Answers to the most common questions about international health insurance

What every expat, retiree, and digital nomad needs to know about international health insurance in Thailand

If you’ve been thinking of staying in Thailand long-term, you’ve probably already asked the big question, “Do I actually need international health insurance?”

It’s a question that often comes up among expats, digital nomads, retirees, and even frequent travellers. Sure, we don’t think we would be the ones to experience a motorbike tumble in Chiang Mai, a dengue diagnosis in Phuket, or a slipped disc after Muay Thai in Bangkok, but accidents happen. And while Thailand’s private hospitals are world-class, they don’t come cheap if you’re paying out of pocket.

The issue is that many people simply don’t know what kind of international health insurance coverage they need until it’s too late. So, to separate fact from fluff, we asked the experts at Pacific Prime Thailand, one of the country’s leading health insurance brokers, to answer the most common questions about international health insurance.

Most common questions about international health insurance

| Topic (Jump to section) | Key Points |

|---|---|

| What is it? | Covers medical care across multiple countries, including private hospitals in Thailand like Bumrungrad and Bangkok Hospital. |

| Who needs it? | Ideal for expats, digital nomads, retirees, long-term travellers, and international students. |

| Local vs International | Local plans are limited to Thailand. International plans offer broader coverage, including care abroad and more hospital choices. |

| What’s covered? | Includes inpatient, outpatient, chronic care, maternity, mental health, and emergency evacuation, depending on the plan. |

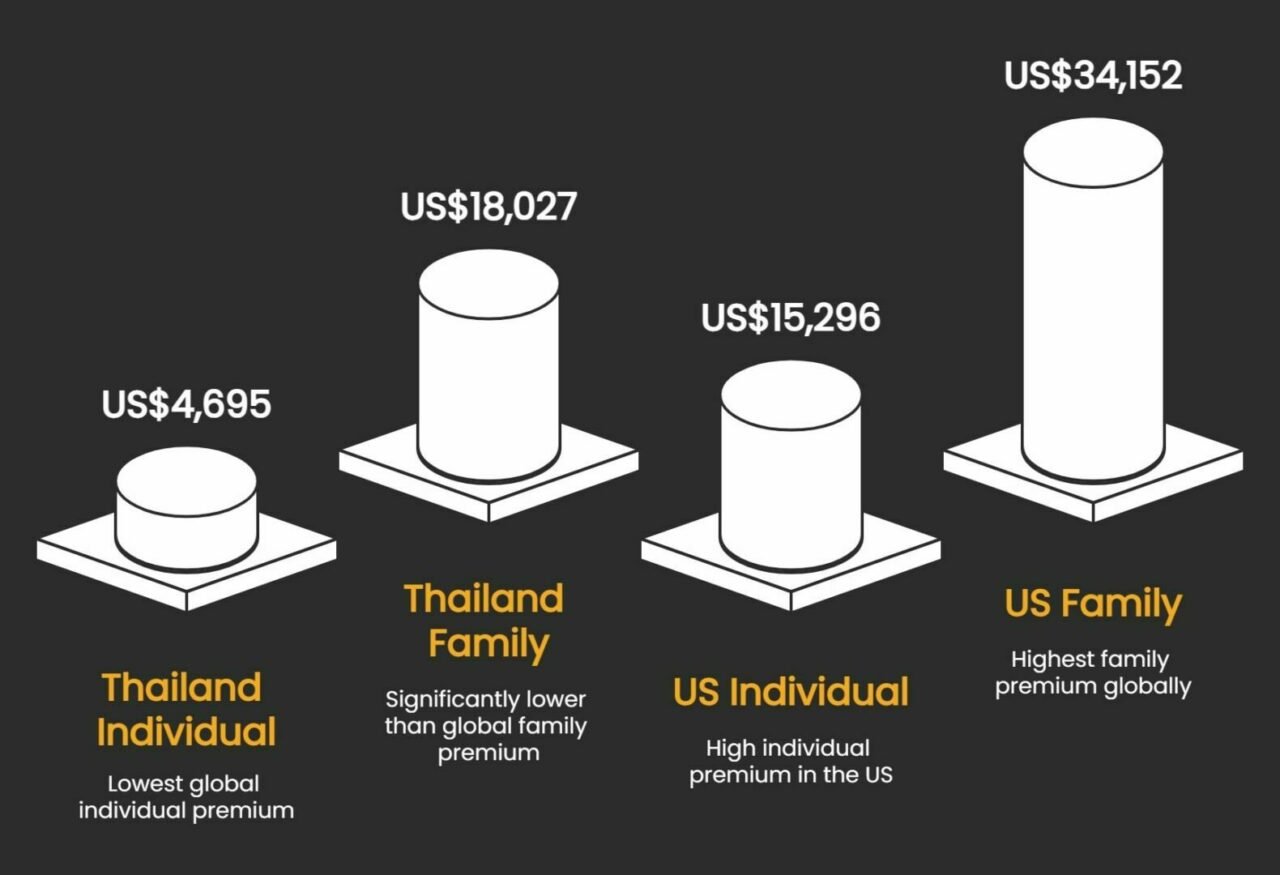

| Cost | Average in Thailand: US$4,695/year for individuals. Lower than global averages. Cost depends on age, coverage, and deductibles. |

| Age limit | Some insurers cover up to 70s or 80s. Higher premiums and medical assessments may apply to older applicants. |

| Pre-existing conditions | May be excluded, covered with extra cost, or included after a waiting period or moratorium. Always declare honestly. |

| Claims process | Many plans offer direct billing with hospitals. Some cases may require upfront payment and reimbursement claims. |

| Choice of doctor/hospital | Most plans allow you to choose your preferred hospital or doctor. Pre-approval may be required for planned treatments. |

| How to find the right plan | Talk to brokers like Pacific Prime Thailand for tailored advice and access to multiple insurers without extra cost. |

1. What is international health insurance?

International health insurance provides year-round medical coverage across multiple countries included in your plan. With it, you don’t have to pay out-of-pocket every time you see a doctor, from routine GP visits to major surgery, whether you’re in Bangkok, Bali, or visiting one of the countries covered by your policy.

Note that international plans don’t always mean full global coverage. You can usually choose which countries are included. For example, many people choose to exclude the US to keep premiums lower. We’ll explain how that works in more detail at point 3.

In Thailand specifically, international health insurance usually gives you access to private hospitals like Bumrungrad, Samitivej, and Bangkok Hospital. These facilities offer shorter waiting times, English-speaking staff, internationally trained doctors, and a level of care that rivals the West.

Without the right policy, though, the cost of a night at one of these hospitals can set you back tens of thousands of Baht. Plus, relying on the public system, especially if your Thai isn’t fluent, can be stressful when you’re already unwell.

2. Who needs international health insurance in Thailand?

International health insurance is ideal for expats, digital nomads, international students, and long-term travellers. And if your partner or family members are joining you in Thailand, they’ll need cover, too.

But do you still need it if you already have travel insurance?

The short answer is yes. Most travel insurance policies are built for emergencies only. They won’t cover you for routine medical check-ups, prescription refills, dental work, maternity care, or any kind of ongoing condition.

Worse still, travel insurance typically limits how long you’re covered in one place, sometimes 30 to 90 days per trip. After that, your policy may become invalid. International health insurance, on the other hand, is built for longevity. Plus, it offers comprehensive coverage across borders.

3. What’s the difference between local and international health insurance?

Local health insurance covers you in one country, say, only in Thailand. It’s typically designed for residents who don’t plan to travel frequently. With local plans, treatment abroad is usually excluded, and you may be limited to a specific network of hospitals and clinics within Thailand. If you step outside that network or need care in another country, you’ll likely have to pay out of pocket.

International health insurance travels with you. It’s ideal for people who live abroad, move between countries, or want the ability to get treatment in Singapore, the UK, or the US if needed.

Many international plans now let you tailor your area of coverage to suit your lifestyle and budget. For example, you can opt for coverage across Asia only, worldwide excluding the US, or full global coverage. Excluding the US is a popular choice because medical care there is extremely expensive, and including it can significantly raise your premiums.

4. What does international health insurance in Thailand actually cover?

Most international plans usually include the basics like inpatient care (surgery, overnight stays, and serious injuries) and outpatient care (GP visits, diagnostic tests, scans, and emergency visits without hospitalisation). In addition, it may also come with extras, such as:

- Routine health check-ups

- Maternity and newborn care

- Vision and dental coverage

- Cancer treatment and screenings

- Chronic condition management

- Mental health and alternative medicine options

- Emergency medical evacuation and repatriation to your home country

International health insurance in Thailand used to be one-size-fits-all, which makes it expensive, confusing, and full of things you’d never use. But today, it’s more customisable than ever. You have the option to exclude certain coverage you’re less likely to use or add a few more if you’re planning to start a family, travel across borders, or manage an existing medical condition.

5. How much does international health insurance cost? Is it expensive?

International health insurance has a reputation for being pricey. However, Pacific Prime’s latest cost report showed that Thailand is among the most affordable countries for it.

In 2024, the average annual premium for individual plans in Thailand was US$4,695, which places it at the bottom of global cost rankings. For families, the average annual premium was about US$18,027. This number is significantly lower than the global average and is in sharp contrast to countries like the US, where premiums can exceed US$15,296 for individual plans and US$$34,152 for family plans.

Still, the cost can vary depending on your age, health, and what you want the policy to include. Basic inpatient-only plans are the most affordable. Add maternity, vision, or dental care, and the price rises, but so does your peace of mind. You can also play with your deductible (that’s the amount you pay before insurance begins) and co-pay to adjust your premium up or down.

6. Is there an age limit for international health insurance in Thailand?

This depends on the insurance company. Some insurers have age caps, but it’s increasingly common to find plans that accept applicants well into their 70s and 80s.

With health insurance now a requirement for securing or renewing a retirement visa, many insurers have adapted by extending their upper age limits and offering plans specifically geared toward older expats. That said, premiums will generally increase with age, and some policies may require a medical assessment before approval.

7. What if I have a pre-existing condition?

A pre-existing condition, by definition, is any illness, injury, or chronic health issue you had before applying for coverage. Depending on the insurer, it can affect how and if your policy covers you.

Most insurers will either exclude the condition entirely, offer coverage with a loading (meaning you’ll pay more for it), or accept it after a waiting period, typically up to 24 months.

Some insurers take a different route altogether by applying a moratorium. With this route, the condition is excluded for a defined period of time, and if it doesn’t recur during that time, the insurer may agree to cover it moving forward.

If you have a pre-existing condition, it’s important to fill out your Medical History Declaration honestly. Incomplete or inaccurate information can lead to denied claims later.

8. What about claims? Do I have to pay upfront and hope for reimbursement?

Not always. Many international health insurance providers in Thailand offer direct billing. This means that the hospital sends the bill straight to your insurers, not you. With direct billing, you don’t have to deal with paperwork, waiting for reimbursement, or chasing down receipts just to get a refund.

There are, however, certain cases where you still need to pay upfront and submit a claim afterwards. Therefore, it helps to know what your plan includes. You can check if your preferred hospital offers direct billing before you turn up at the clinic.

9. Can I choose my own doctor and hospital in Thailand?

Yes, most international health insurance plans let you choose your preferred hospital and doctor. If you’re unsure where to go, your insurer or broker can recommend trusted hospitals nearby.

Just keep in mind that if you’re scheduled for surgery or any planned procedure, you’ll need to notify your insurer in advance. This ensures you’re pre-approved and eligible for direct billing.

10. How do I find the best international health insurance in Thailand as an expat?

Start with a conversation. It’s easy to Google your way through international health insurance, but it’s always better to talk to someone who knows what they’re doing.

Pacific Prime Thailand offers no-pressure consultations in both English and Thai. Since they work with top international providers like AIA, AXA, April, and Allianz, you’re not limited to one company’s offerings. They can explain your options clearly and match you with the right insurer. Plus, they help with renewals, claims, and medical questions down the line.

And because they’re paid by the insurers, you get all the benefits of expert advice without the cost.

Thailand may offer sun, sea, and an enviable pace of life, but health emergencies don’t respect borders. With the right international health insurance plan in place, you can focus on enjoying paradise instead of panicking.

@thethaigerofficial Why Insurance in Thailand is Essential Travelers and expats are recommended to secure travel or health insurance to safeguard their well-being abroad. Pacific Prime offers tailored coverage for expats and travelers, ensuring peace of mind. Don’t let unexpected mishaps ruin your adventure—get covered today! 🚑✈️🏝️ 📌 Contact us now for a free insurance consultation and plan comparison: 👉🏻 https://www.pacificprime.co.th/?campSource=TheThaiger #PacificPrime #SimplifyingInsurance ♬ original sound – The Thaiger

Sponsored

Latest Thailand News

Follow The Thaiger on Google News: