Thai steel firms request BoI incentives for eco-project

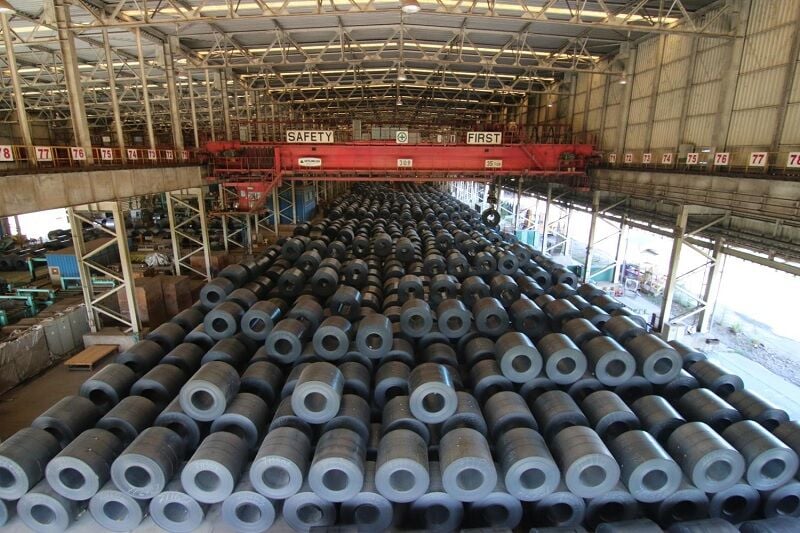

Thai steel manufacturers G Steel and GJ Steel are actively seeking investment incentives from the Board of Investment (BoI) to support a 4.5 billion baht development project. This initiative aims to tackle the challenges plaguing the local steel market while minimising carbon dioxide emissions.

The founder and honorary chairman of both companies, Somsak Leeswadtrakul, revealed that despite employing over 1,000 workers, their production capacity remains low. He attributes this to the influx of low-quality, inexpensive foreign steel flooding the Thai market.

“If the government addresses the dumping issue, our advanced steel plants, equipped with state-of-the-art machinery, can significantly ramp up production and replace a significant portion of imported steel.”

The BoI detailed that the new manufacturing development plan, spanning three years, focuses on enhancing the production processes for hot-rolled sheets. G Steel plans to utilise a 3-billion-baht budget to upgrade production technology at its Rayong plant, while GJ Steel will invest 1.5 billion baht to enhance machinery at its Chon Buri facility.

Both companies will also improve the management of raw materials produced from recycled steel to support their manufacturing processes. This will support the country’s circular economic development and the state’s efforts to achieve carbon neutrality, as noted by the BoI’s Secretary-General, Narit Therdsteerasukdi.

G Steel and GJ Steel are already leaders in eco-friendly steel manufacturing in Thailand, having implemented electric arc furnace (EAF) technology. This technology significantly reduces carbon dioxide emissions by resmelting scrap steel.

Steel recycling companies

Additionally, G Steel and GJ Steel are the largest steel recycling companies in Thailand. Both are subsidiaries of Japan’s Nippon Steel Corporation, the world’s fourth-largest steelmaker. Somsak believes that Nippon Steel’s involvement will enhance the efficiency and quality of the two factories, positioning them as leading steel producers in Southeast Asia.

“It is beneficial for both companies to have Nippon Steel as a partner but the issue of low-quality steel being dumped into the Thai market must be appropriately addressed.

“The government needs to take this matter seriously, as the steel industry is crucial for the country’s broader industrial sector. It has the potential to replace imports and save the nation hundreds of billions of baht in foreign exchange annually.”

Nippon Steel, which has been operating in Thailand for around 60 years, currently oversees more than 30 subsidiaries and employs 8,000 people. In 2022, it invested 40 billion baht in G Steel and GJ Steel to fortify its position in the local steel industry, which includes 180 steel manufacturers.

G Steel and GJ Steel are set to elevate steel production in Thailand, paving the way for low-carbon manufacturing, which is crucial for international trade, especially with the European Union as Narit added.

According to the BoI, Thailand has the highest steel consumption per capita in ASEAN, with an annual rate of 234 kilograms per person. Up to 60% of steel products are utilised in construction, followed by 20% in cars and car parts, 7% in electrical appliances and electronics, 5% in machinery, 5% in packaging, and 3% in other uses, reported Bangkok Post.

Latest Thailand News

Follow The Thaiger on Google News: