Phuket Business: Midyear tax filing deadline tomorrow

PHUKET: Tomorrow, August 31, is the midyear tax return filing deadline for both companies and individuals who have generated income in Thailand during the first six months of 2012 – regardless of where or how payments were made.

The Revenue Department website states: “A company [or individual] is obliged to estimate its annual net profit [or net income] as well as its tax liability and pay half of the estimated tax amount within two months after the end of the first six months of its accounting period. The prepaid tax is creditable against its annual tax liability.”

In a previous Tax Tips article, we outlined the basic regulations and procedures for filing and paying income tax in Thailand, covering both Personal Income Tax (PIT) for individuals and Corporate Income Tax (CIT) for companies. In this follow-up, we will talk about Witholding Tax and move onto brackets for PIT and CIT.

Witholding Tax (WT)

Most types of formal income in Thailand are subject to WT at source. This tax serves as a prepayment, later to be credited against tax liability upon filing their returns. Companies and individuals are required to pay or verify these withholdings to the revenue department twice a year. WT rates are based on the following:

For personal income, WT rates for general employment is 5-37%, depending on the amount; property rental and prizes 5%; ship rental charges 1%; service and Professional fees 3%; public entertainer remuneration 5% for Thai resident and 5-37% for non-resident, while WT for advertising fees is 2%.

For corporate income, the rates are: dividends 10%; interest 1%; royalties 3%; advertising fees 2%; services and professional fees are subject to 3% WT for companies with a permanent branch in Thailand and 5% for those without a Thailand branch; prizes is 5%.

Witholding tax certificates should be kept, copied and submitted when filing the half-year prepayment form (PND 94 for PIT and PND 51 for CIT). The midyear filing deadline is August 31, 2012, while the full year tax returns are due by March 29, 2013. Note that if one fails to file their midyear tax return, they will be subject to paying a small fine upon filing their full-year tax return.

Tax Brackets

Once you have determined all of your deductions and allowances, you are now ready to calculate how much of your income is taxable and which rates to apply. To

determine which tax bracket you should apply, you have to calculate your Taxable Income (Ti) by subtracting the sum of Deductions (D) and Allowances (A) from one’s Accessible Income (Ai). In other words, Ti = Ai – (D+A).

Tax rates in Thailand range from 0 to 37%. For PIT, the rates are progressive, To demonstrate, lets say that after subtracting all deductions and allowances, your Ti is exactly 500,000 baht. In Thailand, the first 150,000 baht of your Ti is exempt.

Therefore, only the remaining 350,000 baht would be subject to the bracket rate of 10%, or 35,000 baht. If less than this amount was withheld as shown on the respective PND or WT certificate, you will owe the difference. Likewise if more was withheld, you can

expect the revenue department to write you a cheque equal to the amount of the surplus.

Moving up brackets, let’s say your Ti is 600,000 baht. Accordingly, the first 150,000 baht is exempt, and the next 350,000 baht would be taxed at 10%, while the remaining 100,000 baht would be subject to a 20% rate, or 20,000 baht. In this example, the total tax owed would be 55,000 baht (0+35,000+20,000).

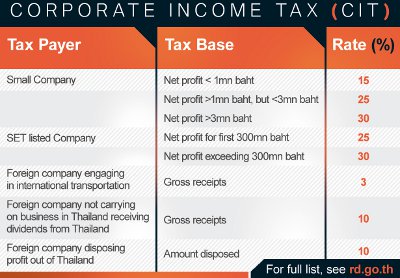

Calculating CIT is similar. Though the rate is set at 30% for large companies, such as those listed on the Stock Exchange of Thailand, the tax rate is progressive, based on profit volume and the company category. For example, small companies are subject to only 15% CIT on their first million baht of net profit, 25% on the next two million and 30% on any net profit over three million baht.

Remember, for this midyear filing, you’ll need to show or make payment for only half of your expected net income/profits.

When you are ready to file, no formal appointment is required at the Revenue Department. However, it is suggested that you get there early and allocate enough time for any potential delays. Finally, be sure to bring with you all the originals and copies of all your PND and/or WT certificates, as well as vital identification and verification documents.

Disclaimer: The information provided in this article is based on personal experience and direct inquiries with the Revenue Department. The author and the Phuket Gazette will not be held liable for any damages claimed from misuse, misinformation or misunderstanding. All specific tax issues should be addressed directly to the Revenue Department. For more information, see rd.go.th or call their hotline: 1161. Also, see right.

— Steven Layne

Latest Thailand News

Follow The Thaiger on Google News: