Expat moms-to-be: Navigating maternity insurance plans in Thailand

A key guide to Thailand's healthcare system for expat mothers

Expecting a baby while living abroad can be exciting and a little overwhelming, especially for expat moms-to-be in Thailand. Maternity insurance is important because it helps cover the high costs of private hospital care and gives you peace of mind during pregnancy and childbirth.

Many expats find it tricky to understand the different insurance plans, waiting periods, what is covered and what isn’t. Questions often arise about when to buy a plan, what benefits to expect, and how to avoid surprise bills.

This guide will help you understand why maternity insurance is essential in Thailand and answer common questions to help you plan for a safe, healthy pregnancy without stress.

Common questions about maternity health insurance plans

| Topic (Jump to section) | Key Points |

|---|---|

| Why does it matter? | Maternity insurance is essential for expats in Thailand to cover the high costs of private hospital births and mitigate financial risks. |

| What to look for? | Look for maternity insurance that covers all stages of pregnancy, while providing access to international hospitals. |

| Common maternity insurance options | Local plans are limited to Thailand. International plans offer broader coverage, including care abroad and more hospital choices. |

| Tips for choosing the right insurance | Expat mothers in Thailand can choose from international, local Thai, or standalone maternity insurance plans, each offering varying coverage. |

| How can Pacific Prime help? | Pacific Prime Thailand helps expat mothers secure maternity insurance, offering tailored advice, plan comparisons, and support for claims and hospital access. |

Why maternity insurance matters for expats

Maternity insurance is very important for expat moms in Thailand because giving birth in private hospitals can be expensive. A normal delivery usually costs around 99,000 baht (about US$2,800), while a caesarean section with premium care at private top hospitals in Thailand can exceed 300,000 baht (around US$9,200).

These fees typically cover the hospital stay, doctors’ fees, medicines, and care for the newborn, but costs can rise quickly if there are complications.

Public hospitals charge much less but may not offer the same language support, privacy, or comfort that many expats want. Because of this, many prefer private hospitals despite the higher price. The quality of service and ease of communication are key reasons for this choice.

Without maternity insurance, expat families face serious financial risks. Unexpected problems during pregnancy or delivery could lead to expensive emergency care and longer hospital stays, which might cause large medical bills.

Maternity insurance helps protect against these costs by covering regular prenatal check-ups, delivery, and postnatal care, giving expat moms peace of mind and financial security in Thailand.

What to look for in maternity insurance plans

When choosing maternity insurance in Thailand, expat moms-to-be should check for a few important features to make sure that they get full coverage and peace of mind.

Coverage for prenatal, delivery, and postnatal care

A good plan covers all stages of pregnancy. This includes prenatal check-ups, ultrasound scans, visits to the obstetrician, delivery costs, hospital stays, medicines, and postnatal care like follow-up appointments. This way, you are protected throughout your whole maternity journey.

Types of delivery covered

Most plans cover both normal (vaginal) deliveries and caesarean sections, including emergency C-sections. It’s important to see if the plan treats these differently, as caesarean births usually cost more.

Coverage limits and waiting periods

Maternity insurance often has a waiting period, usually 10 to 12 months, before you can use the benefits. This means you should buy the plan well before you get pregnant. Coverage limits vary a lot, from about US$7,000 to over US$19,000.

Make sure to check the limits so you don’t face surprise bills. Some plans also cover complications with separate limits.

Inclusion of newborn care

Some plans include limited care for newborn babies, such as medical expenses in the first few weeks after birth. But usually, newborns need their own health insurance for ongoing care.

Access to international-standard hospitals and specialists

Maternity insurance often only covers care at certain hospitals. These are usually top private hospitals with international standards in Thailand. Access to experienced doctors and good hospital facilities, along with language support, is an important benefit for expats who want high-quality care.

Common maternity insurance options for expats in Thailand

Expat moms-to-be in Thailand have a few different types of maternity insurance to choose from, each fitting different needs and budgets.

International health insurance plans with maternity coverage

Many global insurers offer international health insurance that includes maternity benefits, either as part of the plan or as an add-on. These plans usually cover prenatal care, delivery (normal and C-section), postnatal care, and sometimes newborn care.

They provide access to top private hospitals and specialist doctors. However, there is often a waiting period of 10 to 18 months before maternity benefits start, and coverage limits tend to be high to cover private hospital costs.

Local Thai maternity insurance plans

Local Thai insurers also offer maternity coverage, usually included in private health insurance plans or through employee benefits. These plans focus on care at private hospitals in Thailand and often have lower premiums compared to international plans.

Coverage and benefits can vary, and waiting periods still apply. Some expats use local plans alongside Thailand’s social security system to get subsidised maternity care in addition to private services.

Standalone maternity insurance plans

Standalone plans cover only pregnancy-related costs and can be bought separately from general health insurance. These focus on prenatal visits, delivery, and postnatal care, with clear coverage limits and waiting periods.

They are a good option for expats who already have general health insurance but want extra maternity coverage without changing their main plan. Some standalone plans also offer limited newborn care, but babies usually need their own health insurance for ongoing treatment.

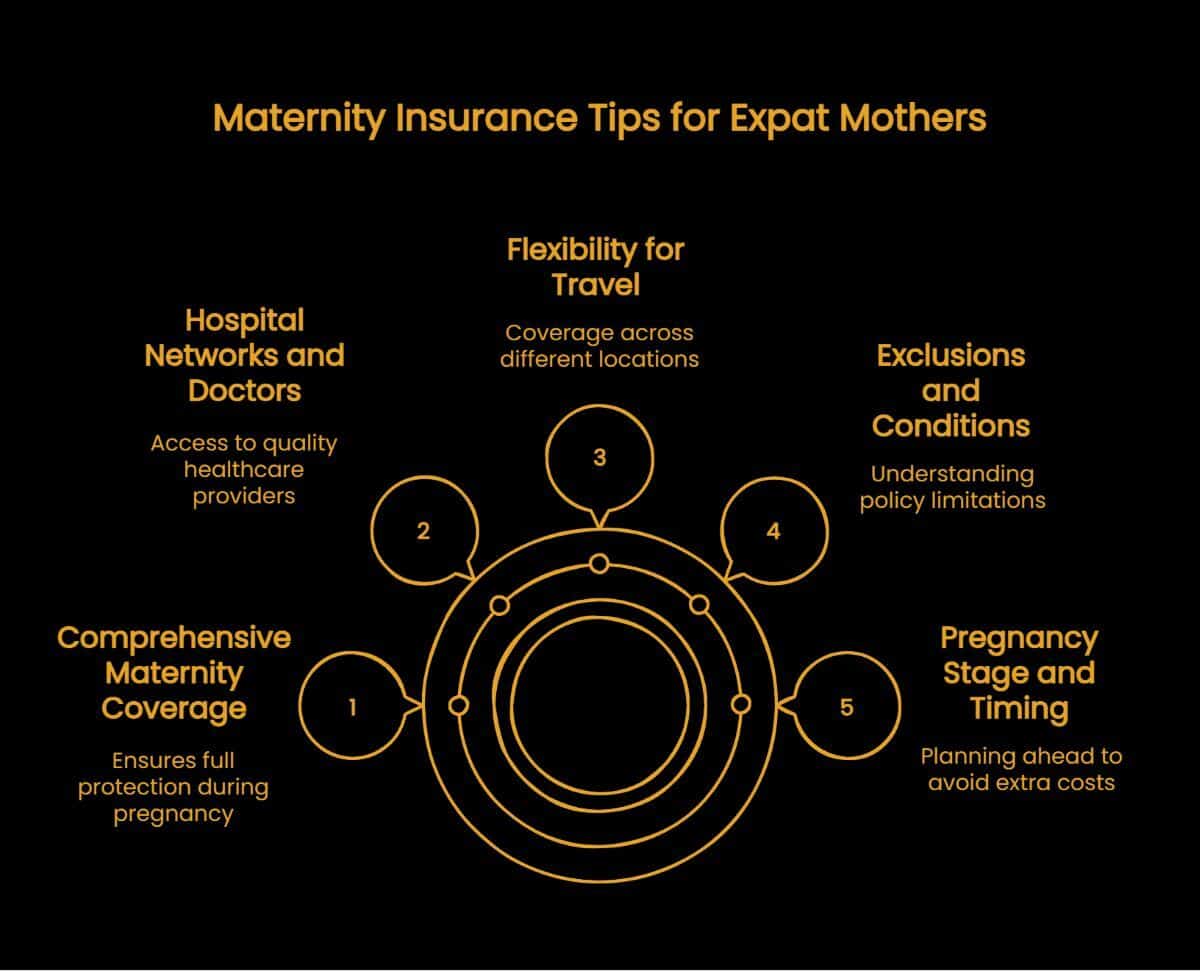

Tips for choosing the right maternity insurance

When picking a maternity insurance plan in Thailand, expat moms-to-be should keep a few important things in mind to get the right coverage and have a smooth pregnancy.

Consider your pregnancy stage and timing

Most maternity plans have waiting periods of 10 to 18 months before they cover pregnancy and childbirth. This means you should buy a plan well before you get pregnant to avoid extra costs. If you are already pregnant, your choices might be limited or more expensive, so it’s best to plan early.

Check hospital networks and preferred doctors

Look at which hospitals and doctors are included in the insurance plan. Many expats prefer international-standard private hospitals for their quality care and English-speaking staff. Making sure your chosen hospital and obstetrician are covered can improve your experience and help you avoid paying extra.

Look for flexibility if you plan to travel or move

If you think you might move within Thailand or abroad during your pregnancy, choose a plan that lets you access care in different places. Some international plans cover treatment in multiple countries, which can be useful if you have a flexible lifestyle.

Understand exclusions and conditions

Read the policy carefully to know what is covered and what is not. Check if both normal and caesarean deliveries are included, how complications are handled, and if newborn care is part of the plan. Also, if you need treatments like IVF, see if these are covered. Knowing these details helps you avoid surprises and get full protection.

How Pacific Prime Thailand can help

Pacific Prime Thailand offers expert help, especially for expat moms-to-be looking for maternity insurance. They provide personalised recommendations that suit your pregnancy needs and budget. This includes coverage for prenatal care, delivery (whether normal or caesarean), postnatal care, and even newborn care from day one.

They help you compare a wide range of international and local maternity insurance plans, explaining differences in coverage limits, waiting periods, hospital networks, and costs. This makes choosing the right plan in Thailand much easier.

Pacific Prime also supports you throughout the process by explaining policy details, clarifying what’s excluded, and helping with claims. Their knowledge ensures you can get care at top private hospitals and see trusted specialists with confidence. They also help you take advantage of features like direct billing, which can reduce your out-of-pocket costs and paperwork.

If you’re expecting and want the best maternity insurance in Thailand, get in touch with Pacific Prime today for personalised advice and support.

Sponsored

Latest Thailand News

Follow The Thaiger on Google News: