Potential homeowners need to show some financial frugality this year, says Bangkok property platform

One of Bangkok‘s largest property platforms is urging potential homeowners to show some financial frugality this year if they’re planning to invest in the real estate market.

DDproperty.com pointed out that property prices and interest rates are rising and warned buyers to show some due diligence.

DDproperty.com General Manager Wittaya Apirakviriya reckons residential prices will increase by 5-10%, in line with higher interest rates and rising development costs.

“Costs are rising, driven by inflation, higher minimum wages, fuel prices and construction materials.

“This year the new land appraisal prices will be applied, which will have a direct impact on expenses from property transactions.”

Naporn Sunthornchitcharoen, the executive committee chairman at Land & Houses Plc, stated that land prices have consistently increased by an annual rate of approximately 5%, reported Bangkok Post.

“With these rising costs, home prices this year will increase by 5%. As there has been a labour shortage since last year, we added a number of prefab contractors to support our business in 2023.

“Homebuyers now pay higher monthly instalments for longer because of rising interest rates. They should consider their financial liquidity and exercise financial discipline before making a decision.

“The market is likely to be sluggish this year as property incentives ended last year, including the easing of the loan-to-value limit and a cut of transfer and mortgage fees to 0.01% from 2% and 1%, respectively.”

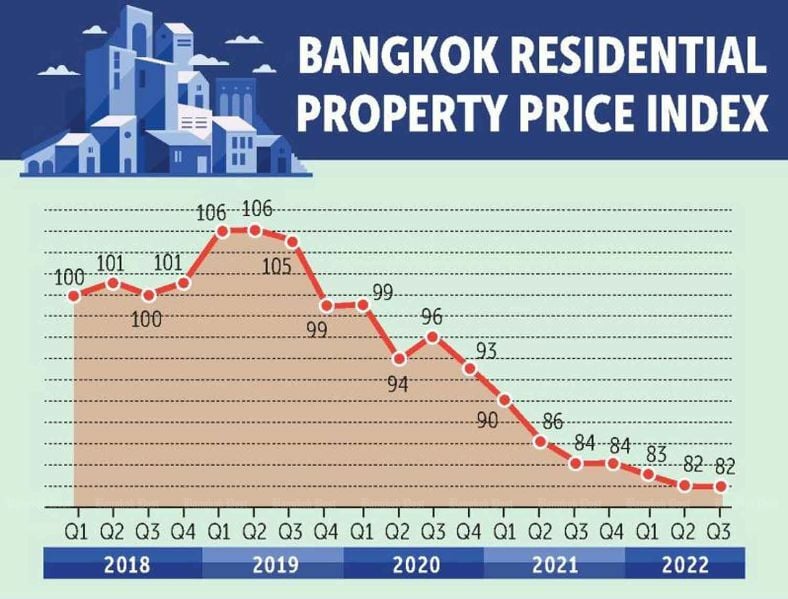

DDproperty said the residential price index in Bangkok saw a 1% increase in the third quarter of 2022, compared to the second quarter of 2022, however, it decreased by 3% when compared to the third quarter in 2021 and dropped 22% from 2019.

The only housing category that recorded a rise in the price index was single detached houses, showing a 6% increase year-on-year and 18% compared to the pre-pandemic period.

The townhouse price index saw a decrease of 2% year-on-year, and also dropped 3% compared to the pre-Covid period. On the other hand, the condo price index remained unchanged YoY but contracted by 16% when compared to the pre-pandemic period.

Neighbourhoods with the largest increase in the price index were primarily located outside of the central business district in Bangkok’s outskirts, such as Thawi Watthana and Taling Chan, which saw a YoY increase of 16% attributed to the Red Line mass transit.

Huai Khwang also recorded a 7% increase for the period, and areas such as Din Daeng, Nong Chok, Nong Khaem and Phra Khanong saw a 6% increase.

The rent index for low-rise houses in the third quarter last year increased, with single detached houses showing a YoY increase of 11% and 41% from the pre-pandemic period.

Townhouses also saw a rise in the rent index of 8% YoY and 11% from the pre-pandemic period, while condos rent index dropped 1% YoY and decreased 13% from the pre-pandemic period.

Areas with rising rents were primarily located along Bangkok mass transit lines and in proximity to job sources, such as Saphan Sung and Laksi, which experienced a YoY increase of 11%. They were followed by Klong Sam Wa and Bang Khen at 10%, Don Muang at 9%, and Lat Phrao and Min Buri at 8%.

Latest Thailand News

Follow The Thaiger on Google News: