This Valentine’s Day, protect your loved ones with comprehensive health insurance

Valentine’s Day is a time to celebrate love, care, and the bonds we share with those who matter most. This Valentine’s Day, show your love in a thoughtful and lasting way by choosing health insurance for your loved ones. Unlike chocolates or flowers, which bring short-term joy, health insurance offers long-term security and peace of mind. It helps your loved ones handle unexpected medical costs, access preventive care, and focus on their well-being. Choosing this gift shows thoughtfulness and a deep commitment to their health, making it a meaningful way to celebrate the bonds you cherish.

Why health insurance matters for your loved ones

Health insurance is a key way to protect your loved ones, offering important benefits that support their health and financial stability.

-

- Financial protection: Rising medical costs can cause serious financial stress, especially during an unexpected illness or accident. Health insurance helps cover these costs, so families can focus on recovery instead of worrying about expensive bills. It provides security, making sure your loved ones get the care they need without financial hardship.

- Access to quality healthcare: Health insurance gives your family access to trusted doctors, specialists, and top hospitals. This ensures they receive timely care, which can improve recovery and overall health. Many plans also include networks of reliable healthcare providers, making it easier to choose the best care.

- Peace of mind: Knowing your loved ones are protected in case of illness or injury offers peace of mind. It reduces worries about unexpected health issues, allowing families to focus on living their lives and enjoying time together without added stress.

- Preventive care: Most health insurance plans include preventive services like check-ups, vaccines, and screenings. These services help detect potential issues early, encourage healthier lifestyles, and support long-term well-being for the whole family.

- Support for ongoing health needs: For loved ones with chronic conditions, health insurance is essential. It covers medications, regular doctor visits, and ongoing treatments, helping to manage their care effectively. This support improves their quality of life and reduces the financial strain on the family.

Choosing the right health insurance plan

Choosing the right health insurance plan for your family is an important decision. Here are some simple things to keep in mind to make sure it fits your family’s needs.

- Comprehensive coverage: Choose a plan that covers a variety of medical needs, like hospital stays, doctor visits, maternity care, and preventive check-ups. A plan with wide coverage ensures your family is protected for both routine healthcare and unexpected emergencies.

- Family plans: A family health insurance plan covers everyone under one policy, which is easier to manage and usually costs less than buying separate plans. It saves money and reduces the hassle of handling multiple policies.

- Global coverage: If your family travels often, a plan with global coverage is a smart choice. It ensures your loved ones have access to medical care no matter where they are, giving you peace of mind even during international trips.

- Simple claims process: Look for a provider with an easy claims process and a good record of paying claims quickly. A smooth process can make a big difference during stressful times when you need care, allowing you to focus on recovery instead of paperwork.

- Network hospitals and providers: Check the list of hospitals and doctors included in the plan. A wider network means more options for quality care without extra costs. Make sure your preferred hospitals and specialists are part of the network to avoid surprises.

Why Cigna health insurance is the perfect choice

Cigna Health Insurance is a trusted choice for individuals and families looking for reliable health coverage, especially for expatriates. With a focus on improving customer health and well-being, Cigna offers flexible plans tailored to meet a variety of needs. Cigna Health Insurance is a trusted choice for individuals and families looking for reliable health coverage, especially for expatriates. With a focus on improving customer health and well-being, Cigna offers flexible plans tailored to meet a variety of needs.

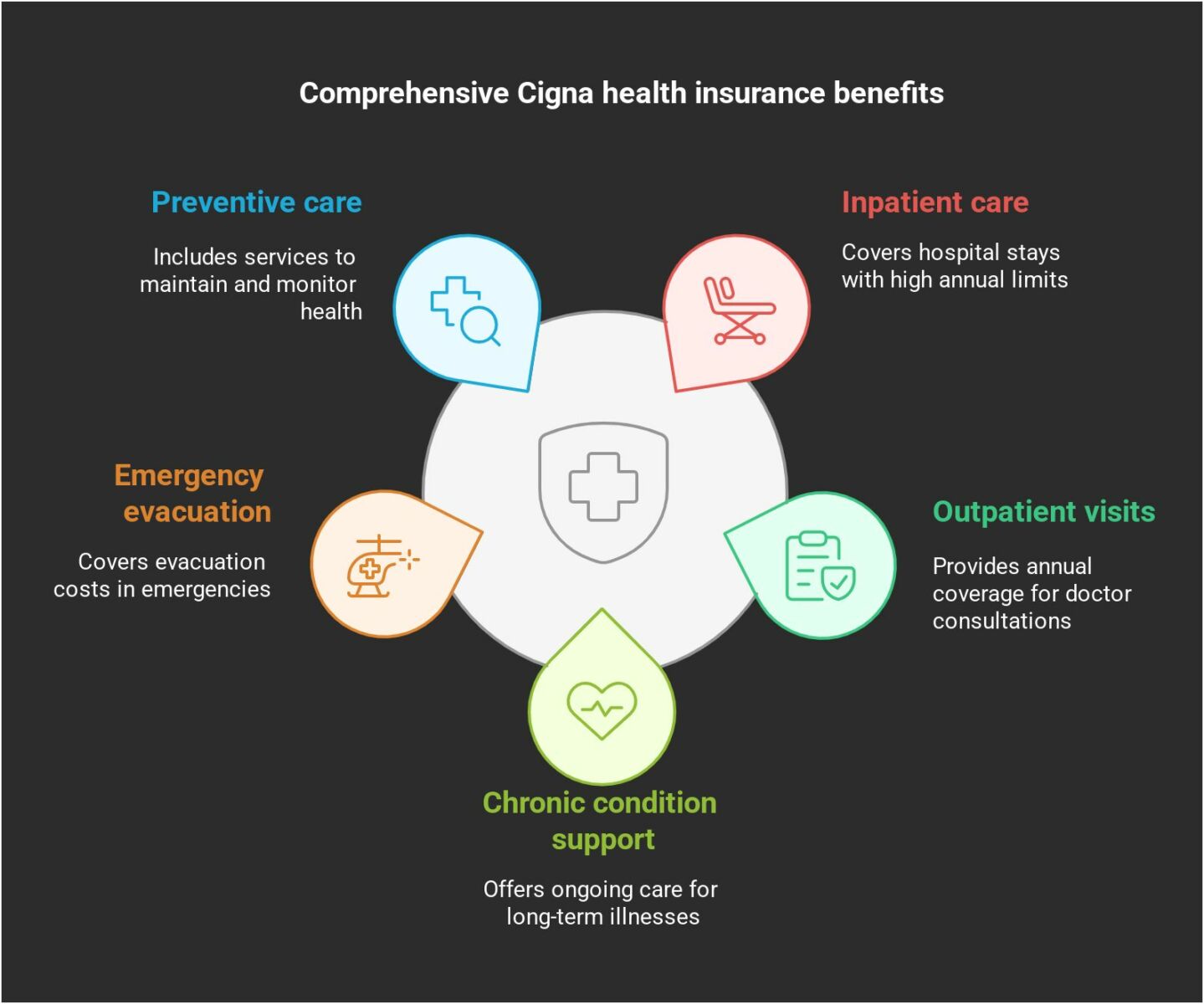

Key benefits of Cigna health insurance for expats

- Inpatient care: Cigna covers hospital stays with up to US$1,000,000 per year. This ensures you or your loved ones can receive the care needed during critical times without financial stress.

- Outpatient visits: Plans include up to US$25,000 annually for outpatient visits, making routine doctor consultations and specialist appointments more affordable.

- Support for chronic conditions: Cigna provides full coverage for ongoing care of chronic illnesses, so individuals with long-term conditions can receive continuous treatment without high costs.

- Emergency evacuation: In life-threatening emergencies, Cigna covers 100% of evacuation costs anywhere in the world. This offers peace of mind, especially for families travelling or living abroad.

- Preventive care: Preventive services like check-ups, vaccinations, and screenings are included, helping individuals maintain their health and catch issues early.

Overview of Cigna plans for expat families

- Cigna close care: This plan is designed for expats living in Thailand and provides access to top local hospitals in cities like Bangkok, Pattaya, and Chiang Mai. It covers essential healthcare services and complies with local requirements.

- Cigna global health plan: This plan is ideal for expats who travel often or live in multiple countries. It offers worldwide coverage and access to private hospitals, making it a great choice for families on the move.

- Inpatient and outpatient coverage: Both plans cover hospital stays, major surgeries, and regular doctor visits, ensuring all your healthcare needs are met.

- Mental health support: Recognising the importance of mental well-being, Cigna includes outpatient counselling and therapy services. This ensures a more complete approach to health care.

Valentine’s Day special offer

This Valentine’s Day, Cigna is giving special discounts on family health insurance plans. It’s a great chance to protect your loved ones and save money at the same time. Don’t miss this limited-time offer to secure their future at an affordable price.

The emotional value of health insurance

Health insurance is more than financial protection; it brings emotional reassurance and peace of mind to families.

Reduces stress during emergencies: Medical emergencies are stressful enough without the added worry of how to pay for care. Health insurance eases this burden by covering medical expenses, allowing families to focus on recovery instead of finances.

Encourages confidence in seeking care: With health insurance, loved ones can visit the doctor without hesitation or fear of high costs. This confidence ensures they get the care they need when they need it, fostering a sense of security and control over their health.

Supports long-term health: Health insurance promotes preventive care, like check-ups and screenings, which help detect potential issues early. This leads to better long-term health and gives families peace of mind knowing they’re taking steps to stay healthy.

Show your love this Valentine’s Day with Cigna

This Valentine’s Day, go beyond traditional gifts and give your loved ones the gift of protection and care with Cigna health insurance. It’s a thoughtful way to ensure their health and well-being are always a priority. With tailored plans and essential benefits, Cigna helps you safeguard your family’s future while offering peace of mind. Show how much you care by choosing a meaningful gift that lasts and explore Cigna’s plans and special promotions today.

Health insurance is a meaningful way to protect your loved ones by offering financial security, access to quality healthcare, and peace of mind. Cigna Health Insurance provides flexible plans designed to meet different needs, including coverage for hospital stays, doctor visits, chronic conditions, and preventive care. It also supports expat families with local and global options, ensuring access to care anywhere. This Valentine’s Day, Cigna’s special discounts make it easier to prioritise your loved ones’ health and well-being. Choosing health insurance is a thoughtful way to show your love and secure a healthier future for those who matter most.

For more details on finding the right health insurance plan in Thailand and how much it might cost, explore this helpful guide: How much is Thai health insurance?

FAQ for This Valentine’s Day, protect your loved ones with comprehensive Health Insurance

Why should I get a health plan?

A health plan helps cover medical costs and protects you from high healthcare expenses. With rising medical fees, having insurance ensures you can get quality treatment when needed without worrying about the cost.

What does health insurance usually cover?

Health insurance typically covers hospital stays, pre- and post-hospitalisation expenses, emergency ambulance services, outpatient treatments, mental health care, and preventive services like check-ups. It’s important to check the policy details to know exactly what’s included.

Does health insurance cover pre-existing conditions?

Most health plans cover pre-existing conditions after a waiting period at the start of the policy. The waiting time depends on the condition and the insurance company, so it’s best to check with your provider for specific details.

Can I add family members to my health plan?

Yes, many health plans allow you to add family members, like dependents, to your policy. You’ll need to update your plan details with your insurer to include them.

Latest Thailand News

Follow The Thaiger on Google News: