The Thai Canal – cutting through the project’s hype

(Photo from mothership.sg)

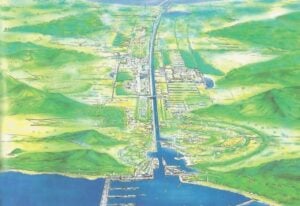

September 11, 2017 was the latest gathering of minds related to the challenges in establishing the much-discussed Kra Canal (now referred to as the Thai Canal) in Bangkok. The canal, if it happens, would slice a new shipping canal through the the slimmest section of the Malay Peninsula, anywhere from Chumpon to south of Phuket.

The Thai Canal Conference attracted an array of experts in their various fields including Chinese investors ready and willing to invest between USD $29-35 billion to construct this mega project which could become a ‘Legacy Project’ of the current NCPO Government.

(Graphic from wallstreetdaily.com)

Over the past 300 years much has been said and recorded about proceeding with the Kra Canal. Obvious concerns from Singapore and Malaysia has planted doubt and concerns in previous Thai administrations but with the recent developments of the Silk Road & Steel Belt rail routes, whereby containers once carried by ships from China to Europe and taking around 45 days, now has competition from the new rail links.

At the moment a single rail track is in operation but the Chinese are quick to announce that by 2020 some 7.5 million containers will be going by rail. Where does that leave the already under pressure shipping lines (all of which are showing operational losses globally)?

(Graphic Forbes.com/Drillinginfo)

To speed up the maritime transit times between China and Europe the shipping lines will be forced to evaluate ‘Off-Route’ Hub Ports such a Dubai (Jebel Ali) and attempt to stick to the most efficient routes (without diversions). The Thai Canal could greatly assist that process by shaving off up to 3 days in each direction.

But how to pay for it as an investment of USD$29-35 billion?. It’s no small sum of money and this may be what has scared off Thai Governments to support the project so far. Free Zone expert – Tony Restall (President & CEO of DSI Ltd) presented the case for the Thai Government to follow the investment example of Dubai (United Arab Emirates) which has witnessed phenomenal growth of its ports and free zones since its first free zone was established in 1985. In 2015 the Emirate of Dubai posted a ‘Free Trade throughput’ total figure in excess of USD $500 billion (*Source –Dubai Economic Department) with Jebel Ali Port and Free Zone posting USD $140 billion of that total.

To prove that a similar free zone regime would be successful in Thailand, Tony is challenging the current Thai administration to set up a pilot scheme using Phuket Port as the guinea pig. This is not new to Phuket as Tony proposed the establishment of a Free Trade Zone in 2004 following what he witnessed happening to the Phuket economy after the tsunami.

In 2006 he presented the case for a Free Trade Zone in Phuket to the then Secretary General to the Thai PM, General Pongthep Tesprateep, who in turn endorsed and supported the submission. Tony Restall even brought Middle East investors from the UAE as well as Qatar to Phuket who were ready to commit the investment into Phuket. The coup of 2006 put everything on hold and investors took a step back as the investment risk into Thailand was increased.

Phuket Port still sleeps having lost its annual 32,000 Containers per year trade and the consortium proposed by Restall were ready to construct a new quay extension, passenger jetty and international ocean terminal. “Everything is back on the table if we can seek the support of the Thai Government and Phuket Administration to utilise Phuket Port as the trial facility that will ultimately create between 5-6 Million new jobs in the Thai Canal corridor and contribute significantly to the GDP of Thailand”, says Tony.

“Sure, we can bring in foreign investment to develop Phuket Port and establish a Free Zone Phase 1 Trading Hub” says Restall but given the excellent return on investment he believes that there would be more than sufficient interest from local investors as well.

“Let’s use Phuket as the testing ground and this can then be replicated all over Thailand (Sea Ports, Airports and Border Crossings). Free Trade Zones shouldn’t be confused with SEZ – Special Economic Zones. Thailand’s Dawei Project was launched as an SEZ and hasn’t delivered as expected.

“Our plans are to introduce a weekly sea feeder service into Phuket Port linking up Singapore, Kuala Lumpur and Penang Ports and linkages to Myanmar ports to the north. The success of the UAE Free Zones is well recorded and has witnessed tremendous growth both inside and outside the Free Zone location.

“A Town Hall meeting in Phuket would provide the business community and local population with a unique insight to see the benefits associated with a successful Free Zone regime and professionally run Sea Port with Sea Feeder access to short sea routes.

“This is a win-win situation for all those involved”. Tony claims that one established (3-4 years) the Free Zone alone could easily contribute USD $2-3 billion into the economy of Phuket much as it has been proved in smaller Free Zones in the UAE.

Check out the Thai Canal Facebook Page

Send Tony an email tony.restall@freezonedev.com

Further reading from Forbes.com

Further reading from Mothership.sg

Latest Thailand News

Follow The Thaiger on Google News: