries happen to riders without helmets, but many still don’t wear them, especially in rural areas.

Environmental and mechanical factors

- Weather-related hazards: Wet roads reduce grip, but most crashes happen in dry weather when riders go faster.

- Faulty equipment: Poorly maintained brakes, tyres, and lights lead to accidents, especially in rural areas where regular vehicle checks are rare.

Tourist-specific vulnerabilities

- Inexperience: Many tourists rent motorbikes without proper riding skills or knowledge of local traffic rules.

- Cultural unfamiliarity: Riding on the left side of the road and dealing with chaotic traffic can confuse visitors, leading to mistakes. At the same time, locals do not exactly drive the safest or the most legal as well so tourists might partake or be caught off guard by the chaotic flow.

Systemic issues

- Inadequate training: Licensing tests often don’t prepare riders for real-world road dangers.

- Vehicle modifications: Changes like aftermarket exhausts or suspension can reduce safety, but enforcement of these issues is weak.

These factors keep Thailand among the world’s most dangerous countries for motorbike riders. Stricter laws, better education, and improved infrastructure are needed to make the roads safer.

Why do most standard insurance policies exclude motorbike accident coverage in Thailand?

Motorbike accidents in Thailand can lead to serious financial and legal problems, but most standard insurance policies don’t provide the right coverage. This happens because insurers consider motorbiking high-risk, there are legal issues, and Thailand’s roads present unique challenges. Here’s why coverage is often excluded and what riders should know.

1. High-risk activity classification

Insurance companies see riding a motorbike as a high-risk activity because of Thailand’s high accident rates. Over 80% of road deaths in the country involve motorbikes. To protect themselves, insurers exclude motorbike accidents unless riders buy special add-ons or policies meant for high-risk activities.

2. Licensing and legal requirements

- Motorcycle licence: Most policies require riders to have a valid motorcycle licence from their home country. Tourists who use a car driver’s licence, which often doesn’t cover motorbikes, won’t be covered.

- International driving permit (IDP): An IDP for motorcycles is required in Thailand. If you don’t have one, your insurance claim may be denied, even if the rental shop doesn’t ask for it.

- Local license issues: Long-term expats may get a Thai motorcycle license, but this can still conflict with the policy if the insurer needs a license from the rider’s home country.

3. Safety and behaviour-based exclusions

- Helmet use: Many policies require riders to wear helmets in case of an accident. If the rider isn’t wearing one, the insurance may be void, even though helmet laws are often not strictly enforced in tourist areas.

- Road law violations: Common behaviours like speeding, lane-splitting, or running red lights, which happen often in Thailand’s busy traffic, can cancel insurance claims.

- Intoxication: Insurance companies won’t cover accidents involving alcohol or drugs, and in Thailand, roadside alcohol checks are rare.

4. Technical restrictions

- Engine size limits: Most standard policies only cover bikes under 125 cc. Bigger bikes, used for touring or off-road riding, need special insurance.

- Vehicle modifications: Changes like aftermarket exhausts or unregistered modifications can cancel coverage.

- Rental operator legitimacy: Renting from an unlicensed shop or one without proper registration documents often breaks the insurance terms.

5. Medical and liability risks

- Medical cost exclusions: Many standard health insurance plans consider motorbike injuries “high-risk” and won’t cover hospital bills, surgeries, or evacuation costs.

- Third-party liability: If a rider causes an accident, regular travel insurance usually doesn’t cover damage or injuries to others, which could lead to lawsuits.

6. Systemic gaps in coverage

- Pre-existing conditions: Insurers may deny claims if they link injuries to existing health issues.

- Geographical limits: Some policies don’t cover certain areas, like the mountainous Mae Hong Son Loop, which is known for dangerous roads.

- Time restrictions: Coverage may only be valid during the day, leaving riders unprotected at night when visibility is poor.

Why specialised travel insurance is important for motorbike riders in Thailand

Specialised travel insurance is important for anyone planning to ride a motorbike abroad, as most standard travel insurance policies don’t cover motorbike accidents because of the higher risks. These specialised policies are made for riders, offering protection for medical costs, liability, and other expenses that may come from motorbike accidents, whether you’re using your own bike or renting one during your travels.

For digital nomads and tourists, SafetyWing is a good option that meets these needs. Their insurance is designed for long-term travellers and remote workers, and it includes coverage for motorbike accidents in some cases. To be covered, riders must meet certain requirements, like having a valid motorcycle licence and wearing a helmet while riding. This ensures that riders are protected from large financial losses if an accident happens, filling the gap left by regular travel insurance policies that usually exclude motorbike accidents.

By choosing specialised travel insurance like SafetyWing, motorbike riders can feel more confident while travelling, knowing they’re covered for the risks that come with riding in countries like Thailand.

What does SafetyWing offer for motorbike accidents?

SafetyWing’s Nomad Insurance offers essential coverage for motorbike accidents, protecting riders from risks often excluded by regular travel insurance. This coverage is perfect for those who frequently ride motorbikes, whether they’re using their own bike or renting one.

Key Coverage

- Emergency medical expenses: Up to US$250,000 for injuries, including hospital stays, surgeries, X-rays, MRIs, emergency dental care, and ambulance services.

- Follow-up care: Covers post-accident treatments like physical therapy or specialist consultations.

- Emergency medical evacuation: Up to US$100,000 for transport to better-equipped hospitals, including air ambulances or medically escorted flights.

- Personal liability protection: Up to US$25,000 for property damage or injuries caused to others in an accident.

- Accidental death and disability: Financial support for severe disability or death from a motorbike accident.

To qualify for coverage, riders must:

- Hold a valid motorcycle licence from their home country and an International Driving Permit (IDP).

- Wear a helmet and follow local traffic laws (no drunk driving or reckless riding).

Why SafetyWing Stands Out

- Designed for digital nomads and long-term travellers: Policies renew automatically every 28 days and cover you in over 180 countries.

- No engine size restrictions: Coverage includes larger bikes (e.g., 250cc and above) as long as you meet licensing and safety requirements.

- Affordable pricing: Starts at about US$56 every 4 weeks, with the cost depending on age and coverage level.

- Simple claims process: You can easily submit claims through SafetyWing’s online portal by providing necessary documents (e.g., medical reports, police statements).

SafetyWing offers clear and comprehensive protection for motorbike riders in high-risk environments like Thailand. It covers medical emergencies, evacuations, and liability without excluding larger bikes or legal rentals, ensuring peace of mind for travellers.

Important Notes

- Coverage does not apply if you’re involved in drunk driving, riding without a license, or performing off-road stunts.

- Always keep rental agreements, proof of helmet use, and accident reports to streamline claims.

Calculate your costs below!

Motorbike accidents are a big problem in Thailand, with motorbikes making up more than 70% of traffic deaths. While motorbikes are a common way for locals and tourists to get around, most regular insurance policies don’t cover motorbike accidents due to the high risk. Specialised insurance like SafetyWing is designed to cover these risks, including medical costs, liability, and other expenses. SafetyWing offers affordable coverage for riders who follow safety rules and have the right licences. With this insurance, riders can feel safer and more confident while travelling in countries like Thailand. To learn more about why the right insurance is so important, check out this related article: The cost of not having the right insurance.

Sponsored

Latest Thailand News

Follow The Thaiger on Google News: