Minor Hotels to reach 600 properties amid optimistic tourism outlook

Minor Hotels is set to expand its portfolio to 600 properties across 59 countries, with over 91,000 rooms this year, as the global tourism industry shows signs of recovery following the easing of Covid-19 infections.

Dillip Rajakarier, Group Chief Executive of Minor International Plc and Chief Executive of Minor Hotels, believes that pent-up demand will drive the industry for years, allowing the company to grow through its “Asset Right” strategy, which balances investments or leased projects with management contracts.

Currently, the company operates over 530 hotels with 78,226 rooms in 56 countries under eight brands. Among the 65 new hotels in the pipeline, 58 will be under management contracts.

Rajakarier noted that owned and leased hotels have contributed more to earnings and profits than hotels under management contracts. New locations for Minor Hotels include Egypt, Peru, and Bahrain, all under management contracts.

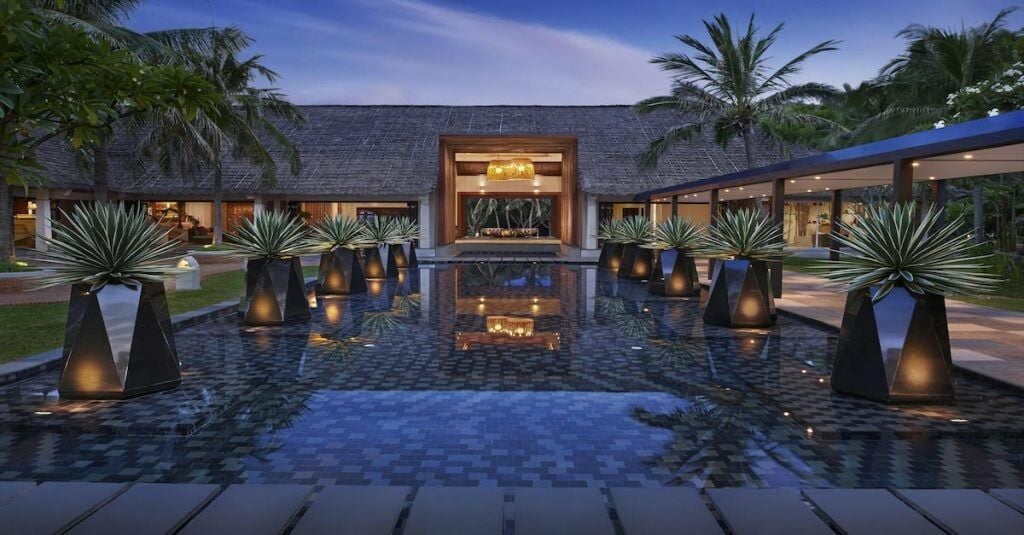

In Thailand, two hotels under management are the Anantara Koh Yao Yai and the NH Collection Chiang Mai Ping River. Through a joint venture investment with Funyard Hotels & Resorts, 30 new hotels will be established in China, bringing the total number of hotels on the mainland to 38 by 2025.

Rajakarier sees an opportunity to introduce a new brand, such as NH Hotels, to China, with the ultimate goal of having 100 hotels in the country within the next five years.

Minor Hotels has also signed a memorandum of understanding with Saudi Arabia’s Tourism Development Fund as a key strategic partner to boost new investments, such as the Anantara Diriyah Gate hotel. Last year, the company signed a joint venture with the Abu Dhabi Fund for Development for over US$100 million, including NH Collections Maldives.

Another long-term growth strategy for Minor Hotels is to continue driving the average daily rate (ADR) and revenue per available room (RevPar), amid a stable occupancy rate. For example, the Anantara Convento di Amalfi Grand Hotel in Italy saw almost triple-digit room rate growth in the high season after rebranding this year. This strategy will also address higher costs resulting from inflation, costs of living, and labour costs.

During the first quarter of this year, Minor Hotels’ ADR was 24% higher, with RevPar 12% higher than the 2019 level among its owned and leased properties.

In Thailand, ADR exceeded 2019 levels by 14% in the first quarter of this year, while RevPar was almost at the same level. With markets like Saudi Arabia, India, Russia, and China ramping up, RevPar is expected to surpass the 2019 level soon, reported Bangkok Post.

Latest Thailand News

Follow The Thaiger on Google News: