Property Watch: Branding unlocks potential of hotel property

PHUKET: Thailand, and more specifically Phuket, is leading a strong Southeast Asia trend in hotel residences to the tune of US$3.5 billion in properties currently up for sale. Overall the SEA regional market inventory is valued at a whopping US$16 billion.

Recently, we conducted research throughout the Southeast Asia markets and identified nearly 120 developments with over 28,000 units. Thailand accounts for 37 per cent of the broader region, with over 40 developments. The lion’s share of these is in resort destinations, though seven are located in urban areas. Viewing the Thai sector, the top three markets are Phuket, Bangkok and Pattaya.

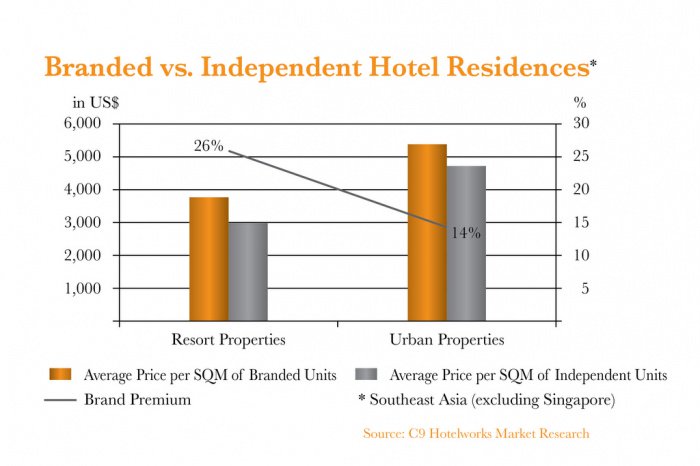

One key hotel brand push has been that chain affiliations create higher pricing points compared to independent projects. Our data shows that this holds most true in resort offerings where a 26 per cent premium is demonstrated, though in urban properties this drops to 14 per cent in broad market terms.

Recently, I had discussions with property developers who want to get inside what really drives buyers to these sorts of offerings, versus the somewhat more traditional viewpoint on yields and capital appreciation. Sentiment seemingly remains a strong driver, as is the perception that capital values will be protected and grown by what is thought to be a higher standard of property management that exists in hotels, versus pure residential estates or buildings.

Thai hospitality groups such as Minor, Onyx, Dusit and Centara are all registering a growing presence in hotel residences here and abroad. Singapore’s Banyan Tree group, which was an early adopter of branding, has even created a real estate-led brand with their successful Cassia offering. On a broader playing field, global hotel chains such as Starwood, Shangri-La, Movenpick, Four Seasons and Ritz-Carlton continue to create critical mass in the residence sector.

Looking back into the Thai looking glass, urban offerings tend to command considerably higher selling prices per square meter at an average of nearly 242,000 baht, while resort locations come in just over 134,000 baht. Higher land prices tend to drive this dynamic and underlying land costs remain both the friend and foe of the property development set.

Though Asia’s real estate trajectory has continued to be prolific since the end of the global financial crisis, pricing continues to be a key factor and this also overlaps with the issue of sizing. Two important things to note here are that discretionary spending, which is linked to the ultimate total value of the property, is a factor, as is the connection to ongoing rental yields that in many cases are more favorable for smaller units.

A current difference to the past is a greater number of hotel branded properties that do not rely on promises of guaranteed returns or rental yields, but tap into consumer’s increasing demand for quality versus quantity and the driving emotion that things are indeed better over the fence in ‘brand land’.

Bill Barnett is the Founder and Managing Director of C9 Hotelworks (C9Hotelworks.com), a leading Thailand-based hospitality and real estate consulting firm

— Bill Barnett

Latest Thailand News

Follow The Thaiger on Google News: