Elderly Thai farmer pleads for justice after losing land over friend’s unpaid car loan

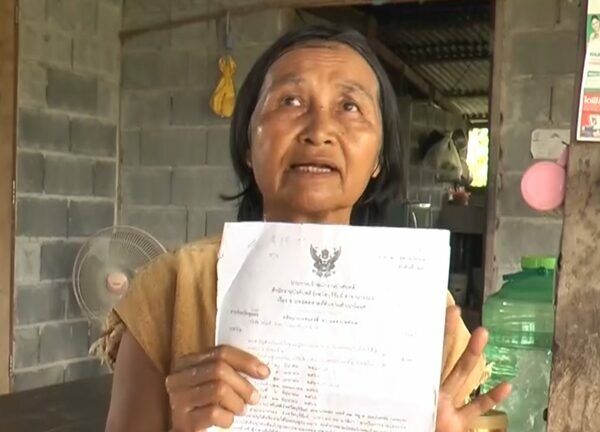

An elderly Buriram farmer today made an emotional plea for justice after being sued over a car loan she cosigned for her friend’s step-niece. Unfortunately, the dispute has escalated into her losing over nine acres of farmland and her adjoining garden property, rendering her both landless and without the means to earn a living.

Sixty-seven year old Sa-ngsop Namprai had helped her step-niece secure a down payment on a car worth over 700,000 baht (US$19,897) when she was working in Chumphon in 2018. Sa-ngsop knew the car would be used by the step-niece, who was also the monthly payer. Both women cosigned the loan along with the niece’s husband.

The situation took an unfortunate turn in 2019 when the friend died and the step-niece, who had been using the car, stopped making payments. The niece falsely believed that the insurance company would waive the car’s title to the deceased buyer. However, they didn’t, since the death was not due to an accident. The finance company then took back the car and sued the step-niece in Chumphon for eight months of default payments and other charges, adding up to 120,000 baht (US$3,409), reported KhaoSod.

Sa-ngsop was forced to pay the outstanding balance in monthly instalments of 3,000 baht (US$85), to protect her assets from being seized. Although she sometimes struggled to pay on time, she managed to clear most of the owed sum, leaving only around 30,000 baht (US$852) outstanding. Yet, she was shocked to discover a notice of auction for two of her land parcels, exceeding 11 acres in total, was already announced.

Adding to Sa-ngsop’s confusion, a contract of sale between the finance company and a buyer was initiated in April 2023, offering her 9-acre farmland for just 50,000 baht (US$1,421). She questioned the sale’s legitimacy, as she had failed to finalise the settlement of an outstanding Bank for Agriculture and Agricultural Cooperatives (BAAC) loan of approximately 580,000 baht (US$16,485). The debt was related to her husband’s initial loan using a land mortgage made previously.

To address this issue, Sa-ngsop’s two sons took separate BAAC loans of 300,000 baht (US$8,527) each, totalling 600,000 baht (US$17,054). They aimed to repay their father’s debt of 580,000 baht (US$16,490), but the bank did not return the land title deed to them after the debt was cleared. Instead, their farmland was auctioned for 50,000 baht, a disappointment given the buyer did not take responsibility for the attached debt. This was a condition implied in the sale of foreclosed land.

Sa-ngsop has called for a thorough investigation and legitimate justice from related agencies and the BAAC. She remains 600,000 baht in debt to the BAAC due to co-signing the car loan for others. The case has already been submitted to the Provincial Justice Office in Buriram.

Latest Thailand News

Follow The Thaiger on Google News: