Asia-Pacific markets to gain from US-Europe supply chain diversification

Asia-Pacific emerging markets are predicted to gain from the ongoing supply chain decoupling, as analysts highlight the US and Europe’s efforts to diversify risks in security-related sectors.

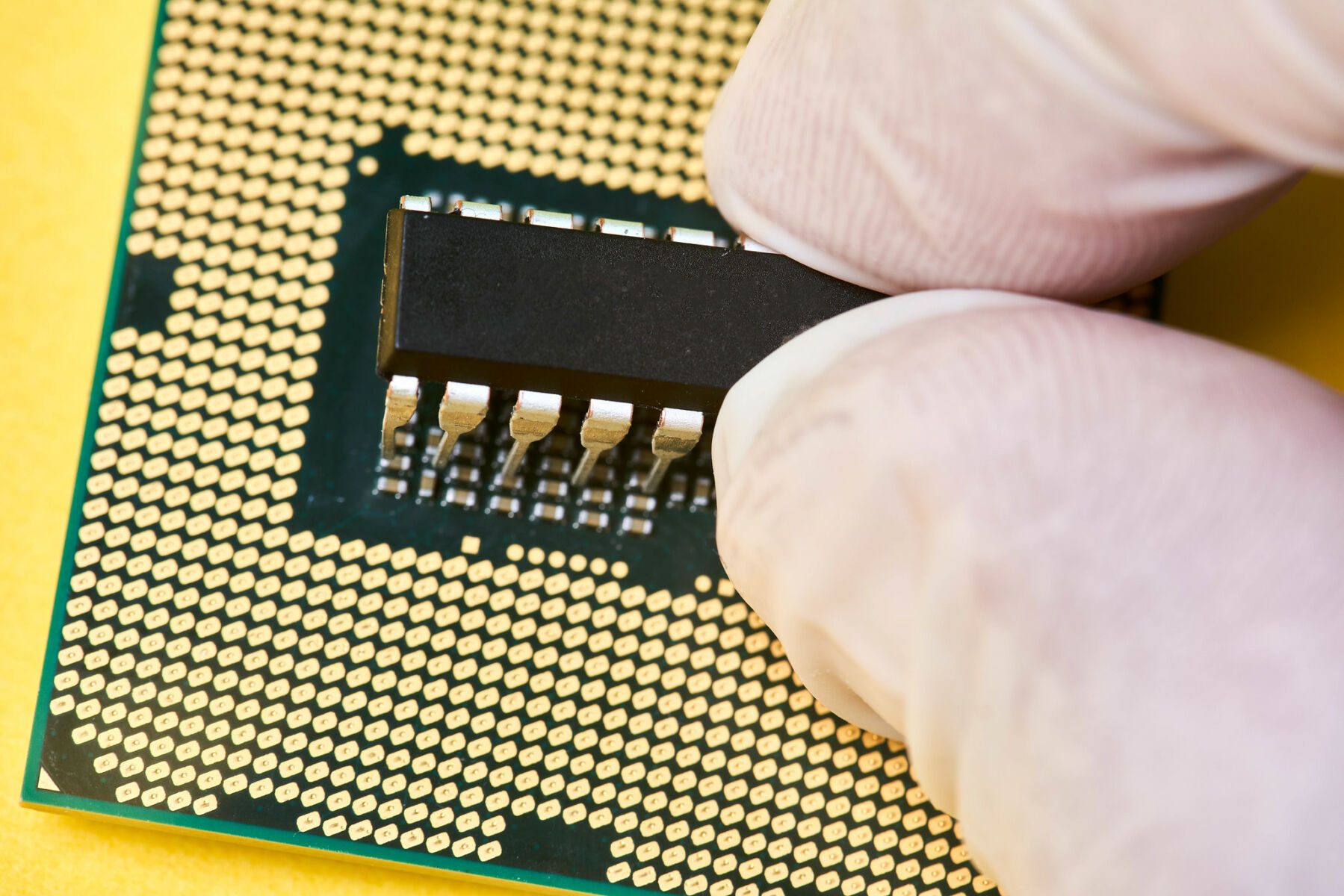

Steven Cochrane, Moody’s Analytics chief Asia-Pacific economist, recently discussed the decoupling between the US and China within intermediate goods production during an online event. He explained that incentives, rather than government policies, are driving the development of the semiconductor industry domestically in the US and Europe.

Cochrane believes that the Asia-Pacific economy, particularly India and Southeast Asia, can capitalise on this de-risking or “China plus one” sentiment, due to their vast labour market resources.

Moody’s Analytics data reveals that electronics exports from Southeast Asia and Taiwan have been in decline since late 2022, with significant contractions in Singapore and South Korea. The domestic electronics export rate fell below 20% in the first quarter of this year.

Denise Cheok, an economist at Moody’s Analytics, attributes this correction to high export prices peaking in 2021 and 2022, as well as a slowdown in major economies such as China, the US, and the EU, which are significant drivers of demand for electronic products.

Cheok said…

“We are still looking for a bottom for this current downturn. We do not see the turnaround just yet, as it is expected to extend perhaps to the end of the year before demand slowly starts to pick up in 2024, where we forecast there will be a recovery in the global economy.”

Cheok emphasised that the medium and long-term prospects for the tech sector remain highly positive, with support coming from advancements in artificial intelligence, electric vehicles, and other technological developments.

Furthermore, Cochrane noted that as inflation gradually decreases, the overall outlook for many Asia-Pacific sectors is positive, leading to a slow recovery in demand for semiconductors. However, he warned that central bank policy remains the most significant risk, as extended high-interest rates or premature easing of monetary policy could result in market volatility, reported Bangkok Post.

Latest Thailand News

Follow The Thaiger on Google News: