Malaysia and Cambodia launch cross-border QR payment system

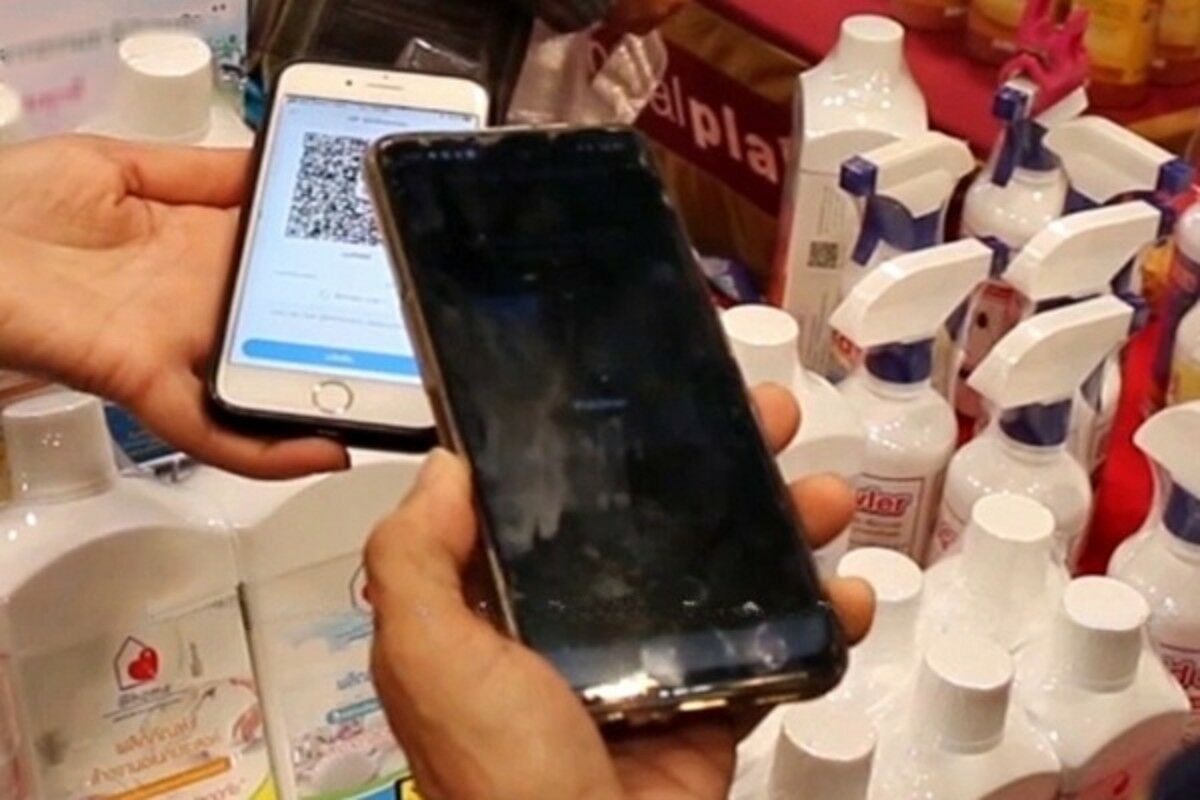

Malaysia and Cambodia have collaboratively launched a cross-border quick response (QR) payment linkage, enabling consumers and merchants to conduct instant retail payments via mobile applications.

This initiative, announced by Bank Negara Malaysia and the National Bank of Cambodia (NBC), aims to enhance the payment experience and expand market reach for over 5 million merchants in both countries, primarily small businesses.

In a joint statement, Bank Negara Malaysia and NBC expressed that the QR payment linkage would significantly benefit small businesses by providing access to a broader customer base across Malaysia and Cambodia.

NBC Governor Chea Serey, during the launch event in Phnom Penh, elaborated on the project’s benefits. She highlighted that the cross-border payments could be made using Cambodia’s Bakong app or Maybank M2U KH app, as well as Malaysia’s PayNet’s DuitNow QR.

“The first phase of this connectivity will allow Cambodian visitors to enjoy a more efficient and secure payment experience by using their Bakong app or M2U KH app to scan and pay at over 2 million merchants displaying PayNet’s DuitNow QR, Malaysia’s national QR code payment system, in Khmer Riel as the primary transaction currency.”

She further mentioned that the next phase would enable individuals in Malaysia to utilise mobile banking applications from participating commercial banks to scan KHQR Codes displayed by merchants in Cambodia.

This development is part of a broader effort among Southeast Asian countries. Vietnam, Indonesia, Malaysia, Thailand, the Philippines, and Singapore have been working towards integrating their payment systems, including QR code systems for retail transactions, reported Bangkok Post.

In related news, Thailand announced a significant economic stimulus package targeting vulnerable groups, including those with disabilities and state welfare cardholders.

Starting Wednesday, September 25, the government will distribute 10,000 baht per person through the PromptPay system. The initiative, approved by the Cabinet for the 2024 economic stimulus plan, aims to support 14.55 million recipients.

Latest Thailand News

Follow The Thaiger on Google News: