5 ways retirees in Thailand lose money (and how to stop it)

Simple fixes to help retirees in Thailand stay financially secure

Retiring in Thailand can be affordable and enjoyable, but many retirees lose money due to common mistakes. High living costs, scams, and unexpected expenses can quickly drain savings. There are five ways that retirees in Thailand can lose money and how to avoid them and with the right planning, retirees can protect their finances and enjoy a secure, worry-free life in Thailand.

5 ways retirees can lose money in Thailand

| Topic (Jump to section) | Description |

|---|---|

| Poor currency exchange practices | Bad currency exchange habits, like unfair rates and high ATM fees, can lead to significant losses for retirees in Thailand. |

| Overpaying for healthcare | Lack of proper insurance can result in expensive medical bills. It’s crucial to choose the right health insurance for coverage. |

| Investment scams and fraud | Investment scams promising high returns with low risk are a common threat. Verifying advisors and avoiding risky schemes is essential. |

| High cost of living in tourist areas | Living in popular tourist areas like Bangkok or Phuket can be expensive. Opting for less touristy locations can save money. |

| Lack of comprehensive coverage | Without comprehensive health insurance, retirees may face financial strain from medical bills. It’s crucial to have full coverage. |

1. Poor currency exchange practices

Many retirees in Thailand lose money due to bad currency exchange habits. The two biggest issues are unfair exchange rates and high ATM withdrawal fees. These can quickly eat into savings, but simple changes can help keep more money in your pocket.

The problem

- Unfair exchange rates: Banks and traditional money transfer services often offer lower rates than the market, taking a percentage of each transaction. Over time, this adds up to a big loss.

- High ATM fees: Using foreign cards at ATMs in Thailand comes with extra charges from both the Thai bank and the card issuer. Withdrawing small amounts often makes the fees even worse.

How to avoid it

- Use multi-currency accounts: There are services out there that offer better exchange rates and lower fees, helping retirees get more for their money. Multi-currency accounts also allow money to be held in different currencies without immediate conversion.

- Withdraw larger amounts less often: Instead of frequent small withdrawals, taking out a larger sum at once reduces the number of transactions and cuts down on fees.

- Get a bank account and use the appropriate ATMs: If you need to withdraw for daily life, you should have a bank account in Thailand for your savings. On top of that, you need to withdraw from the ATM that belongs to your bank to avoid paying fees (KBank ATMs for Kasikorn and Bangkok Bank ATMs for Bangkok Bank for example).

Following these steps, retirees in Thailand can manage their money smarter and avoid unnecessary losses.

2. Overpaying for healthcare

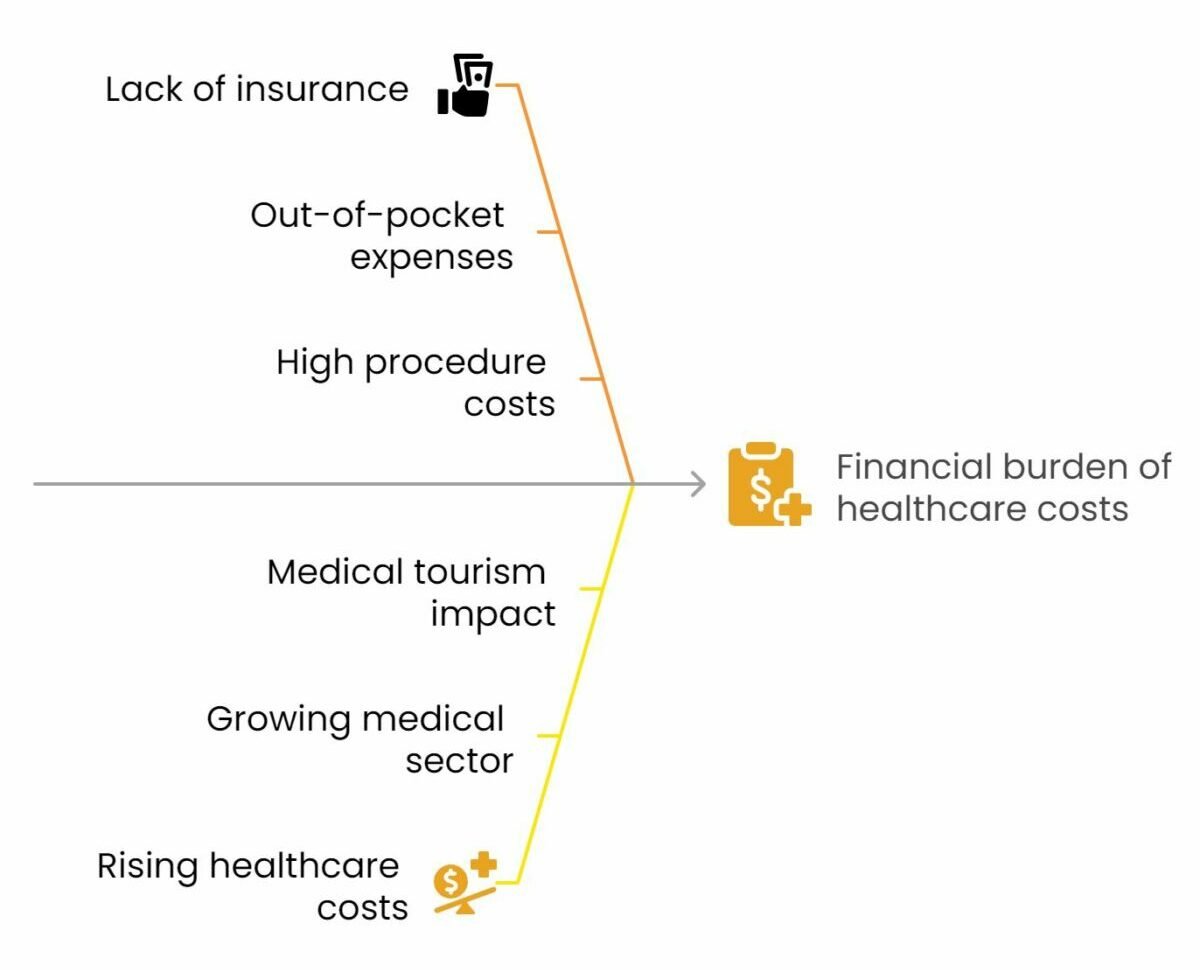

Many retirees in Thailand struggle with high medical costs, especially if they don’t have proper health insurance. Without coverage, even routine treatments can become expensive, and major procedures can be a serious financial burden. Simple steps can help retirees manage healthcare costs and avoid unnecessary expenses.

The problem

- Lack of proper insurance: Without health insurance, retirees must pay out of pocket for medical care. While private hospitals in Thailand offer high-quality treatment at lower prices than in Western countries, major procedures can still be costly, sometimes reaching up to 1.3 million Thai baht (about US$42,000).

- Increasing healthcare costs: Thailand’s growing medical sector and the popularity of medical tourism mean that healthcare prices will likely rise over time. Without insurance, these costs can quickly add up.

How to avoid it

- Choose a reputable health insurance provider: Companies like Cigna offer health insurance plans that cover unexpected medical expenses. A good policy should include inpatient and outpatient care and extras like dental or optical coverage.

- Compare policies: Insurance plans vary in price and coverage. If you plan to travel, it’s important to check coverage limits, deductibles, and whether the plan includes international coverage.

- Ensure compliance with visa requirements: Retirement visas in Thailand require health insurance with at least 400,000 Thai baht for inpatient care and 40,000 Thai baht for outpatient care per year. Make sure your policy meets these minimums to avoid visa issues.

With the right health insurance and proper planning, retirees in Thailand can protect their savings and enjoy retirement without the stress of medical bills.

3. Investment scams and fraud

Many retirees in Thailand fall victim to investment scams that promise high returns with little risk. These scams often include Ponzi schemes, cryptocurrency fraud, and unlicensed financial advisors, leading to serious financial losses.

The problem

- Lack of verification: Some retirees do not check if financial advisors or investments are legitimate, making them easy targets.

- Too-good-to-be-true schemes: Scammers promise high profits with no risk, which is a clear sign of fraud.

How to avoid it

- Verify financial advisors and investments

- Check if financial advisors or investment firms are registered with Thai regulators.

- Use official sources like the Bank of Thailand’s license verification system to confirm legitimacy.

- Avoid high-risk schemes

- Be wary of investments offering unusually high returns with no risk.

- Remember, real investments always carry some level of risk—guaranteed profits are a red flag.

By staying cautious and verifying financial opportunities, retirees can protect their savings and avoid falling for scams in Thailand.

4. High cost of living in tourist areas

Living in tourist hotspots like Bangkok or Phuket can be expensive. These areas attract visitors, leading to higher prices for rent, food, and services. While Thailand is generally affordable, retirees in tourist areas may struggle with higher costs.

The problem

- Higher accommodation costs: Rent in tourist areas is expensive. A one-bedroom apartment in central Bangkok or Phuket costs 15,000 Thai baht to 25,000 Thai baht per month, while less touristy areas offer cheaper options.

- Increased food and entertainment prices: Restaurants and bars in tourist zones charge more. A mid-range meal for two in Bangkok can cost 1,200 Thai baht to 2,000 Thai baht. Luxury goods and imported products also have high taxes.

- Higher demand for services: Transport, utilities, and other services cost more in high-traffic areas due to demand.

How to avoid it

- Consider less touristy locations: choose cities like Chiang Rai or Nakhon Ratchasima, where rent and daily expenses are much lower while still offering cultural experiences and natural beauty.

- Track expenses and set a budget: Monitor housing, food, and transport costs to identify ways to save and stay within a reasonable budget.

- Use cost-effective services: Better to use public transport, energy-efficient utilities, and local service providers as often as you can to reduce daily expenses.

By choosing the right location and managing expenses, retirees can enjoy life in Thailand without the high costs of tourist areas.

5. Lack of comprehensive health coverage

Without proper health insurance, retirees in Thailand may face high medical costs, especially for chronic illnesses, emergencies, or long-term care. While healthcare in Thailand is affordable compared to Western countries, major treatments can still be expensive.

Sometimes if the occasion occurs, you might find that your ailment is not covered by health insurance as well so make sure to read up on the conditions.

The problem

- High medical bills without insurance: Private hospitals offer excellent care but can be costly. Major procedures can reach 1.3 million Thai baht.

- Rising healthcare costs: Thailand’s growing medical tourism industry has led to increasing prices, making healthcare more expensive over time.

How to stop it

- Opt for international health insurance

- Choose reputable providers like Cigna that offer comprehensive coverage for retirees.

- Look for plans that cover inpatient and outpatient care, chronic conditions, and optional benefits like dental or optical care.

- Regularly review and update policies

- Make sure your insurance meets your current and future healthcare needs.

- If you travel often, consider a plan that includes international coverage.

- Meet visa requirements

- Retirement visas require at least 400,000 Thai baht for inpatient care and 40,000 Thai baht for outpatient care per year.

- Ensure your policy meets these requirements to avoid visa issues.

By choosing the right insurance and keeping policies up to date, retirees can protect their savings and access quality healthcare without financial stress.

Retiring in Thailand can be affordable, but many retirees lose money due to bad exchange rates, high medical costs, scams, expensive tourist areas, and no health insurance. Using better currency exchange services, choosing the right insurance, and avoiding risky investments can help protect savings.

Furthermore, living in cheaper areas, tracking spending, and using public transport also keep costs low. Health insurance is essential since medical care can be expensive so it is important to fully grasp the cost of Thai health insurance.

Latest Thailand News

Follow The Thaiger on Google News: