Holiday blues: Thailand tourism hits bump in the flight path

Confidence crisis, soaring costs and safety fears send Land of Smiles visitor numbers sliding

Thailand’s golden age of tourism seems a distant memory as the Land of Smiles battles to reclaim its pre-pandemic glory. While neighbours like Vietnam and Malaysia have soared past their 2019 highs, Thailand’s tourist engine has stalled and experts warn it might be years before the country climbs back into the global travel top tier.

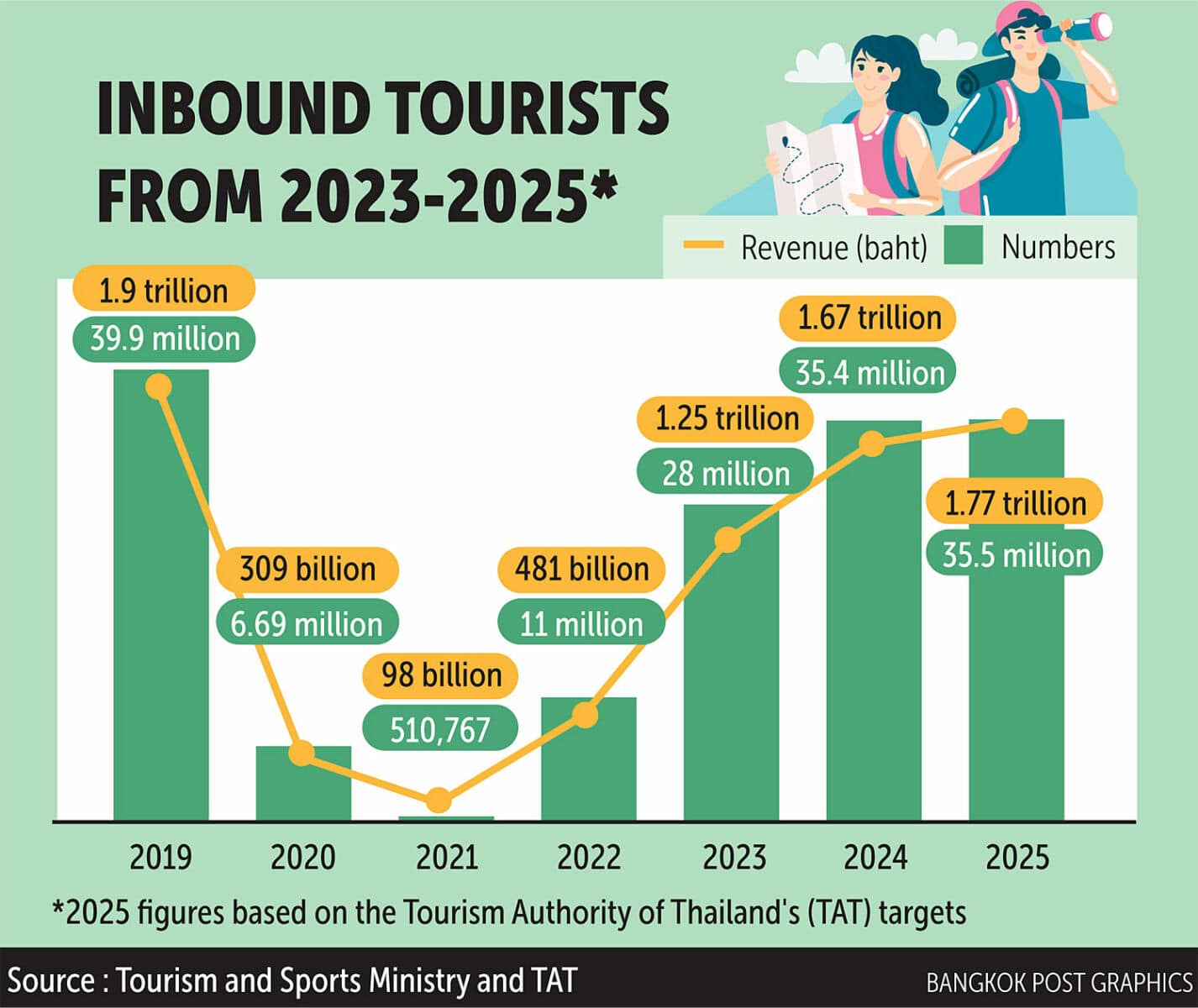

Thailand welcomed 35.5 million foreign tourists in 2024, a healthy 26% jump year-on-year, but still shy of the near-40 million record set in 2019. And with just 16.6 million arrivals in the first half of 2025, the dream of smashing old records is fading fast.

Today, the Tourism Authority of Thailand (TAT) launches its new campaign under the banner Healing is a New Luxury with a 2026 target of 36 million visitors and 1.63 trillion baht in revenue. But that’s still a far cry from the 1.9 trillion baht tourists splashed in 2019.

Even if next year’s ambitious 2.8 trillion baht revenue goal is met, it won’t touch the 3 trillion baht milestone Thailand once reached.

And while some bounce-back began in 2023, largely thanks to China’s long-awaited border reopening, momentum from the mainland has fizzled.

The Chinese market once accounted for a quarter of all foreign tourists to Thailand. But despite an initial boom in 2023 and early 2024, arrivals from China have slumped alarmingly.

January 2024 saw a 453% increase in Chinese visitors compared to the previous year. By December, that had slumped to just 25%. And in the first half of 2025, Chinese arrivals fell 34% year-on-year to just 2.26 million.

“Thailand might welcome only 4-5 million Chinese visitors this year,” warned former TAT governor Yuthasak Supasorn. “That would be the lowest in 12 years, excluding the Covid years.”

And the reason? It’s not just China’s sluggish economy.

Vietnam and Japan both saw Chinese arrivals soar, up 144% and 62.9% respectively. Meanwhile, Thailand has been dogged by a series of high-profile disasters and safety concerns.

Thailand’s reputation took a hammering this year when Chinese actor Wang Xing was kidnapped, and a 30-storey building dramatically collapsed in Bangkok. These incidents followed a long list of past tragedies, including the Erawan shrine bombing and Phuket’s deadly 2018 boat disaster, that dented confidence among Chinese holidaymakers.

The World Economic Forum’s 2024 Travel & Tourism Index saw Thailand’s safety ranking tumble to 102nd out of 117 countries. Confidence in Thai police and walking alone at night is also plummeting.

According to a recent Dragon Trail International survey, Chinese travellers’ perception of Thai safety dropped from 26% in late 2024 to just 19% by April 2025.

“If Thailand doesn’t address these chronic issues,” warned Yuthasak, “we won’t return to our tourism peak.”

Replacing Chinese spenders isn’t easy. Malaysia surged to Thailand’s No.1 source market in early 2025, but Malaysian tourists spend significantly less.

A Chinese visitor spends an average of 42,428 baht over 7.35 days, while Malaysians fork out just 21,450 baht over 4.17 days.

“Losing one Chinese tourist means you need to bring in two Malaysians just to make up the shortfall,” said Yuthasak. “And Malaysia’s entire population is only 35 million, compared to China’s 1.4 billion.”

The short-term fix? Focus on European travellers, who spend twice as much per head, a tactic that helped Phuket enjoy sky-high hotel rates in the last high season.

But the boom didn’t last. According to Suksit Suvunditkul, head of the Thai Hotels Association’s southern chapter, Phuket’s low season has been far quieter than previous years.

June occupancy dropped to 59%, down from 72% the year before. Average room rates also dipped to 2,394 baht, lower than in 2023 and 2024.

“Only hotels attracting Indian and Middle Eastern markets are doing well right now,” he said.

Once seen as a bargain paradise, Thailand is rapidly losing its budget appeal. The country’s cost competitiveness ranking slipped to 48th this year, down three places, and the soaring price of living is putting off thrifty travellers.

The rise of Qióngyóu, budget-friendly travel among Chinese millennials, has seen price-sensitive tourists seek better value elsewhere, Bangkok Post reported.

Yuthasak believes it’s time to flip the model.

“We must move from ‘More for Less’ to ‘Less for More,’ focus on fewer, better-paying tourists and maximise economic impact.”

Thailand has proven resilient in past crises, from tsunamis to political unrest, but experts say this one feels different.

“We’ve lost the ability to adapt,” Yuthasak said. “Without regaining trust, improving safety and offering better value, we won’t hit 40 million again anytime soon.”

The path to tourism recovery may now lie not in chasing numbers, but in overhauling the industry’s very foundations, turning Thailand from a cheap getaway into a quality destination where experience, safety and service come at a fair price.

And with regional rivals storming ahead, the clock is ticking.

“Thailand still has huge potential,” Yuthasak added. “But we can’t rest on past glories. It’s time to evolve, or be left behind.”

Latest Thailand News

Follow The Thaiger on Google News: