Unlocking the secrets of gold trading: Strategies and tips for success

Gold has captivated the world for centuries, and its enduring value makes it an attractive commodity to invest in. Trading gold comes with complexities, however – so understanding key strategies is essential if you want your investments to thrive.

We will provide you with 3 effective strategies for gold trading as well as helpful tips that everyone should note when trading.

Gold trading strategies

1. Day trading strategy

Day trading gold is a popular gold trading strategy for smart traders looking to maximise their returns in the short term. It requires knowledge of the market, access to substantial capital, and an ability to capitalise on fleeting price movements that can yield tremendous profits – all within one single session.

2. News trading strategy

News trading can be a great way to take advantage of large price swings when key economic news is released. Gold traders use this technique, but they must also consider the possible risks that come with it. Prices could rise or crash unpredictably in any direction based on what’s announced. Thus, successful trades rely upon having an understanding of the market and being quick to react. Plus staying updated on all relevant headlines so you know how best to respond as soon as new information breaks.

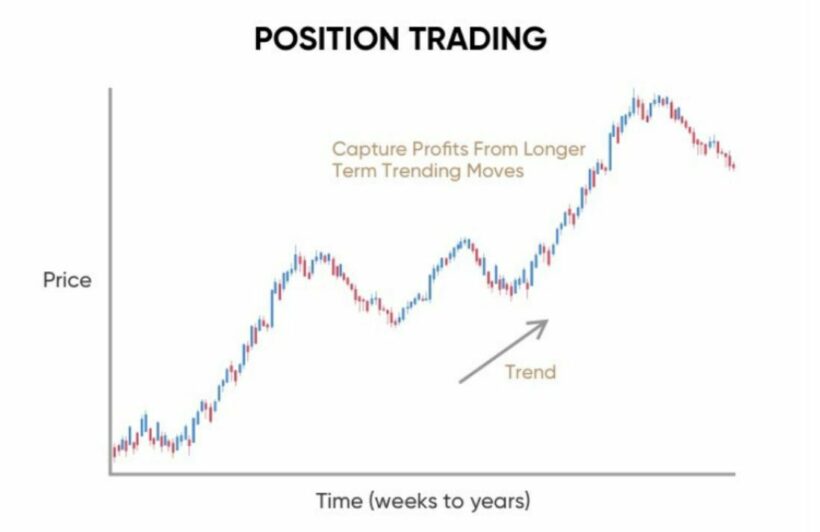

3. Position trading strategy

Position trading is a great way for traders to maximise their profits by holding onto profitable positions over extended periods. To be successful in the gold market, staying informed of company news and global economic trends is key. Smart traders who stay ahead of changes can capitalise on favorable currency prices.

Gold Trading Tips

1. Pay Attention to Risk Management

Gold trading, like any investment, carries inherent risks, and implementing proper risk management strategies is crucial for long-term success. Set realistic profit targets and stop-loss levels to limit potential losses. Reduce your exposure to a single asset by diversifying your portfolio. Additionally, consider using risk management tools such as trailing stops or options contracts to protect your investments.

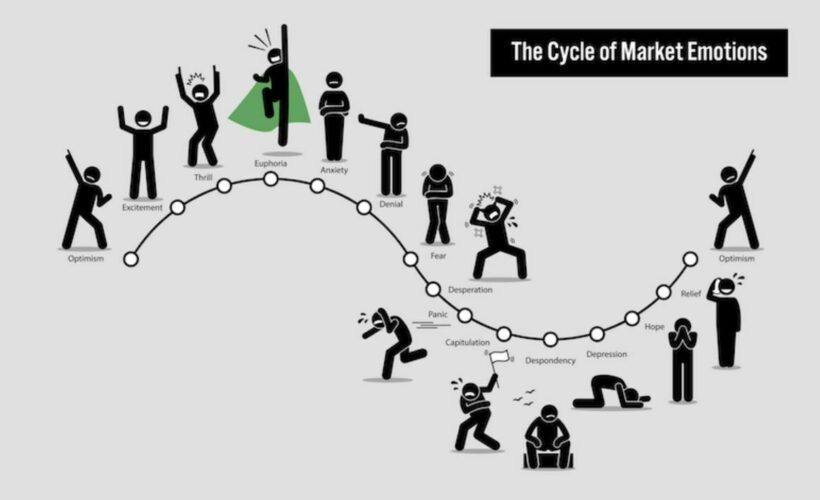

2. Keep an Eye on Market Sentiment

Market sentiment refers to the overall mood and outlook of traders and investors. Monitor market sentiment indicators such as the Commitment of Traders (COT) report, investor surveys, and media sentiment. Understanding market sentiment can provide valuable insights into the behavior of market participants and help you make more informed trading decisions.

3. Choose the Right Trading Platform and Broker

Selecting a reliable trading platform and broker is important for successful gold trading. Look for platforms that offer advanced charting tools, real-time data, and a user-friendly interface. Ensure that your chosen broker provides competitive spreads, low commissions, and fast order execution. Additionally, consider factors like customer support, security measures, and regulatory compliance when choosing a platform and broker.

Conclusion

Gold trading offers immense potential for profit, but it requires careful analysis, informed decision-making, and disciplined execution. By employing the strategies and tips we have outlined, you can unlock the secrets of gold trading and increase your chances of success. With dedication and perseverance, you can navigate the complexities of the gold market and achieve your trading goals.

Latest Thailand News

Follow The Thaiger on Google News: