Phuket Investor: The alternative gold rush

PHUKET: With all the economic strife the world has seen over the past 12 months, I feel as if I’ve turned into a portrayer of doom. So, I’m taking the doom gloves off and jumping on the feel good train, which seems to have hit the European markets this last couple of weeks.

I’m not saying that the problems have gone, far from it, but at least wheels have been put in motion that should stabilize the financial markets in the short term.

The Eurozone’s agreement to further prop up the banking system has given us a small respite from all too familiar financial ruin stories.

However, one thing has come to my attention. Even through all this economic turmoil there are still a few decent bets out there that could potentially turn out a satisfactory profit.

The meteoric rise of the price of Gold over the last few years has been nothing short of astounding – however a correction does seem to be underway. Even though the price of Gold has risen sharply, one area that hasn’t had the same turbo charged boost is the Gold mining companies. This now is beginning to look like a very attractive area for investment.

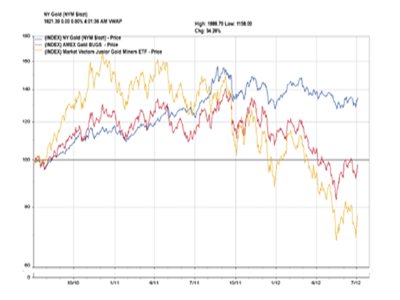

The graph on the right shows an example of how a selection of Gold mining companies have further lagged behind the physical gold price, and thus, this in itself provides an opportunity for significant rises.

Gold mining stocks have taken a real hammering recently and there are clearly some valid reasons why you should be cautious about gold companies. Many of the major mining companies made a stupid decision a few years ago to hedge their reserves, by selling gold futures (contracts to deliver a certain amount of gold in the future). This locked them out of rising prices.

Also, Asian demand for gold, one of the key drivers of the soaring price, could be hit if China makes it harder to buy gold, or India imposes a rumored tax on jewelery.

All this aside however, it would seem that since April, gold mining stocks, like other mining industry stocks, have underperformed the underlying metal.

In our view, this kind of under-performance is only partly explained by stock-specific issues and by a general trend towards higher industry costs. Despite rising industry costs, we have seen expanding margins in the gold industry, leading to significant improvements in return on equity for gold miners for the first time in many years.

There is an expected rebound in gold mining equities, as the gap between equities and the underlying metal has widened to unsustainable levels. Gold mining stocks are showing very attractive valuation fundamentals, with the market apparently ignoring current gold prices.

These attractive valuation fundamentals could herald an excellent buying opportunity in general. A potential near term re-rating of up to 20%, particularly for the larger gold players.

This is one area I’ll certainly be keeping a close eye on, and in my view could potentially be a wise choice in helping a flagging portfolio get back on track.

For any information relating to Gold mining stocks please contact Alyman@montpeliergroup.com. Anthony Lyman is a Senior Financial Consultant with the Montpelier Group.

— Anthony Lyman

Latest Thailand News

Follow The Thaiger on Google News: