Economist warns of panic as new Thai government risks fiscal sustainability

Concerns about fiscal sustainability have been raised by Kiatnakin Phatra Securities (KKP), as the new government‘s potential “addiction to budget deficits” may cause panic in the stock market.

KKP’s chief economist, Pipat Luengnaruemitchai, expressed his apprehensions regarding the country’s fiscal outlook if excessive expenditure is allocated by politicians and the government without a clear financing plan.

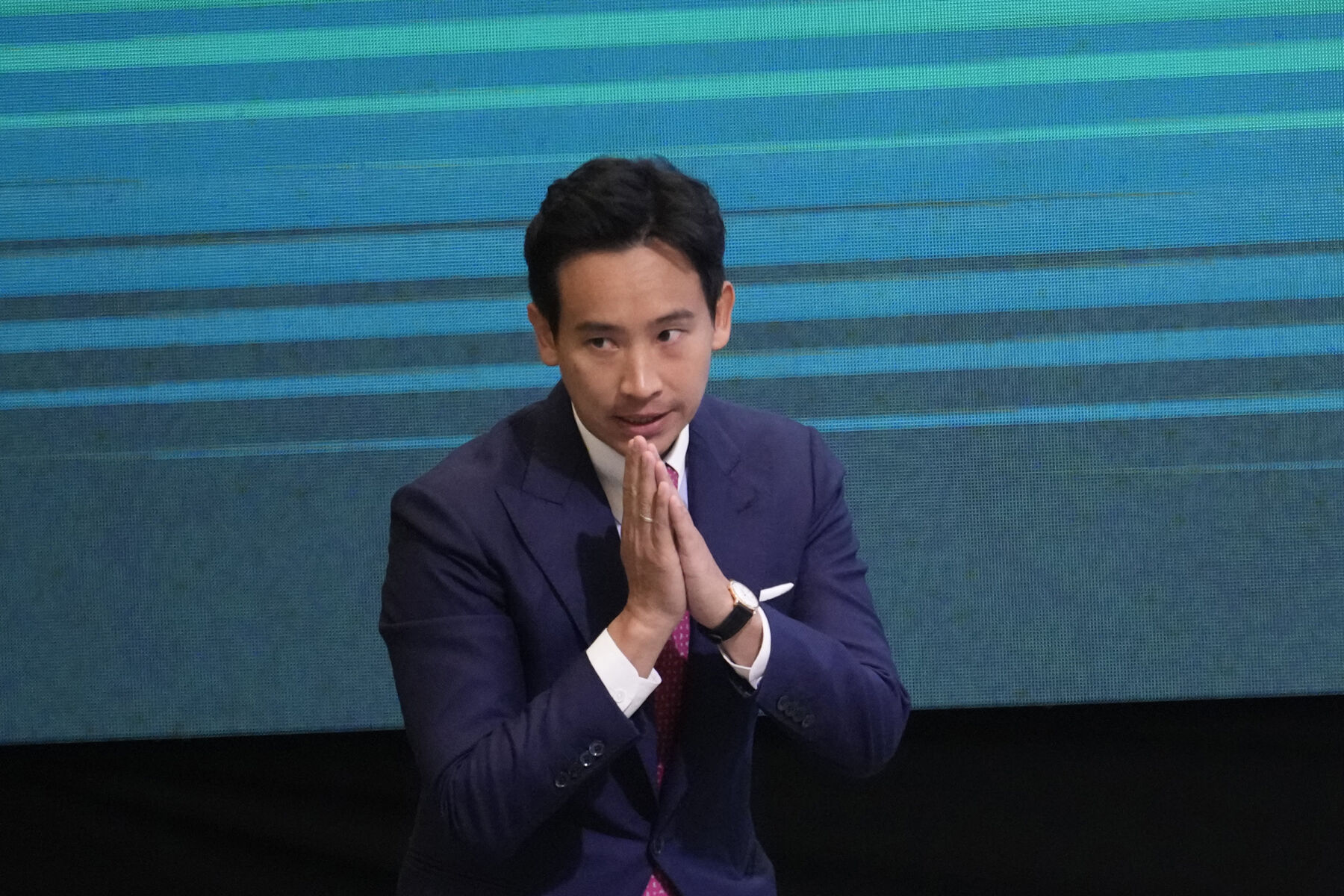

As Thailand prepares for a new government, political parties have proposed policies involving significant funding. The Move Forward Party (MFP), which intends to lead a coalition government, focuses its aid policies on education, children, disabled individuals, and retirees. These policies are estimated to require an additional 650 billion baht in spending.

Pipat questioned the source of this funding, as the MFP’s plan aims to reduce military spending and other budgets it considers unnecessarily high. The party also seeks to increase revenue through wealth and land taxes, as well as raising the corporate tax for large companies. According to the MFP, the combined effect of these cuts should decrease government expenses by 650 billion baht per year. Pipat said…

“If the plan works and the budget deficit does not increase, it will benefit the economy more than other economic stimulus.”

With Thailand’s changing demography and an increasing number of elderly people, more money is needed for the country’s welfare system, while the number of tax-paying individuals is declining. Pipat highlighted the importance of the public debt-to-GDP ratio as an indicator of interest.

“If the ratio is expected to increase uncontrollably, the market and investors will be concerned about the status of the government.”

Based on KKP’s pre-interest average fiscal deficit of approximately 2% to GDP, Thailand’s public debt-to-GDP ratio is projected to slowly rise from around 61% today to 68% in a decade. However, Pipat warned that if Thailand experiences a higher budget deficit as interest rates increase, public debt could spike more sharply and become increasingly challenging to reduce, reported Bangkok Post.

“Although the current state of public debt is not much of a concern in the short term, we are in a state of distrust, and with the increasing fiscal burden from the demographic structure, slower economic growth and the need for other expenses, we could be at a critical point where the country’s fiscal position could become a constraint.”

Latest Thailand News

Follow The Thaiger on Google News: