Trump’s 36% tax on Thailand: Impact on exports & survival tips

Analysis is based on information as of April 2, 2025

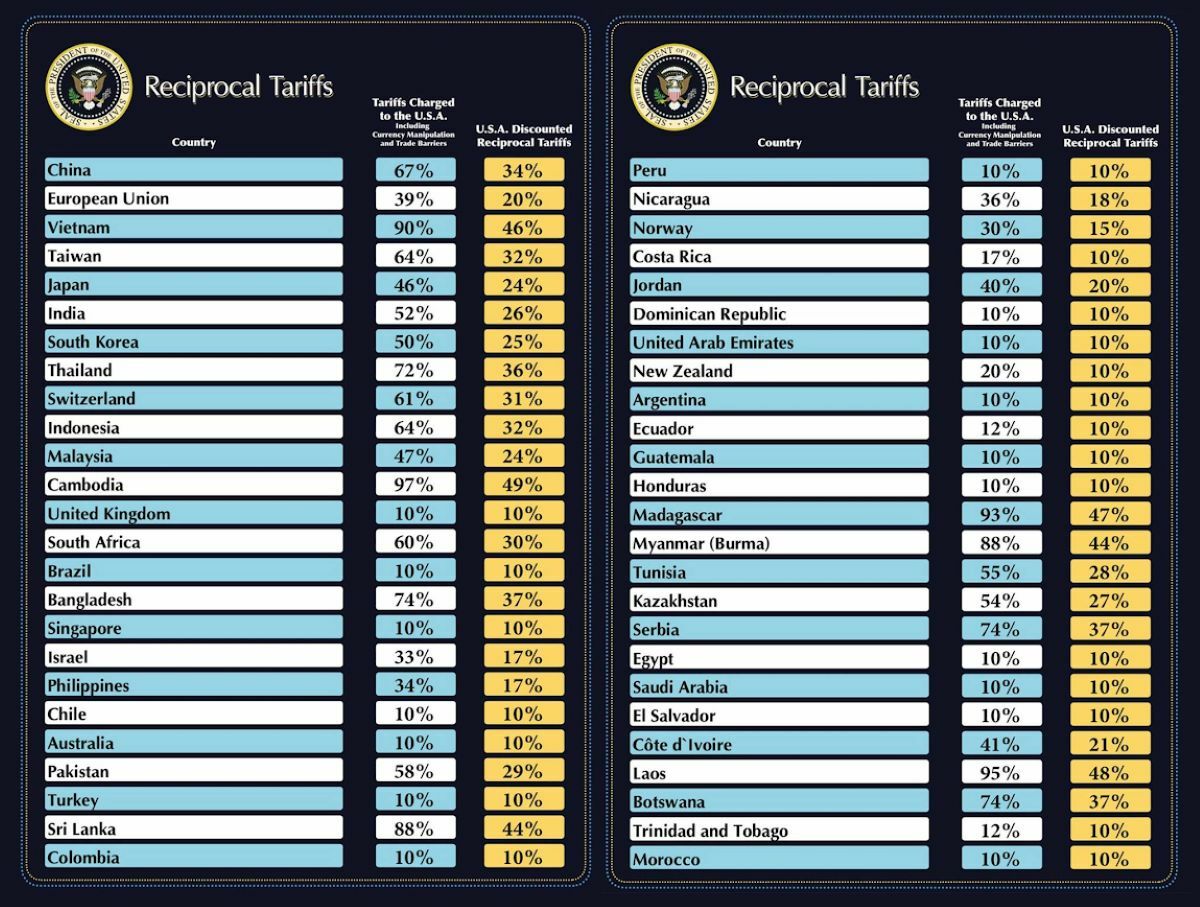

The America First policy under President Donald Trump has sent shockwaves through the global economy once again. This follows the announcement of a baseline tariff of 10% on imports from all countries, along with a reciprocal tariff aimed at countries with which the US has a large trade deficit. With this, Thailand has been hit with a 36% tax from Trump’s new policy which will affect the Kingdom.

An important question that economists and policymakers around the world are pondering is: What are the underlying reasons for this tough decision? How will Thailand, which is facing a 36% tax wall, be affected, and what should we prepare for?

Reason behind Trump’s tough worldwide tax increase

The core of Trump’s policy is his belief that trade deficits are detrimental, like the US being “robbed” of its wealth by trading partners. Therefore, imposing tariffs is seen as the most effective tool to counter this by making imports more expensive, thus reducing their attractiveness to American consumers and producers.

This, in turn, is intended to encourage the purchase of domestically-produced goods, thereby reducing the trade deficit and stimulating employment in the US industrial sector with a promise to bring America’s industry back.

This policy aligns with Trump’s key support base, aiming to invigorate domestic politics, particularly among industrial workers who have been affected by the relocation of production to other countries and competition from cheaper imported goods.

By taking a tough stance against trade partners and protecting domestic industries, Trump is fulfilling a promise made to his supporters and creating satisfaction within this group.

Trump sees tariffs as a powerful negotiation tool to force trade partners to adjust their policies, such as reducing tariffs on US goods or opening up markets to American goods and services. While the announced tariff rates are calculated at half of what those countries charge the US, the strategy is more about interpretation than precise calculations.

Trump is openly dissatisfied with the multilateral trading system under the World Trade Organization (WTO), believing it is outdated and puts the US at a disadvantage. However, most mainstream economists argue that this approach is risky, and the disadvantages may outweigh the benefits.

Increasing tariffs not only raise prices for American consumers but also negatively affect US manufacturers who rely on imported materials or components, increasing their costs and reducing their competitiveness.

Additionally, there is a high risk of retaliatory trade measures from other countries, which could further damage both the global economy and the US economy. However, Trump warns that any retaliation should be avoided.

In 2023, Thailand’s top 5 exports to the United States:

- Electrical and Electronic Equipment: US$16.59 billion

- Machinery and Parts: US$10.32 billion

- Rubber and Rubber Products: US$4.62 billion

- Vehicles and Parts: US$2.60 billion

- Jewellery and Precious Metals: US$1.70 billion

Impact on Thailand when facing a 36% tax wall

Thailand’s inclusion in the group facing a high tariff rate is a very concerning situation. It will have broad effects, especially on the export sector. The US is one of Thailand’s major export markets.

Many Thai products, such as electronic parts, automotive products and parts, processed foods, clothing, and rubber products, will immediately lose their price competitiveness when compared to products manufactured in the US or from countries with lower tariffs.

What else would happen under Trump’s Tax in Thailand is that Thai exporters will face difficulties in maintaining their market share and may have to cut production or, in severe cases, close businesses if they cannot bear the additional costs or find new markets in time.

Many Thai industries are part of the global supply chain, and the tariff increase could disrupt or change the supply chain routes. Multinational companies may reconsider investments or purchases from Thailand if they view the trade policy risks as too high.

The decrease in exports will directly impact foreign currency earnings, leading to a worsened trade and current account balance in Thailand, which could put pressure on the Thai baht to depreciate.

The uncertainty of US trade policy and its impact on exports from Thailand to the US may cause foreign investors to delay investment decisions or even consider relocating production to countries with less trade policy risk.

A contraction in the export sector and related industries will affect domestic employment and purchasing power, which will slow down the growth of Thailand’s Gross Domestic Product (GDP).

Thailand’s strategy: How to seek new opportunities within Trump’s Tax policy

- Bilateral negotiations and diplomacy: The Thai government will have to use diplomatic channels at all levels to directly negotiate with the US, presenting facts and information about trade structures, investments, and strategic relationships between the two countries, to secure tariff reductions or exemptions for certain product categories or seek clarity on the calculation of reciprocal tariffs.

- Collaborate with ASEAN and affected countries: Thailand would work with ASEAN countries and others affected by the tariffs to form a joint bargaining position. The WTO mechanism could also be considered to address concerns about non-compliance with global trade rules, though its effectiveness may be limited in an era where the US may not prioritise the WTO.

- Expand into new markets: Thai exporters will probably accelerate their efforts to explore new, promising markets or expand existing markets beyond the U.S., such as China, ASEAN, the EU, India, the Middle East, and Africa. Having diverse markets will help mitigate risks from reliance on one market.

- Improve products and services: Enhance competitiveness by investing in Research & Development (R&D) to create innovations, improve product quality, and add value to goods that can be demanded in the global market, reducing reliance on price-based competition.

- Adopt technology and automation: The use of technology and automation will be encouraged to reduce costs and increase productivity.

- Fiscal and monetary policies: Fiscal and monetary policies will have to be used to stimulate domestic consumption and investment to compensate for the loss of foreign demand, such as investing in infrastructure projects or promoting domestic tourism.

- Targeted assistance for industries and SMEs: Provide targeted assistance to industries and SMEs heavily impacted by the tariffs, such as offering low-interest loans, debt moratoriums, support for business transformation, and workforce development programmes (Reskill/Upskill) to adapt to industrial changes.

- The Bank of Thailand must closely monitor the exchange rate and manage volatility without being seen as intervening for competitive advantage.

Though Trump’s tariff wall is like a new storm hitting the global trade system, this protectionist and economic nationalism approach challenges free trade principles and creates uncertainty for all countries. Facing a 36% tax in Thailand from Trump is a tough challenge, but there are always opportunities in times of crisis, so we will see what development comes out of this.

Opinion

Latest Thailand News

Follow The Thaiger on Google News: