Can one insurance plan cover you while working from anywhere?

Remote work and the digital nomad lifestyle let people earn a living from almost anywhere—whether it’s a city, a beach, or a small village. But with this freedom comes one big question: can one insurance plan cover you while working from anywhere? Most regular insurance plans don’t work well for people who travel often or live in different countries. That’s why global insurance for digital nomads and remote workers like SafetyWing insurance is now more popular. These plans are simple, flexible, and made to keep you covered regardless of where you go.

The problem with traditional insurance plans for expats in Thailand

Many expats in Thailand find that standard insurance plans don’t match the needs of a cross-border lifestyle. These plans often have limits that make it difficult to stay protected while living or travelling abroad.

Limited coverage outside Thailand

Most local insurance plans focus on care within Thailand, even if they say they offer “international coverage”.

- Some only cover emergencies abroad, so you may have to pay for routine care in other countries.

- Certain countries may be excluded, or you might need to pay more for treatment outside Southeast Asia.

Time limits on overseas coverage

- Many plans cover emergencies abroad for only 60 to 90 days—too short for long trips.

- Plans made for visa purposes, like the O-A visa, often don’t work well for people living in more than one country.

Gaps in what’s covered

- Pre-existing conditions are usually not covered unless you wait several years.

- Outpatient care, mental health services, and non-urgent treatment abroad often cost extra or aren’t covered at all.

- Some plans set yearly limits for things like ICU stays or organ transplants, which can lead to big out-of-pocket costs.

Lack of flexibility

- Premiums often include Thai-based care, even if you spend most of your time abroad.

- After making a claim, some insurers may raise your premium or refuse to renew your policy.

Important exclusions

Many plans don’t cover:

- Injuries from adventure sports or motorbike accidents

- Health issues linked to alcohol, drug use, or STDs

- Routine care, like dental check-ups or vaccinations, unless you buy extra coverage

Because of these issues, expats often need to buy extra insurance just to feel fully protected while living in more than one country.

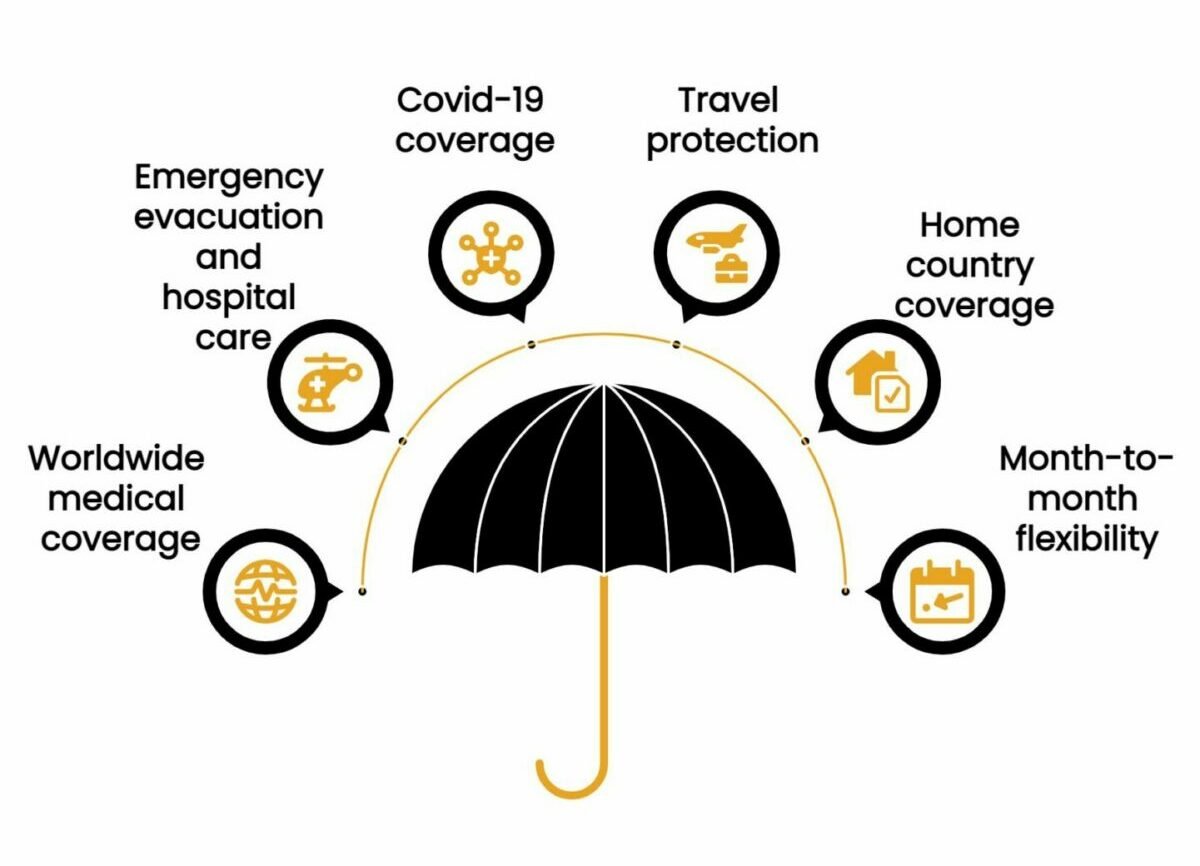

What global remote workers need from health insurance

Remote workers who travel often need health insurance that fits their international lifestyle. Regular insurance plans usually don’t offer enough support. The following points are what a good plan should include.

- Worldwide medical coverage: You should be able to see a doctor, go to the hospital, or visit a specialist anywhere in the world, not just in your home country or where you’re living now.

- Emergency evacuation and hospital care: If you get seriously sick or injured, your insurance should pay to move you to the nearest hospital that can treat you. It should also cover surgeries, hospital stays, and intensive care, regardless of where you are.

- Covid-19 coverage: Your plan should clearly include testing, treatment, and quarantine costs if needed. Pandemic-related care must be part of the policy.

- Travel protection: Good insurance should help when your travel plans change. It should cover lost luggage, flight delays, and cancellations and offer support when problems arise during your trip.

- Home country coverage during short visits: When you return home for a short time, your plan should still cover you. You shouldn’t need separate insurance just for visiting home.

- Month-to-month flexibility: You should be able to pay monthly and cancel or change your plan as needed. No long-term contract should be required.

- Why it matters: Remote workers need health insurance that moves with them. The right plan gives peace of mind and protection, regardless of where work or life takes you.

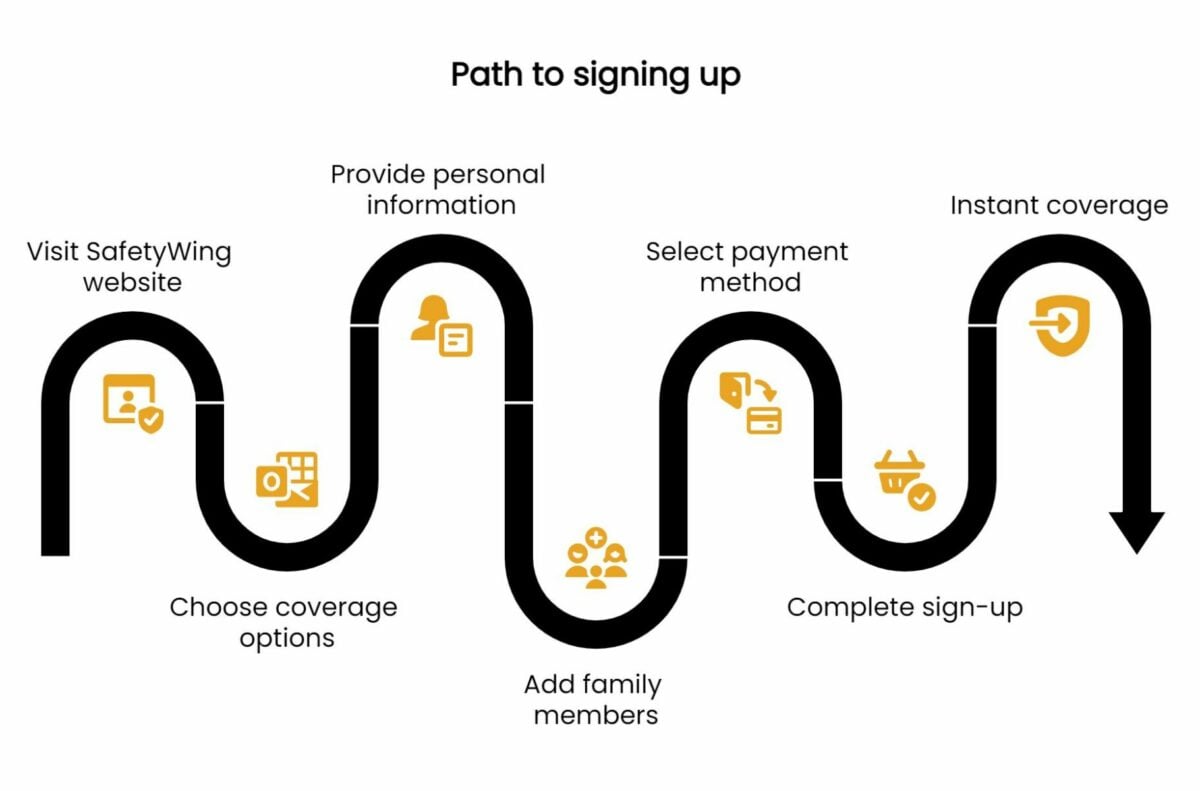

SafetyWing Nomad Insurance: Flexible global coverage

SafetyWing’s Nomad Insurance is made for freelancers, remote workers, and digital nomads who travel and work around the world. It offers worldwide coverage in over 180 countries, giving you protection wherever you go.

One of its best features is flexibility. You can buy the plan online even after you’ve started your trip—no need to arrange it before leaving. It works on monthly auto-renewals, so you stay covered without long contracts or paperwork. You can also pause or cancel anytime if your plans change.

The insurance covers many medical and travel problems, including emergency hospital stays, medical evacuation, Covidtreatment, and travel issues like lost luggage or trip delays. If you’ve been abroad for 90 days, you’ll also get short-term medical coverage during visits to your home country.

SafetyWing insurance is easy to use. You can sign up and manage your plan through their simple online platform. You can also add family members or extras if needed. With its global reach, flexible setup, and useful benefits, SafetyWing is a smart choice for people working and living across borders.

Calculate your costs below!

Key features to look for in a remote-ready insurance plan

Expats and digital nomads need health insurance that works across borders and fits their lifestyle. Here are the most important things to look for:

Global reach

- Coverage in over 180 countries, from big cities to remote places

- No country exclusions for emergency or regular care, even in places like the U.S. or Europe

- Coverage during short visits to your home country (usually 15–30 days a year)

Clear pricing

- No hidden charges for using the plan abroad or changing currencies

- Easy-to-understand info on deductibles, co-pays, and coverage limits

- Stable monthly costs, even if you travel often or file small claims

Emergency and urgent care

- 24/7 medical helpline with support in different languages

- Full coverage for hospital stays, ICU, and surgeries in any country

- Covid testing, treatment, and quarantine included

Add-ons for adventure and remote work risks

- Extra cover for risky activities like hiking, diving, or riding a motorbike

- Emergency evacuation from remote or risky areas

- Protection for work gear, like laptops or cameras if lost or stolen

Easy claims and strong support

- Fast digital claims through an app or website

- Direct billing with hospitals, so you don’t pay upfront

- Help from teams who understand international healthcare

Other helpful features

- Mental health support, including therapy while abroad

- Some coverage for pre-existing conditions, even if limited

- Options to add dental, maternity, or long-term care as needed

Choosing a plan with these features helps remote workers and expats stay safe and covered, regardless of where they are in the world.

Why SafetyWing stands out

SafetyWing offers two plans—Essential and Complete—made for the needs of remote workers and digital nomads. These plans are flexible and easy to use and offer strong protection at fair prices.

Competitive pricing

- The Essential Plan starts at around US$56.28/month. It’s great for those who want basic coverage for medical care and travel issues.

- A Complete Plan starts at around US$161.50/month and includes routine check-ups, mental health, and more coverage overall.

- Prices depend on your age, and there are no big price jumps. Kids under 10 are free when added to an adult’s policy.

Flexible and mobile-friendly

- The Essential Plan covers emergencies, hospital stays, lost luggage, and travel delays.

- The Complete Plan adds regular care, mental health, pregnancy care, and protection for sports like hiking or diving.

- Both plans run on a rolling 28-day subscription. You can pause, cancel, or change your plan anytime.

Home country coverage

- Essential gives you short-term coverage when visiting home, up to 30 days after every 90 days abroad.

- Complete offers more generous coverage during home visits with fewer limits.

Easy sign-up and claims

- Buy either plan online at any time, even after your trip has started. No need to live in a specific country.

- The Essential Plan covers up to US$250,000 each year, including Covid treatment and emergency evacuation.

- The Complete Plan covers up to US$1.5 million each year and includes cancer treatment, wellness care, and higher travel coverage.

Trusted by the nomad community

Thousands of remote workers and digital nomads use SafetyWing. Many praise it for being simple, flexible, and reliable for life on the move.

With two options, SafetyWing helps you choose the plan that fits your needs—whether you want low-cost protection or full coverage. Both plans are designed to make life easier for people living and working around the world.

Can one insurance plan cover you while working from anywhere?

Yes, one insurance plan can cover you while working from anywhere—if it’s designed for people who live and work across different countries. Most regular health insurance only works in your home country, which doesn’t suit digital nomads or remote workers who move often.

That’s why many people choose global health insurance plans like SafetyWing, which are built to follow you wherever you go. These plans usually include emergency care, hospital stays, and sometimes routine checkups or preventive care, depending on the level of coverage. Some also offer travel protection, such as coverage for lost luggage, trip delays, or emergency evacuations.

A key advantage of SafetyWing is its flexibility. You can sign up or manage your plan online, even after your trip has started. There are no long-term contracts, and you can pause or cancel anytime. SafetyWing also offers short-term coverage when visiting your home country, so you stay protected during short returns.

Not all insurance plans are made for this kind of lifestyle, but SafetyWing insurance is a smart and easy solution for remote workers and digital nomads who want reliable protection without the hassle.

More people are working remotely and living in different countries, but many insurance plans don’t cover this kind of lifestyle. Expats in Thailand and digital nomads often deal with gaps in coverage, high costs, and limited support when they travel. That’s why global insurance plans like the one SafetyWing offers are becoming a popular choice. They offer health and travel protection in over 180 countries, cover emergencies and routine care, and even include short-term home country coverage.

SafetyWing also makes it easy to sign up, change, or cancel your plan anytime. If you’re working from anywhere, it’s a simple and flexible way to stay protected. To learn more about why insurance matters for nomads, refer to this article on why health insurance for digital nomads is more important than ever.

Sponsored

Latest Thailand News

Follow The Thaiger on Google News: