China and Japan fight it out for Thailand’s EV market

In Thailand’s (electric vehicle) EV market, China’s auto manufacturers are locked in a bitter struggle against Japanese incumbents.

China’s biggest maker of electric and hybrid cars, BYD, is to build an EV car plant in Rayong. The Great Wall Motor Co.’s production line in the same town has produced more than 10,000 vehicles. Meanwhile, Hozon New Energy has its Neta on display at a showroom in Bangkok’s Central Rama 2 mall.

Bloomberg informs us that Chinese automakers are exporting a record number of new-energy vehicles (NEVs) to Thailand — some 60,000 since January. Thailand is now the third export destination for Chinese EVs, behind Belgium and the UK.

Bangkok became the first government in the region to offer cash subsidies — up to 150,000 baht (US$5,600) — for EVs. Battery-powered cars from China are also exempt from most duties. Thailand wants 30% of its car output to be electric by 2030.

Narit Therdsteerasukdi, the secretary-general of Thailand’s Board of Investment, said in an interview with Bloomberg that…

“Our policies show how determined we are to become a global EV production hub. That’s boosted confidence and brought in many new players. Of course, most of them are from China. And more will likely follow.”

Foreign direct investment from China has doubled from a year ago, and much of that has flowed into the EV sector.

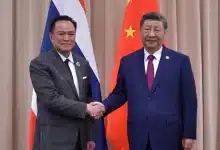

Under President Xi Jinping, green policies have boosted production of cleaner cars and China’s EV market is now the world’s largest. A cut-throat domestic landscape has spurred rapid innovations in car design, high-tech offerings and other customer-centric services. These affordable, popular EV models are now making inroads into markets once dominated by Japanese and western automakers.

Home to some 675 million people, passenger EV sales in Southeast Asia are forecast to jump from just 31,000 this year to 2.7 million in 2040.

Japanese incumbents like Toyota, which commands about one-third of Thailand’s auto market, only plan to launch its first battery EV later this year.

But Chinese automakers still have a long way to go. The top five Japanese carmakers in Thailand have a combined market share of almost 80%.

More competition may change that. BYD’s Atto 3 electric SUV went on sale this week and Tesla has been expanding its presence with a hiring spree in Bangkok.

Narit is excited by the prospects. He said…

“Our International Motor Expo at the end of the year is going to be heated. Brands we’ve never seen before will launch new models, pitting EVs against each other.”

Latest Thailand News

Follow The Thaiger on Google News: