180 countries, US$2 a day: The insurance built for digital nomads

Learn to get coverage in 180 countries for just US$2 a day with SafetyWing, the insurance designed for digital nomads.

Working and travelling as a digital nomad gives you freedom, but things can still go wrong. You might get sick, lose your bags, or face travel delays, and these problems can be expensive. That’s why many remote workers choose SafetyWing nomad insurance.

It costs around US$2 a day and covers you in over 180 countries. You can sign up online, even if you’re already abroad, and your plan renews automatically every month. Whether you’re in Bali, Lisbon, or Chiang Mai, SafetyWing helps you stay safe and worry-free while you explore the world.

On this page

| Topic (Click to skip to section) | Description |

|---|---|

| Why digital nomads need special insurance | Traditional insurance plans don’t fit digital nomads’ unique needs, lacking global coverage and long-term care. |

| Essential vs. Complete: Choosing the right SafetyWing plan | SafetyWing offers the Essential and Complete plans for flexible, comprehensive coverage for digital nomads. |

| What SafetyWing covers | SafetyWing covers medical, dental, travel issues, and emergency evacuation, all under one flexible plan. |

| How it works | Sign up online, pay monthly, and get coverage in over 180 countries with easy renewal every month. |

| Who is it for? | SafetyWing is made for digital nomads, remote workers, backpackers, and expats needing flexible global coverage. |

Why digital nomads need special insurance

Most regular travel or health insurance plans don’t work well for digital nomads. They’re made for short holidays or single-country stays and usually need to be bought before you leave home. These plans often have strict rules, limited coverage, and don’t support long-term care. For people who move from place to place and don’t have a set schedule, that’s a problem.

Common issues with traditional insurance

- Too strict: Many plans only cover certain dates or countries. That doesn’t help if you travel often or don’t know where you’ll be next.

- Limited coverage: Most plans focus on one country or region, but nomads often visit many places in a short time.

- Must buy before travel: You often need to get insured before leaving your home country. That’s hard if you’re already abroad or decide to extend your trip.

- No long-term care: Things like mental health, dental visits, or treatment for existing health problems are usually not included.

- No support from work or country: Digital nomads don’t get health insurance from an employer or local government, so private insurance is a must.

How SafetyWing helps

SafetyWing was made for digital nomads. It’s simple, flexible, and works worldwide.

- Pay one monthly fee and stay covered regardless of where you go.

- Use it in over 180 countries. You can sign up or renew even if you’re already travelling.

- Get benefits like emergency medical help, support for ongoing health needs, and even coverage during short trips back home.

- Enjoy quick claims, 24/7 help, and extra features like tech and travel coverage—all managed online.

With SafetyWing, you don’t need to worry about changing countries or unexpected problems. It keeps things easy and helps you stay protected while living and working around the world.

Essential vs. Complete: Choosing the right SafetyWing plan

SafetyWing offers two plans made for digital nomads and long-term travellers: the Essential Plan and the Complete Plan. Both give you worldwide coverage, including Covid-19, and let you travel across 180+ countries with no long-term contract.

Essential plan

Focus: Emergency medical care and travel problems

What’s included:

- Medical coverage up to US$250,000

- Hospital stays, emergency evacuation (up to US$100,000), and accidental death

- Help with trip interruptions, lost checked bags, and political evacuations

- Emergency dental care up to US$1,000

- Covid coverage, if it wasn’t a pre-existing condition

- Costs about US$56.28 every 4 weeks (for travellers under 39, not visiting the US)

- Monthly subscription that renews every 28 days—easy to start or stop anytime

Best for: Digital nomads who want simple and affordable coverage for health emergencies and travel issues

Complete plan

Focus: Full health and travel protection

What’s included:

- Everything in the Essential Plan

- Plus: routine checkups, vaccinations, mental health support, and maternity care

- Higher coverage for medical needs and personal liability

- Costs about US$161.50 per month

Best for: Travellers who want more complete care on the road, including support for chronic conditions and regular health checkups

Both plans are flexible and can be bought or renewed online—even if you’re already abroad. The Essential Plan is great if you want to stay protected at a low cost. The Complete Plan is a better choice if you need more health care services while travelling long-term.

Calculate your costs below!

What SafetyWing covers

SafetyWing Nomad Insurance is designed for the unpredictable life of digital nomads. It covers medical needs, travel issues, and more—all in one flexible plan.

Medical and hospital care

- Emergency treatment: Covers hospital stays, surgeries, MRIs, and ambulance services for sudden illness or injury.

- Dental emergencies: Up to US$1,000 for sudden pain relief or dental accidents.

- Emergency evacuation: Up to US$100,000 for medical evacuation and up to US$5,000 for repatriation if needed.

- Physical therapy: Up to three sessions per injury; more sessions require a doctor’s referral.

Covid coverage

- Medical care: Covered like any other illness, including hospitalisation and tests.

- Quarantine support: US$50 per day, up to 10 days, if government quarantine is required during a covered trip.

Travel protection

- Lost luggage: Up to US$500 per item, with a maximum of US$3,000 per trip for checked baggage.

- Trip interruption: Covers return travel if a family member dies, your home is damaged, or you’re hospitalised.

- Stolen passport: Up to US$100 if reported to the police within 24 hours.

Natural disasters and political evacuations

- Political unrest: Evacuation costs are covered if your location becomes unsafe due to sudden government-declared emergencies.

- Natural disasters: Covers trip interruption if weather-related events affect your place of stay.

Home country coverage

- Optional add-on: Covers up to 30 days every 90 days in your home country (check your plan for details).

Price and flexibility

- Monthly cost: Starts at US$56.28 per 4 weeks for ages 18–39 (outside the U.S.).

- Flexible plans: Auto-renews every 28 days with no long-term commitment; cancel anytime.

What’s not included

- Pre-existing conditions: Generally not covered, except for acute flare-ups under specific conditions.

- Routine dental or vision care: Not covered unless it’s an emergency.

- Adventure sports: Only covered if non-professional and within policy terms.

Extra info

- Deductible: US$250 applies to most non-emergency medical claims.

- Age limit: Available for travellers up to 69 years old.

- 24/7 global support: Help is available anytime for emergencies or claims.

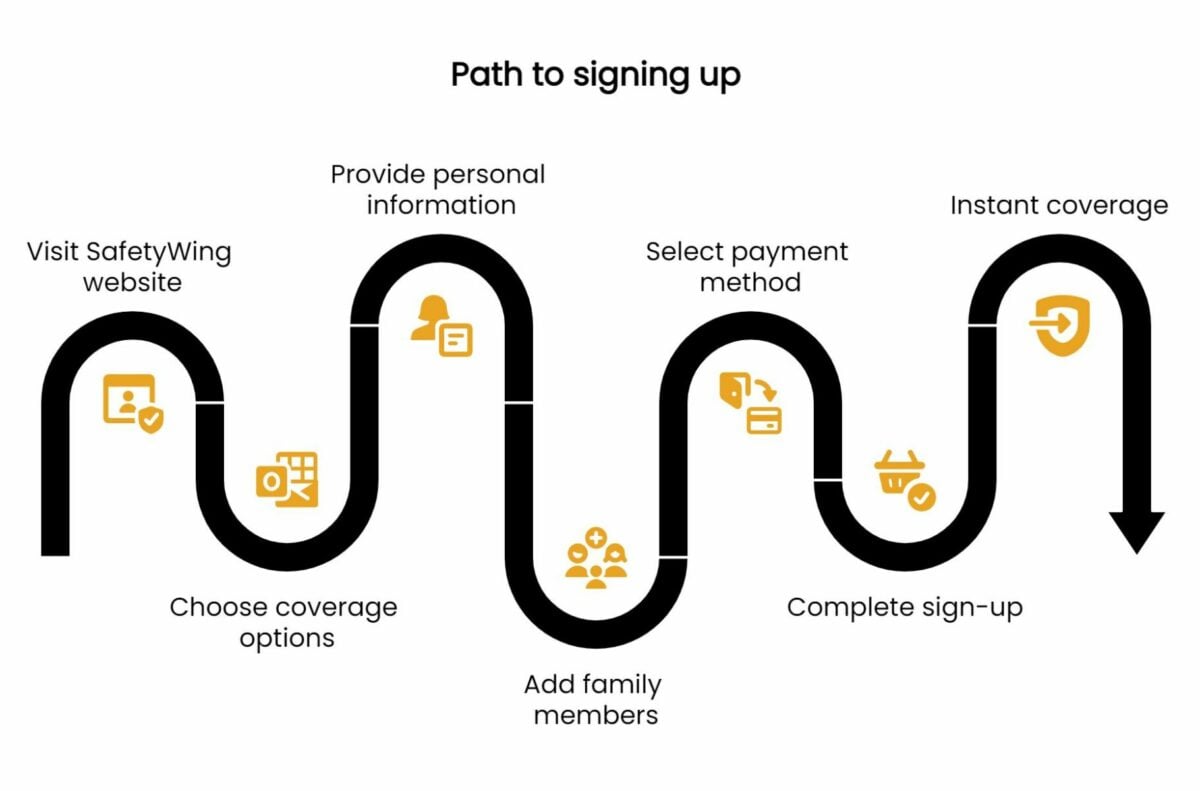

How it works

SafetyWing makes insurance easy for digital nomads. It’s flexible, simple to manage, and works regardless of where you are.

1. Sign up online in minutes

- No fixed location needed: You can sign up from anywhere—even if you’re already abroad. You don’t need to return home to start.

- Simple process: Just fill in your age, travel plans, and passport details. You don’t have to pick one country.

- Start right away: Your coverage can begin immediately after payment. Some conditions, like maternity or pre-existing issues, may have waiting periods.

2. Flexible monthly payments

- Pay month to month: Use a credit card or PayPal. No long-term contract.

- Auto-renews every 28 days: Your plan keeps going without needing to reapply.

- Cancel anytime: Stop your plan easily online if you no longer need it.

3. No country limits

- Covers 180+ countries: You’re protected almost everywhere you go.

- No travel plan required: Move between countries freely. You don’t need to update your policy each time.

4. Instant coverage and automatic renewals

- Starts immediately: Perfect for last-minute trips or if you forgot to get insurance before leaving.

- No paperwork: Your plan renews automatically unless you cancel.

Key features

- 24/7 help: Support is available any time if you need to ask questions or make a claim.

- Easy claims process: Upload your receipts or documents online. Most claims are paid back within 21 days.

- Extra travel protection: Includes help for lost bags, trip delays, and political emergencies.

SafetyWing takes the stress out of insurance. It’s made for people who live and work around the world, without the usual limits.

Who is it for?

SafetyWing is made for people who live and work around the world. If your lifestyle doesn’t fit traditional insurance, this might be the right fit for you.

- Digital nomads: If you work online and travel often without a fixed home, SafetyWing gives you flexible coverage across 180+ countries.

- Freelancers and remote workers: If you work for yourself or a company abroad and don’t get health insurance from an employer, SafetyWing fills that gap.

- Backpackers and long-term travellers: Whether you’re on a gap year or just travelling for months at a time, you can keep exploring without worrying about updating your insurance.

- Expats without local health insurance: If you live in another country but don’t have permanent residency or local coverage, SafetyWing gives you peace of mind.

SafetyWing is popular with younger, tech-savvy travellers aged 25 to 34 who value freedom, flexibility, and simplicity. With its monthly payments and easy sign-up, it’s perfect for anyone living a location-independent life.

SafetyWing is a simple and flexible insurance made for digital nomads, remote workers, and travellers who move from place to place. For about US$2 a day, it covers you in over 180 countries, including protection for medical emergencies, lost luggage, and Covid.

You can choose between the Essential Plan, which covers the basics, or the Complete Plan, which includes checkups, mental health support, and more. It’s easy to sign up online, and the plan renews automatically every month. You don’t need to be in your home country, and you can cancel anytime. If you’re based in Thailand, take a look at our guide on the best insurance for digital nomads in Thailand to find more useful options.

Sponsored

Latest Thailand News

Follow The Thaiger on Google News: