Robust Phuket tourism numbers in Q4 last year and high winter season set the stage for recovery by year-end

Return of Chinese travelers expected in the third and fourth quarter during key Mainland holiday periods

Press Release

PHUKET Thailand’s leading resort island of Phuket’s post-pandemic tourism recovery has been headlined by a surge in Russian travellers in the high season. But the backstory is how a spike in regional visitors from India, Malaysia, and Singapore set the stage in Q4 of last year that pushed hotels and the service sector back into action.

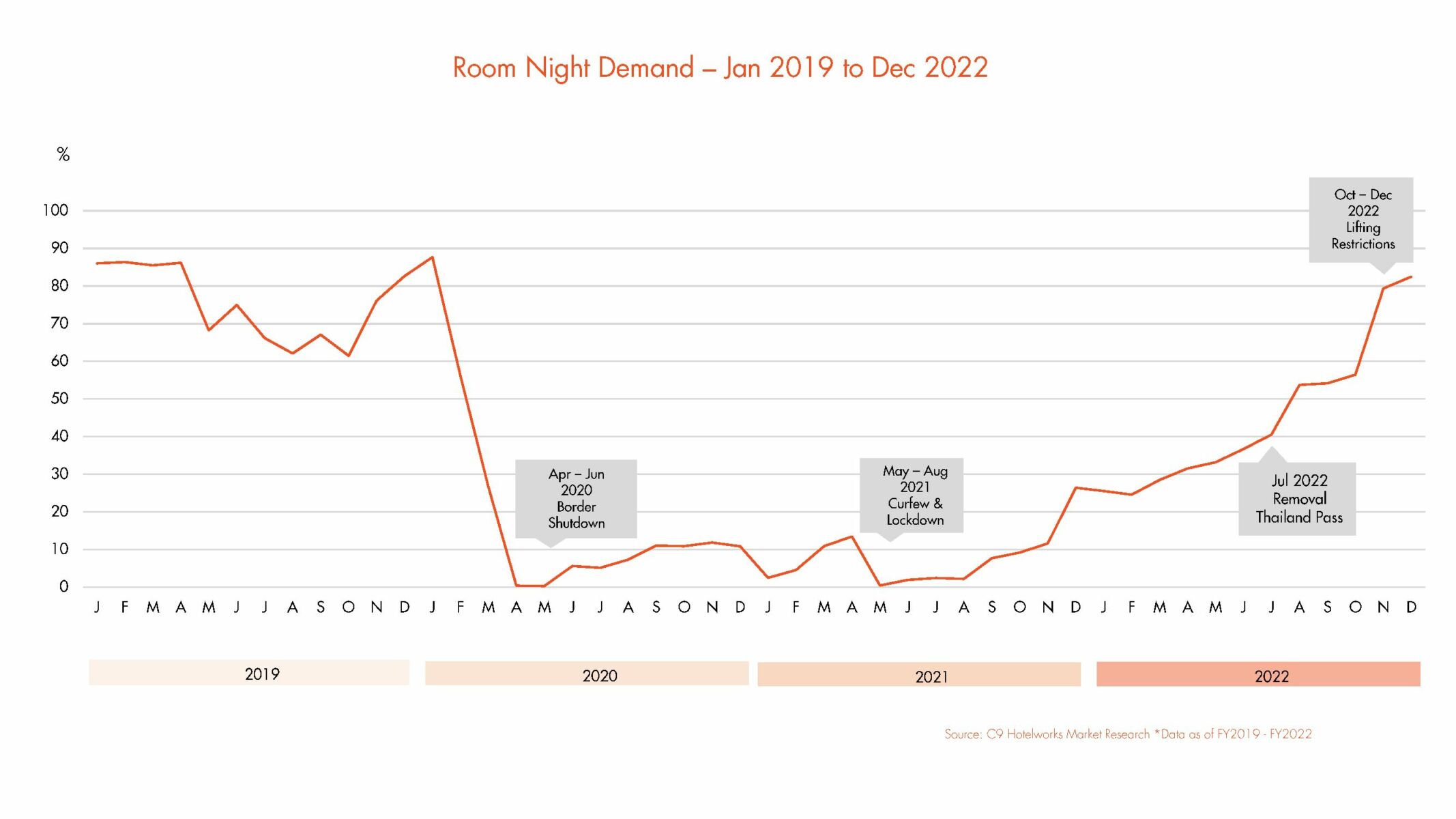

Data on hotel Phuket hotel performance in C9 Hotelworks’ newly released Phuket Hotel Market Update 2023 shows how the industry escalated after Thailand lifted travel restrictions at the beginning of October 2022. The influx of tourists propelled market-wide occupancy for the year to 48%, up year-on-year from a COVID-19-impacted low of 8% in 2021.

While Phuket’s winter high season which is November through to March has seen a return of the island’s traditional ‘snowbird’ visitors from Northern Europe and Scandinavia, the main mover has been Russia and a handful of other Eastern European countries. Despite limited direct airlift due to a backdrop of economic sanctions by the EU and airfares which have in many cases risen by 200-300%, the Russians indeed came. Though numbers were sharply down compared to the nearly one million count in 2019, stays increased from a normal average of 11 days, and rose by over 50%.

Speaking about the impact of the Eastern European markets on the island C9 Hotelworks Managing Director Bill Barnett said “the arrival of tourists from Russia not only created a spark in economic recovery for hotel and tourism businesses but radiated into retail, transportation, and real estate. The segment is now the most active direct foreign investment (FDI) leader in Phuket’s booming property market. A knock-on effect has been also seen on land prices across the island which are growing at their high rates in over two decades.”

Looking inside the numbers and key trends in Phuket’s hospitality industry, C9’s research points to a broader overall movement of hotel owners converting from management agreements to franchises and also changes in brands. Two recent notable deals have seen the Destination Group inking agreements with InterContinental Hotels Group (IHG) for two Holiday Inn properties and two with Radisson. Additionally, one of the island’s largest hotels, the Arcadia has been reflagged as a Pullman under ACCOR, and Thailand’s hospitality giant AWC (Asset World Corporation) has made public plans to upgrade and convert the Westin Siray Bay into a luxury resort branded to Ritz-Carlton.

Citing the conversions C9’ Bill Barnett commented “this is a sign of maturity for Thai hotel owners who are experienced enough to operate but look for distribution and brand value in a franchise scenario. This practice is prevalent in North America and Europe so it was only a matter of time until Asia caught up. We expect to see more changes in brands for the remainder of 2023 and beyond, given many hotel agreements signed in the early millennium tourism boom years are set to expire. “

Despite positive economic indicators, the reality on the ground is evident everywhere in the stress placed on Phuket’s transportation infrastructure. Population growth, development spread to inland areas and skyrocketing tourism demand has created a massive traffic problem. The clearest example was when a landslide closed an important thoroughfare between the popular Patong tourist area and its central island feeder road. Delays in repairs caused a domino effect in access to west coast hotels in peak season and demonstrated how fragile the island’s transportation network is.

Reflecting on the potential return of mass tourism to Phuket, C9’s Bill Barnett who has lived and worked from Phuket for over 20 years said “the lack of a dedicated tourism master plan for the island is a key long-term issue that much is resolved. With airport flights and passenger flow mounting we can clearly see how important the new Phang Nga airport is, though the site remains inactive. This goes for the expressway and Patong tunnel projects that are in essence a lifeline for the island’s future growth. We punched the card of urbanization already and with nearly 100,000 registered hotel rooms on the island we’ve done too far to go back.”

To read and download C9 Hotelworks Phuket Hotel Market Update 2023 CLICK

Latest Thailand News

Follow The Thaiger on Google News: