Branded residences gain ground in Asia’s Property Market with Thailand taking the lead

Blending high-end real estate with the services and credibility of globally recognised brands, branded residences are increasingly appealing to discerning buyers, and Thailand is at the centre of the action.

A quiet transformation has been shaping Asia’s residential landscape for over a decade: the rise of branded residences. Once a niche offering, this category has grown into a significant segment of the region’s property market. Blending high-end real estate with the services and credibility of globally recognised brands, branded residences are increasingly appealing to discerning buyers, and Thailand is at the centre of the action.

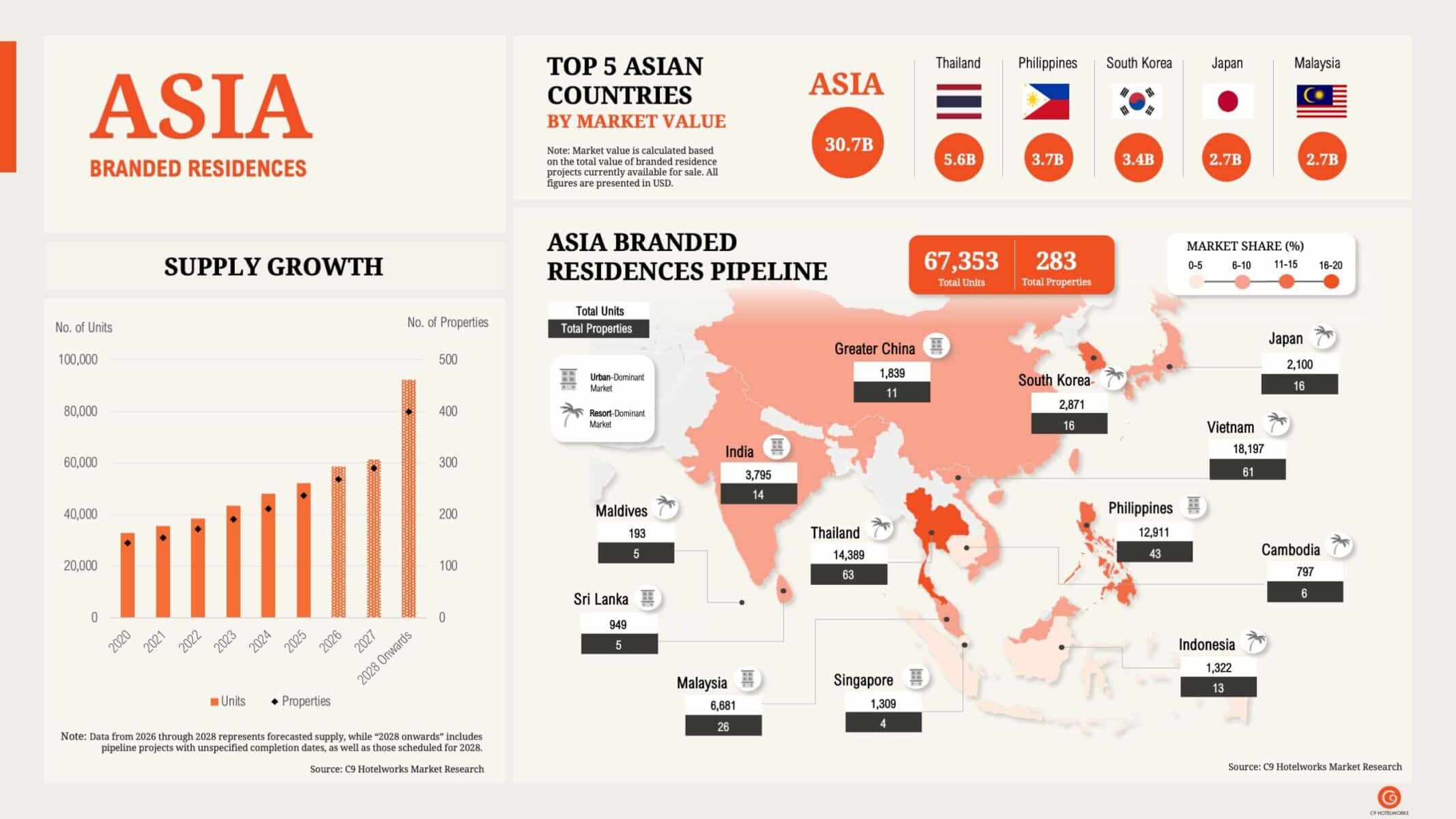

According to the C9 Hotelworks Asia Branded Residences Market Review 2025, the total value of branded residences currently for sale in Asia has reached USD30.7 billion, comprising 38,893 units in 178 developments. Thailand leads the region, accounting for 18% of the active pipeline, followed by the Philippines and South Korea.

What are branded residences?

Branded residences are residential properties developed in collaboration with hotel or lifestyle brands. These homes combine prestige branding, hospitality-level services, and often, access to resort-style amenities. Owners benefit from features such as concierge, housekeeping, spa and wellness facilities—and in many resort areas, the option to join a managed rental program.

This blend of lifestyle and convenience has made branded residences a popular choice for buyers seeking second homes, investment properties, or luxury primary residences with added services.

Thailand’s position in the market

Thailand has emerged as a regional leader in branded residences due to its strong tourism appeal, lifestyle offerings, and maturing infrastructure. The country’s current pipeline features over 14,000 units across 63 projects. Resort destinations dominate, with Phuket, Pattaya, and Hua Hin accounting for the majority of developments. These areas attract both international and domestic buyers seeking leisure properties that can also serve as income-generating assets.

Bangkok remains the leading urban market, with more than 4,500 units in the pipeline. Many of these are positioned in the upscale and luxury segments. As land values rise in core areas, developers are increasingly eyeing secondary cities such as Khao Yai and Rayong for future projects—an indicator of both market depth and growing consumer interest beyond traditional hotspots.

Shifting preferences

Urban buyers typically favour larger configurations such as three- and four-bedroom units, often intended for personal use. In contrast, resort projects focus on smaller units, which are more compatible with short-term rental programs. The flexibility to use a branded residence part-time while generating rental income is a major draw, especially in leisure destinations.

What distinguishes branded residences from conventional real estate is the integration of lifestyle. From internationally designed interiors to curated services and facilities, these properties are positioned as turnkey solutions for elevated living. For many buyers, the brand name delivers not only consistency and peace of mind but also long-term value and liquidity.

Brands and market dynamics

As highlighted in the C9 Hotelworks report, luxury-branded properties account for the largest share of the market at 32%, followed closely by upscale and upper-upscale segments. Many projects are co-located with hotels (57%), although standalone and mixed-use branded residences are on the rise.

While hotel groups continue to dominate the space, there is a noticeable entry of non-hospitality names, ranging from automotive to fashion and wellness brands. As of mid-2025, over 2,700 units in Asia are affiliated with such non-hotel brands. This reflects a broader trend where brand recognition and lifestyle alignment increasingly influence buyer decisions.

Outlook: Evolving, not emerging

Unlike emerging trends, branded residences have established their footing in Asia. What’s changing now is the scale and diversity of offerings. Vietnam, the Philippines, and Malaysia are seeing accelerating pipelines, but Thailand’s mix of established tourism, lifestyle-driven development, and investor demand keeps it ahead.

As more buyers seek homes that offer a blend of comfort, service, and asset value, branded residences are set to remain a mainstay of the region’s property sector. For real estate buyers looking at Thailand, the market presents a range of opportunities—whether for leisure, living, or long-term investment—rooted in brand trust and lifestyle appeal.

Latest Thailand News

Follow The Thaiger on Google News: